Ethereum

SharpLink’s $463M Ethereum bet – Is it a sign of things to come?

Credit : ambcrypto.com

- Ethereum acquired a lift after Sharplink purchased $ 463 million from ETH

- Whale exercise and a peak in new deposits appeared to assist Ethereum’s value spring pressure

The prize of Ethereum is steadily consolidating round $ 2500 vary final month. This has been the case, regardless of the blended alerts from the broader market.

Though it’s not but in bull mode, ETH has been robust on a regular basis as a result of it’s combating excessive drawing. This consistency is extra desirous about each retail and institutional traders.

Supply: TradingView

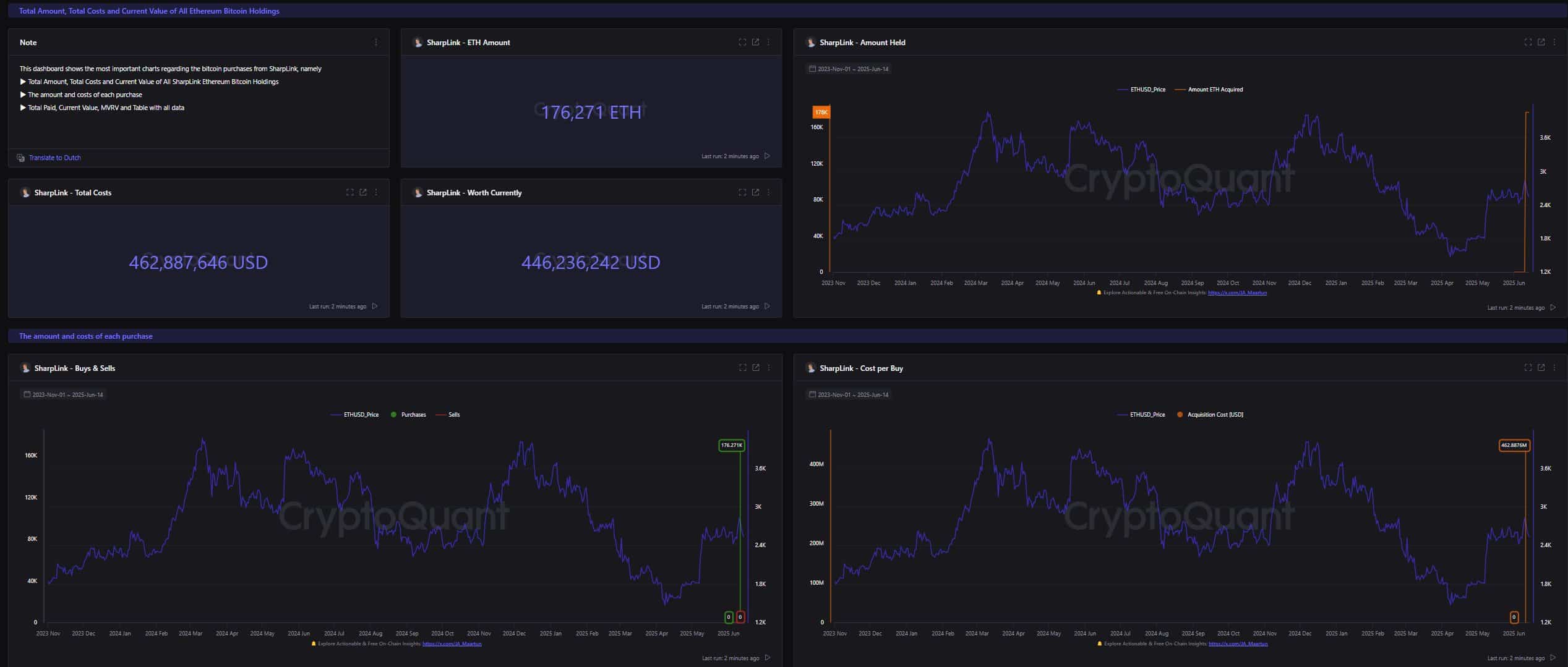

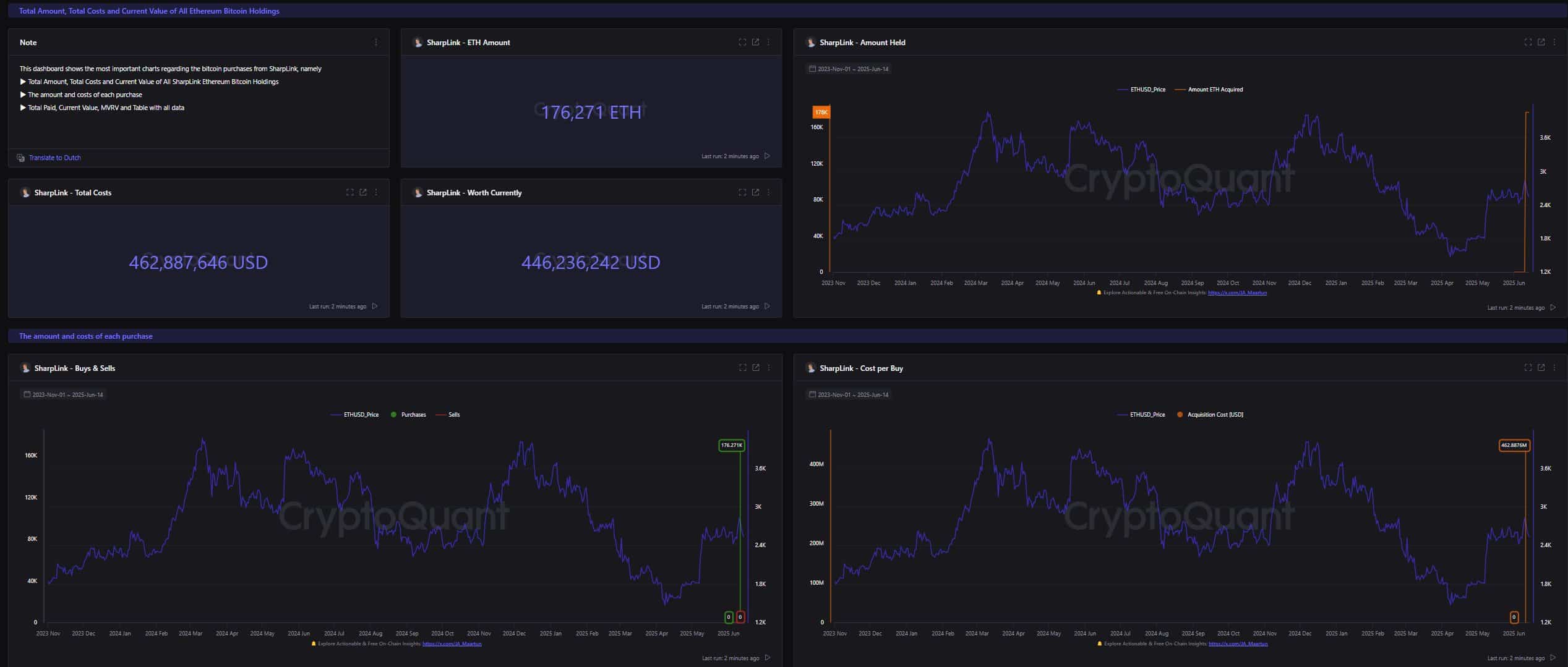

Sharplink’s huge Ethereum funding suggests strategic recalculation

In a motion that’s as fats as that of micro technique, Sharplink lately purchased 176,271 ETH – value it $ 463 million. The corporate is now the biggest listed holder of Ethereum. The transfer could make once more how public firms see and embrace ETH in lengthy -term funding positions.

The aggressive buy-in from Sharplink signifies robust confidence sooner or later use of Ethereum in cross-border financing. Identical to Micro Technique’s wager on Bitcoin throughout the first institutional wave, this Eth-Purchase-in can launch the highway for others.

Supply: Cryptuquant

Settings’ favourite asset?

The timing of Sharplink’s Purchase corresponds to a wider pattern. Most conventional firms now warmth to crypto belongings. Ethereum, with its ecosystem of good contracts, Defi protocols and stake alternatives, is more and more being seen as greater than only a speculative recreation.

This narrative shift-of a excessive threat asset to institutional portfolio element within the long-term win over all Poles. Because the rules turn into clearer, extra firms can take into account Ethereum. Not solely as a hedge, however as a core competitors.

Whale exercise and span of the keeper add gas

Knowledge on the chain has additionally proven that smaller whale entities which have amassed between 1,000 and 10,000 ETHs have amassed on value ranges of the press. Their actions hinted with confidence in a value base and a possible profit.

Supply: Cryptuquant

Furthermore, the variety of distinctive deposits who interact with Ethereum has additionally risen significantly.

Such a rise in community exercise provides extra gas to the bullish momentum of the Altcoin. It additionally displays the rising retail involvement and lengthy -term perception within the usefulness of ETH.

Supply: Cryptuquant

From rising institutional pursuits to rising whale confidence, the foundations of Ethereum have been strengthened recently. The funding of $ 463 million from Sharplink may even be the primary of many headline actions within the subsequent adoption cycle of ETH.

If ETH follows the method that Bitcoin did after the buy-ins from MicroSstratey, we could also be initially of a brand new Ethereum story.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024