Solana

Solana Could Face Selling Pressure, Reason You Should Know

Credit : coinpedia.org

Newest replace from Solana: Amid the market restoration, a crypto pockets linked to bankrupt FTX/Alameda withdrew a major 177,693 SOL, value $23.75 million, from Solana PoS, based on SolScan. Merchants and buyers ought to control this substantial fund as its transfer to centralized exchanges (CEXs) may probably trigger vital promoting strain.

FTX-linked pockets raises considerations about promoting strain

As of now, Solana merchants and buyers are curious to know the doable motive behind the non-stake. As soon as the tokens cease being staked, they may probably be moved to the CEXs, growing the SOL reserve on the exchanges, leading to vital promoting strain and unfavorable value impacts.

Along with this vital withdrawal of tokens from staking, the pockets presently holds a large 7.057 million SOL, value $943 million, in Solana PoS stakeout.

Present value momentum

On the time of writing, SOL is buying and selling round $135 and has skilled a value improve of over 2.85% within the final 24 hours. Moreover, this notable withdrawal had no influence on the SOL value. In the meantime, buying and selling quantity has dropped by 30% over the identical interval, indicating decrease dealer participation, probably as a result of latest transaction by the FTX-linked pockets.

Solana technical evaluation and upcoming ranges

In response to skilled technical evaluation, SOL is presently dealing with a powerful resistance degree at $138, which it has been scuffling with for the previous two weeks. Moreover, it’s buying and selling beneath the 200 Exponential Transferring Common (EMA) day by day, indicating a downtrend.

Primarily based on the historic value momentum, if SOL closes a day by day candle above $138, there’s a excessive probability that it may rise 18% to $163 and even greater, probably reaching $185. This bullish assertion solely holds true if SOL closes a day by day candle above $138, in any other case it may fail.

Bullish statistics within the chain

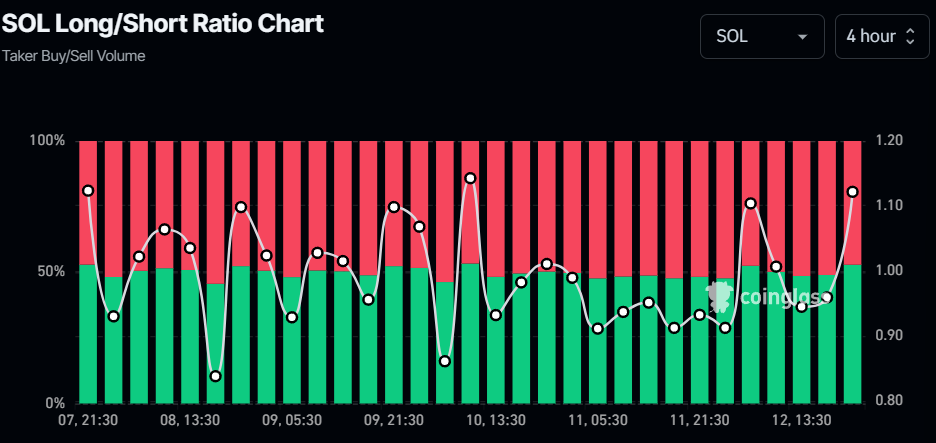

Nonetheless, this bullish outlook is additional supported by on-chain metrics. Mint glass The SOL Lengthy/Brief ratio presently stands at 1.121, indicating bullish market sentiment. Moreover, 52.86% of Solana’s high merchants have lengthy positions, whereas 47.14% have quick positions.

In the meantime, SOL’s open curiosity is unchanged over the previous 24 hours however has fallen since early September 2024.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024