Ethereum

Will Ethereum Price Hit ATH in the Next 24 Hours?

Credit : coinpedia.org

Ethereum -Value has risen sharply at this time, a rise of seven.66% since yesterday and greater than 27% prior to now week. Now performing at $ 4,628, it is just 5.5% shy of its highest peak of $ 4,891.70. The commerce quantity elevated by 44.7% to $ 63.4 billion, whereas institutional influx reached unseen ranges, as a result of ETFs absorbed $ 1.02 billion in in the future. It’s price noting that the figures have conquered Bitcoin’s $ 178 million.

Polymarket information successively exhibits a 75% probability that ETH ATH will attain by 31 August. However as a result of the ATH is just 5.5% eliminated, can the ETH value declare a recent excessive excessive within the subsequent 24 hours? Learn this detailed Ethereum value evaluation for all particulars.

Information on chains does bullish accumulation?

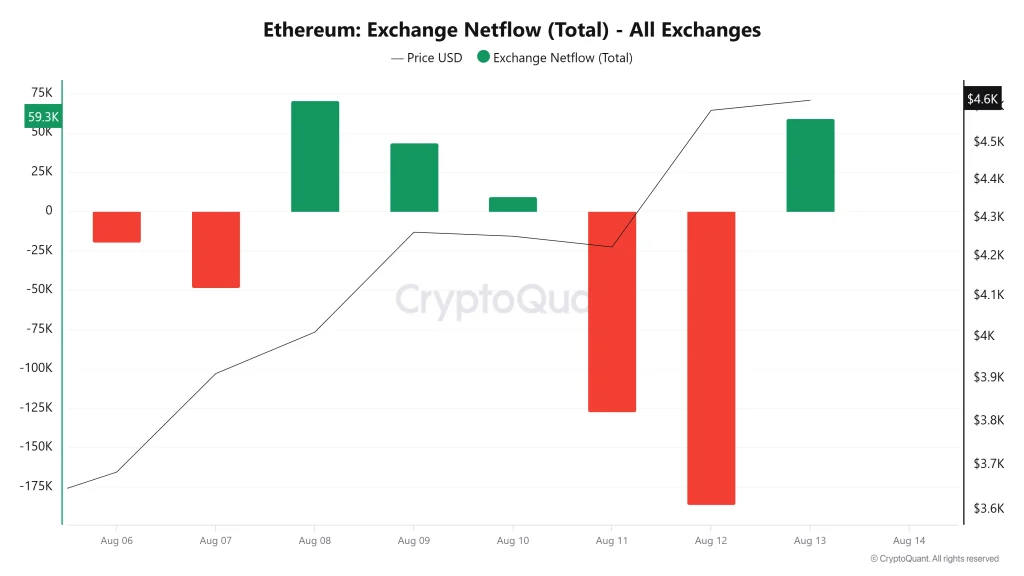

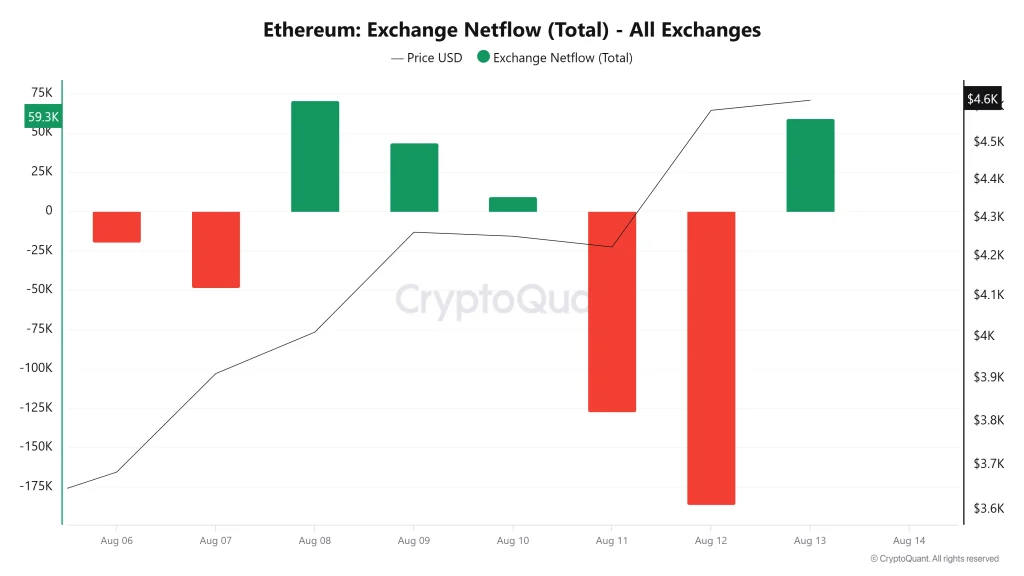

Ethereum’s Trade Netflow Door Cryptoquant Unveils outstanding outflows in the previous couple of days. With greater than 100,000 ETH, that is that centralized exchanges go away on 11-12 August alone. Massive shops often point out that buyers transfer funds to chilly portfolios as an alternative of making ready themselves to promote, decreasing the rapid supply strain.

That is in keeping with the rising institutional demand. ETH ETFs now include 2.6% of the circulating supply, and enterprise treasury containers akin to Sharplink Gaming and Bitmine added greater than $ 19 million to ETH firms. Mixed with a optimistic financing proportion of +0.0093%, leverage shifts to lengthy positions, which means that belief in increased costs.

ETH -Value evaluation:

The 4-hour graph that I’ve shared exhibits ETH value that has greater than $ 4,400 resistance and check $ 4,678 intraday highs. Momentum indicators are nonetheless sturdy, with RSI at 74.3, which signifies mild overbought situations however not but excessive. Quick resistance is $ 4,878, slightly below the earlier ATH. A decisive break can open a path to $ 5,067.

A brief squeeze has strengthened the rally. Abraxas Capital stood for $ 244.8 million in losses. With $ 188.7 million in Eth -Shorts that was pressured to cowl as a result of Eth $ 4,500 knew. Furthermore, the open curiosity of $ 56.1 billion remains to be within the sport, excessive leverage can nonetheless stimulate a step of 5-15% earlier than consolidation.

Assist is $ 4,402 and $ 4,040, with a powerful buy curiosity that’s clear on Dips. Except the ETF abruptly gradual or derivatives overheated, ETH appears able to problem its ATH within the very brief time period.

FAQs

ETH is traded round $ 4,628, round 5.5% under the height of $ 4,891.70.

Document ETF entry, a big brief squeeze and bullish choices positioning nourish the query.

If the buying strain stays sturdy and the outflows persist, ETH can check $ 4,878 – $ 4,900 inside a day.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024