Ethereum

61% Ethereum holders still in profit: What does this mean for ETH?

Credit : ambcrypto.com

- 61% of Ethereum holders continued to make earnings regardless of current value declines, demonstrating the market’s resilience.

- The rising debt burden and reducing variety of new addresses indicated potential market volatility sooner or later.

Ethereum [ETH] has been on a downward pattern in current weeks and has fallen beneath some key value ranges.

This drop has resulted in a drop in worth of greater than 10% previously month, with the cryptocurrency now buying and selling round $2,298, down 2% previously week alone.

Regardless of this bearish transfer, market evaluation agency IntoTheBlock has made some vital factors insights in Ethereum and the state of its holders, which may present a extra nuanced view of the asset’s present state of affairs.

Ethereum holders: 61% achieve

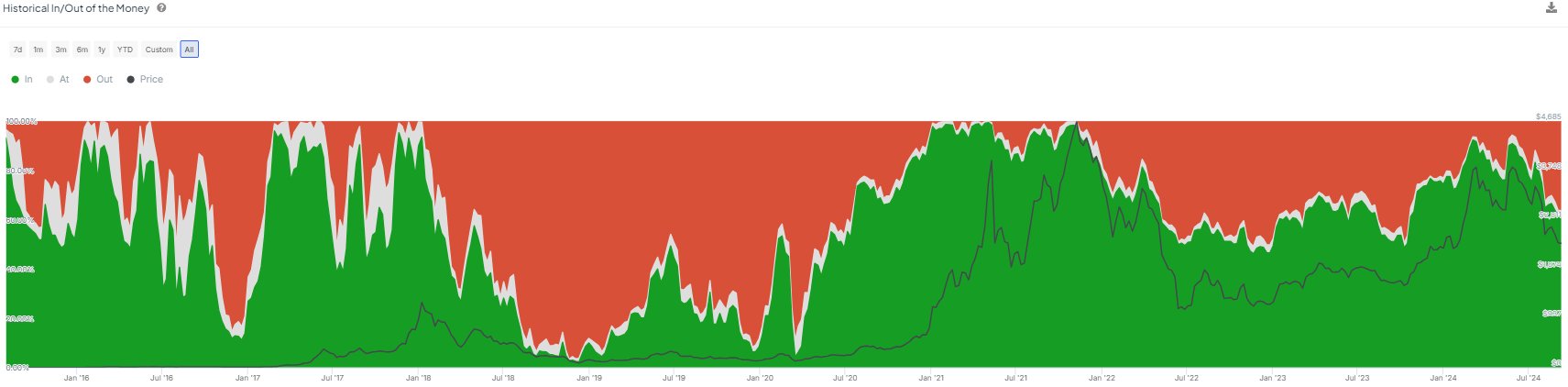

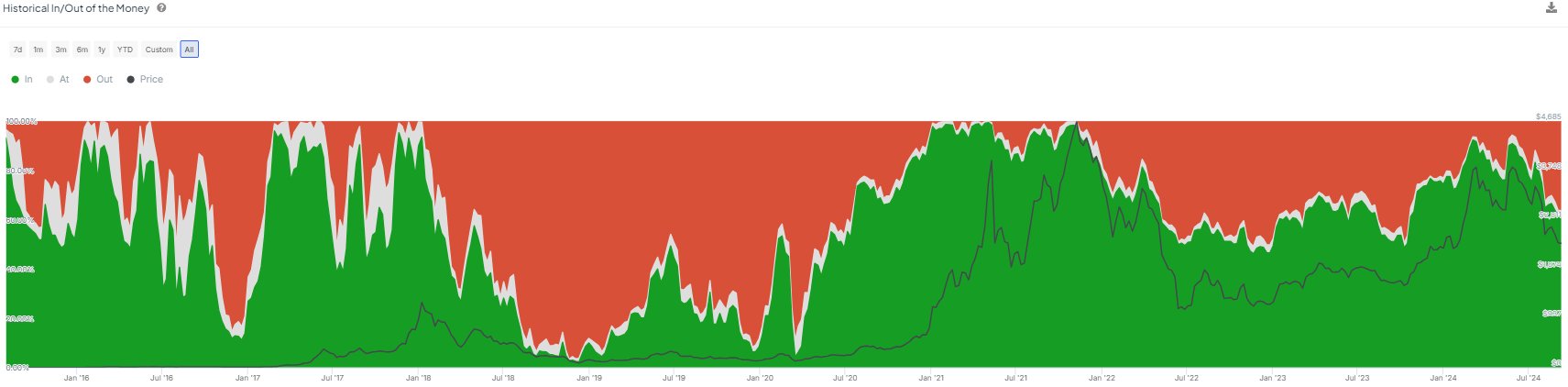

In keeping with a current evaluation by IntoTheBlock, 61% of Ethereum holders continued to make earnings regardless of the continued market decline.

IntoTheBlock revealed that this determine mirrored a level of resilience amongst Ethereum holders, in comparison with earlier market cycles.

Supply: IntoTheBlock

Drawing a parallel to the earlier yr, the analytics agency famous that throughout the current bear market, the share of worthwhile holders dropped to a low of 46%.

After the 2017 market cycle, the share of addresses with earnings dropped to simply 3%.

This indicated that the present cycle exhibits a stronger perception in Ethereum’s long-term worth.

IntoTheBlock notes that this resilience displays elevated confidence amongst holders, which might point out a extra strong basis for Ethereum even throughout market downturns.

In keeping with IntoTheBlock, the present state of affairs, in comparison with the 2019-2020 interval, when earnings fell beneath 10%, means that any downturn could also be much less extreme.

Knowledge within the chain

To additional perceive Ethereum’s present market place, it’s essential to look at among the most vital on-chain knowledge units. A kind of knowledge is the estimated leverage ratio.

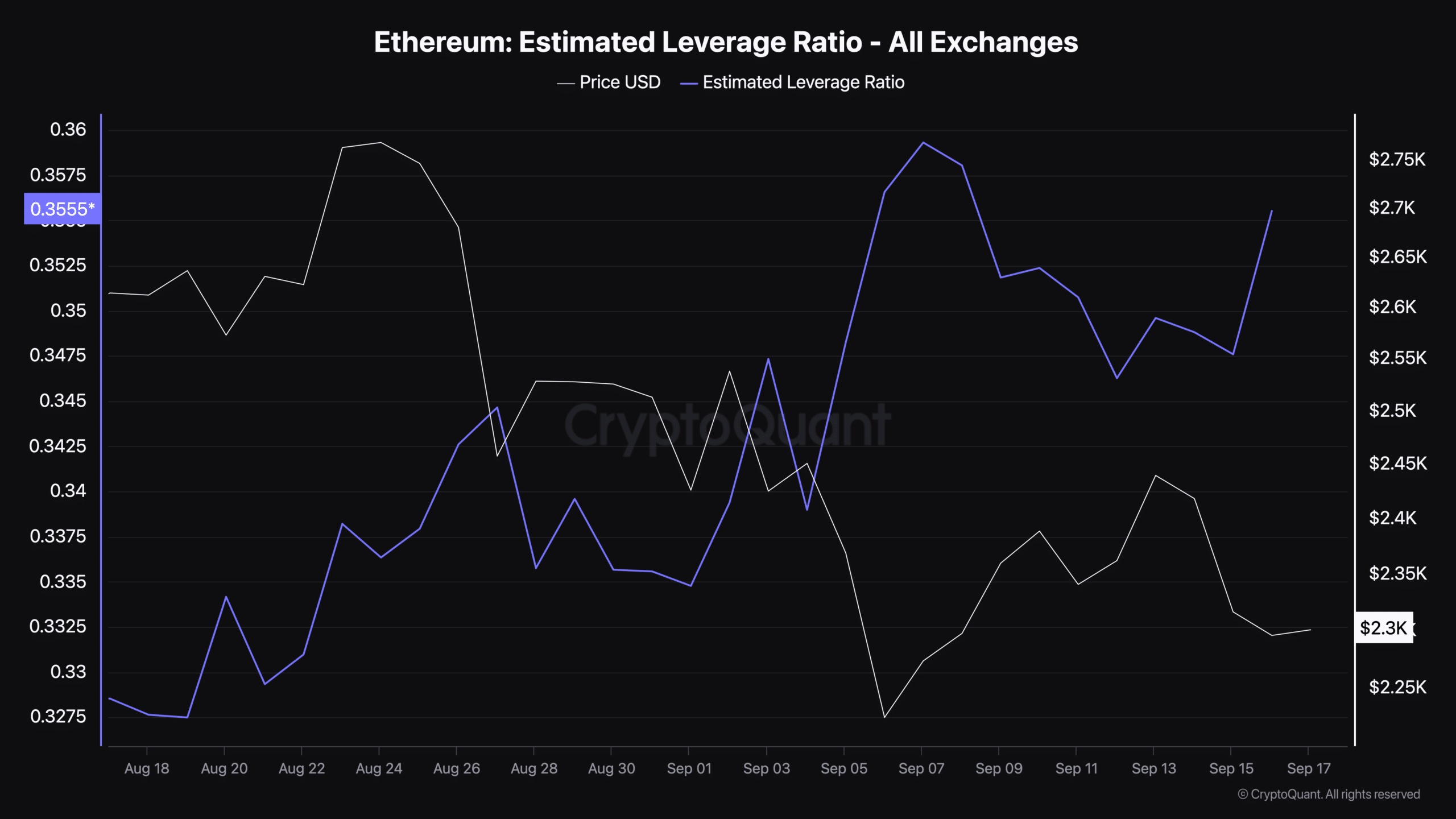

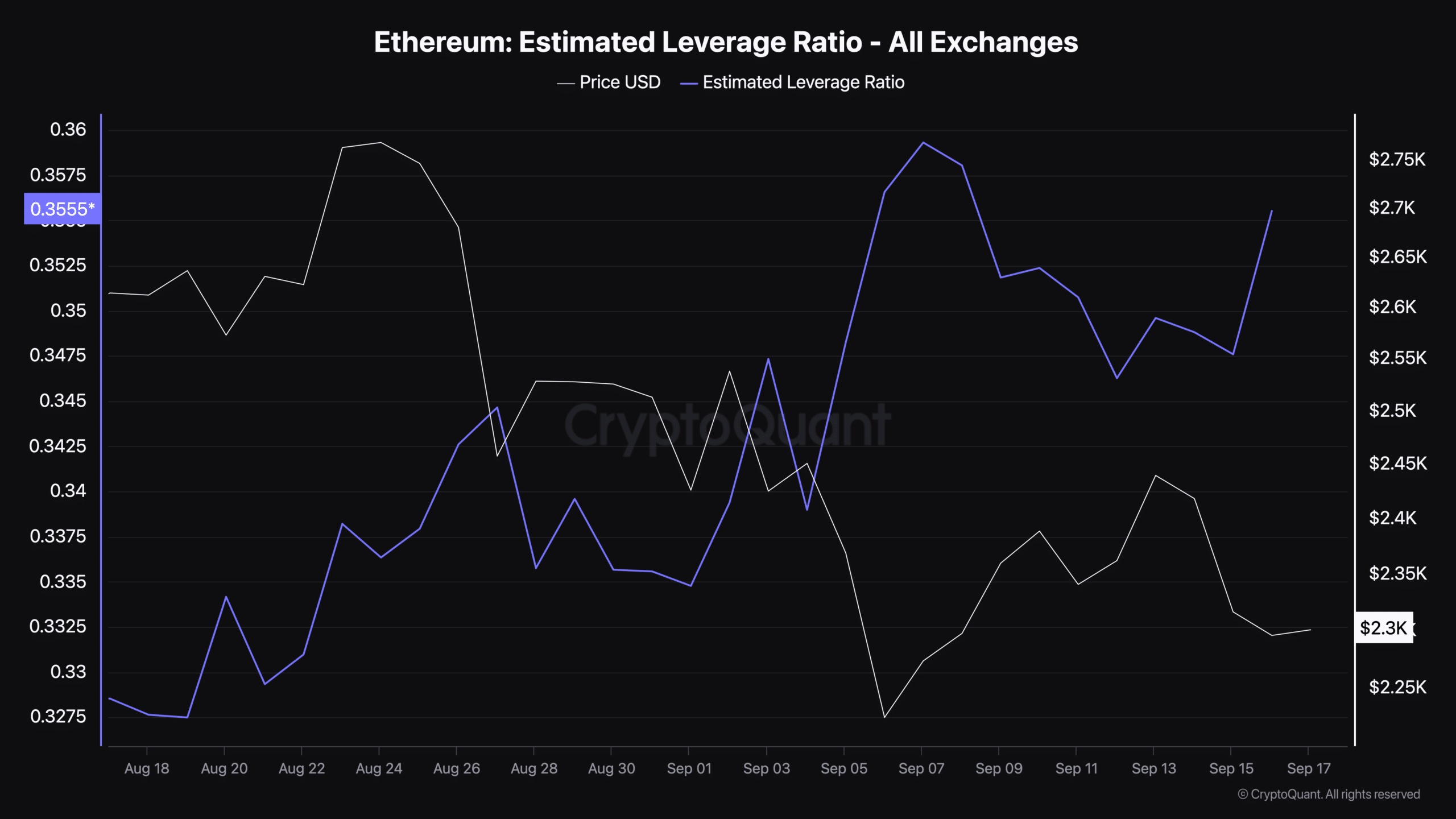

In keeping with CryptoQuantEthereum’s estimated leverage ratio has elevated noticeably in current months and stood at 0.355 on the time of writing.

Supply: IntoTheBlock

The estimated leverage ratio measures the diploma of leverage used within the derivatives market, evaluating the quantity of Open Curiosity to the overall variety of cash held on exchanges.

An rising leverage ratio could point out elevated leverage speculative exerciseindicating that merchants could also be taking extra threat.

This pattern can result in greater value volatility in both course, as extra leveraged positions enhance the probability of liquidations, which may exacerbate value actions.

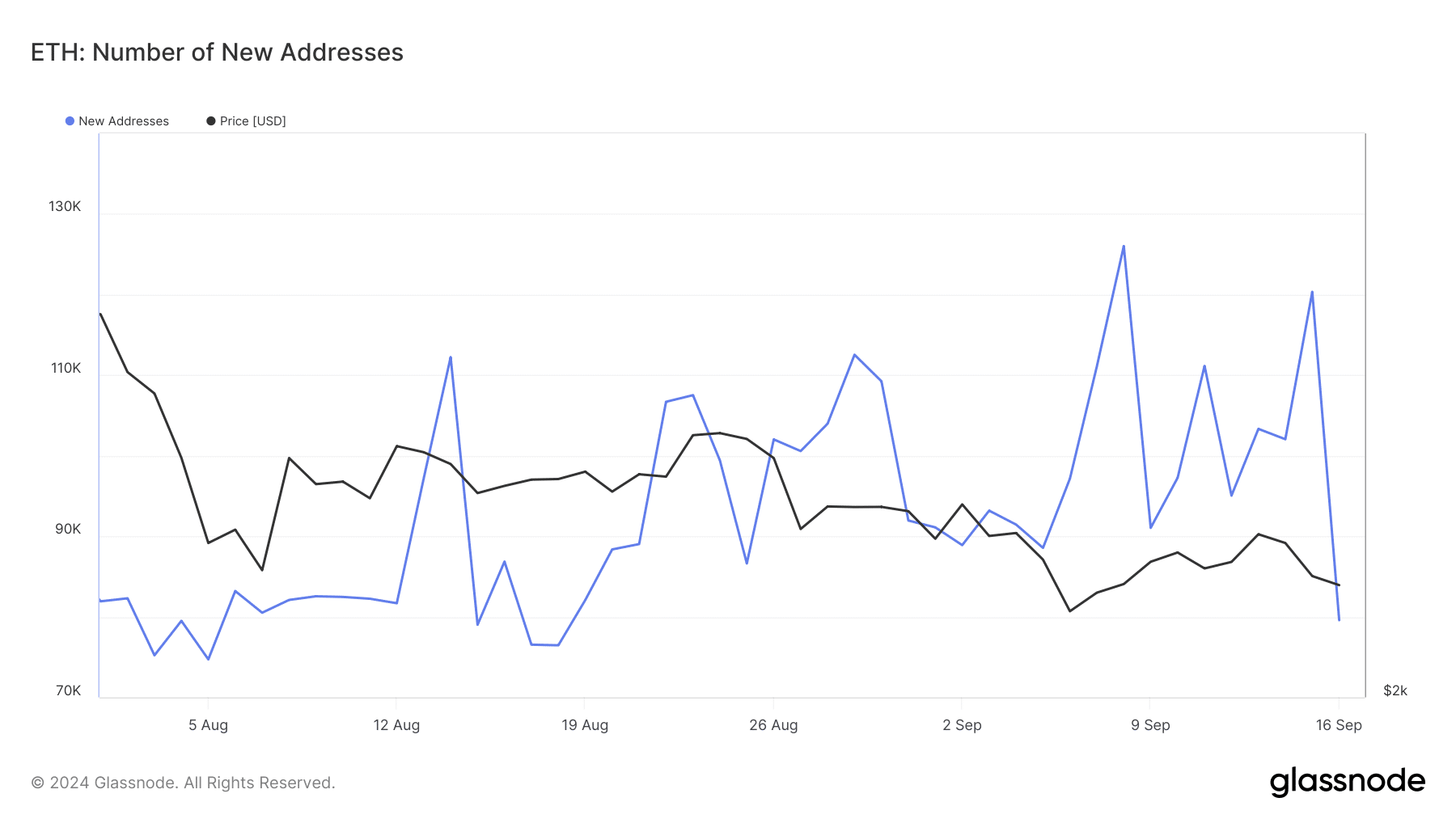

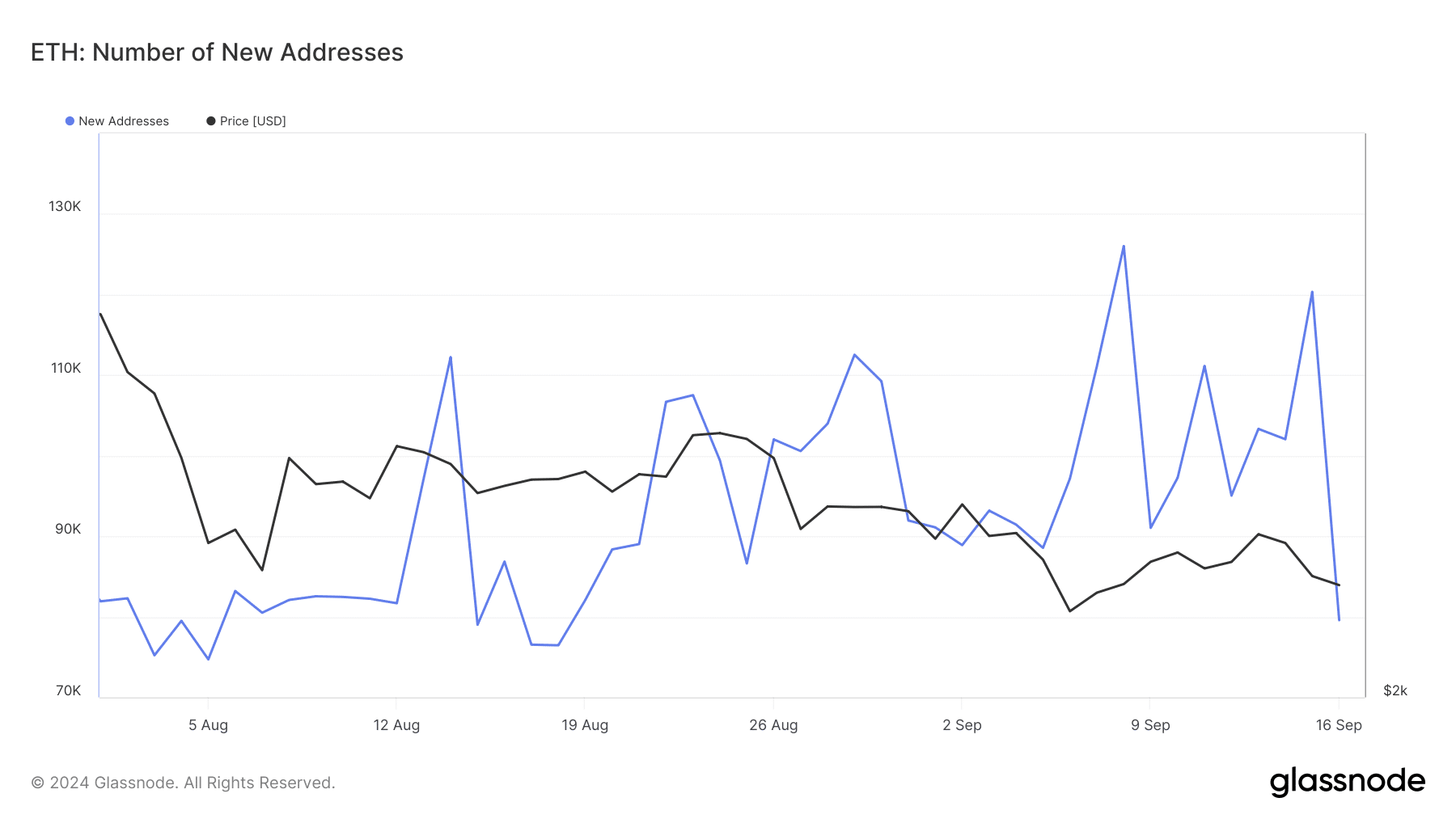

Along with the leverage ratio, the variety of new Ethereum addresses gives perception into community exercise and potential market sentiment.

Facts from Glassnode confirmed a lower within the variety of new addresses. After reaching a peak above 126,000 on September 6, this determine has now fallen sharply to roughly 79,000 new addresses.

Supply: Glassnode

A reducing variety of new addresses sometimes signifies decreased participation or curiosity within the community, which could be a bearish indicator.

Learn Ethereum’s [ETH] Value forecast 2024–2025

Decrease progress within the variety of new addresses could suggest that fewer new buyers are coming into the market, probably resulting in a lower in buying strain.

This decline in community exercise could contribute to the continued downward strain on Ethereum’s value, particularly when mixed with the rising leverage ratio.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024