Adoption

MicroStrategy buys $1.1 billion in Bitcoin amid market volatility

Credit : cryptoslate.com

MicroStrategy acquired roughly 18,300 Bitcoin for $1.1 billion at a mean value of $60,408 per BTC between August 6 and September 12, in accordance with a September 13 report submit with the US Securities and Alternate Fee (SEC).

Coinflip information shows The corporate’s newest buy has already resulted in a paper lack of $2.2 million because of the present volatility of its key digital belongings.

Financing

The corporate acknowledged that the acquisition was financed by promoting greater than 8 million shares of firm inventory by means of a gross sales settlement with a number of monetary establishments, together with TD Securities, The Benchmark Firm, BTIG, Canaccord Genuity, Maxim Group and SG Americas Securities.

The capital raised from these gross sales was used on to develop his Bitcoin holdings.

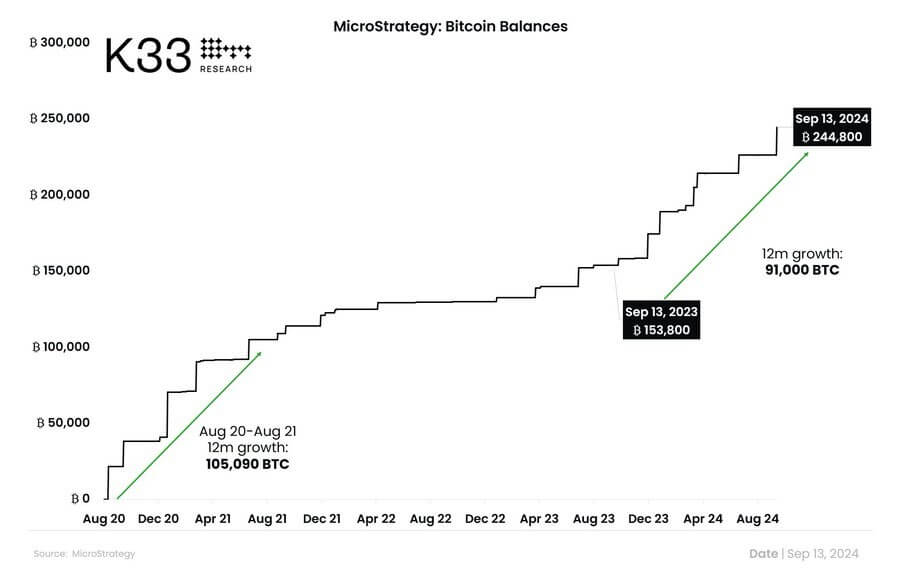

Notably, the corporate has aggressively pursued this financing technique over the previous yr to amass key digital belongings. K33 Analysis acknowledged that the corporate bought roughly 91,000 BTC between September 2023 and at this time.

It added:

“August 2020-21 is the one interval with larger year-on-year progress of MSTR’s BTC publicity of 105,090 BTC.”

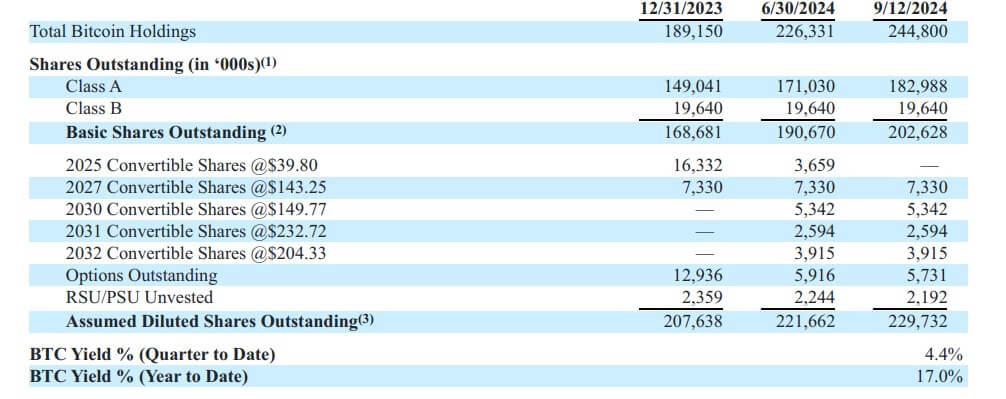

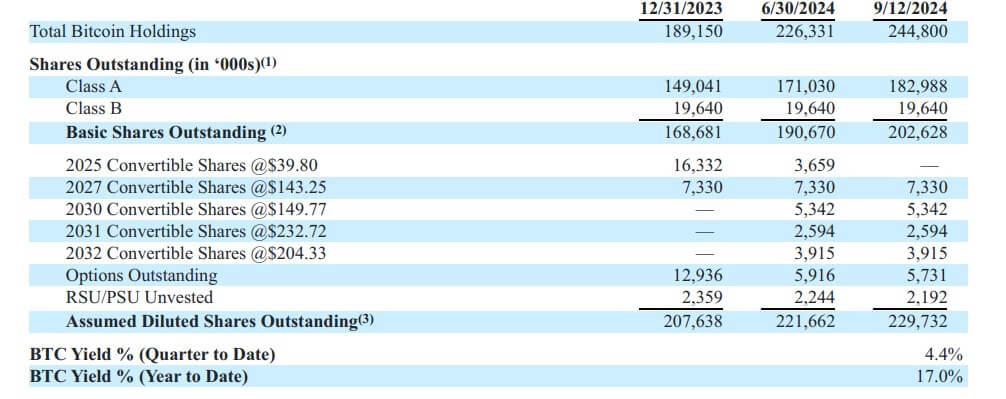

In the meantime, this newest acquisition introduced MicroStrategy’s whole Bitcoin holdings to 244,800 BTC, valued at over $14 billion at present costs. The corporate’s whole funding in Bitcoin quantities to $9.45 billion, with a mean buy value of $38,585 per Bitcoin.

Saylortracker facts signifies that the corporate has unrealized earnings of greater than $4 billion.

Bitcoin yield

Michael Saylor, government chairman of MicroStrategy, reported a Bitcoin return of 4.4% for the quarter and 17% for the present yr on his investments.

In keeping with the SEC submitting, this Key Efficiency Indicator (KPI) helps assess the corporate’s technique for buying Bitcoin. The BTC return metric tracks the proportion change over time within the ratio of MicroStrategy Bitcoin possession to diluted shares.

The corporate believes that this measure can improve buyers’ understanding of its choice to finance Bitcoin purchases by means of the issuance of extra shares or convertible devices.

Regardless of information of the newest buy, MicroStrategy shares are flat in premarket buying and selling. Nevertheless, it’s up 91% this yr.

Talked about on this article

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024