Policy & Regulation

Traders Should Pay Attention to This Benchmark Amid Ongoing Macroeconomic Uncertainty, Says Billionaire Investor Ray Dalio

Credit : dailyhodl.com

Billionaire Ray Dalio says that traders ought to keep watch over one benchmark -indicator within the midst of macro -economic uncertainty.

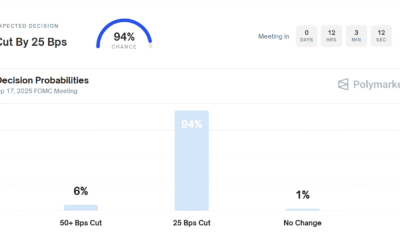

In a brand new thread on the social media platform X, hedge fund supervisor Ray Dalio says that if the Federal Reserve would decrease the rates of interest an excessive amount of, this might result in additional financial deflections and that merchants ought to comply with the rate of interest curve of the FED.

Based on Dalio, a mix of lengthy charges can rise, the greenback that falls in worth and might trigger a rise in gold issues.

“The FED is in a really tough place as a result of he tries to stability the advantages of decreasing rates of interest when sustaining the worth of cash. For the time being there’s quite a lot of uncertainty all through the economic system, together with a decline in sentiment.

Mix that with political stress and the truth of our upcoming funds for debt providers, and you’ve got this worth of cash conflicts. So modifications in financial coverage – particularly if the reduce is simply too aggressive – can result in a interval of nice concern.

My recommendation: View the yield curve. If you happen to see lengthy charges rising along with downward motion within the greenback and rising in gold, that there’s a motion from bonds. As a result of the worth of cash issues lots. ”

The income curve is a graph that exhibits the rates of interest (yields) of American treasury results over totally different maturities, from brief -term accounts to lengthy -term bonds. It displays market expectations about future rates of interest and financial circumstances and is intently adopted by the Federal Reserve and Market members.

Earlier this week, Dalio warned in opposition to buying and selling the most well-liked meme shares as a result of they undoubtedly cross out.

“These memes are normally resulting from a mixture of extrapolating what occurred earlier than and emotional issues. Additionally, most traders normally don’t take market costs under consideration.

In different phrases, they have a tendency to establish what a terrific funding has been (for instance a powerful performing firm) as nice, and they don’t pay sufficient consideration to costs, though the costs (whether or not it’s low cost or costly) is a very powerful factor. “

Observe us on X, Fb and Telegram

Do not miss a beat – Subscribe to get e -mail notifications on to your inbox

Examine worth promotion

Surf the Every day Hodl -Combine

Generated picture: midjourney

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024