Bitcoin

Are You Selling Your Bitcoin to Institutions? Top Reasons to Reconsider and Hold BTC

Credit : coinpedia.org

Prior to now yr there was an enormous shift within the possession of Bitcoin, whereby the institutional gamers are more and more gathering BTC. This development is accelerated shortly after the approval of spot ETFs in January 2024. Alternatively, many retail traders, seduced by short-term wines or afraid by volatility, are loading their BTC participations. However right here is the flip: they promote to the settings that doubted Bitcoin for a very long time and are the identical that now imagine that BTC is an extended -term retailer.

The information on the chains counsel that the institutional demand for BTC has elevated for the reason that begin of the second quarter. Within the meantime, the demand for topping the retail traders has taken a giant hit for the reason that starting of the yr, which rose marginal as the value marked a brand new ATH, however later dropped. This means that the settings management the present BTC -Uptrend, with ETFs and enterprise treasury that aggressively accumulate. Within the meantime, the relative absence of the retail commerce can imply on pent -up FOMO if the value breaks, results in sharp volatility as new consumers accumulate, and likewise extra dangers of native tops when sentiment peaks.

That’s the reason retail merchants are anticipated to remain centered on quantity forces and spot questions, as a result of some elements will quickly level to a big value promotion.

For $ 108k, the BTC value remains to be undervalued

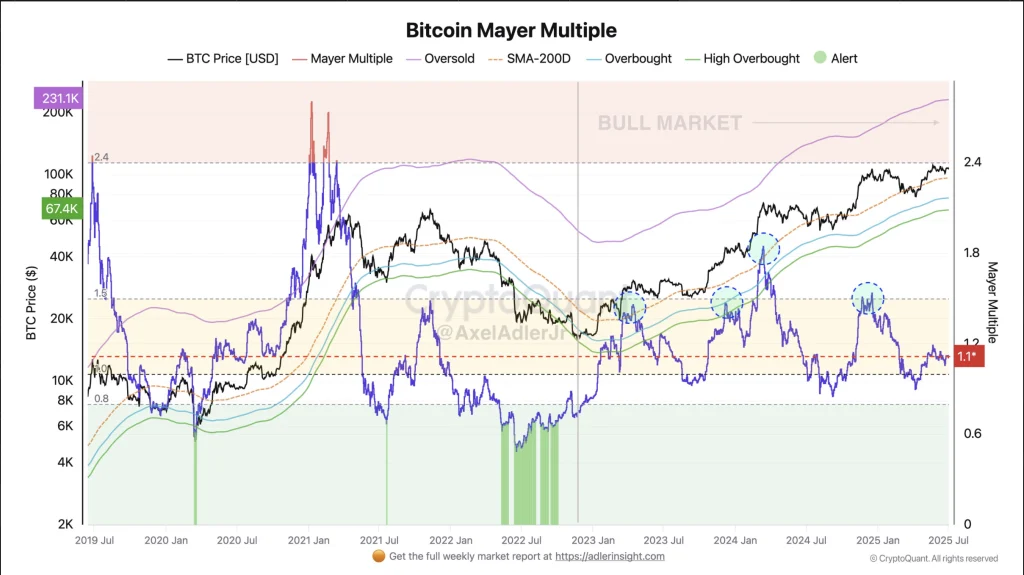

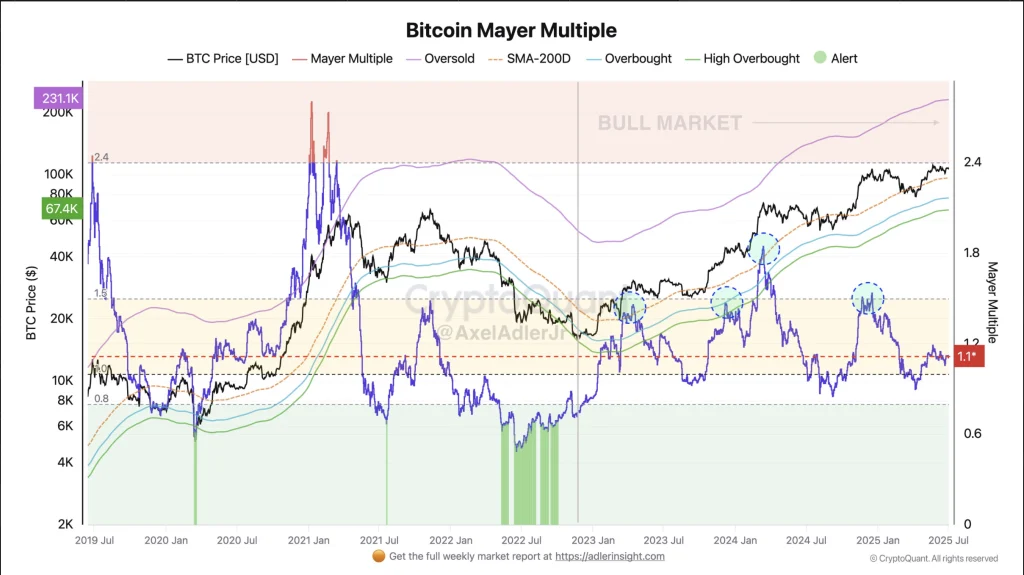

The Bitcoin value nonetheless reveals house for strolling, as prompt by the Mayer A number of, an oscillator calculated because the ratio between value and the 200-day MA. It helps to find out whether or not Bitcoin could also be overbought, fairly priced or undervalued. A better a number of means that the BTC value acts at a premium, however the present charges are decrease, which signifies that token is on the lowered charges.

As will be seen within the graph above, Bitcoin’s Mayer A number of is 1.1x, solely 10% above 200 DMA and properly beneath 1.5x overheated zone. This alerts that it’s not overheated, even within the occasions that the BTC value is simply an inch away from the ATH. This means that token nonetheless appears to be undervalued and even performing at $ 108k.

One other sleeping whale wakes up

In latest days, the crypto room witnessed a historic occasion of the sleeping portfolios that out of the blue grew to become lively after 14 lengthy years. As well as, a part of the transferred Bitcoin was reportedly offered, which mounts enough bearish stress over the token, however the slender consolidation of the BTC value means that the bulls are nonetheless beneath management. However, an identical occasion passed off during which Bitcoin marked the third largest revival with at some point of Outdated Provide in historical past.

The information of Glass node means that greater than 80,000 BTC that has remained inactive for greater than 5 years is on the transfer. The same occasion passed off in the midst of 2024 and within the first few days of 2022. In occasions when the market capitalization of Bitcoin is above $ 2 trillion, nearly $ 8.6 billion in BTC switch will be fairly a giant factor. The influence on the value within the brief time period, nonetheless, continued to neglect, however the provide shock may very well be revenue.

Pack!

At a time when settings acquire aggressive bitcoin, retail traders should pause and take into consideration the lengthy -term implications of the sale. The worth of Bitcoin is just not solely in value, but in addition within the design as a decentralized, finite lively. By holding, you keep your monetary sovereignty and also you take part in a uncommon financial shift. Promoting can now supply positive factors within the brief time period, however holding you’ll be able to place you for exponential worth creation, since international acceptance and institutional curiosity will proceed to speed up within the coming years.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024