Bitcoin

Bitcoin’s $60,000 breach triggers $48M in short liquidations – More to come?

Credit : ambcrypto.com

- Over the previous three months, whales and sharks have collected over 28,000 BTC

- Bitcoin was buying and selling above $60,000 on the time of writing, regardless of latest declines

Bitcoin [BTC] has efficiently crossed the important psychological resistance of $60,000, leading to a big variety of brief liquidations within the final 24 hours. Within the run-up to this worth breakthrough, the buildup patterns of main addresses have intensified over the previous three months.

Moreover, the provision of BTC on exchanges steadily declined, with extra Bitcoin leaving the exchanges.

BTC crosses the psychological barrier

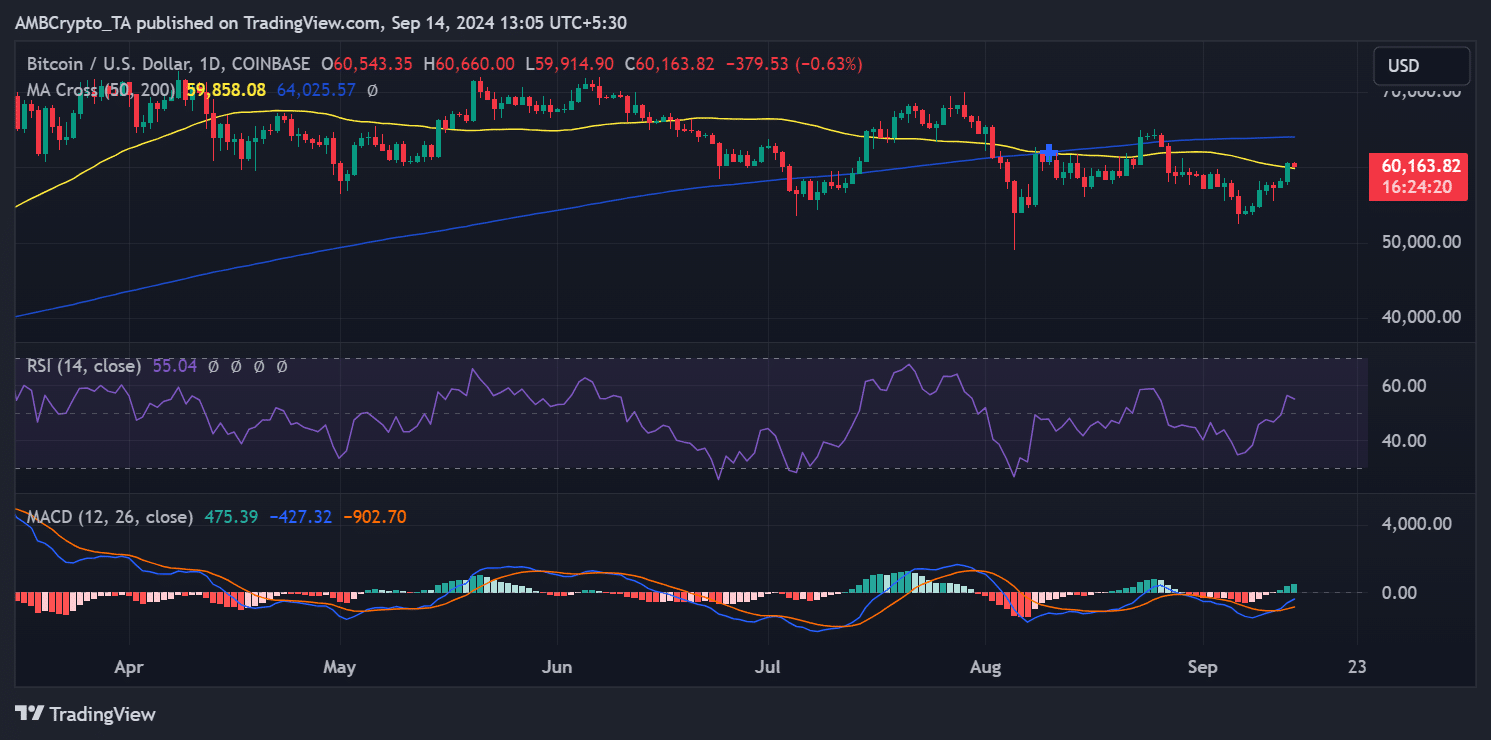

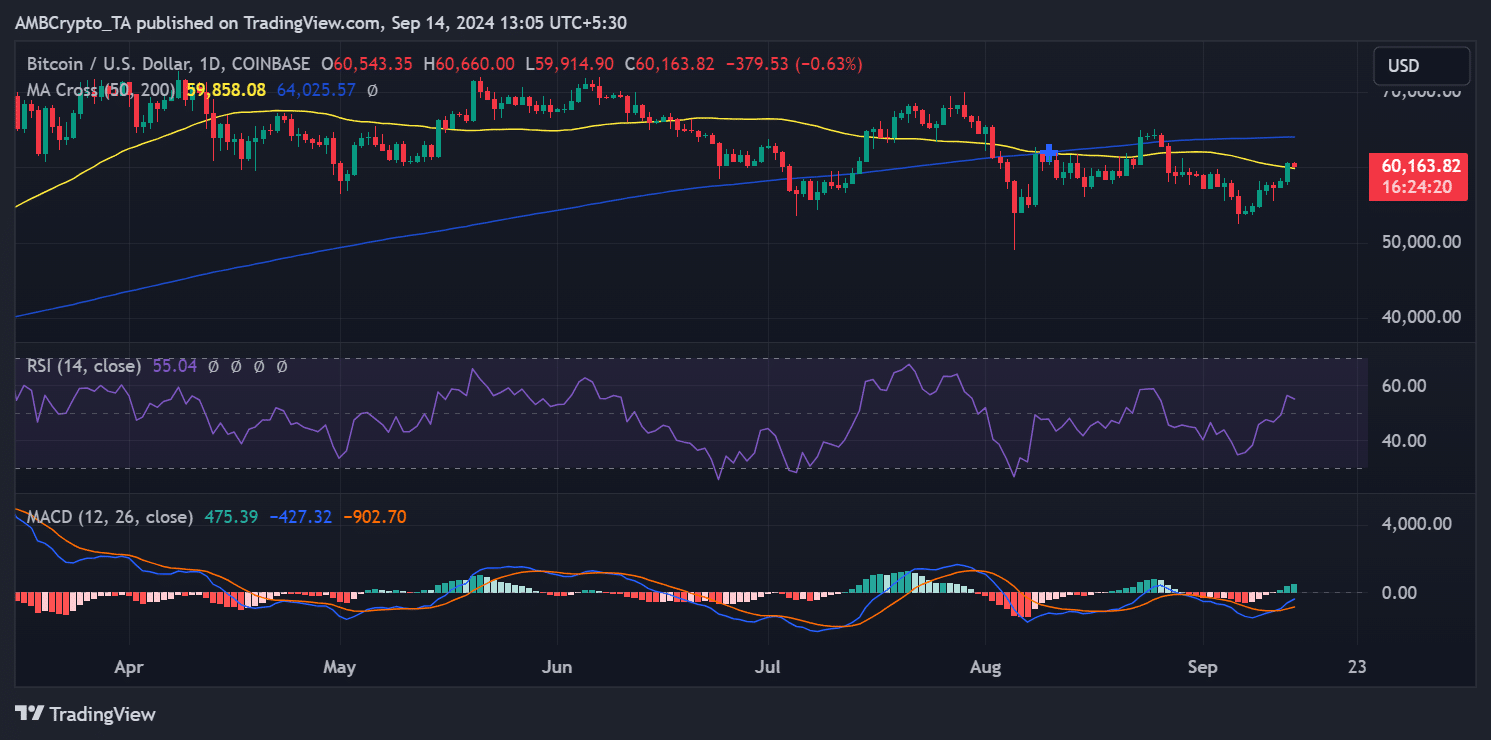

An evaluation of Bitcoin’s worth motion on September 13 revealed a robust rebound, which pushed BTC above its psychological resistance at $60,000. At one level it was even buying and selling at $60,543, up 4% in simply 24 hours. This rise allowed Bitcoin to interrupt above its short-term transferring common (yellow line), which had beforehand acted as resistance.

Whereas the cryptocurrency fell to $60,177 quickly after, BTC stays bullish. The identical was confirmed by the Relative Power Index (RSI), which hovered round 55 – an indication of constructive market momentum.

Supply: TradingView

The transfer above the short-term transferring common and continued bullish RSI urged that Bitcoin should be on an upward trajectory. The slight pullback may very well be non permanent, with potential for additional features if shopping for stress continues to extend.

Bitcoin’s continued accumulation and retreat

Latest information has additionally proven that Bitcoin accumulation and withdrawals have been important in latest months – a bullish development.

In response to information from Santimentaddresses with 10 BTC or extra have accrued greater than 28,000 BTC within the final three months. These massive holders now management over 16 million BTC, demonstrating larger confidence within the asset.

Moreover, Bitcoin fell under $60,000 on August 29, that means these addresses have accrued BTC at completely different worth ranges. This strategic accumulation throughout worth swings means that these holders are getting ready for potential future earnings.

The provision of BTC on the exchanges additionally fell considerably, with 75,000 BTC withdrawn within the final three months. This leaves roughly 1.8 million BTC left on the exchanges. The lowered trade provide is a transparent bullish sign as a result of it means holders are choosing long-term storage slightly than promoting. This consequently reduces the out there buying and selling provide.

Supply: Santiment

If Bitcoin’s worth maintains its present degree or strikes greater, the mix of accumulation and provide discount on the exchanges may additional strengthen the bullish momentum. This can drive the worth greater within the charts.

Quick positions result in monumental losses

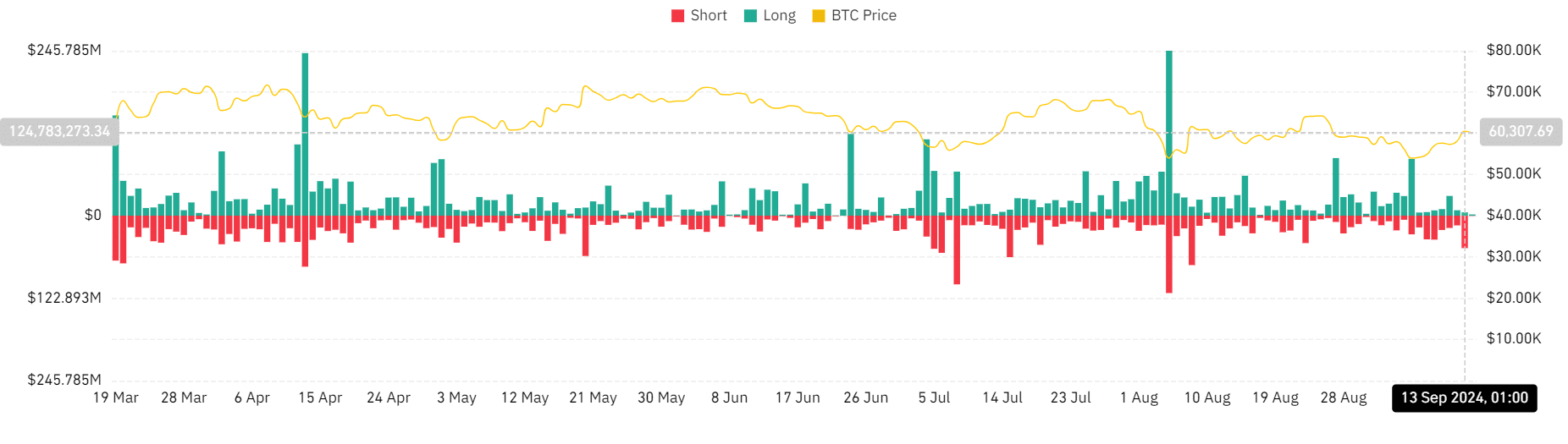

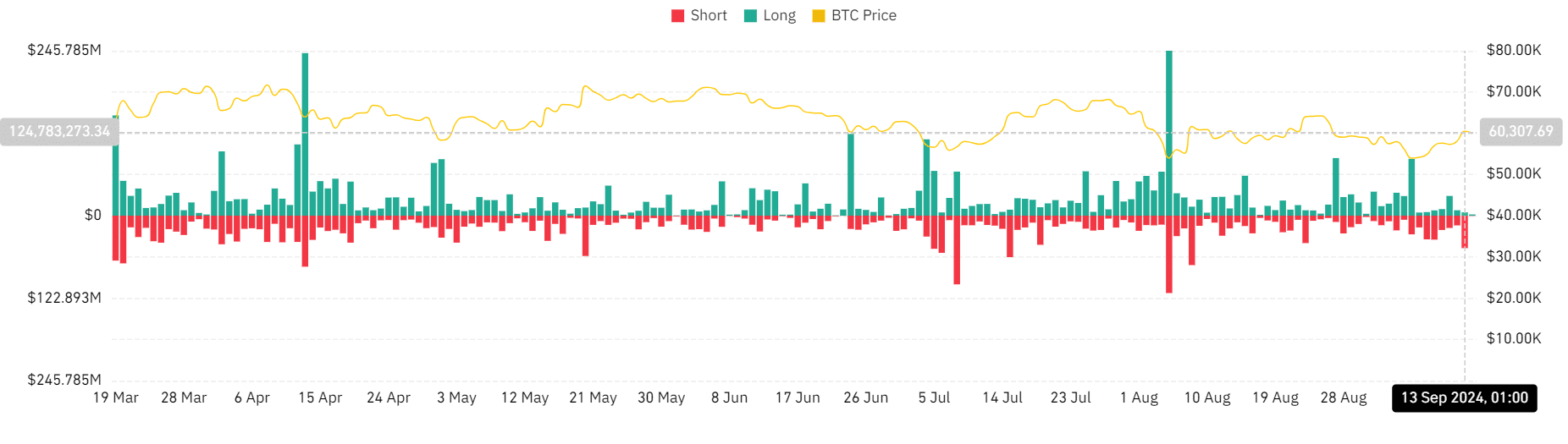

The 4% rise in Bitcoin’s worth over the last buying and selling session led to a serious liquidation of brief positions.

In response to the Mint glass In response to liquidation chart evaluation, brief positions confronted greater than $48 million in liquidations on the finish of buying and selling on September 13. Quite the opposite, solely $5 million in liquidations occurred among the many lengthy positions.

Supply: Coinglass

– Learn Bitcoin (BTC) worth prediction 2024-25

This mirrored the same occasion on August 8, when Bitcoin’s worth rose from $55,000 to over $61,000, resulting in the same spike briefly liquidations.

This liquidation occasion and broader bullish alerts may gasoline additional upside momentum within the close to time period.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024