Ethereum

Ethereum ETFs struggle: Is the market losing interest in ETH?

Credit : ambcrypto.com

- ETH skilled weak demand amid Ethereum ETF outflows, indicating investor disinterest.

- Open Curiosity fell, however high merchants went lengthy, indicating a possible shift was on the horizon.

Ethereum [ETH] ETFs have seen continued outflows not too long ago, regardless of earlier excessive expectations that ETFs would drive demand.

Many analysts have seen this and a few consider it may very well be the rationale why ETH has been bearish.

Wu Blockchain reported that Ethereum spot ETF web outflows peaked at $15.114 million on September 17.

Subsequent, Ethereum ETFs data discovered that almost all ETFs didn’t report constructive flows in the course of the week. The outflow was dominant in the course of the week.

Outflows from Ethereum ETFs might have performed a heavy position in ETH’s current efficiency. The latter corresponded to the muted sentiment, which consequently influenced the low community exercise.

Low investor pleasure was clearly seen in ETH’s newest value motion. Whereas Bitcoin rose greater than 14% from the present month-to-month low, ETH rose solely about 7.7%.

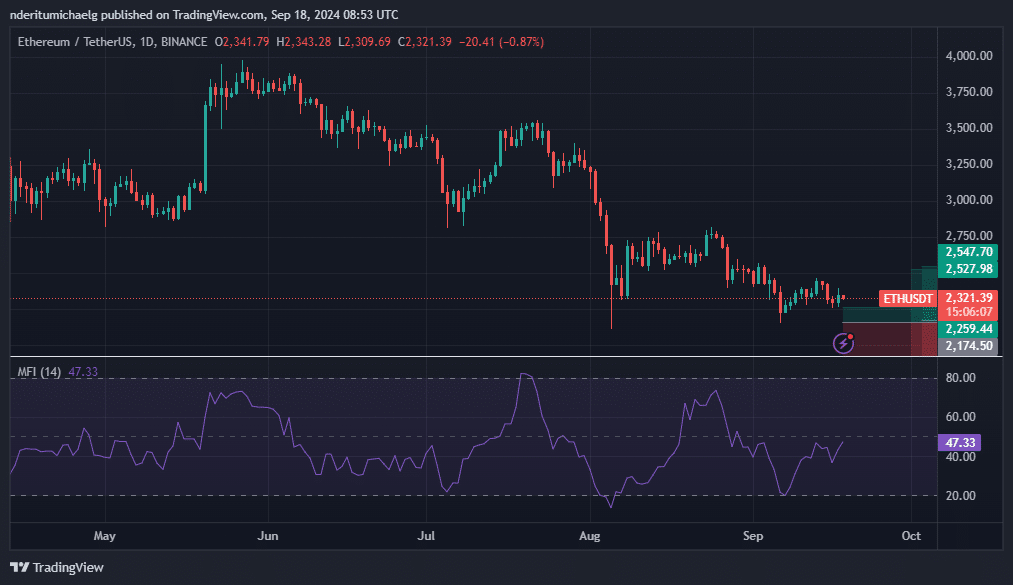

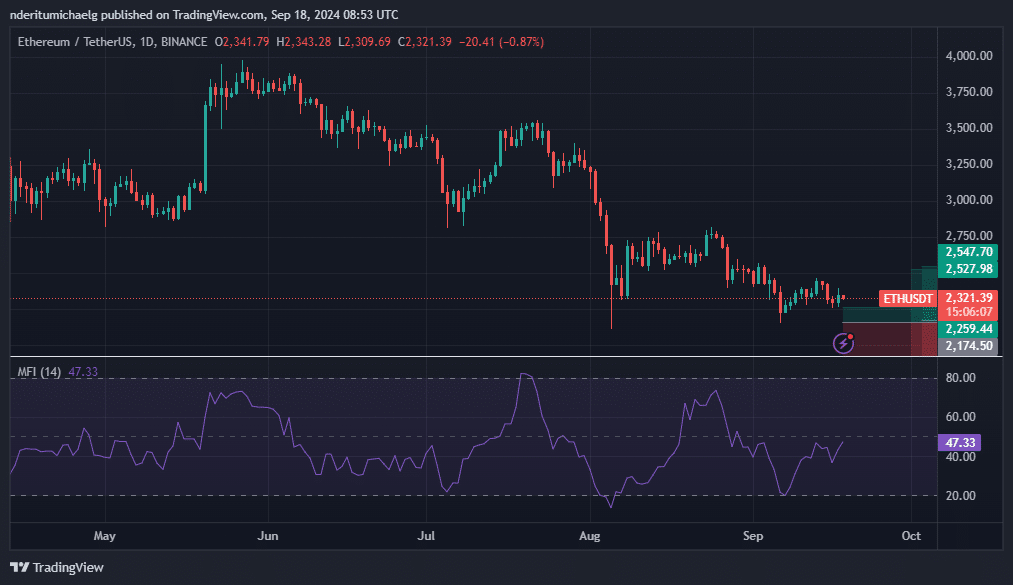

This highlighted the declining demand for ETH. The cryptocurrency was buying and selling at $2,321 on the time of writing.

Supply: TradingView

ETH’s RSI is struggling to interrupt above the 50% degree, confirming the low bullish momentum. Regardless of this, the MFI exhibits that there’s nonetheless some liquidity flowing into the foreign money, albeit in small volumes.

Can ETH make a powerful comeback?

A powerful rally is just not utterly off the desk. ETH’s present state of affairs is the results of a number of components, together with ETF outflows and low on-chain exercise.

Nonetheless, a turnaround in these components may revive strong demand, particularly if Ethereum ETFs begin experiencing wholesome inflows.

ETH’s present value degree will also be thought of a wholesome zone. Nonetheless, it’s presently filled with uncertainty and this has affected its efficiency even within the derivatives section.

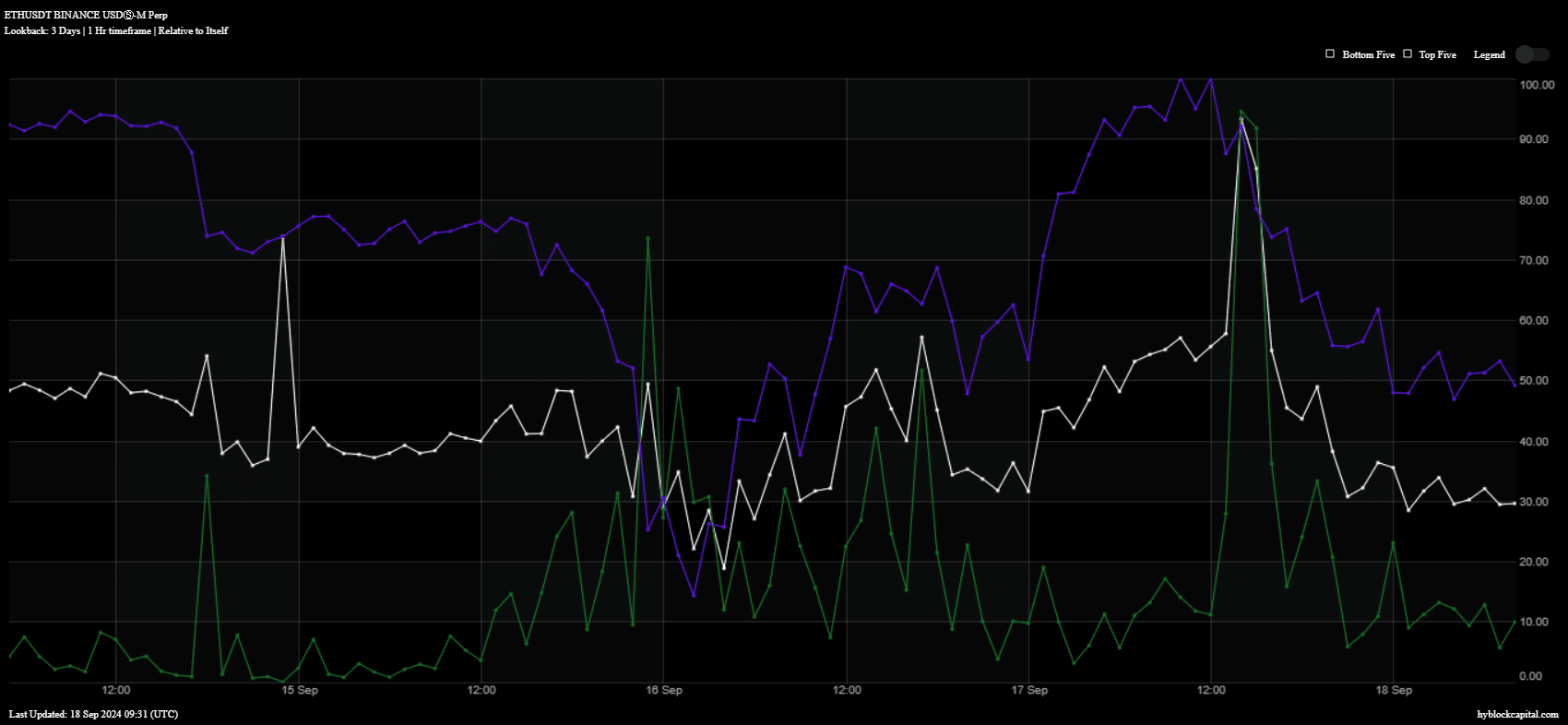

For instance, the extent of Open Curiosity (blue) has fallen during the last 24 hours. Throughout the identical interval we additionally noticed a lower in buying quantity (inexperienced).

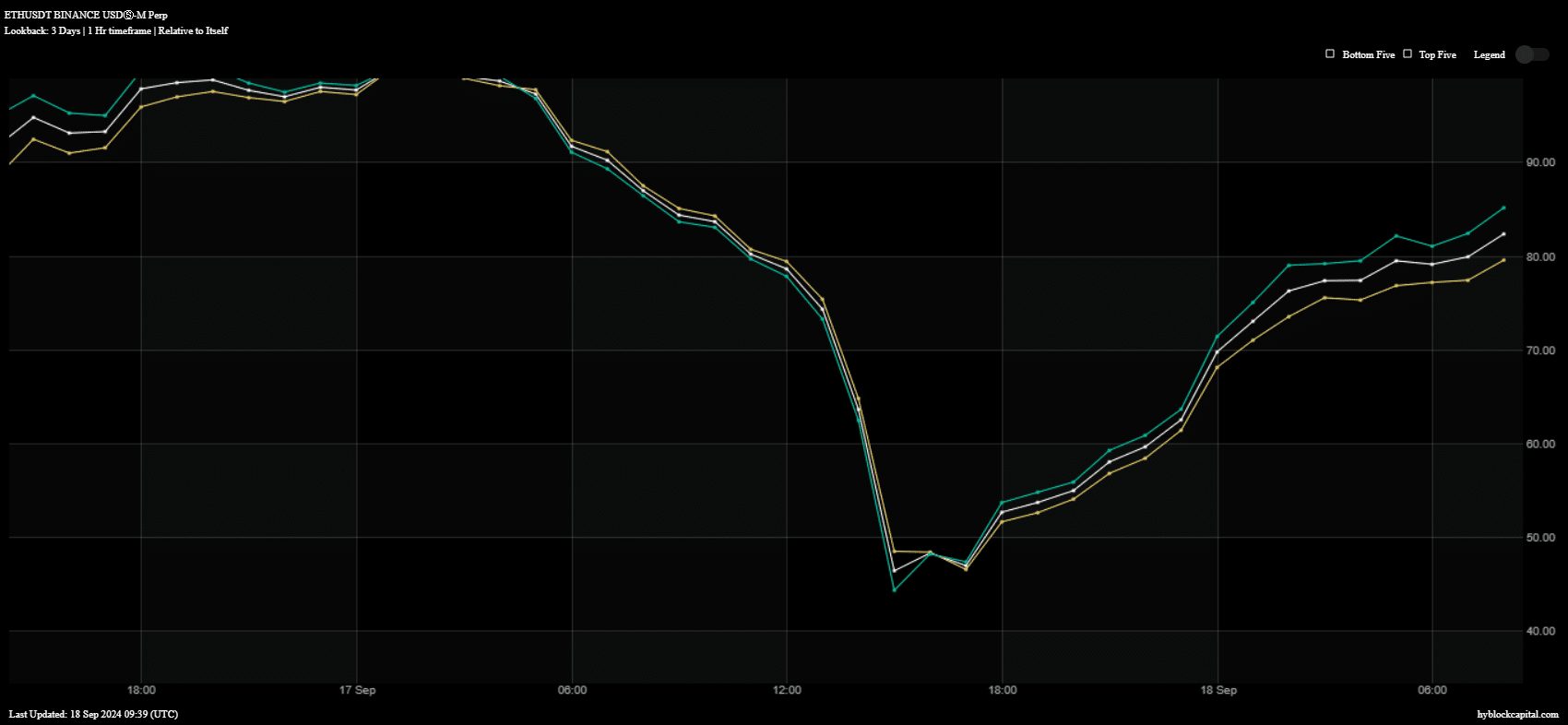

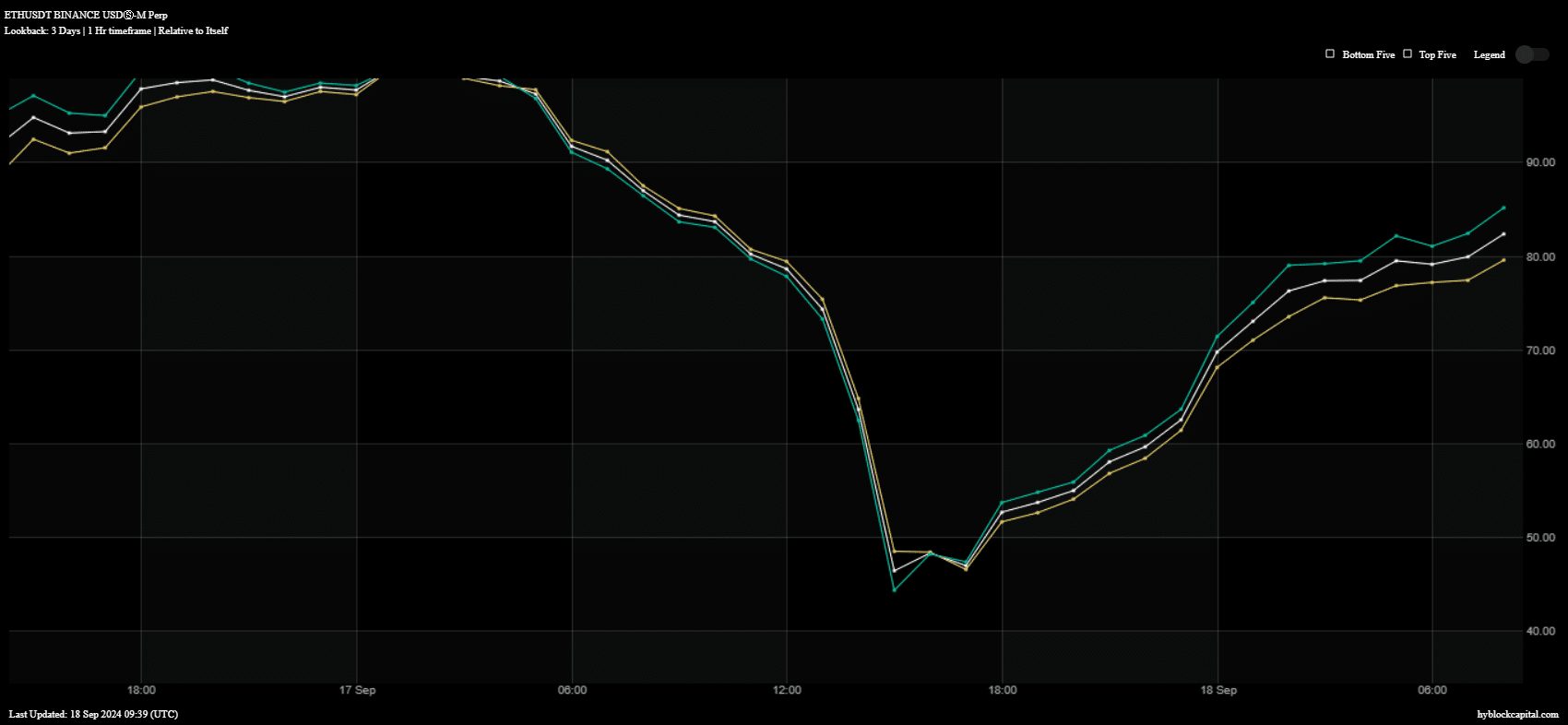

Supply: Hyblock Capital

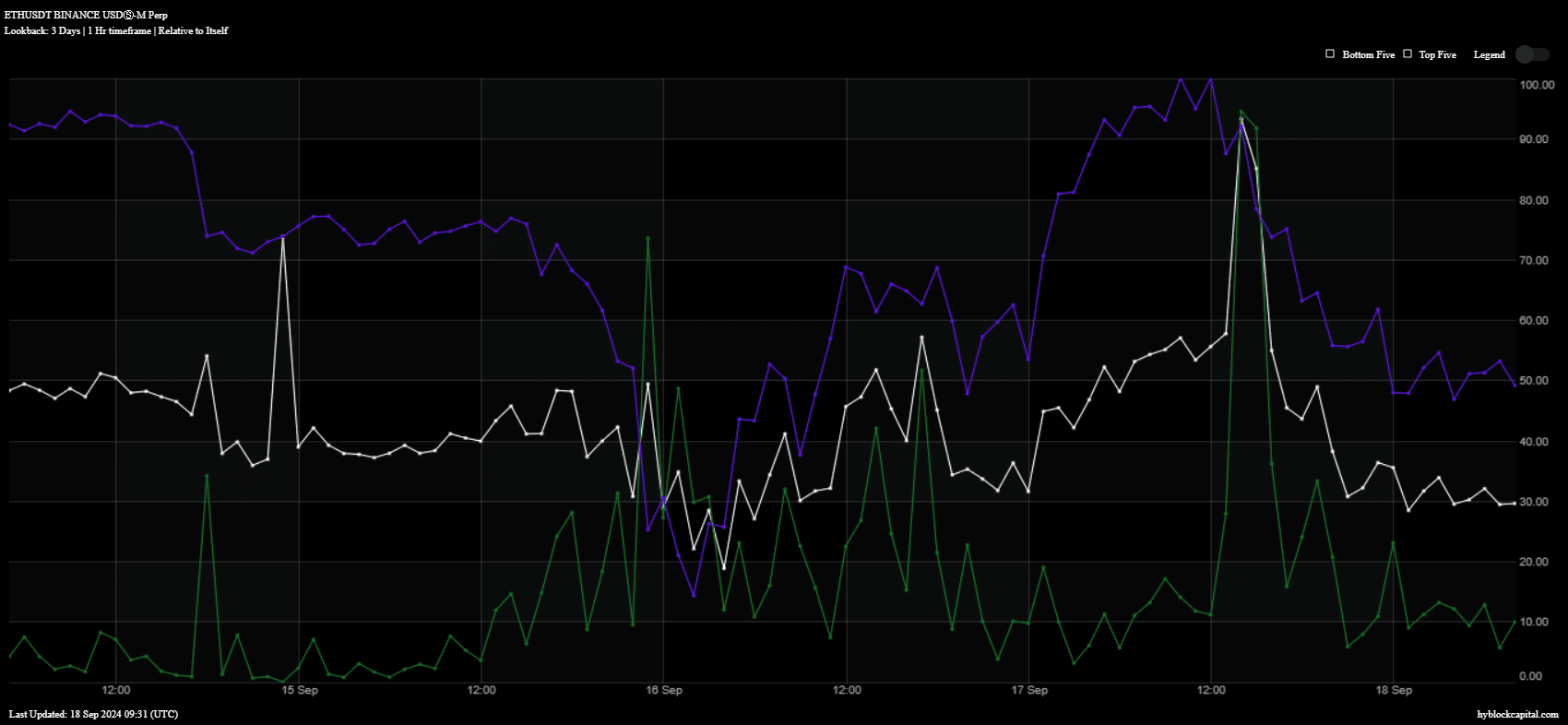

There have been additionally indicators that these leads to ETH’s efficiency may have been associated to whale manipulation. The variety of longs amongst high merchants fell throughout Tuesday’s buying and selling session.

Nonetheless, it bounced again, indicating that high merchants are returning to a bullish temper.

Supply: Hyblock Capital

Learn Ethereum’s [ETH] Value forecast 2024–2025

ETH longs amongst high addresses (inexperienced) and longs globally (yellow) have rebounded considerably over the previous 24 hours. This recommended that ETH bulls could also be flexing their muscle tissue heading into the weekend.

Nonetheless, it will rely upon whether or not ETH can collect sufficient demand and momentum to push the worth again up.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024