Bitcoin (BTC) prize has skilled an elevated resistance in current days round $ 108k in the midst of the de-escalation of the disaster within the Center East. The flagship Munt fell barely to behave at round $ 107,472 on Thursday 26 June through the Mid-Noord-American session.

After recording a powerful comeback, after the 90-day break about most mutual charges in April, BTC prize varieties a possible reversing sample. The Bearish sentiment for BTC worth was created within the midst of the rising demand of institutional traders, led by technique and metaplanet.

Essential elements that weigh on the medium bullish sentiment for Bitcoin worth

Technical headwind

Within the day by day time frame body, the BTC worth has shaped a falling development after a bearish breakout of an rising wedge shaped ultimately of Could 2025. The MidTerm bearish sentiment for BTC prize is bolstered by the falling day by day relative energy (RSI) with the MACD line that underneath the Nero line.

From the viewpoint of technical evaluation, the BTC worth is effectively positioned to re-test the help degree once more within the coming weeks above $ 92k. The final word help degree for BTC worth was set above $ 76k earlier this yr.

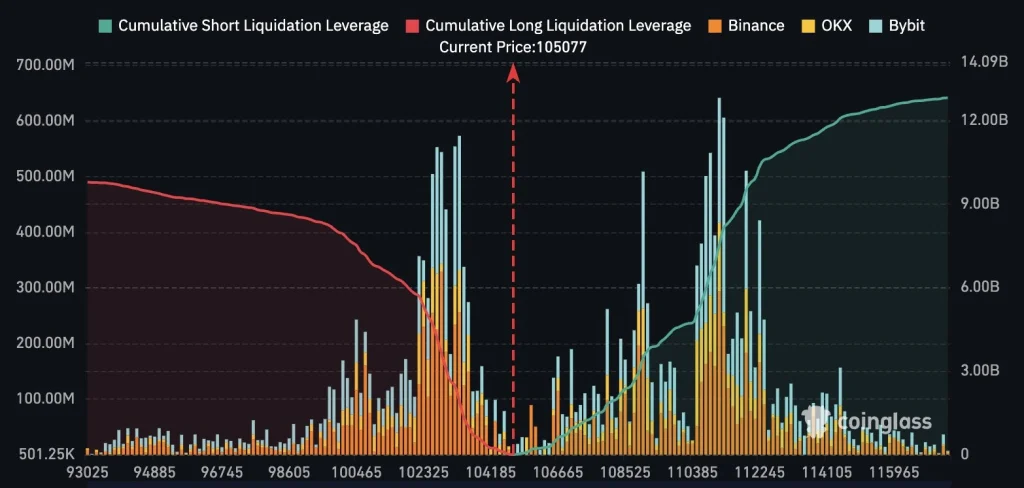

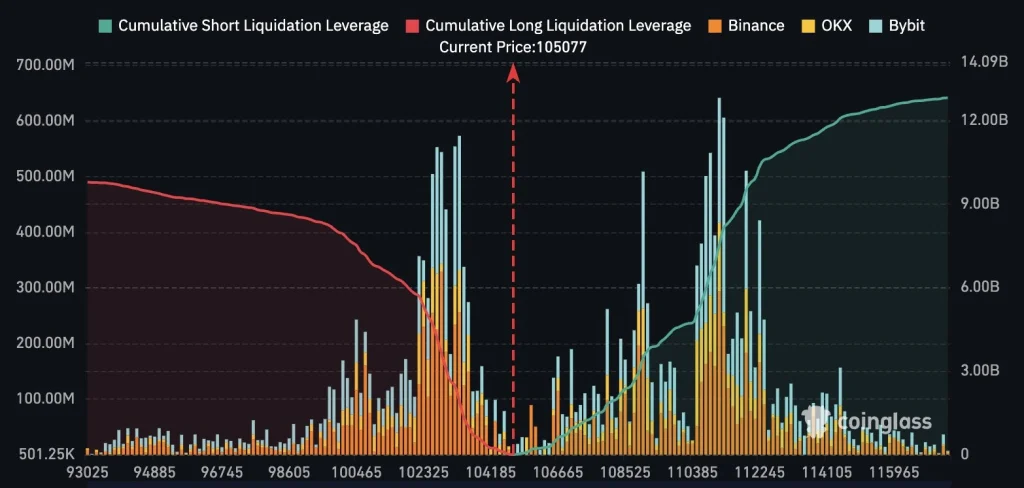

Excessive cumulative brief liquidation -leprobe operation

Bitcoin -Worth Facies Intensified Bearish sentiment fed by cumulative brief liquidation -leverage of round $ 12 billion round $ 112k. It’s supreme to say that extra institutional traders attempt to suppress the BTC worth through the futures and livered markets to accumulate as many cash as doable earlier than the long-awaited parabolic rally. Earned, knowledge on chains, knowledge on chains, it seems that institutional traders have aggressively extra BTC by way of lifting farm markets amassed by Fairness markets. Based on market knowledge of Bitcointreasuries251 entities have greater than 3.47 million BTCs of their respective treasury.