Ethereum

Crypto Market Hit by $500M Liquidations as Bitcoin and Ethereum Lose July Gains

Credit : coinpedia.org

The cryptomarkt was confronted with a serious setback, as a result of greater than $ 500 million in positions had been liquidated, after a pointy lower within the costs of Bitcoin and Ethereum. After having proven robust earnings in July, each high cryptocurrencies misplaced the momentum, which activated a wave of sale. Since each Bitcoin and Ethereum are actually round new month-to-month in -depth, there’s an elevated probability of a brand new lower within the coming hours.

$ 500 million liquidation prompts contemporary worth low factors

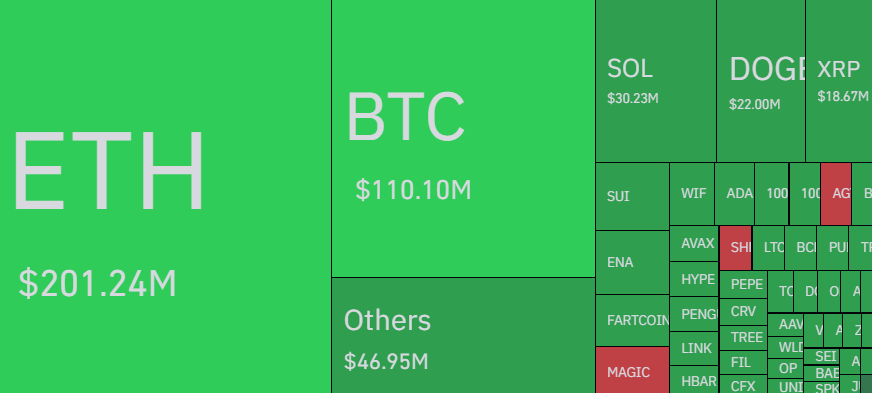

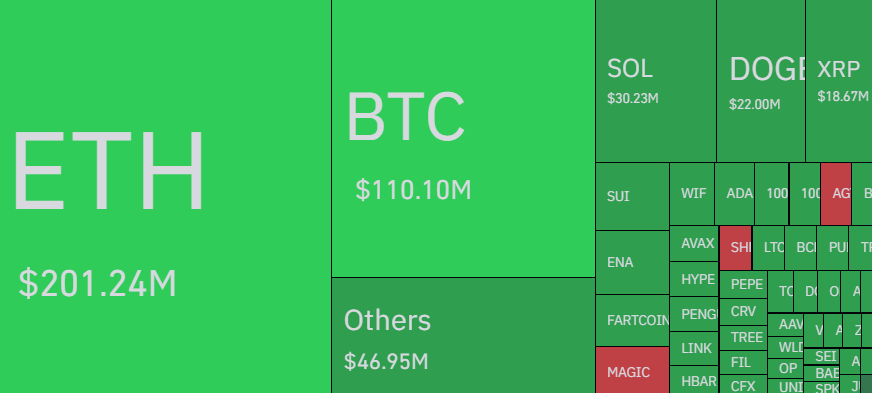

The Cryptocurrency market has handed a big flush within the final 24 hours, with complete liquidations that rise to $ 527.75 million. The transfer leaned closely to lengthy positions, which had been good for $ 468.75 million of the entire, whereas Shorts noticed a a lot smaller $ 59 million in losses, in response to information from Coinglass.

Ethereum emerged as the largest sufferer, with a surprising $ 201 million in positions – of which $ 177 million had been lengthy bets. Bitcoin adopted with $ 110 million in liquidations, dominated by $ 106 million in longs. Collectively, these two high cryptocurrencies shaped practically 60% of the entire liquidations of the market.

Learn additionally: Blackrock sees zero outstreams within the midst of market correction as $ 152 million leaves Ethereum ETF

The height in liquidations comes within the midst of the persevering with market volatility, with Bitcoin whose round $ 113,200 and Ethereum -trade close to $ 3,474. Each belongings have posted weekly losses – a lower of 4.14% for BTC and 6.9% for ETH, which signifies a robust gross sales stress.

Bitcoin -Value evaluation

The worth of Bitcoin has returned to the neckline of an inverted head and shoulder sample, an vital stage that carefully displays merchants. From writing, BTC worth acts at $ 113,068, which has fallen greater than 2% within the final 24 hours.

If the worth is strongly bouncing from this stage, it might show that patrons attempt to make assist. A motion over the 20-day exponential advancing common (EMA) for $ 115,444 might push the worth to $ 123k. Sellers will in all probability provide robust resistance there, but when patrons break by, Bitcoin might rise to $ 130,000.

However, the assist between the pattern line and $ 110k is anticipated to see a robust buy rate of interest. Nevertheless, if Bitcoin falls beneath this vary, the gross sales stress can rise, in order that the worth could also be dragged to $ 105,000 and even as little as $ 100,000.

Ethereum Value Evaluation

Ethereum closed beneath the assist stage of $ 3,500, suggesting that merchants take a revenue within the quick time period. On the time of writing, ETH worth acts at $ 3,478, which has fallen greater than 4.18% within the final 24 hours.

The worth has now fallen beneath the 20-day exponential advancing common (EMA) at $ 3,636, an vital stage of resistance to observe.

If it bounces strongly from the present stage, patrons can attempt to push ETH/USDT above $ 3,636. A profitable step can ship ETH worth to $ 4,000, though sellers are anticipated to defend that stage strongly.

If Ethereum applies beneath the 200-day EMA, this may fall to the Retracement stage of fifty% Fibonacci at $ 3,300, and probably as much as the extent of 61.8% in $ 3,000.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024