Altcoin

Avalanche sales fell more than 40% in the second quarter

Credit : www.newsbtc.com

This text is accessible in Spanish.

Avalanche (AVAX) has had a horrible Q2 2024 by a number of measures, with a big drop in market cap coupled with low income era.

Associated studying

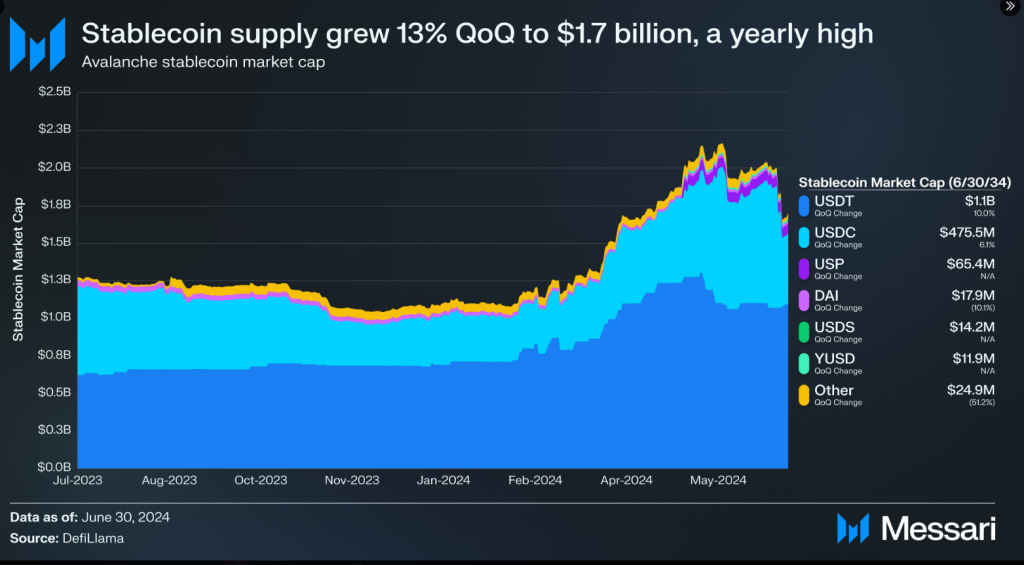

Messari’s latest report exhibits that AVAX confronted a pointy correction after two quarters of progress on the trot. The market capitalization fell by 40% within the final quarter to $11.6 billion. Regardless of this hunch, the ecosystem remains to be wholesome AVAX nonetheless has a market cap of $4.5 billion – that is a rise of 157% in comparison with the identical interval in 2023.

State of @avax Query 2

Main Replace: A number of partnerships introduced, together with notable ones @streep, @homiumAnd @konami.

QoQ statistics 📊

– AVAX deployed ⬆️ 6%

– DeFi TVL (AVAX) ⬆️ 11%

– Stables ⬆️ 13%Learn the total report 🔗https://t.co/7xsKIj1ml3 pic.twitter.com/0dSZnfXOVE

— Messari (@MessariCrypto) September 13, 2024

Value forecast shines by way of the dip

The downturn is hurting the bigger ecosystem, however AVAX’s future seems brighter. In actual fact, the token’s value prediction will create hope for traders. AVAX will rise 70.68% over the following three months, exhibiting a restoration from latest costs. analysis of CoinCheckup exhibits.

This bullish sentiment is strengthened by long-term projections that recommend 166% progress for the approaching yr. It seems that AVAX is poised for a restoration, making it an intriguing asset for merchants watching the market.

Drop in earnings and exercise within the chain

Revenues for the Avalanche ecosystem have been one other supply of concern, as its worth fell from 176,700 AVAX within the second quarter of 2024 to 96,200 AVAX in the identical interval. In greenback phrases, that translated to $7.5 million, dropping to $3.5 million.

The decline is because of slowed exercise on varied on-chain platforms. Nonetheless, some analysts imagine that renewed curiosity in on-chain transactions might assist revive income progress within the close to time period.

Regardless of these declines, deployment stays strong throughout the Avalanche ecosystem. There was a 6% improve within the variety of AVAX tokens staked as a consequence of new measures to incentivize staking. Staking rewards proceed to draw new traders, regardless of a 7% decline within the variety of lively validators. This displays some discomfort amongst validators amid these market circumstances.

Community stability

The typical variety of transactions stays blended. With roughly 11,262 transactions and a median block time of 1.61 seconds, Avalanche exhibits stability. Greater than 2% of the full cash have been despatched from the Elliptic Curve Digital Signature Algorithm pockets. Regardless of the recorded declines, new initiatives are anticipated to spice up stakes and future coin balances.

Associated studying

Curiously, the place the community had a median transaction drop by 57% from 495,000 to 201,500, some protocols on Avalanche refused to stick to this pattern. Tether (USDT) and GMX elevated transaction volumes, indicating that particular sectors within the system are doing properly regardless of this broad slowdown for the crypto market.

As AVAX prepares for a potential market upturn, traders may even see renewed curiosity within the asset if such a predicted value improve comes true.

The partial restoration in transaction volumes for choose protocols additionally means that there’s something extra occurring beneath the floor – an indication that Avalanche might rapidly decide up as soon as the crypto market picks up. For now, traders are keen to look at how AVAX behaves within the brief and medium time period.

Featured picture from Durango.com, chart from TradingView

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024