Bitcoin

Mathematically Predicting The Bitcoin & MSTR All Time Highs

Credit : bitcoinmagazine.com

With Bitcoin who strikes new highlights of all time, the inevitable query involves the fore for each investor: how excessive can this bull market really go? On this evaluation we observe a data-driven and mathematical method to attempt to estimate potential value targets for each bitcoin and (micro) technique throughout the present cycle.

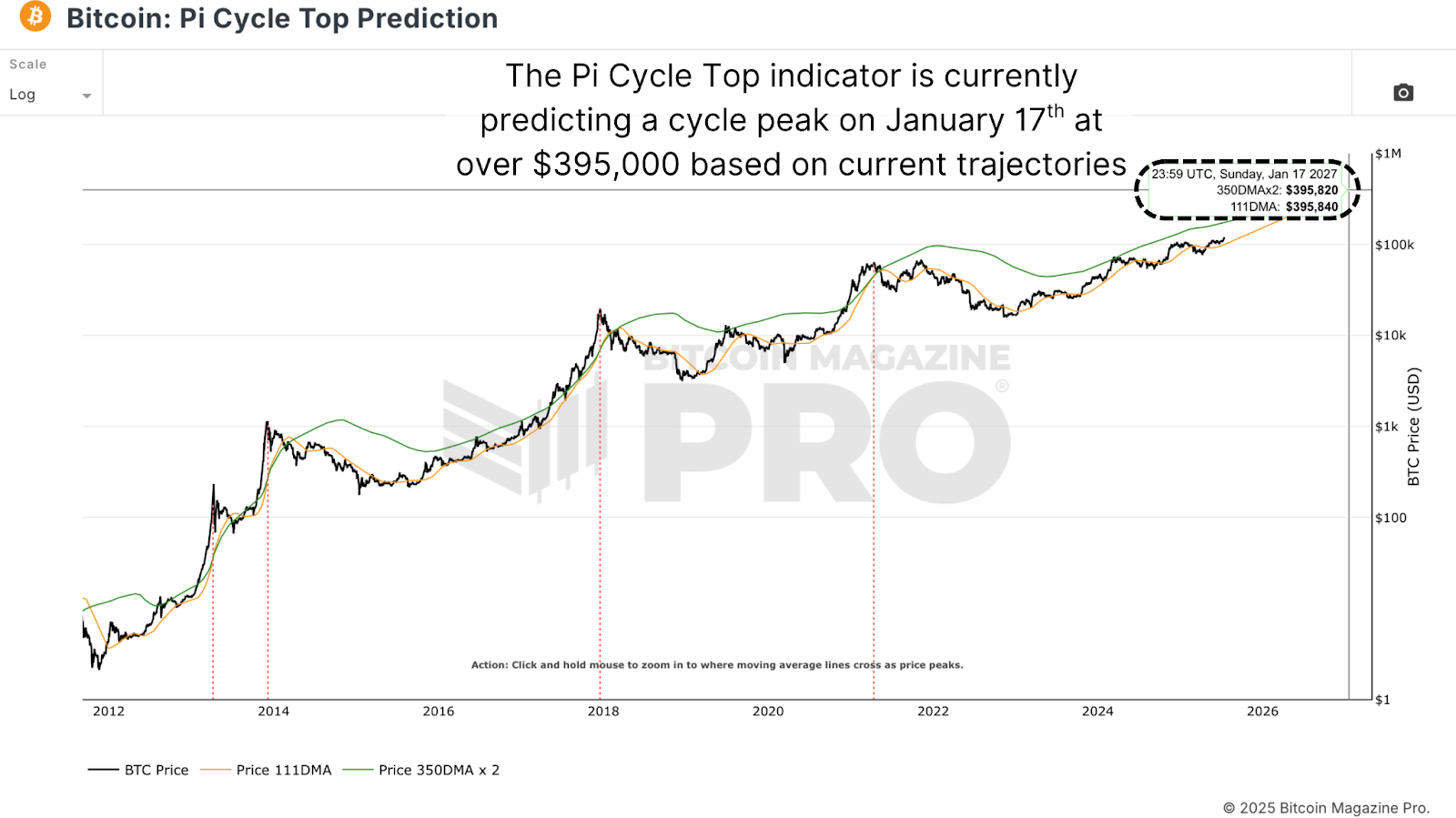

Re -evaluate the Pi

The Pi cycle Top prediction Graph relies on two essential advancing averages: the progressive common of 350 days multiplied by two (inexperienced line) and the 111-day advancing common (Orange Line). Traditionally, when the 111-day MA crosses above 350-day MA x 2, a Cyclus peak passed off inside just a few days. Regardless of the accuracy up to now, together with flawless calls throughout earlier cycles, it is very important keep cautious.

For the present processes, the indicator predicts a cycles peak round January 17, 2027. For every crossover, nonetheless, BTC ought to keep the costs that far above 350DMA*2 for months, in all probability at costs significantly larger than $ 200,000. That stage of persistent value ranking appears unlikely to this cycle, though I want to be incorrect! Though the device stays a beneficial indicator for danger administration, we must always not solely belief Timing Macro tops solely due to the historic accuracy.

MVRV ratio

A extra grounded methodology consists of the Market value for realized value (MVRV) Relationship. By analyzing the connection between market value and the value realized (the typical price foundation of all BTC in circulation), we are able to set life like expectations. If we’ve a conservative CyclusSpiek MVRV rating of two.8 extrapolation with the assistance of earlier buy returns, peaks that we’ve already set within the MVRV on this cycle and the present value of $ 50,000, we arrive at a present projected Bitcoin prime of roughly $ 140,000.

Nevertheless, because the realized value continues to rise because the capital flows flows in Bitcoin, a realized value of $ 70,000 later within the cycle would counsel a possible peak nearer to $ 200,000. This methodology displays a extra dynamic method to understanding Bitcoin’s market conduct primarily based on knowledge from chains and investor psychology.

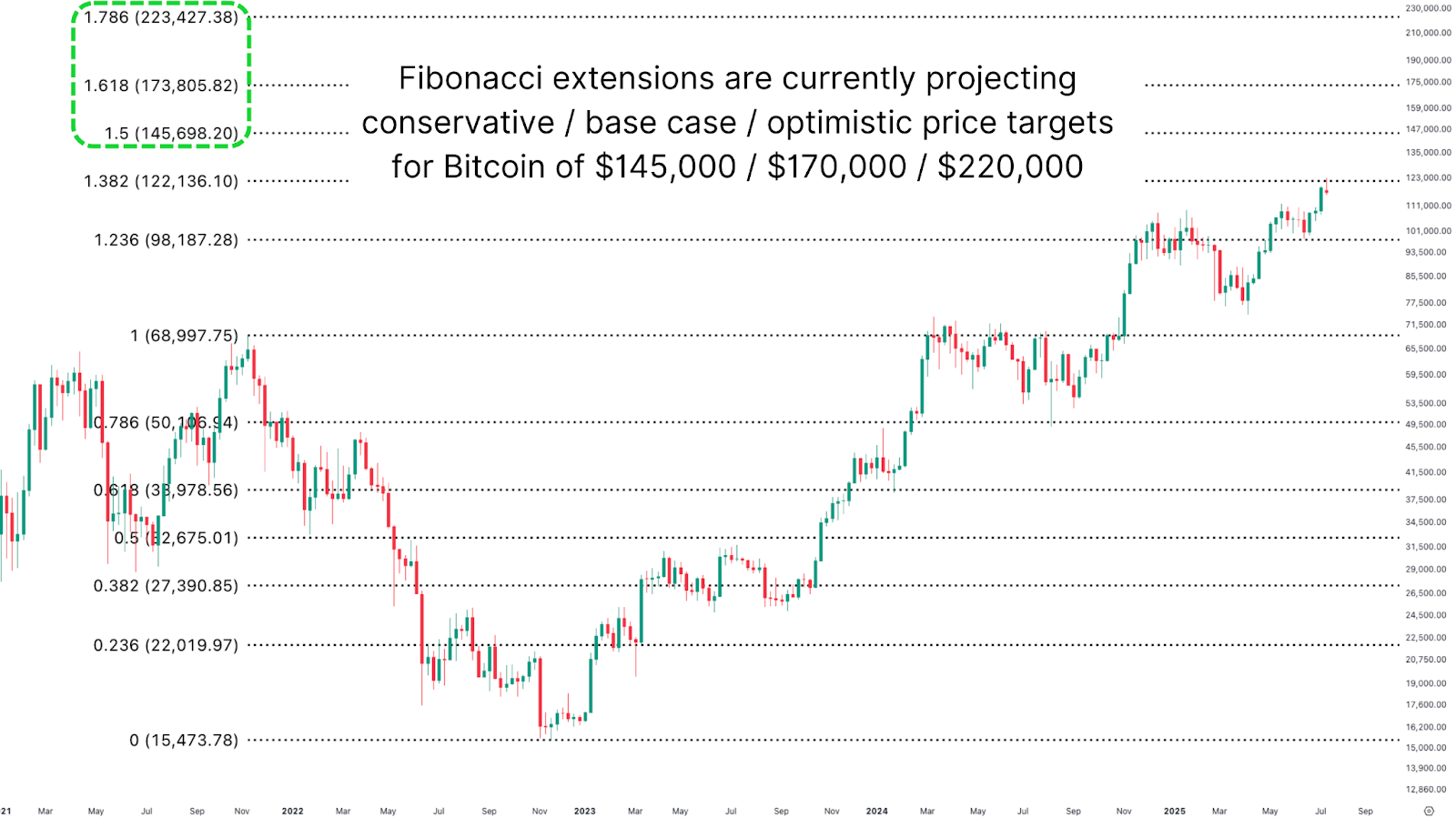

Fibonacci -Extensions

For extra technically supposed merchants, Fibonacci extensions can supply insights into the introduction of value discovery. With the assistance of the FIB extension device of TradingView on the lows and highlights of earlier cycle, we’ve recognized important ranges which have supported resistance and assist traditionally with an extremely excessive diploma of accuracy. As well as, the current excessive was extremely intently equivalent to the 1,382 FIB stage at ~ $ 122,000.

Trying forward, the 1,618 extension ~ $ 170,000 suggests as a probable Cyclustop, with a extra aggressive upward goal of ~ $ 220,000. Curiously, that is intently according to the projections from $ 140k to $ 200K derived from MVRV evaluation, which affords strong cross-model validation.

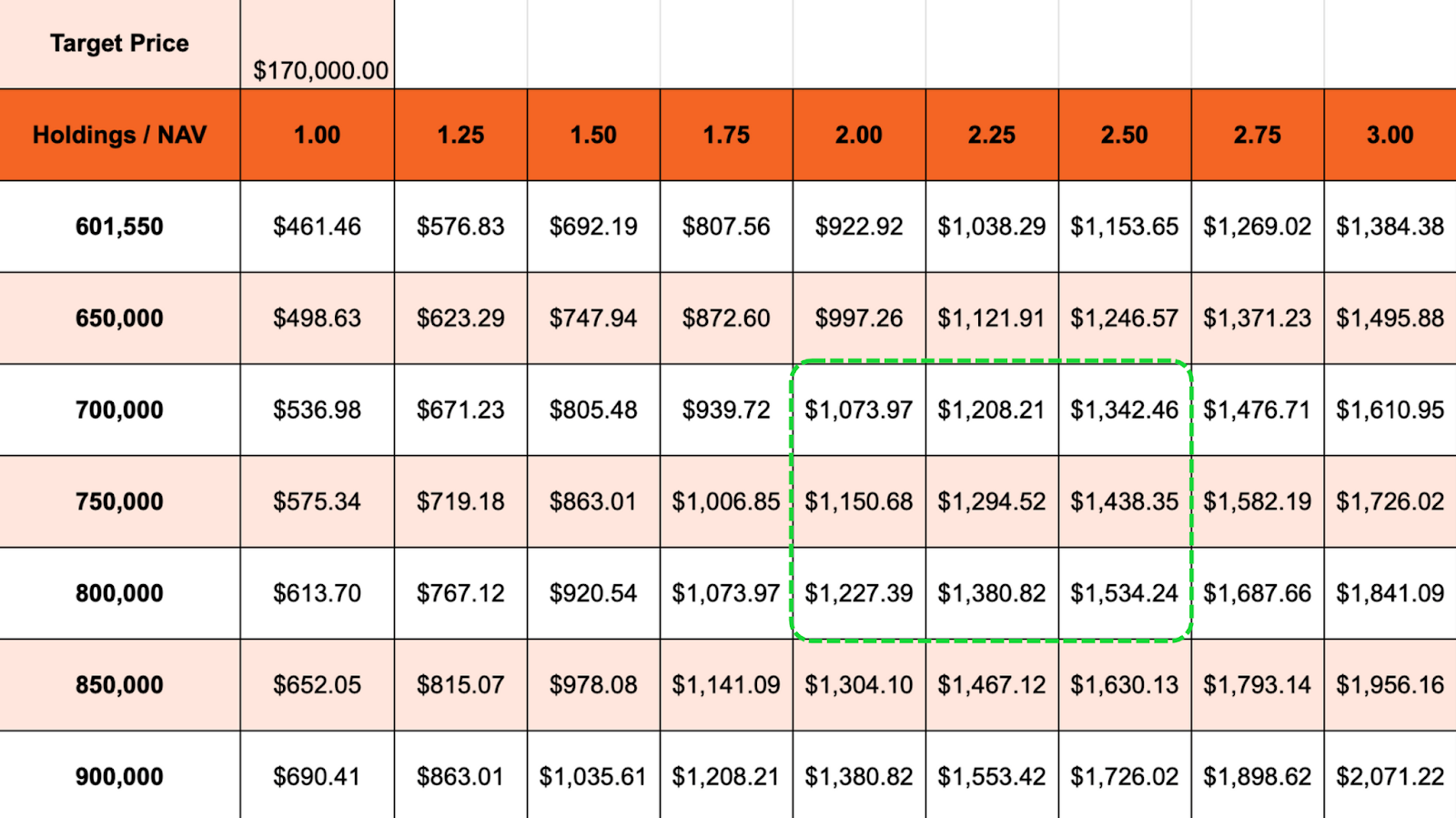

Technique peaks

(Micro) Technique’s inventory value is strongly influenced by the rising BTC reserves. The corporate at present has greater than 600,000 BTC and is anticipated to extend this to between 700K and 800K because the cycle continues. Making use of the identical Fibonacci framework to MSTR reveals a possible resistance round $ 543, additionally the present of all time excessive, and upcoming targets of ~ $ 800 and ~ $ 1,300.

To validate this, we’ve analyzed the premium of MSTR on his Bitcoin Web Asset worth (NAV), which has fluctuated this cycle between 2x and nearly 3 occasions a number of occasions. Based mostly on a future Bitcoin value of $ 170k and steady accumulation, a 2-2.5x premium means that MSTR is a reputable higher restrict with $ 1,300.

Conclusion

The worth potential of Bitcoin, this cycle varies from $ 140,000 to the conservative finish, as much as $ 170,000 within the basicase and as much as $ 220,000 in a bullish situation. For the technique, this interprets into a probable higher restrict of roughly $ 1,300 and affords the asymmetrical benefit for traders betting on oblique Bitcoin publicity.

In the end, though modeling a future value promotion is informative, knowledge should not information your choices. Caught not solely to be numbers or fashions alone. Be prepared to behave when danger indicators come up, even when your favourite mannequin has not reached its magic quantity.

💡 Love this deep dive in Bitcoin -price dynamics? Subscribe to Bitcoin Magazine Pro on YouTube For extra knowledgeable market insights and evaluation!

Go to for extra in -depth analysis, technical indicators, actual -time market warnings and entry to knowledgeable evaluation Bitcoinmagazinepro.com.

Disclaimer: This text is just for informative functions and shouldn’t be thought of as monetary recommendation. At all times do your personal analysis earlier than you make funding choices.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024