Gaming

Why are big games building on Avalanche instead of Ethereum?

Credit : cryptonews.net

This can be a section of the 0xresearch publication. Subscribe to learn full editions.

FIFA, Maplestory, from the schedule, inversion.

These are one of many few controversial names which have lately launched chains (or are planning to launch) on Avalanche’s Tech Stack.

Why avalanche and never Ethereum?

The reply begins with Avalanche9000, the most important improve of the community that got here into impact final December. It was Avalanche’s personal model of ‘The Merge’, which radically overhauled the validator financial system.

As a part of ACP-77, the excessive fastened curiosity price necessities of Avalanche Valator (2000 Avax) had been changed by an affordable, pay-as-you-go mannequin.

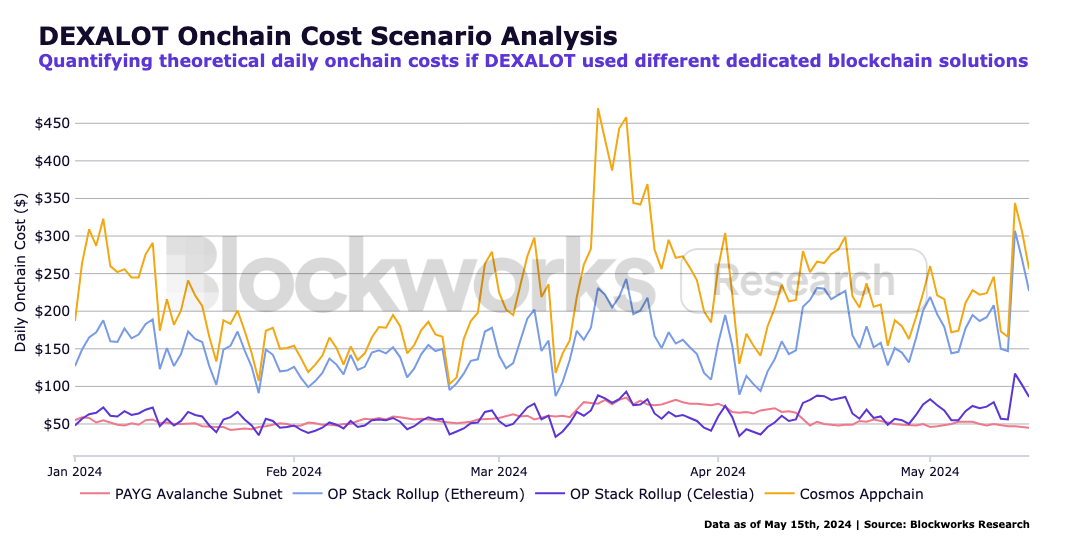

Lowered prices prematurely have made it enticing to launch a sovereign avalanche L1 chain -it is feasible even cheaper than a Celestia -Rollup or Cosmos Appchain, based mostly on estimates by the Blockworks Analysis train capital.

The fee financial savings proceed.

Groups Bootstrapping A avalanche L1 could make use of what the C-chain-Avalanche’s Liquidityshub-Al has constructed up.

Avalanche L1S can, for instance, provide customers the comfort of a CEXoprit by way of the C chain with out paying a considerable proportion of their token inventory to combine immediately.

“That is likely one of the core worth propositions at Avalanche,” mentioned Ava Labs Chief Technique Officer Luigi d’Orio Demeo Me. “From a go-to-market perspective, the groups save lots of time and hundreds of thousands of {dollars} in integration prices.”

This is applicable to most traditional chain infrastructure that the C chain already has, similar to Oracles, RPCs, indexers, explorers, NFT marketplaces, and so on. all of them as much as an estimated $ 13 million for an impartial L1 for a bootstrap itself.

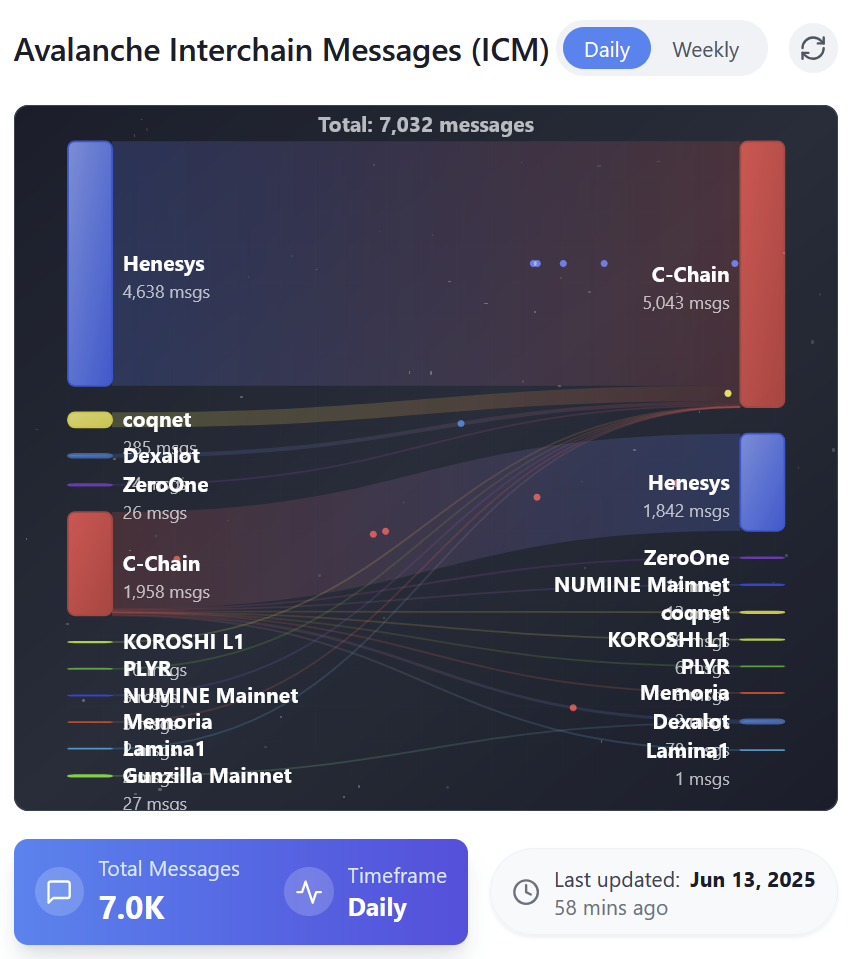

All of it depends upon Avalanche’s “Interchain Messaging” (ICM) protocol, which Use avine L1s to simply transfer property to and from the C chain to benefit from the aforementioned features.

C-chain to Henesys (Maplestory’s Chain) is immediately probably the most energetic forwards and backwards route on ICM, which makes hundreds of messages facilitated day by day.

Supply: l1beat.io

Worth constructing is one other vital cause to launch an avalanche L1.

Avalanche L1S can draw up clear worth -build -up flows to their indigenous tokens by switching on their very own validator units and publishing block rewards (or utilizing their very own native token as fuel).

Ethereum L2S can’t use the identical levers and subsequently have restricted or not worth constructing flows to their tokens, exterior the board (there are exceptions).

Lastly, Avacloud’s Hypersdk additionally grants a excessive diploma of L1 adjustment, a grim profit in comparison with the constraints that L2S facial construct -up on modern Rollup -technical piles.

Avax -value construction

Given the issues of worth construction that Eth and Atom has plagued, it’s price seeing how Avax yields worth.

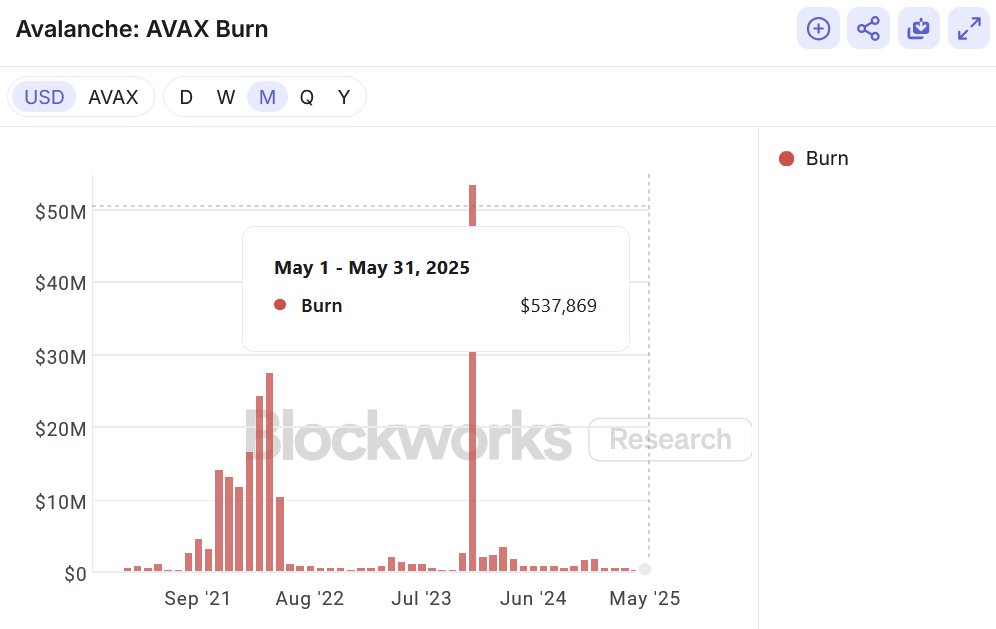

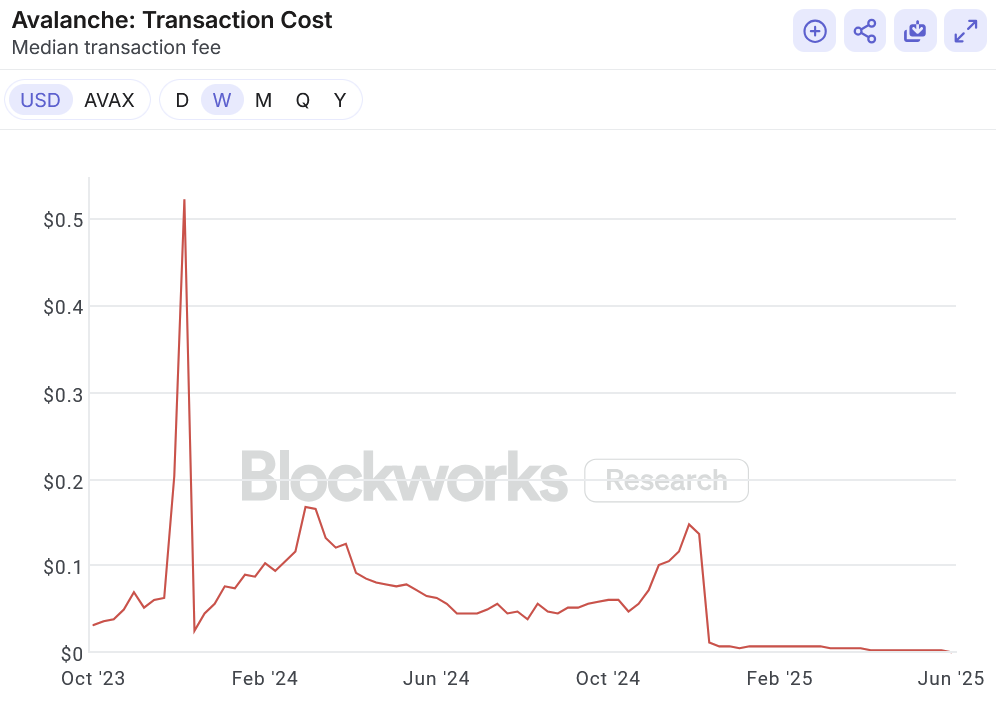

Firstly, 100% of all C chain prices are burned, in comparison with partial burns for Solana or Ethereum. Avax Burn had a month-to-month common of round $ 453k in 2025.

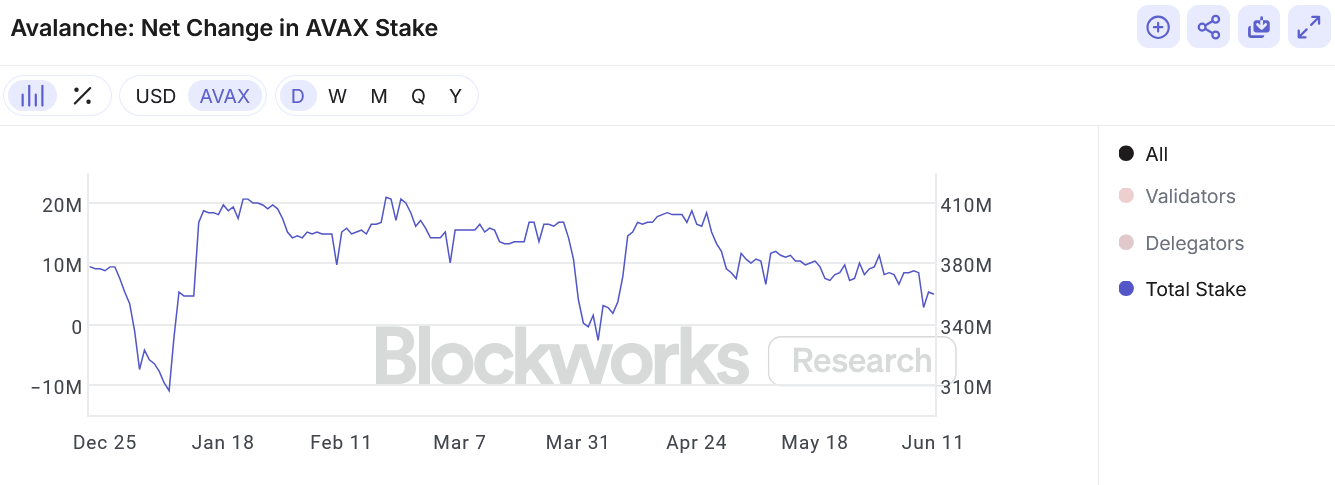

Secondly, Validators proceed to set Avax to validate the first networks – round $ 8b (360.2 million Avax) is about immediately.

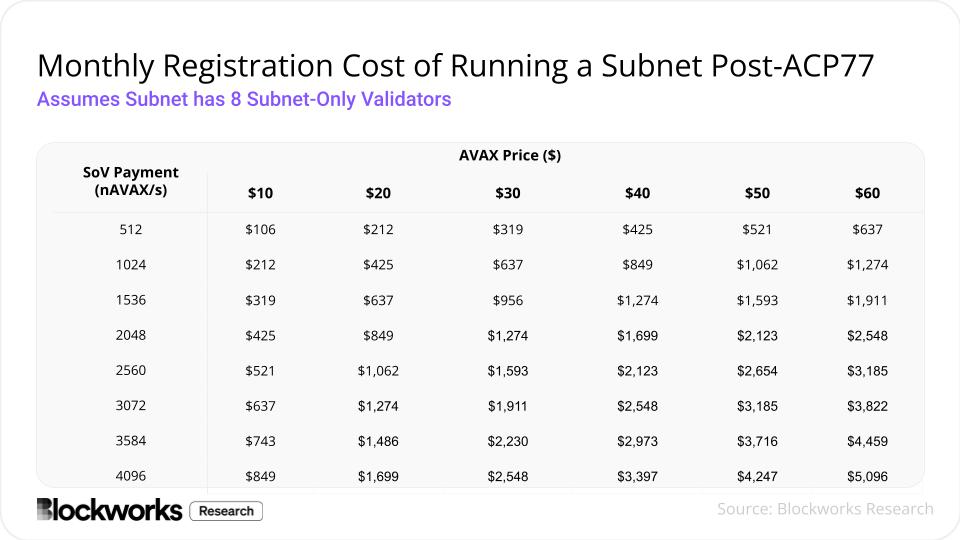

Thirdly, each Avalanche L1 validator pays a small month-to-month steady compensation in Avax, as a part of ACP-77. Relying on what number of validators there are, these prices fluctuate from a whole bunch to hundreds. The Boccaccio of Blockworks Analysis has drawn up numerous good estimates for the Gunzilla chain right here:

Lastly, there’s a minimal, oblique compensation on ICM that’s burned when transactions with the C chain work together.

Avalanche’s path forward

When every thing is claimed and performed, the Avalanche enterprise technique is thought: cut back the prices prematurely to subsidize the lengthy -term progress.

Ethereum does the identical by forfeiting the implementation prices within the brief time period to L2S within the hope of elevating the prices of knowledge availability in the long run. Celestia additionally offers Da virtually free away within the pursuit of lengthy -term progress.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024