Altcoin

BNB: 85% DIP in developer activity can mean problems! – Analyze …

Credit : ambcrypto.com

- The good contract of the BNB chain and the exercise of the developer have fallen, which reveals over -dependence on the Defi sector

- Regardless of the steady value and open curiosity, technical means present a weak momentum and a disconnected constructing neighborhood

Binance [BNB] exhibits cracks beneath the floor.

Good contract exercise on BNB has fallen to the bottom level in a yr. Latest information reveals an unhealthy dependence on Defi and DEX sectors, each of which at the moment are retreating sharply.

Different ecosystems, however, are increasing to gaming, NFTs and broader developer innovation. The restricted diversification of BNB can expose it to larger lengthy -term dangers.

BNB -Kintenhulpers uncovered

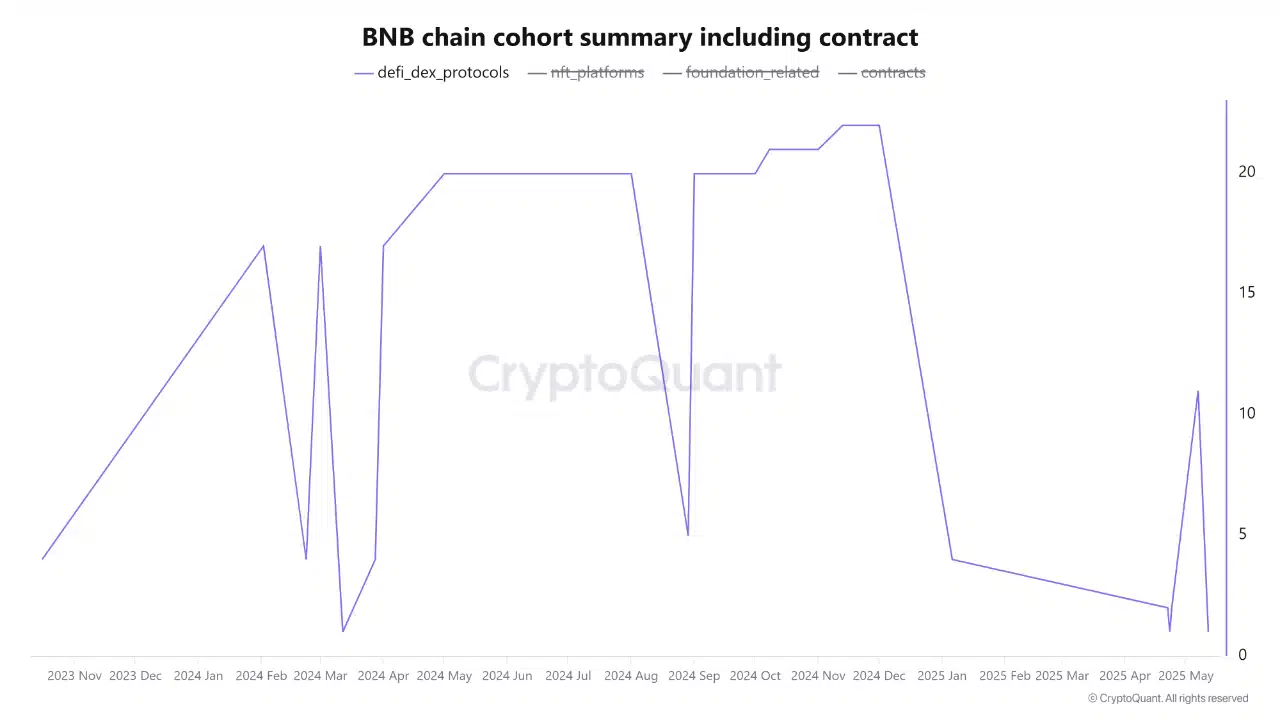

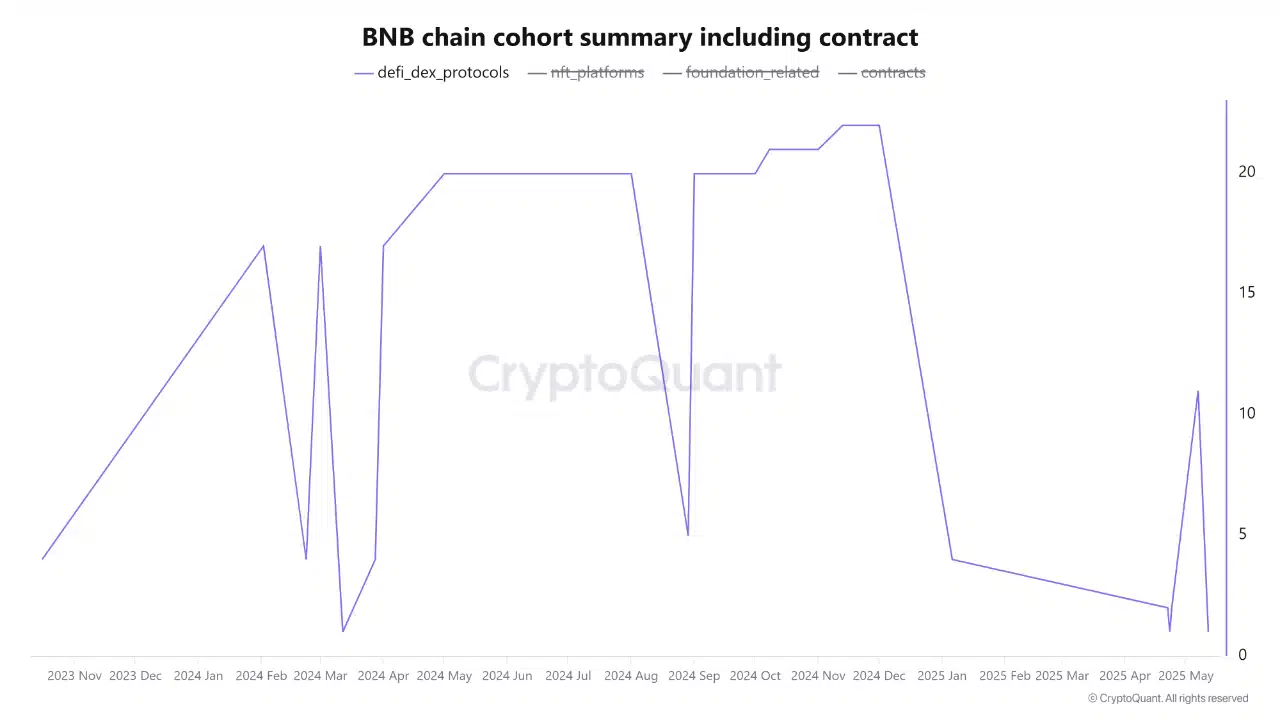

BNB chains Latest cohort data Unveils a related collapse in energetic good contracts, reducing to a yr.

An additional consideration of the breakdown exhibits that the majority exercise on the chains is concentrated within the Defi/Dex sector, with different verticals, comparable to NFTs, tasks with basis and gaming, which just about no traction register.

Supply: Cryptuquant

The latest decline of the community straight displays the lower in Defi exercise. This lack of diversification is now a critical systemic danger.

With out a significant development in different sectors to compensate for this stoop, the BNB chain stays dangerously uncovered to the volatility in a single sector, making it very delicate to say no, migrations or reliability shocks.

Open curiosity applies, however the growth disappears

Supply: Coinglass

Regardless of steady futures open curiosity, the exercise of the chain builders on BNB has fallen greater than 85% up to now month.

This emphasizes a grim hole between speculative curiosity and actual builder involvement. Whereas merchants appear to be left, builders step away.

Supply: Santiment

With growth exercise that’s now approaching, there’s a clear damaged connection between market sentiment and underlying community well being.

With out renewed growth of builders, the long-term sustainability of the BNB ecosystem can endanger, no matter what Futures information implies within the quick time period.

Momentum stalls with indicators that flash impartial – however is that a part of the issue?

Technical indicators on BNB’s Every day Chart present indecision.

On the time of the press, the RSI floated close to 51 and confirmed neither power nor weak. MacD strains had been flat and hardly crossed to a constructive space, which confirmed an absence of significant momentum.

Within the meantime, it remained steady at round 574 million, which didn’t present clear accumulation or distribution.

Supply: TradingView

This neutrality is an indication of a market in Limbo, the place the value is steady, however conviction is absent.

With Fundamentals Figuring out and collapse of the developer exercise, the Gedempte Indicators from merchants present that the deeper drawback of the ecosystem isn’t panic, however indifference.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now