Altcoin

Bitcoin -Price discharge is it coming? Analysts shares 2025 Route Card

Credit : www.newsbtc.com

Motive to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by consultants from the trade and thoroughly assessed

The very best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

This week Bitcoin (BTC) has recovered from his latest lower within the $ 100,000 stage and tries to help the essential resistance of $ 108,000 for the fourth time. After we strategy the second half of 2025, a market keeper shared his prediction for BTC.

Associated lecture

Bitcoin sees the transition interval

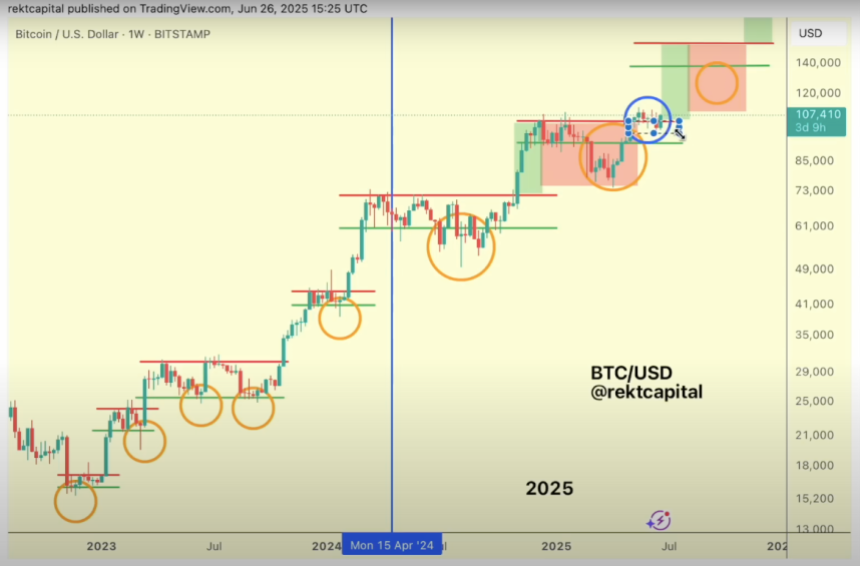

Thursday, analyst stretches Capital shared A route map for BTC for the remainder of the 12 months. He famous that this cycle was ‘actually a cycle of re-accumulation rouses’, wherein it’s defined that they’ve shaped in the course of the cycle for the reason that finish of 2022 and halved for the reason that Bitcoin final 12 months.

Within the pre-having interval, BTC registered brief worth deviations with downward wispers beneath the Hercumulation OK LOTTPPRENTS within the weekly graph. Within the meantime, the Bitcoin abnormalities can have occurred with a number of weeks of clusters of full candles beneath the lows.

After his first worth limitation, which lasted roughly seven weeks, BTC, for instance, went inside his re-accumulation rig for about ten weeks. Subsequently, it modified to the primary worth discharging correction, whereby it recorded a downward deviation of 9 weeks beneath the attain of the vary earlier than he broke out and gathered past the attain to a brand new ATH final month.

The sooner variations instructed that BTC was able to introduce his second prize dedication. However as Capital Detailed, a transition interval has taken place for the primary time, whereby the worth consolidation across the excessive space of the racing space is a excessive space.

Based on the analyst, that is “maybe the primary time that we see a deviation beneath the attain excessive”, making this space an important stage to modify to a brand new upward development.

We by no means actually needed to withdraw, maybe, till that remaining corrective interval, which might final a number of months, however every re-accumulation oak would see fairly a little bit of benefit, and that benefit can be in a short time and never an actual retest after the collapse, not actual pausing. What we see right here is one thing very, very totally different.

Weekly shut key for the way forward for BTC

Based mostly on the brand new transition interval, crucial stage for Bitcoin to get well within the weekly time frame is the help of $ 104,400, which it had nearly seven weeks earlier than the latest pullbacks. This stage was misplaced after BTC was closed beneath final week and “shouldn’t be a resistance stage.”

For the analyst, it’s the key that this week’s near the worth restore, as a result of it might place the cryptocurrency for a retest and affirmation of $ 104,400 as help and continues the idea round this space to modify to the following a number of weeks of discovery.

Capital added that the timeline for the following BTC insurrection will depend on the size of the brand new transition interval. Nevertheless, he believes that it’ll take “a bit longer” to interrupt out.

Associated lecture

Furthermore, he instructed that what comes after the upcoming uptrend will even rely upon how lengthy it takes, as a result of this will lead to an intensive cycle or an extension of this section, which may push the Cycluspiek in deeper phases of 2025.

However, the analyst confirmed that it’s essential that the following corrective interval, which Bitcoin may see between 25% to 33%, is brief to presumably take pleasure in a 3rd worth discovery for the Bears market.

BTC is at present being traded in opposition to $ 107,555, a rise of three.2% within the weekly interval.

Featured picture of unsplash.com, graph of TradingView.com

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024