Altcoin

What happens in every year after the year of the year?

Credit : www.newsbtc.com

Motive to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by specialists from the business and punctiliously assessed

The very best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

As Bitcoin (BTC) arrives The third quarter (Q3) of 2025Bullish Sentiment is rising, fed by historic post-radiation patterns which have repeatedly marked the start Explosive market actions. A crypto analyst now factors to recurring traits which can be noticed in earlier cycles, the place Q3 has typically succeeded as a launch platform for vital worth rallies in BTC after each half yr.

Bitcoin Submit-Redition years level to explosive Q3

Luca, a crypto market knowledgeable on X (previously Twitter), has doubled within the coming quarter with expectations for a big Bitcoin worth rally. He to claim That expectations of intensive consolidation in Bitcoin, based mostly on the fractals and market conduct that shall be seen in 2023 and early 2024, don’t take a essential issue under consideration: 2025 is a yr.

Associated lecture

The analyst point to A constant sample that’s noticed in every after the all -year yr Bitcoin’s Historical past. In his graph evaluation revealed on 26 June, Luca notes that Q3 has persistently demonstrated energy in these years, with no historic precedent for weak point, because of which the case for one Bullish breakout.

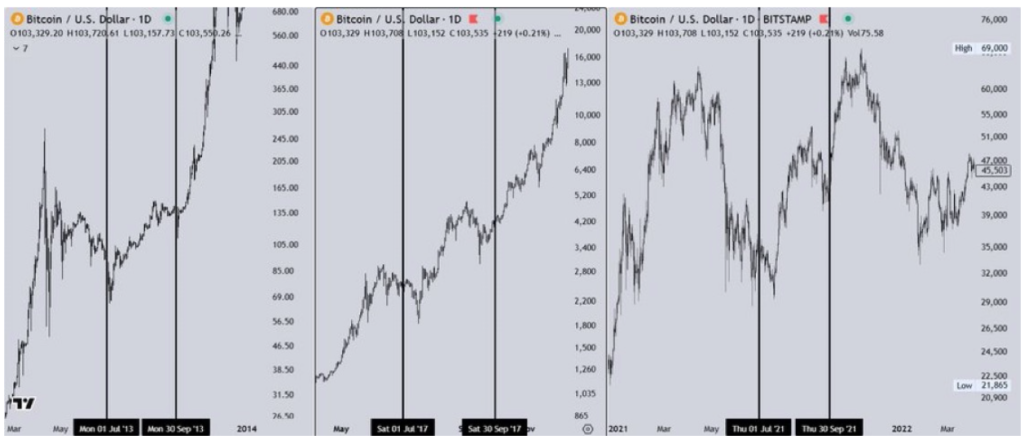

The graph compares the Q3 efficiency through the years after relieving years of 2013, 2017 and 2021. In any case, Bitcoin began the third quarter with average or corrective worth motion, solely to gather significantly within the following weeks.

The left panel of the graph exhibits the Submit-Redition Yr 2013, the place Bitcoin went from lower than $ 100 to greater than $ 680 in July in November. In 2017, the center panel emphasised an analogous course of, through which BTC broke out of lower than $ 2,800 initially of the early Q3 to greater than $ 16,000 in direction of the tip of the yr.

The newest cycle in 2021, proven in the suitable panel of the graph, noticed a restoration rally of Q3 that Bitcoin introduced from lower than $ 39,000 to a former in July At all times excessive above $ 69,000 in November.

Luca specifically claims that this constant historic conduct shouldn’t be coincidental, and predicts {that a} comparable assembly within the present cycle may unfold throughout the coming months. He acknowledged the Chance of a withdrawal within the quick time periodHe emphasizes that the broader market construction of Bitcoin stays sturdy bullish, with Momentum that also prefers additional the other way up.

Analyst predicts $ 140,000 – $ 160,000 bitcoin cycle high

Sooner or later, Luca’s graph reveals technical components that match his bullish thesis. Primarily based on vital Fibonacci extension ranges, the analyst projects That BTC’s subsequent cycle high falls between $ 140,000 and $ 160,000, a goal he believe may very well be reached in opposition to the tip of Q3.

Associated lecture

Though it acknowledges that the precise goal may shift, relying on how technical mergers are evolving, it’s anticipated {that a} Bitcoin rally shall be imminent. With BTC who now acts round $ 107,423 after returning a earlier one Dip below $ 100,000A possible relocation to $ 140,000 and even $ 160,000 would mark a substantial revenue of round 30.35% and 48.97% respectively.

Featured picture of Unsplash, graph of TradingView

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024