Policy & Regulation

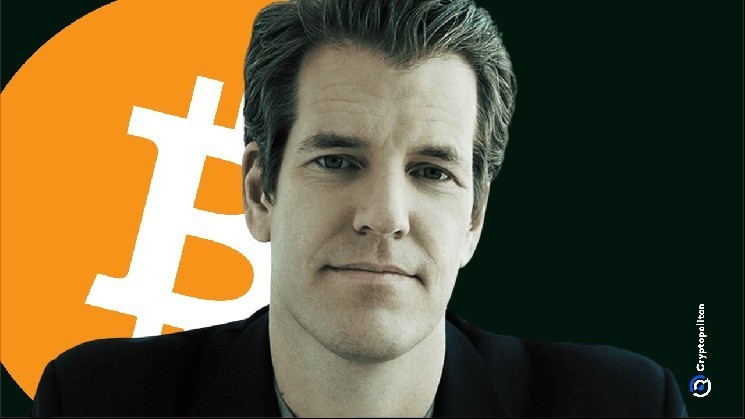

Tyler Winklevoss accuses JPMorgan of halting Gemini’s onboarding after he criticized the bank

Credit : cryptonews.net

Tyler Winklevoss accuses JPMorgan Chase of stopping efforts to board his crypto firm, Gemini, on board boating after he publicly criticized the financial institution on X.

The feedback Got here on July 19, shortly after Bloomberg reported that JPMorgan had determined to begin fintech firms to cost the financial institution particulars of their customers. Tyler stated that this new coverage would financially destroy those that assist folks hyperlink their financial institution accounts to platforms corresponding to Gemini.

Tyler took his frustration to X and Tagde Jamie Dimon, the chief govt of the financial institution, in his place. “Sorry Jamie Dimon, we do not stay silent” written. “We are going to name this anti-competitive, rent-seeking habits and the immoral try to do fintech and crypto firms too bankrupt. We are going to by no means cease combating for what is nice!”

The criticism was not simply in regards to the prices. Tyler claimed that JPMorgan’s reply was to his put up to totally pause the onboarding technique of Gemini. That call, he stated, was a deliberate act of retribution. And it isn’t the primary time this occurred.

JPMorgan dropped Gemini earlier than Trump supported the crypto

Years earlier than Trump’s crypto-friendly method, JPMorgan Gemini had already instructed you to seek out one other financial institution. On the time, the corporate thought-about Gemini unprofitable and threw it dumped. Tyler identified that this lengthy -term friction has now surfaced, and it occurs once more below totally different circumstances, this time, instantly after he publicly criticized them.

Tyler and his twin brother, Cameron Winklevoss, each supported Donald Trump’s final marketing campaign. In 2025 they can even be current at a number of occasions of the White Home throughout Trump’s present time period. This renewed entry to Washington is as a result of his administration coverage helps that the regulatory stress on cryptom firms scale back.

Though Tyler’s feedback have been bone, they don’t seem to be fully surprising. Jamie Dimon has constructed up a popularity over time for throwing away crypto. Previously he known as Bitcoin a “fraud” and even instructed the press that if a JPMorgan dealer was purchased Bitcoin, they might be fired. He additionally labeled the activa class solely as helpful for criminals.

However in a shocking flip, JPMorgan is now on the lookout for Crypto -Loingen.

JPMorgan quietly prepares crypto -credit plans

Even when Tyler shoots the financial institution for damage crypto firms, JPMorgan is alleged to be getting ready to supply loans supported by crypto. The financial institution is planning to borrow straight in opposition to Bitcoin and Ether, presumably already subsequent 12 months. The plan can embody using crypto as collateral, one thing that the majority conventional banks, together with Goldman Sachs, nonetheless don’t do.

The financial institution is already borrowing in opposition to crypto ETFs, and this may be the following step. Though no formal announcement has been made, the general public tone of Dimon has shifted. In Might he stated: “I do not assume it’s best to smoke, however I defend your proper to smoke. I defend your proper to purchase Bitcoin. Go together with it.” That was a dramatic change in comparison with his older perspective.

The interior pivot at JPMorgan might be as a result of alienation of wealthy prospects who’ve constructed their portfolios by way of Crypto. Tyler believes that their present method, which costs fintechs for entry to financial institution knowledge, reveals that the financial institution nonetheless doesn’t need crypto firms in its house, particularly those that dare to criticize the coverage.

Gemini just isn’t standing nonetheless. Earlier this 12 months, it was confidential on a primary public provide, in response to Bloomberg, which says that the corporate may point out earlier than the top of the 12 months, relying on how shortly the American results and trade committee will play its present investigation. In January, Gemini settled with the Commodity Futures Buying and selling Fee and agreed to pay $ 5 million.

Gemini was based in 2015 by Tyler and Cameron after their authorized combat with Fb founder Mark Zuckerberg in regards to the origin of the social community. Since then they’ve constructed Gemini in one of the crucial well-known crypto exchanges within the US, regardless of frequent regulatory fights and financial institution challenges.

The accusations of Tyler come at a time when the political sentiment in Washington has modified for the primary time. After years of uncertainty below Biden, crypto firms achieve energy. The American Home of Representatives has simply adopted the primary main crypto legislation to control Stablecoins. Trump signed the invoice the following day within the legislation.

That change may open the door for extra crypto-oriented monetary merchandise, even from banks corresponding to JPMorgan. However so far as Tyler is anxious, the combat is now about benches that silence their critics. And this time the goal is evident.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now