Bitcoin

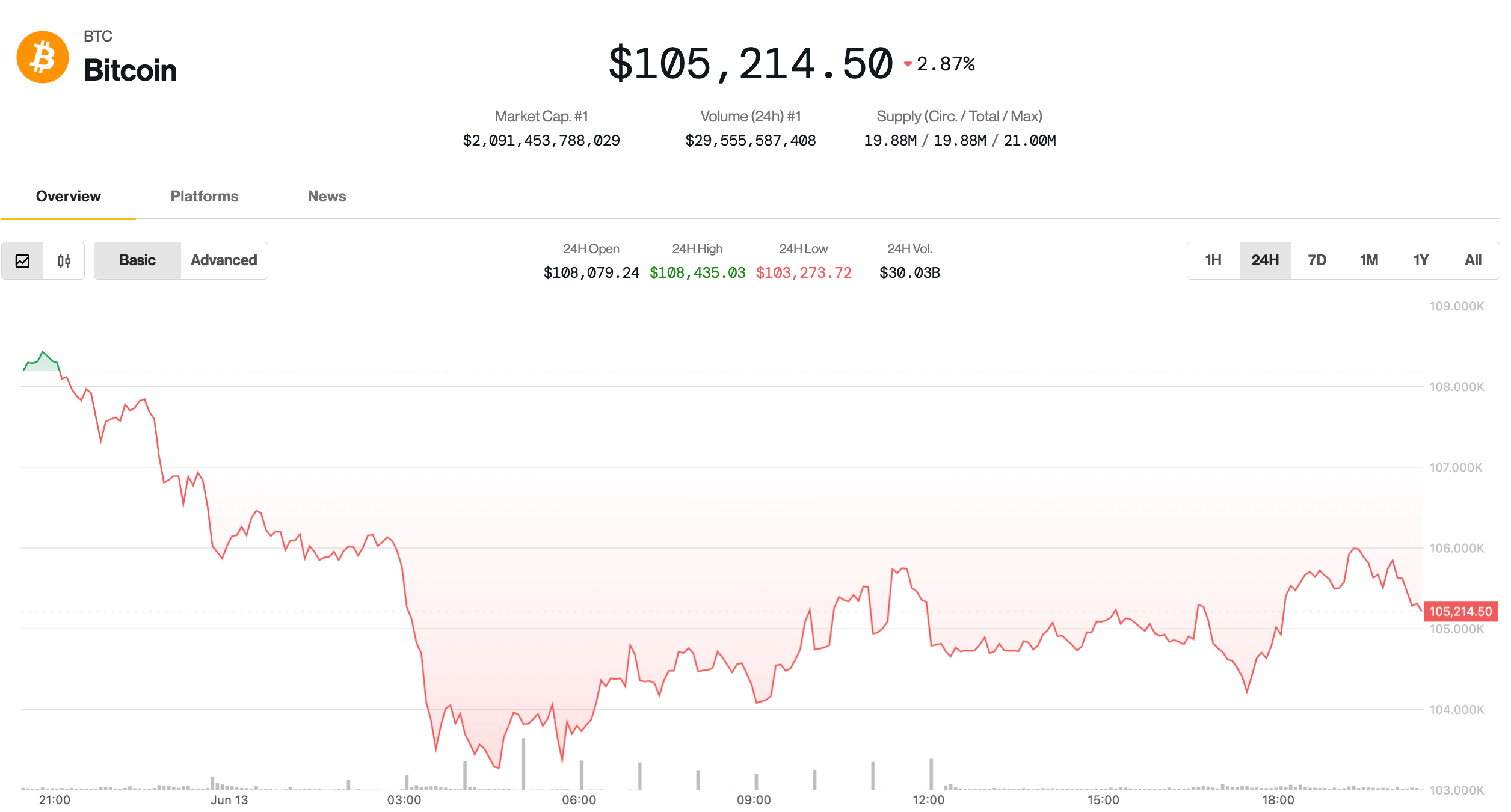

Bitcoin Bounces to $106K After Iran-Israel Jitters, but Analysts Warn of Deeper Pullback

Credit : www.coindesk.com

The cryptomarkt bounces again considerably from the tickles of early Friday about escalating battle between Israel and Iran.

After sinking to the $ 102,600 mark, Bitcoin

returned to round $ 106,000 earlier than he light decrease within the American afternoon hours with report A couple of new wave of air strikes aimed toward Iran. The highest cryptocurrency fell by 1.6% within the final 24 hours and altered possession of $ 105,200 and nonetheless lower than 6% shy of its excessive worth.

Within the meantime, the Coindesk 20 – an index of the highest 20 cryptocurrencies by means of market capitalization, excluding memecoins, stablecoins and alternate cash – has misplaced 4.4% in the identical interval. Tokens similar to ether

Avalanche and Toncoin have been essentially the most troublesome affected, which luggage between 6% and eight%.

Crypto shares, nonetheless, are usually not too sizzling. Most shares are within the purple, particularly Bitcoin Miners Mara Holdings (Mara) and Riot platforms (Riot), with 5% and 4% respectively. A outstanding exception is Stablecoin Emittent Circle (Circl), who nonetheless advantages from the windfall of his current IPO; The share has risen by 13% right this moment, with information about Retail giants Amazon and Walmart exploring Stablecoins that contribute to the Momentum.

Conventional markets don’t appear overwhelming concerning the struggle. Whereas gold has risen 1.3%, probably prepares for brand new all-time highlights, the S&P 500 and Nasdaq are solely 0.4% decrease.

What’s the subsequent step for Bitcoin?

“Good bouncing thus far and lack of followers decrease,” stated good crypto dealer Skew in a Friday X. Members out there are prone to stay cautious throughout the weekend with BTC that’s firmly correlated with conventional markets within the midst of raised geopolitical dangers, Skew added.

Within the longer time period, some analysts see the danger of a deeper withdrawal.

10x analysis founder Markus Thielen famous that BTC’s fall decrease than $ 106,000 interprets right into a failed outbreak and merchants have to attend for extra favorable setups earlier than they hurry to purchase the dip.

He emphasised the $ 100,000 $ 101,000 zone as essential help, warning that an interruption interruption may mark a return to the broader consolidation section akin to final summer time.

John Glover, Chief Funding Officer at Bitcoin Lender LEDN, argued that Bitcoin accepted a corrective section from his file highs that the biggest digital property may see falling to $ 88,000- $ 93,000.

He stated that the extent of $ 90,000 may provide a good entry for opportunistic buyers earlier than BTC resumes its upward development.

“As quickly as this sample has taken place, it’s anticipated that the following step larger will begin to the $ 130,000 space,” he stated.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024