Bitcoin

Bitcoin: Short-term rally, long-term risk? BTC faces double-top warning

Credit : ambcrypto.com

Vital assortment eating places

The MVRV ratio of Bitcoin signifies a double prime formation. Buyers can see a brief -lived rally earlier than a possible September correction, making warning on the wiser gamble.

Bitcoin [BTC] has remained in a comparatively bullish section after greater than $ 123,000. Nonetheless, it has been stagnated previously week and has solely proven modest income.

That may change quickly. The evaluation of Ambcrypto means that Bitcoin might put together for a brand new rally, one that may be accomplished between the top of August and the start of September.

Bitcoin Rally might finish in September

In keeping with the MVRV 365-day advancing common, Bitcoin can quickly get a major lower.

This projection relies on the double camel sample, which led to the 2021 bear market. The sample is created when two peaks happen about six months aside.

From the second of the press, Bitcoin has fashioned the primary peak and is on its option to kind the second – praised round 10 September – that would activate a market cascade.

Supply: Cryptuquant

Cryptoquant Analyst Yonsei Dent reflect This sentiment, warning that wider market situations are cautious.

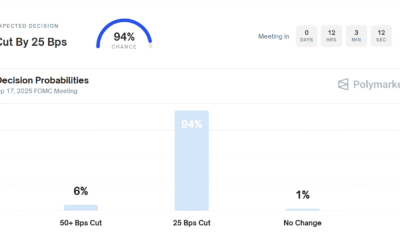

“This timing suits in effectively with wider market tales, corresponding to expectations for a potential acceleration of the Fed Charge and shifts within the macro sentiment.”

He additionally warned that the decline might begin sooner, with the lagging MVRV 365DMA as an vital indicator that would mark the beginning of a downward pattern on the finish of August.

Accumulation stays steady regardless of the chance

Regardless of the upcoming sample, his traders didn’t cease accumulating.

The realized worth -hit checklist of the Worth -Utxo exhibits that BTC consumers raised the businesses by 3.6percentwithin the final month within the 1W -1m cohort, whereas holders of 1D -1 W grew by 1.4%.

Supply: Cryptuquant

These cohorts have collected BTC between $ 115,252 and $ 117,762, just under the present worth of $ 118,786.

This conduct implies belief in a brief -term rally, as a result of holders cancel panic gross sales in the long run.

Assist for these prospects, Bitcoin’s Alternate Reserve rejected Within the final day, to 2.3 million BTC.

A lower within the Bitcoin of the alternate usually signifies that traders transfer belongings to non-public portfolios for lengthy -term retaining, with little intention to promote within the quick time period.

Supply: Cryptuquant

Institutional traders, nonetheless, appear to take the alternative route.

Institutional publicity is falling

Previously 4 buying and selling days, institutional traders have shortened their publicity to Bitcoin, in accordance with Coinglass Spot BTC ETF Circulation facts.

Between July 21 and 23, this group launched $ 285.2 million to BTC, which suggests a shift in sentiment.

Between 24 and 25 July, nonetheless, they purchased $ 375.5 million from BTC, which contributes to the bullish case, though briefly, it appears.

Supply: Coinglass

Nonetheless, that two -day buy was the bottom registered in latest months, which signifies reducing curiosity and a potential willingness for a market in market.

Bitcoin was in a position to see extra the other way up within the coming days.

Nonetheless, the broader knowledge – particularly of the MVRV sample and the institutional present -, nonetheless, point out an imminent danger of an important decline, which means that traders have to be cautious.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024