Blockchain

Ethereum Surges, Solana and Base Close Behind

Credit : cryptonews.net

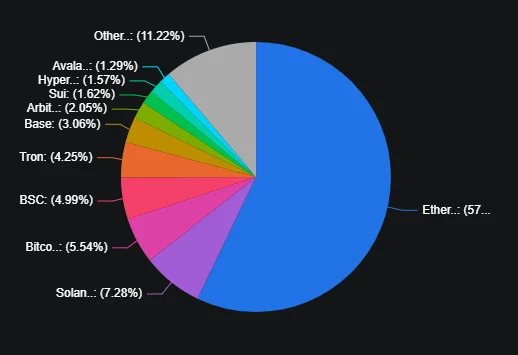

Defi’s Multi -Chain -story This week is one in all each consolidation and diversification. In accordance with the info from Defillamas on 12 July, the ten block chains that lock probably the most capital noticed a mixed whole worth locked (TVL) of greater than $ 114 billion, with Ethereum solely good for nearly two -thirds of that whole.

Whereas the TVLe from Ethereum rose almost 11% on the again of unlocked stake rewards of the Shanghai -Improve, Capital additionally flowed into excessive -speed networks and rollups, with the evolving, multi -chain actuality of Defi. From the rising yield devices of Bitcoin to the rise of latest layers -2 contenders, this week’s figures reveal each the sustainable affect of older chains and the growing enchantment of the subsequent -generation platforms.

Ethereum and the layer -1 heavyweights

This week Ethereum once more claimed its supremacy in decentralized financing, with a complete worth locked by nearly 11% to round $ 72.1 billion. A lot of that influx stems from renewed exercise on mortgage platforms and automatic market makers after the Shanghai improve, which unlocked ETH and unleashed new liquidity of the community in a very powerful protocols of the community.

Not far behind, Bitcoin’s Defi -Ecosystem, largely powered by packed BTC devices and BTC -Pegged Polish, noticed his TVGed rise about 11% to $ 6.9 billion, which exhibits that Bitcoin is now not only a retailer, however an more and more lively effectivity reduction activa.

Within the meantime, BNB Sensible Chain (BSC) has added round 4.5% (TVL has been lifted to $ 6.2 billion) as enticing revenues on BSC -Ininative AMMs and contemporary bridge deposits from different networks continued to attract capital. Tron additionally achieved a weekly revenue of 11.4%, now $ 5.3 billion with a rock -bottom charges and enlargement of USDT -backed liquidity swimming pools.

Layer -2 -Rollups and rising contenders

Past the Massive Three, numerous Layer -2 options and various chains have taken out their niches. Solana registered a rise from 7.4% to round $ 9.1 billion, pushed by Dex exercise with excessive transit and a wave of latest credit score protocols on its quick, low -feature. The essential function of Coinbase impressed a weekly revenue of 11.6%, and pushed its TVL nearly $ 3.9 billion, whereas each merchants and builders come to his Ethereum -Backed surroundings.

Different outstanding artists embody arbitrum (solely 0.9% slip to $ 2.5 billion), avalanche (+7.9% to $ 1.6 billion), polygoon (+1.4% to $ 1.1 billion), and on Maving, who led the peloton with a bounce of the highest of the highest of the highest of the highest of the highest ten and collective, the ending of the highest of the highest of the highest of the collective and collective of the collective and collective, the ultimate of the collective of the Collective, -Chain.

The capital stays ebb and flows between layer -1 colossen, rollups and various networks, so maintaining a tally of these ten chains stays important for anybody who follows the place probably the most thrilling Defi innovation and the deepest poles of liquidity happen.

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International