Ethereum

eToro trading: U.S. clients restricted to BTC, ETH, BCH post SEC deal

Credit : ambcrypto.com

- The eToro buying and selling platform will restrict US crypto transactions to Bitcoin, Ethereum and Bitcoin Money following a settlement with the SEC.

- The SEC has fined eToro $1.5 million for working as an unregistered crypto dealer and clearing group.

The eToro trading platform has reached a settlement with the US Securities and Trade Fee (SEC), which agreed to halt most cryptocurrency choices to its US clients.

For context, the SEC accused eToro of offering entry to crypto property thought-about securities since 2020 with out adhering to federal securities registration necessities.

As a part of the settlementeToro can pay a $1.5 million fantastic for working as an unregistered dealer and clearing company in reference to its crypto companies.

Executives weigh in

eToro co-founder and CEO Yoni Assia made the identical remark, saying in a press release that the settlement permits the corporate to:

“Deal with delivering modern and related merchandise throughout our diversified US operations. As an early adopter and world pioneer in crypto property and a significant participant in regulated securities, it will be significant for us to be compliant and work intently with regulators world wide.”

Evidently, Assia wasn’t the one one to answer the scenario. A number of trade specialists additionally gave their opinions.

For instance, Lowell Ness, a accomplice at Perkins Coie, added his perspective, saying:

“It’s fascinating to see events agreeing to most of these drastic settlements when considered towards federal courtroom rulings that programmatic transactions should not securities transactions. This settlement highlights the large rift that might develop between regulators and a few of the early courtroom rulings.”

What else is happening?

That stated, eToro will restrict its US clients to buying and selling Bitcoin solely [BTC]Bitcoin money [BCH]and Ethereum [ETH] on its platform.

For all different cryptocurrencies, customers have a 180-day interval to promote their holdings, after which these tokens will now not be out there for buying and selling.

This choice marks a big shift within the platform’s crypto providing in response to regulatory challenges. Nevertheless, this transfer acquired vital criticism, with many viewing it as an overstep by the SEC.

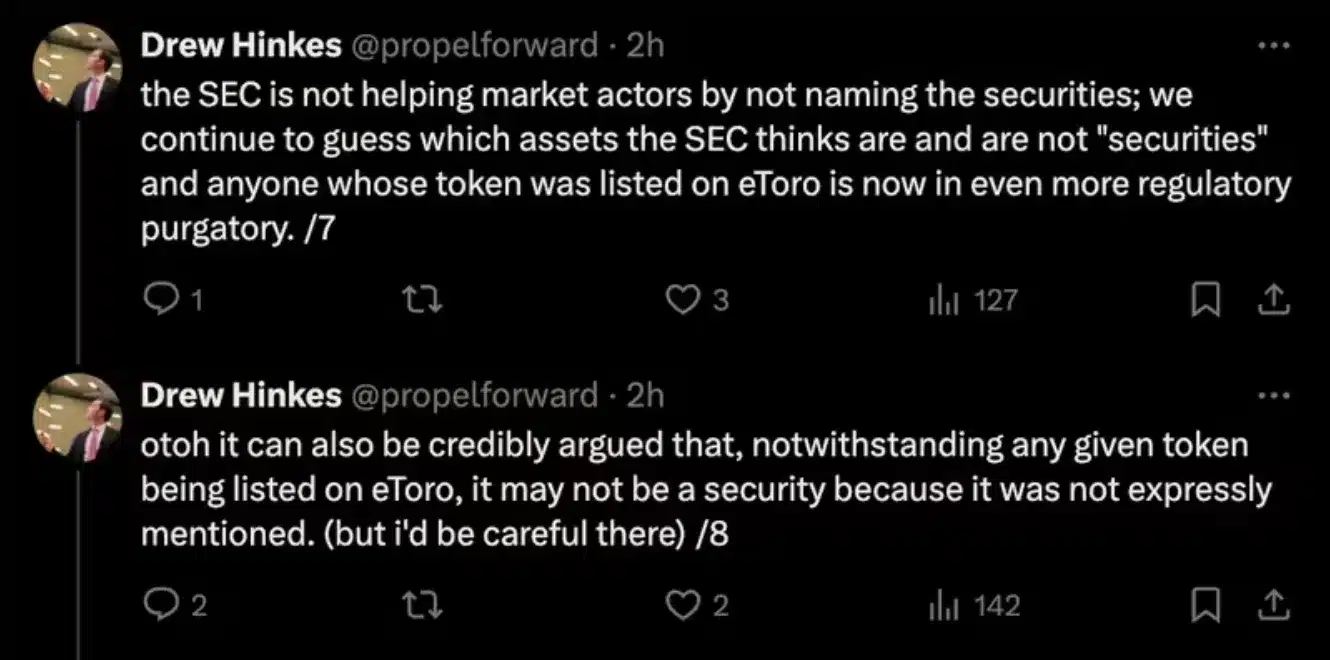

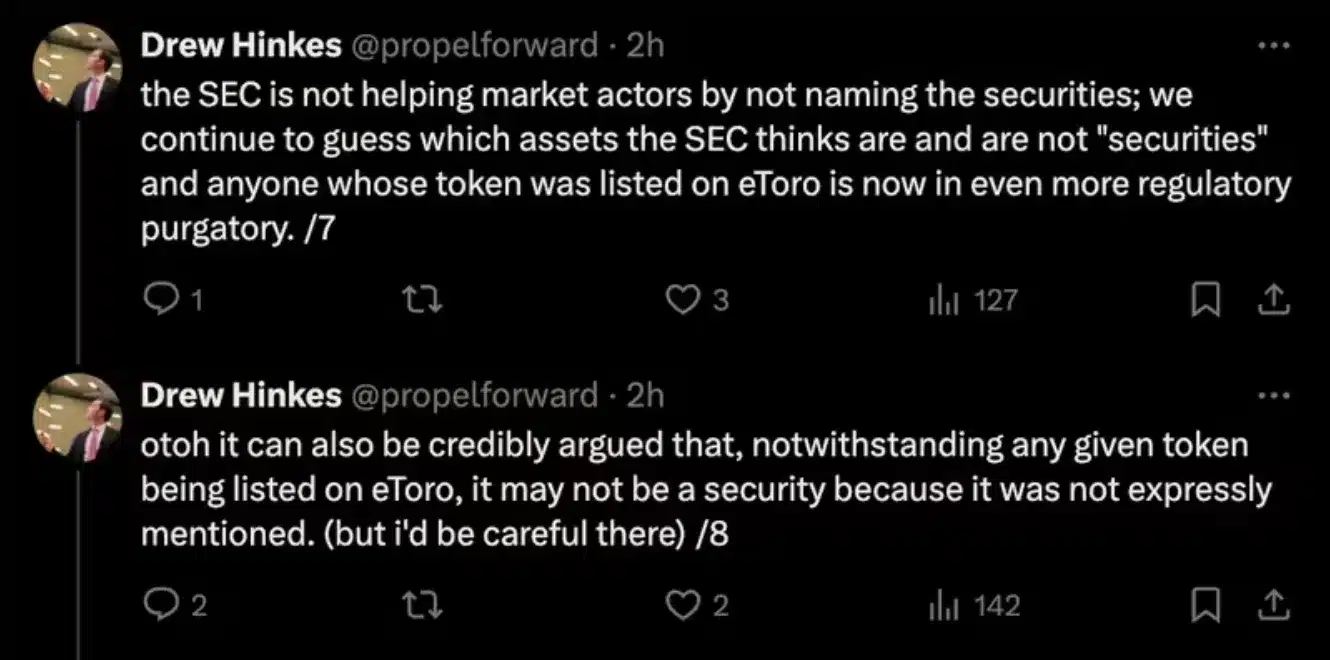

In response to the difficulty stated Drew HinkesAccomplice at Okay&L Gates, shared his ideas on

Supply: Drew Hinkes/X

This case at eToro isn’t remoted, as quite a few main crypto platforms resembling Coinbase, Kraken, Binance and Uniswap [UNI] have additionally confronted authorized challenges on the SEC.

Whereas a few of these battles are nonetheless ongoing, others have ended with the SEC profitable.

SEC Fines Report Unveiled

Actually, a latest report reveals that the SEC imposed vital fines on distinguished crypto corporations between 2013 and 2024, highlighting vital circumstances and the character of those corporations’ regulatory violations.

In accordance with the report,

“Since 2013, the SEC has levied greater than $7.42 billion in fines on crypto corporations and people, with 63% of the fantastic quantity, i.e. $4.68 billion, coming in 2024 alone.”

Since 2022, the SEC has stepped up efforts to control the cryptocurrency house, levying fines on corporations and holding executives accountable to emphasise stricter oversight.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024