Altcoin

Is LINK’s price turnaround in sight? Historical UDPI levels mean…

Credit : ambcrypto.com

- Chainlink shaped a possible double backside sample

- The long-term UDPI suggests LINK is on the bottom

Chain hyperlink [LINK] has seen vital developments via partnerships with numerous trade gamers. This has pushed its adoption within the cryptocurrency house.

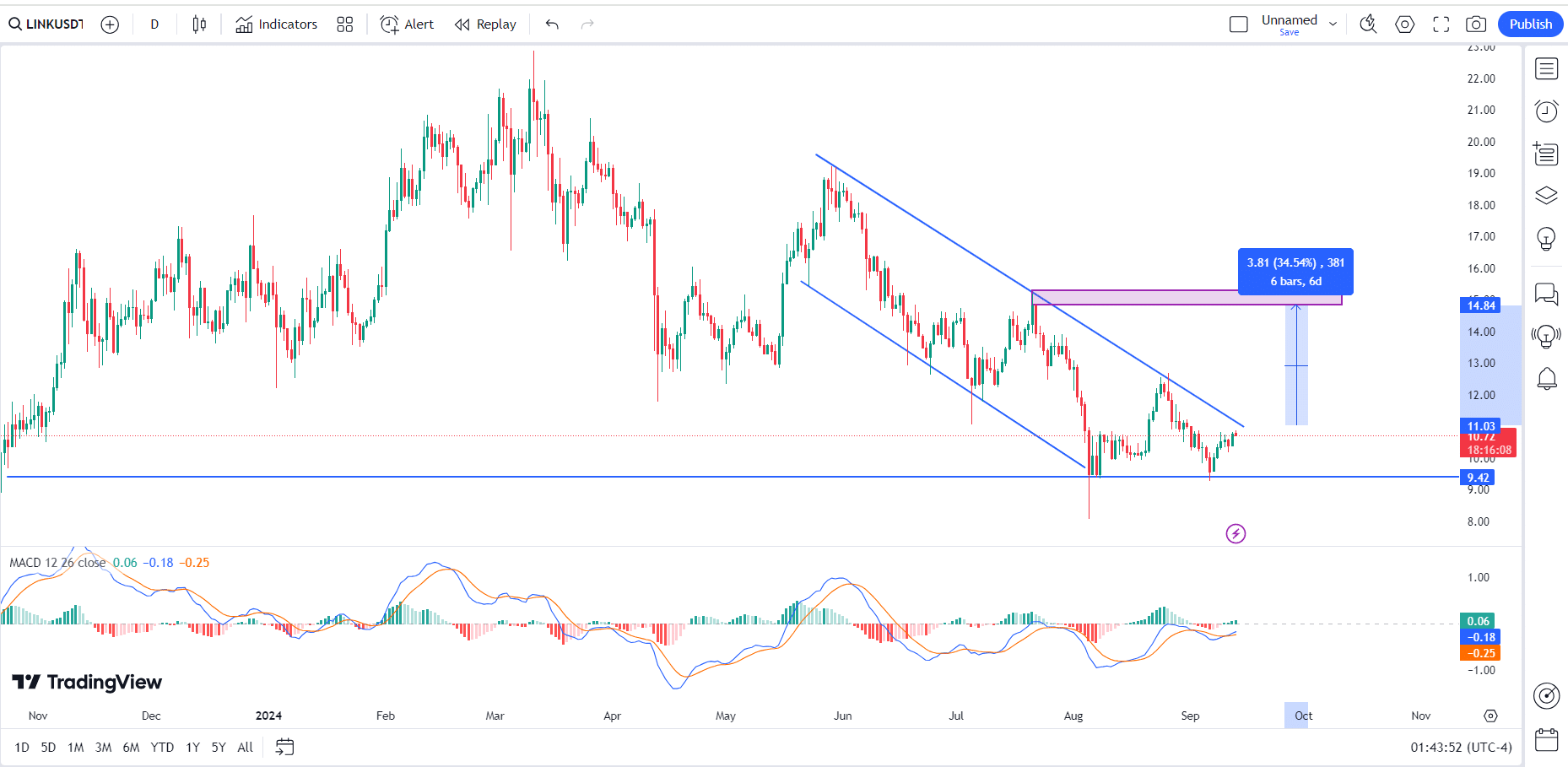

On the time of writing, given the every day time-frame, LINK’s value gave the impression to be transferring in a downtrend channel. Though this has been the case since June, it has just lately discovered a possible backside. The underside to be confirmed if the value breaks the short-term excessive at $13.

LINK’s value, which has been trending south recently, took liquidity beneath $13 and located assist at $9.42. Right here the double backside gave the impression to be forming.

The MACD additionally turned bullish, partially confirming this sample. That mentioned, the primary check will come whether or not LINK can break the $13 degree.

Supply: TradingView

Ought to the value rise above the higher trendline and keep there, this might imply a 35% improve if the entire altcoin market cap helps this transfer. Nonetheless, if LINK falls beneath the prevailing assist zone, it might proceed to say no.

If the present backside holds, the fourth quarter of 2024 might be bullish for LINK. It will present a perfect place to begin for merchants and buyers betting on a value restoration.

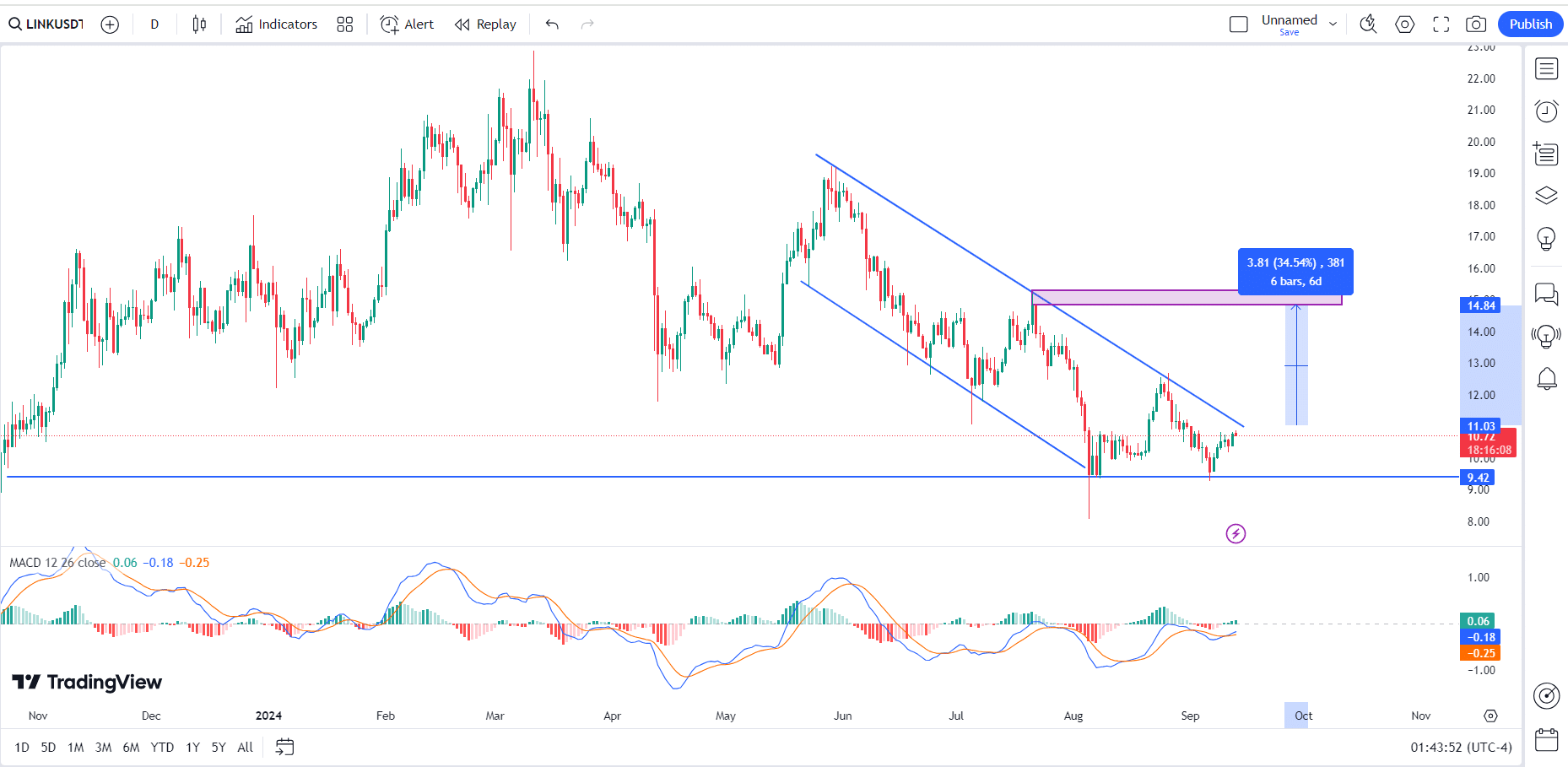

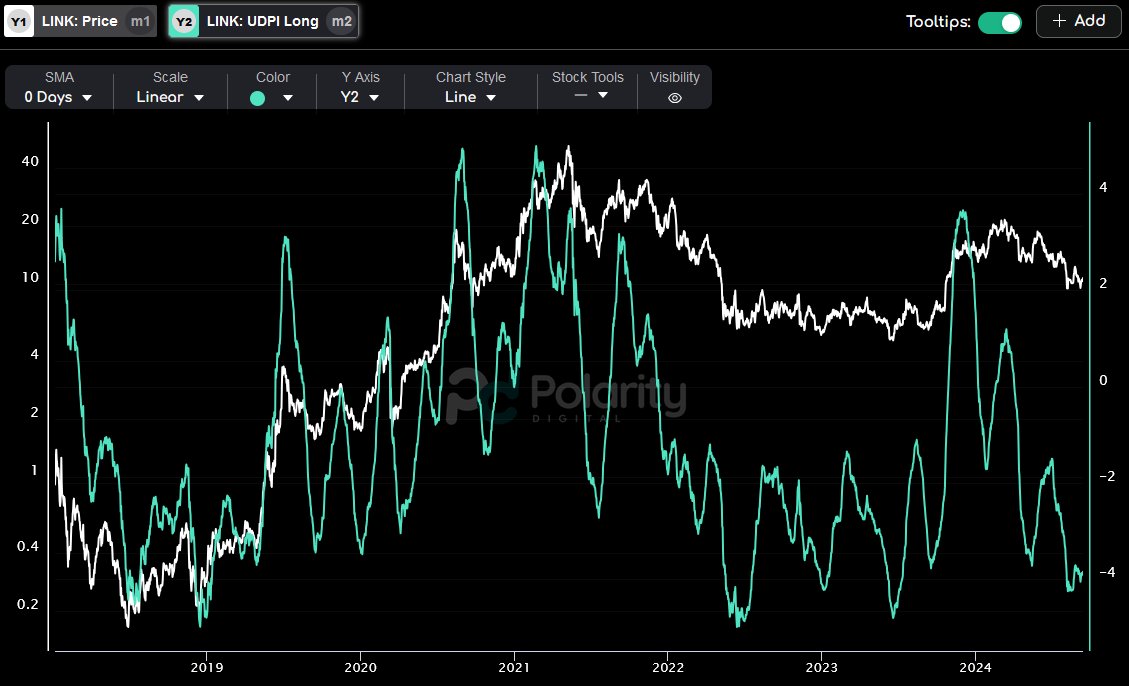

Chainlink long-term UDPI threat mannequin

The long-term threat mannequin for the Upside-Draw back Potential Index (UDPI) for LINK can be now at an all-time low.

This mannequin, which evaluates risk-reward eventualities over time, means that LINK has larger revenue potential when the UDPI is low.

Present market sentiment round LINK is extraordinarily low, with value motion and bullish exercise being subdued. Nonetheless, the UDPI confirmed that LINK is on the lowest threat degree – an important space to observe because the fourth quarter approaches.

Supply: Polarity Digital

Traditionally, such ranges have marked deep worth zones for LINK. And a turnaround might be imminent as market circumstances modify.

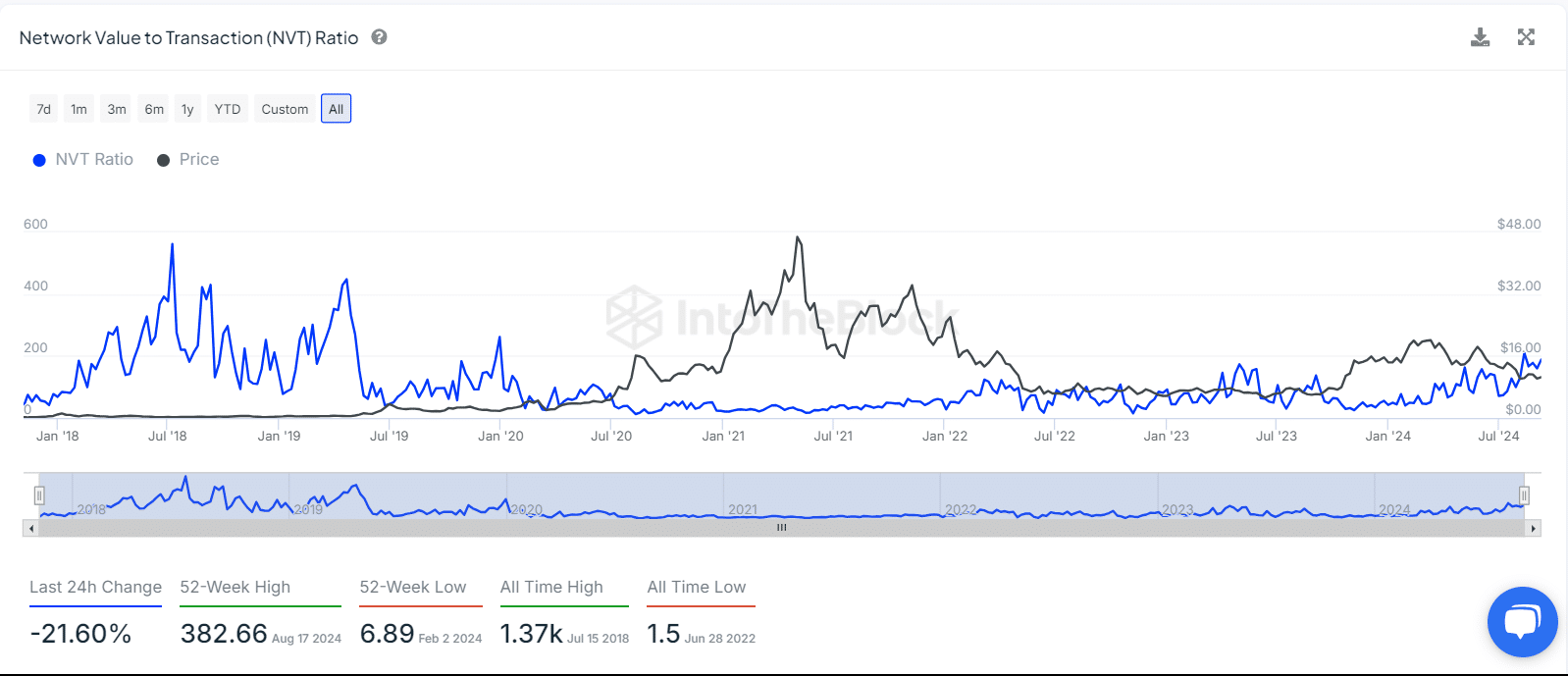

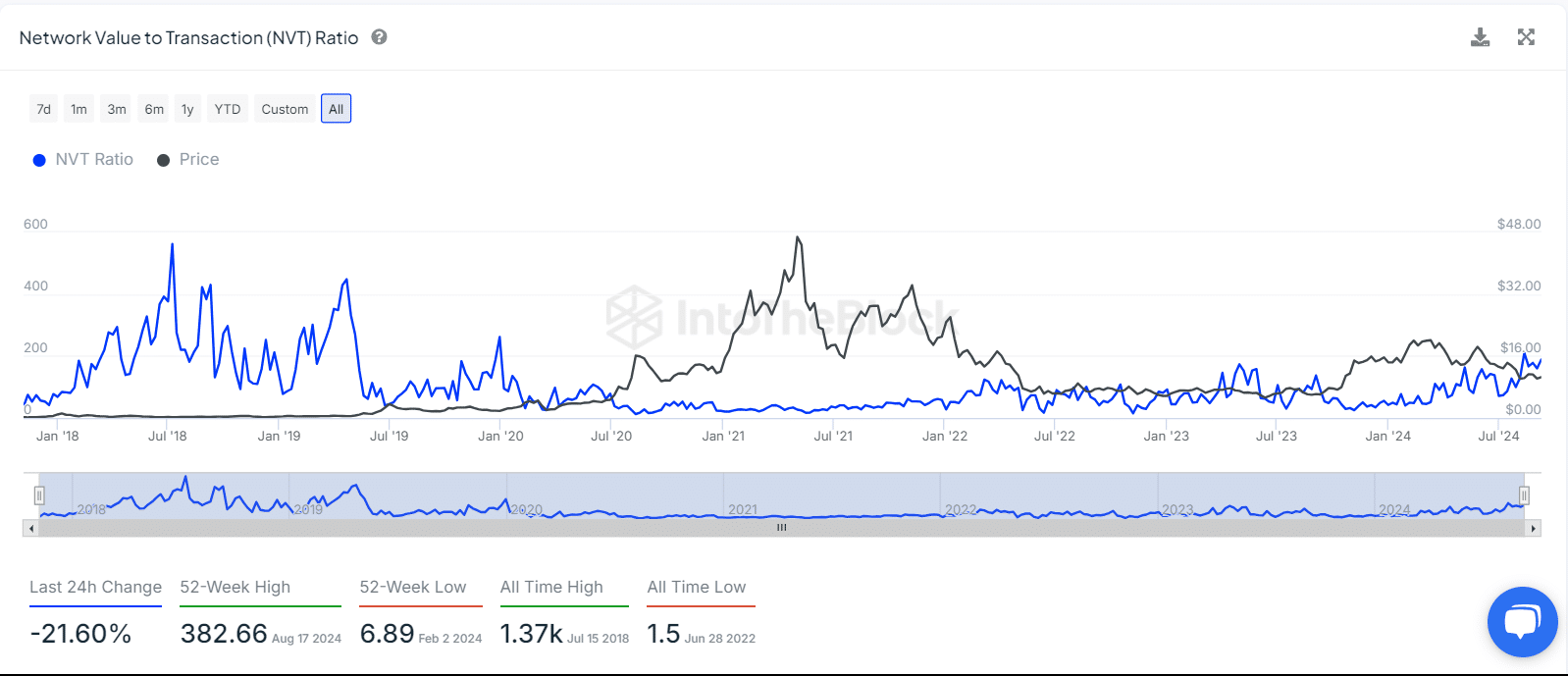

NVT ratio rising…

Moreover, Chainlink’s on-chain actions have additionally elevated, with the community worth to transaction (NVT) ratio exhibiting progress.

The regular improve in NVT from the start of the 12 months signifies growing exercise on the Chainlink blockchain.

This can be a bullish sign for LINK, one which helps the concept that the value has discovered a stable backside and will head greater quickly.

Supply: IntoTheBlock

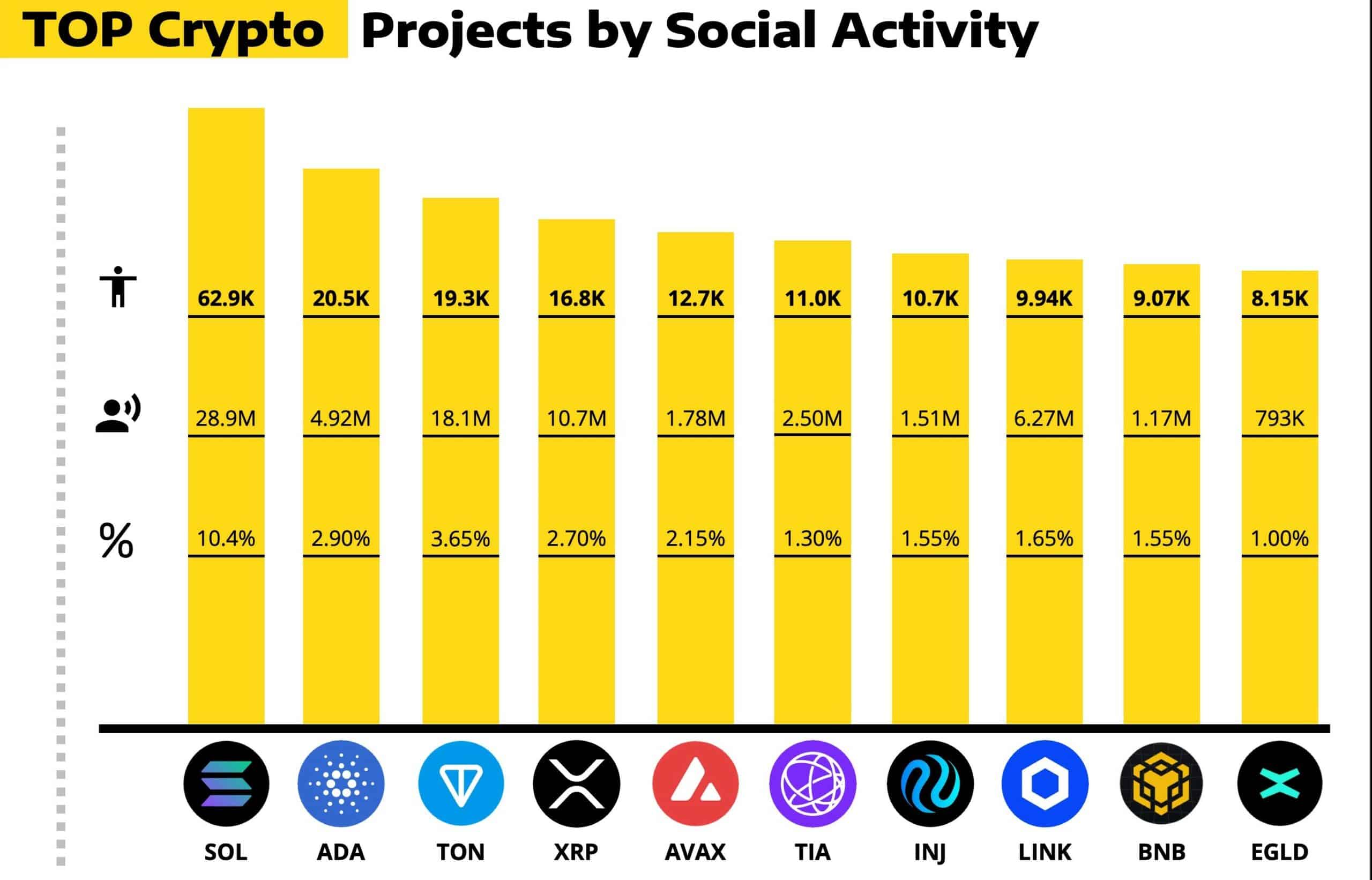

Chainlink’s social dominance

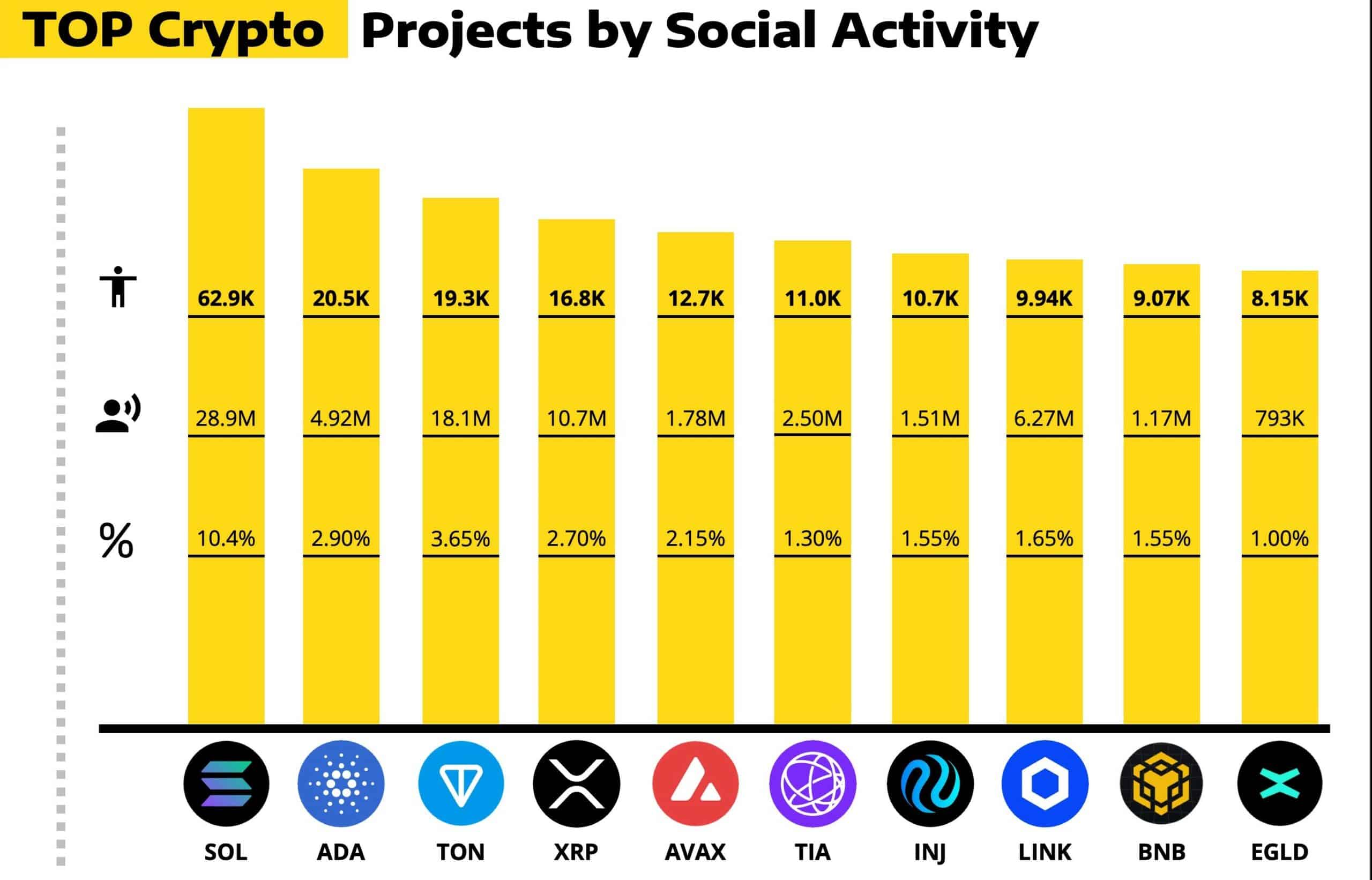

Lastly, LINK’s social exercise has additionally elevated enormously. Among the many prime 10 crypto tasks, Chainlink has a social dominance of 1.65%, primarily based on social posts and engagements throughout platforms.

This rising social engagement additional strengthens the bullish sentiment for LINK. Particularly since larger social visibility usually comes with greater rates of interest and potential value actions.

Supply: LunarCrush

In conclusion, Chainlink’s latest partnerships, on-chain exercise, and social dominance all level to the potential for the next value as market circumstances enhance.

If LINK holds its present assist and the double backside sample performs out, vital value appreciation may happen within the coming months.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now