Ethereum

Ethereum Funding Rate drops to lowest level in 2024: Impact on ETH?

Credit : ambcrypto.com

- ETH had the bottom funding fee of the yr.

- ETH is buying and selling across the $2,300 value degree.

Ethereum [ETH] has seen a notable decline within the derivatives market, indicating a doable shift in market sentiment.

Nevertheless, the interpretation of this decline can result in totally different conclusions relying on how different elements, similar to spot quantity, carry out.

Ethereum’s funding rate of interest is falling

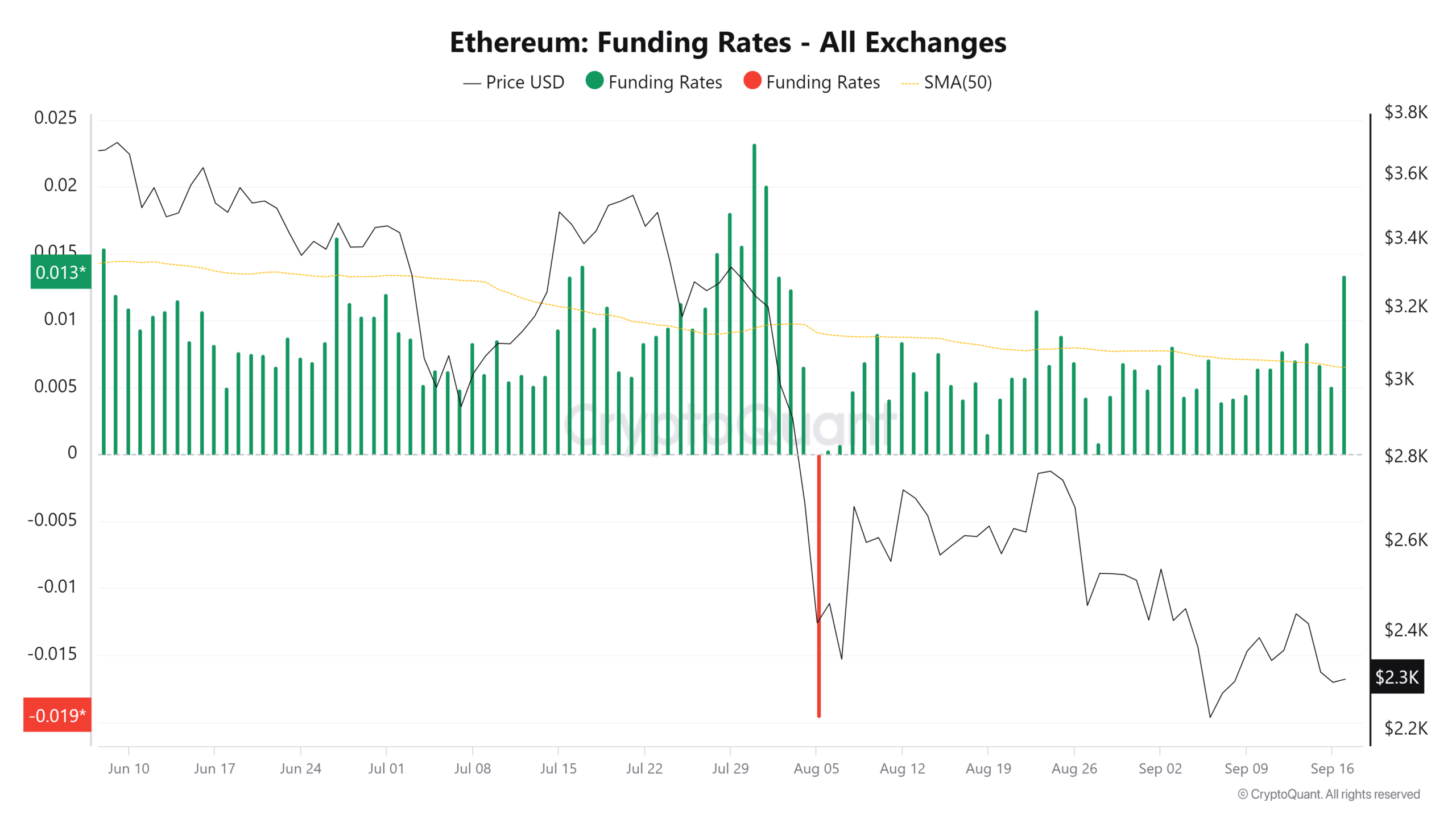

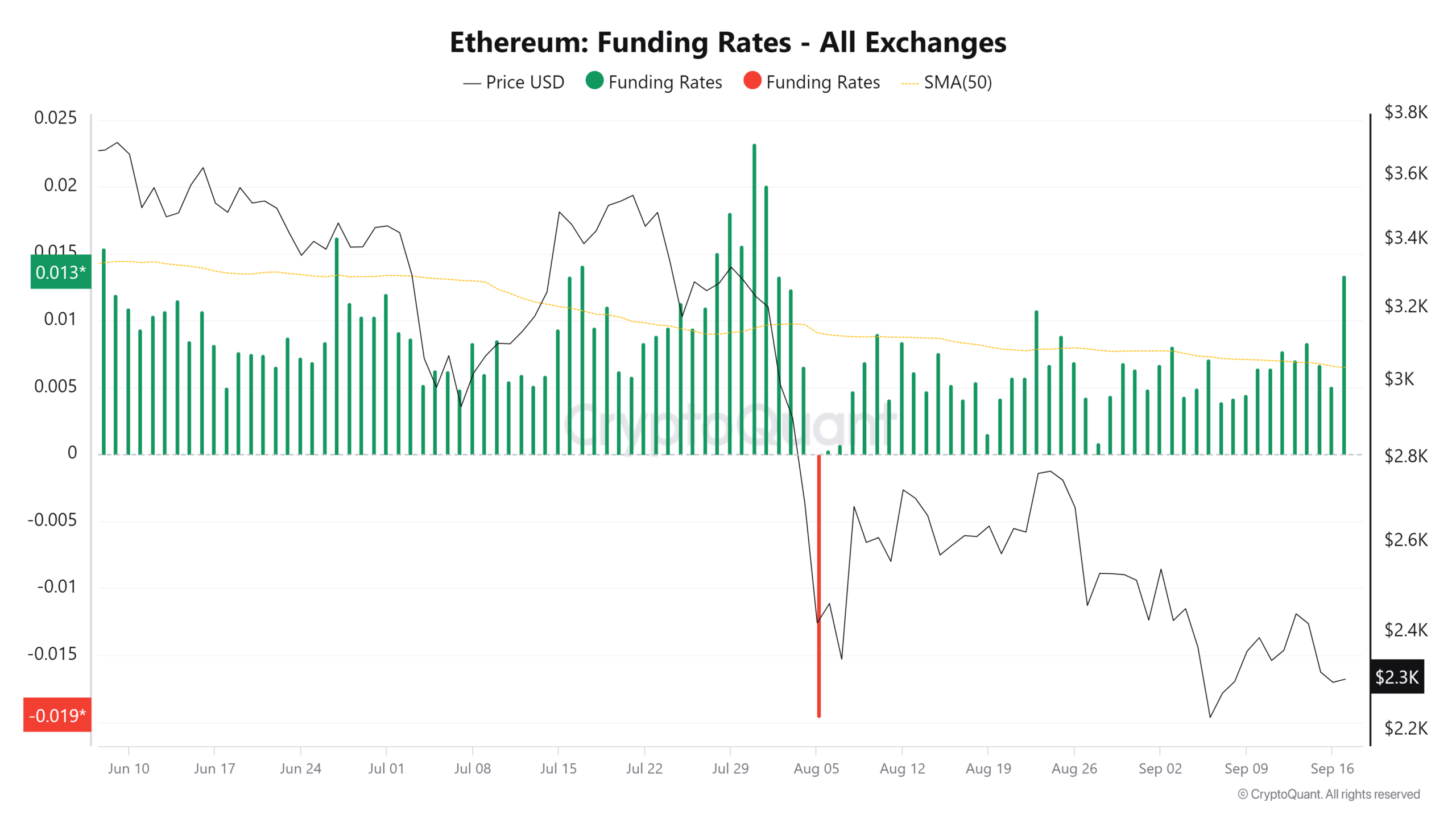

The current information from CryptoQuant revealed that Ethereum’s Funding Price hit its lowest level of the yr, indicating a pointy decline in shopping for curiosity from derivatives merchants.

The funding fee is a vital indicator utilized in futures markets to measure the price of holding lengthy (purchase) or brief (promote) positions.

A adverse funding fee signifies that brief sellers are paying lengthy holders to maintain their positions open, indicating bearish sentiment.

ETH’s Funding Price falling to its lowest degree this yr displays a decline in demand for purchasing Ethereum with leverage by means of derivatives. This could possibly be a bearish signal for the worth within the brief time period.

Supply: CryptoQuant

The decline in funding charges alerts an absence of enthusiasm amongst merchants within the derivatives market, which might additional stress Ethereum’s value.

A possible for a brief squeeze in Ethereum

With fewer merchants keen to take lengthy positions, Ethereum’s downtrend might proceed except spot consumers step in to offset the promoting stress.

Whereas low funding charges point out bearish sentiment, it additionally units the stage for a possible brief liquidation cascade. The adverse financing fee might rapidly reverse if spot consumers enter the market sufficiently.

This forces brief sellers to shut their positions, leading to compelled shopping for (brief squeeze), which may enhance the worth.

How ETH’The quantity is trend-based

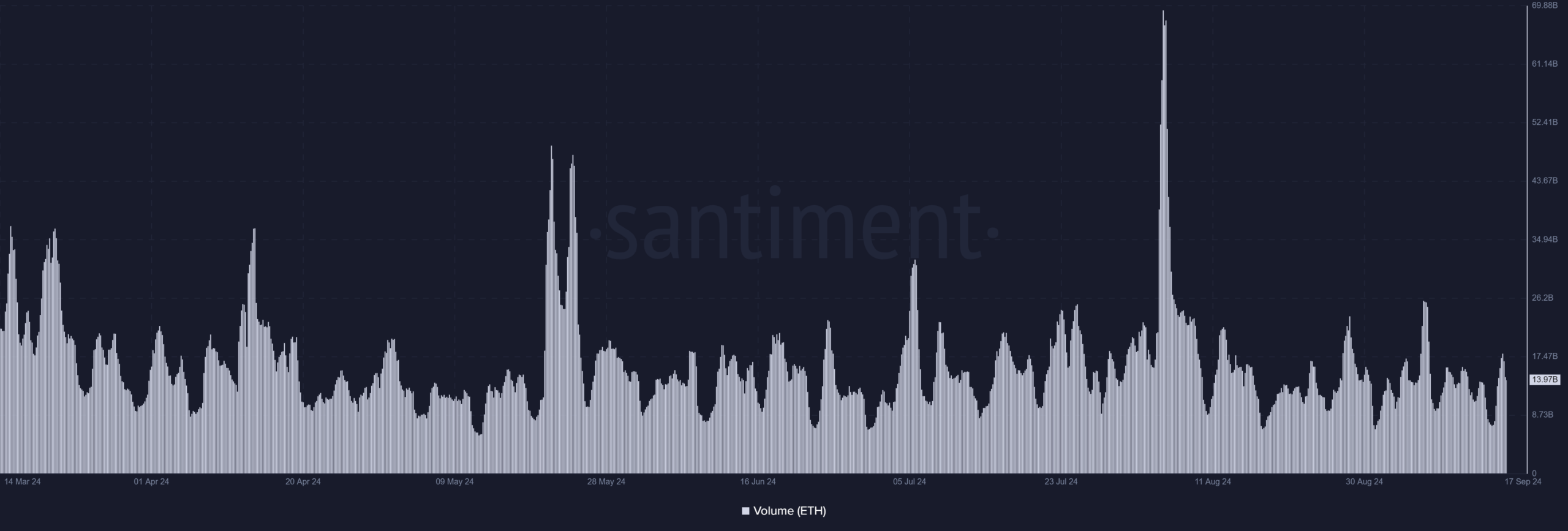

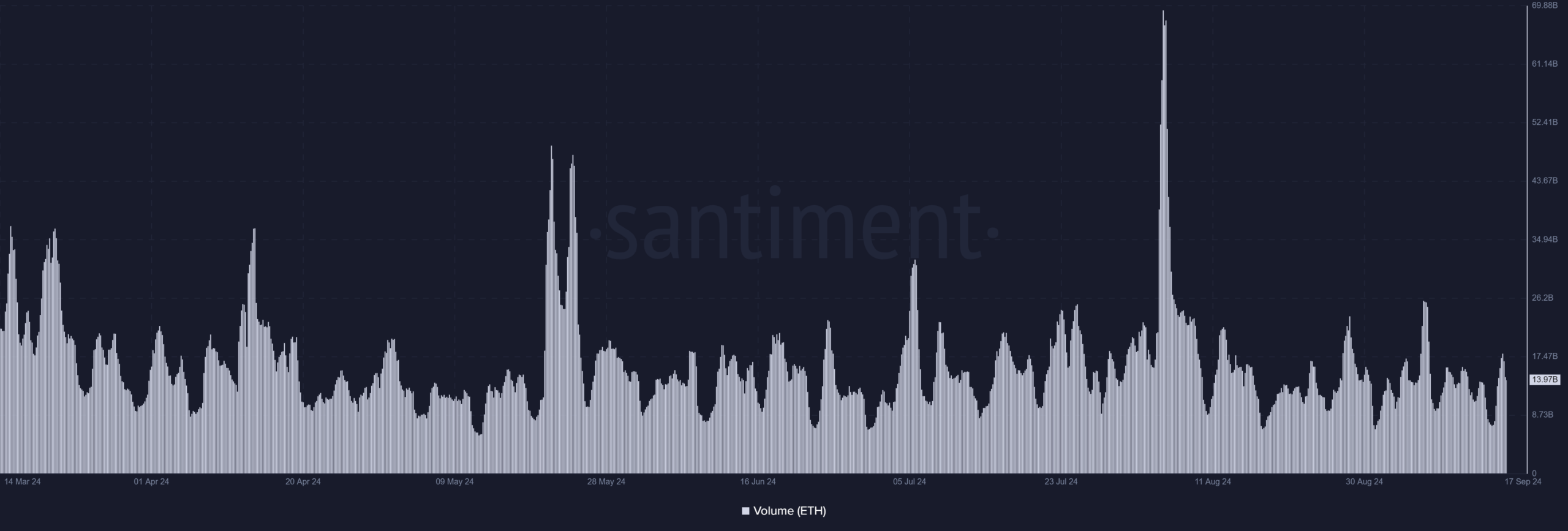

Evaluation of Ethereum spot quantity on Santiment confirmed that the present common quantity has remained steady at round $14 billion over the previous few weeks.

This constant quantity is essential for sustaining value stability, particularly as Ethereum’s funding fee has fallen to its lowest degree of the yr.

Supply: Santiment

Spot quantity for Ethereum has remained comparatively steady, averaging $14 billion. This constant quantity probably helped ETH keep away from a extra critical value drop.

This regardless of the bearish sentiment of derivatives merchants, which is mirrored within the adverse financing rate of interest.

Moreover, if spot quantity falls beneath this $14 billion vary, Ethereum might face larger downward stress.

Learn Ethereum’s [ETH] Value forecast 2024-25

With financing charges already at report lows, a drop in spot quantity would cut back shopping for curiosity. The shopping for curiosity is critical to compensate for the adverse sentiment on the derivatives market.

The present low financing rates of interest point out that brief positions dominate the derivatives market. If spot quantity decreases, there might not be sufficient demand to fulfill the promoting stress, main to cost declines.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024