Policy & Regulation

$512,900,000,000 in Unrealized Losses Hit US Banks As Number of ‘Problem Banks’ Rises To 66: FDIC

Credit : dailyhodl.com

In response to the Federal Deposit Insurance coverage Company (FDIC), the variety of U.S. banks in deep trouble is rising.

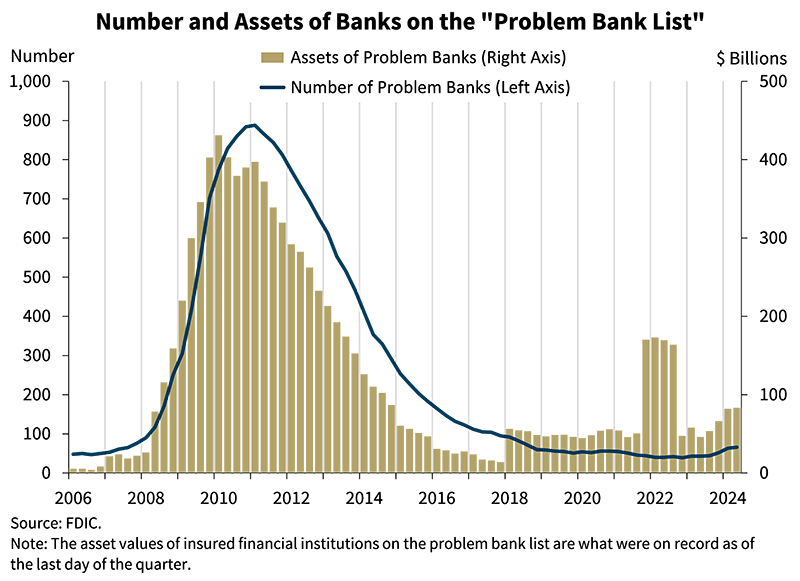

The quarterly financial institution profile for the second quarter of 2024 reveals that the variety of lenders on the “Drawback Banks Record” has elevated quarter-on-quarter from 63 to 66.

That is the fifth consecutive quarterly enhance of banks rated 4 or 5 on the CAMELS ranking system because the second quarter of 2023.

A ranking of 4 on the CAMELS system signifies {that a} financial institution is experiencing monetary, operational or managerial issues that might moderately jeopardize its viability if not resolved, whereas a ranking of 5 signifies {that a} financial institution is severely poor and rapid remedial motion required.

“The variety of downside banks represents 1.5% of the overall variety of banks, which is throughout the regular vary for non-crisis intervals of 1% to 2% of all banks. Complete belongings of troubled banks elevated by $1.3 billion to $83.4 billion.”

In the meantime, U.S. banks proceed to saddle billions of {dollars} in unrealized losses on securities. The FDIC stories a complete of $512.9 billion in unrealized losses within the second quarter, down 0.7% quarter-over-quarter.

Says FDIC Chairman Martin Gruenberg:

“Rates of interest rose modestly within the second quarter, placing downward stress on bond costs, however the ensuing enhance in unrealized losses was greater than offset by bond gross sales by a number of main banks, which resulted in vital realized losses.

That is the tenth consecutive quarter that the business has reported unusually excessive unrealized losses because the Federal Reserve started elevating charges within the first quarter of 2022.”

The risks of unrealized losses got here into focus final yr through the collapse of Silicon Valley Financial institution, when issues in regards to the lender’s stability sheet triggered a financial institution run.

At this time, Gruenberg says the U.S. banking sector continues to indicate resilience, however dangers nonetheless exist.

“…The business continues to face vital draw back dangers resulting from uncertainty within the financial outlook, market rates of interest and geopolitical occasions. These points might trigger credit score high quality, earnings and liquidity points for the sector.

As well as, weak point in sure mortgage portfolios, significantly workplace properties, bank cards and multifamily loans, continues to warrant monitoring. These points, together with pressures on funding and margins, will stay problems with continued FDIC supervisory consideration.”

Do not miss a beat – Subscribe to obtain e mail alerts straight to your inbox

Test value motion

Comply with us additional XFb and Telegram

Surf to the Each day Hodl combine

Generated picture: Midjourney

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024