Bitcoin

Is Bitcoin Price Outperforming Gold And NASDAQ This Cycle?

Credit : bitcoinmagazine.com

The Bitcoin worth at the moment appears to be about to introduce a euphoric section of worth motion after an already sturdy bull market. Nonetheless, has this cycle actually been as spectacular because the USD worth chart suggests, or would Bitcoin really underperform as compared with different property and historic cycles? This evaluation digs within the figures, compares a number of cycles and investigates the efficiency of Bitcoin, not solely towards the US greenback, but in addition versus property similar to gold and American technical shares, to offer a clearer image of the place we actually are.

Earlier Bitcoin -PRIJCYCLI

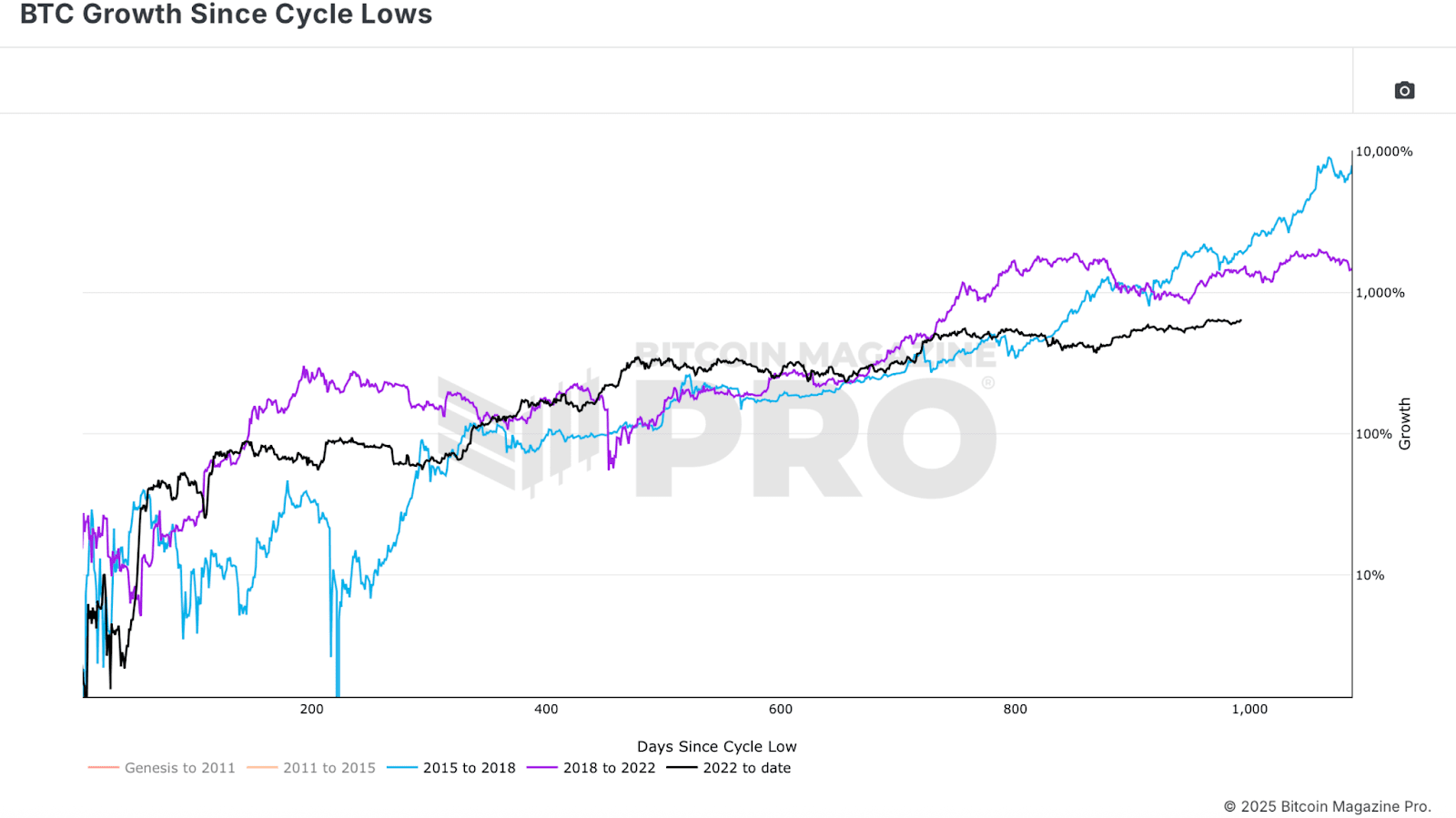

Trying on the Bitcoin growth since cycle low Graph, the info initially appears to be like promising. From the lows on the finish of the final Berenmarkt, Bitcoin achieved returns on the return of round 634% on the time of writing. These are appreciable revenue, not solely supported by worth motion, but in addition by sturdy fundamental rules. Institutional accumulation by way of ETFs and Bitcoin Treasury Holdings is strong and information on the chain reveals a big a part of the lengthy -term holders that refuse to take a revenue. Traditionally, that is the form of background that precedes a powerful begin -up section within the bull cycle, much like what we noticed in earlier cycles.

Present Bitcoin prize cycle

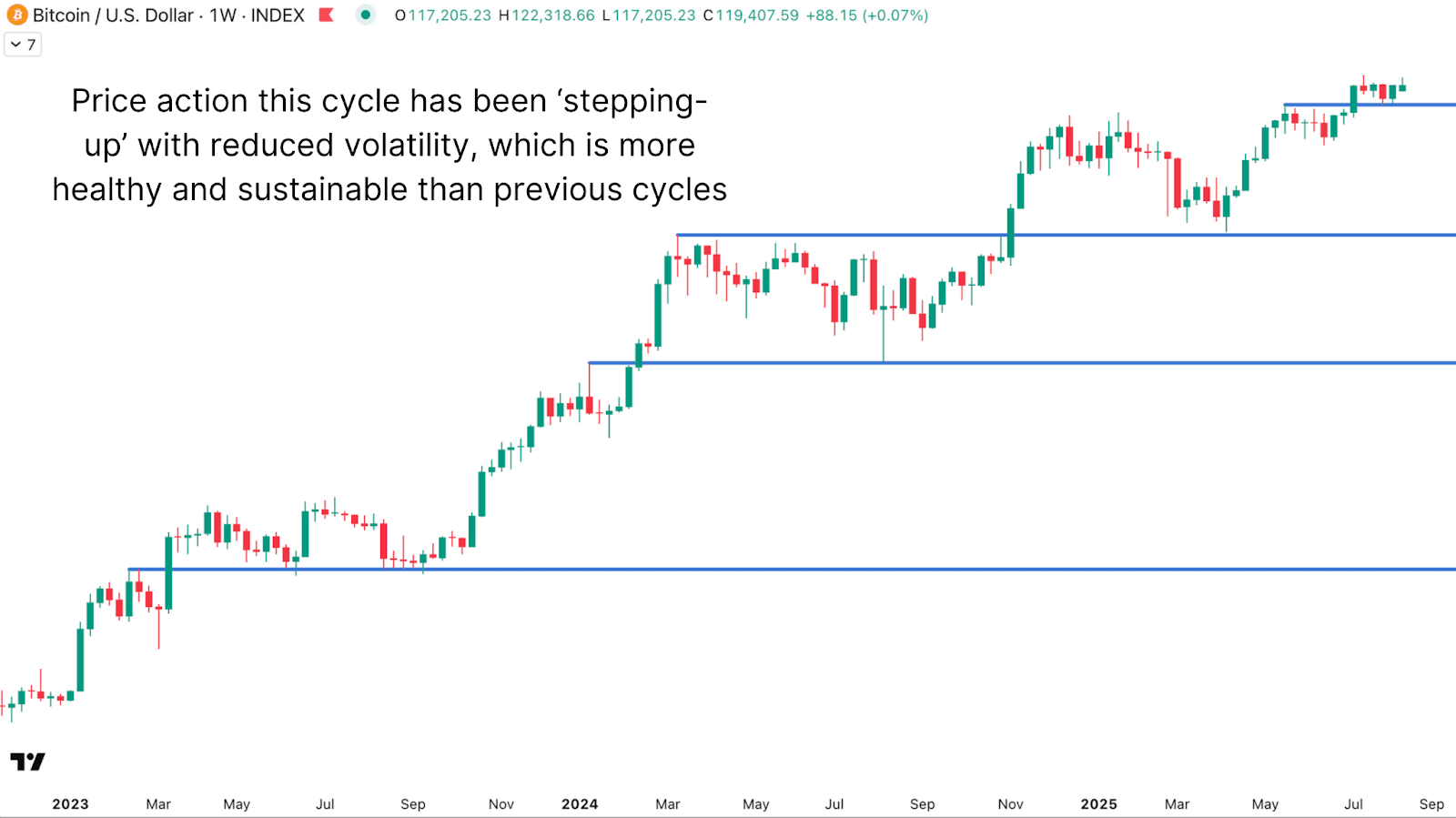

Concerning the USD worth diagram on TradingView, the present Bitcoin prize cycle doesn’t look unhealthy in any respect, particularly when it comes to stability. The deepest Retracement This cycle was round 32%, which came about after surpassing $ 100,000 and withdrawn to round $ 74,000 – $ 75,000. That is a lot milder than the 50% or bigger drawings which are seen in earlier cycles. Lowered volatility can imply a diminished potential for upward, however it additionally makes the market much less treacherous for traders. The worth construction has adopted a “step -up” sample, sharp rallies adopted by turbulent consolidation, then one other rally, which repeatedly pushes to new all time. The market stays sturdy from a elementary standpoint.

Bitcoin -Worth versus different property

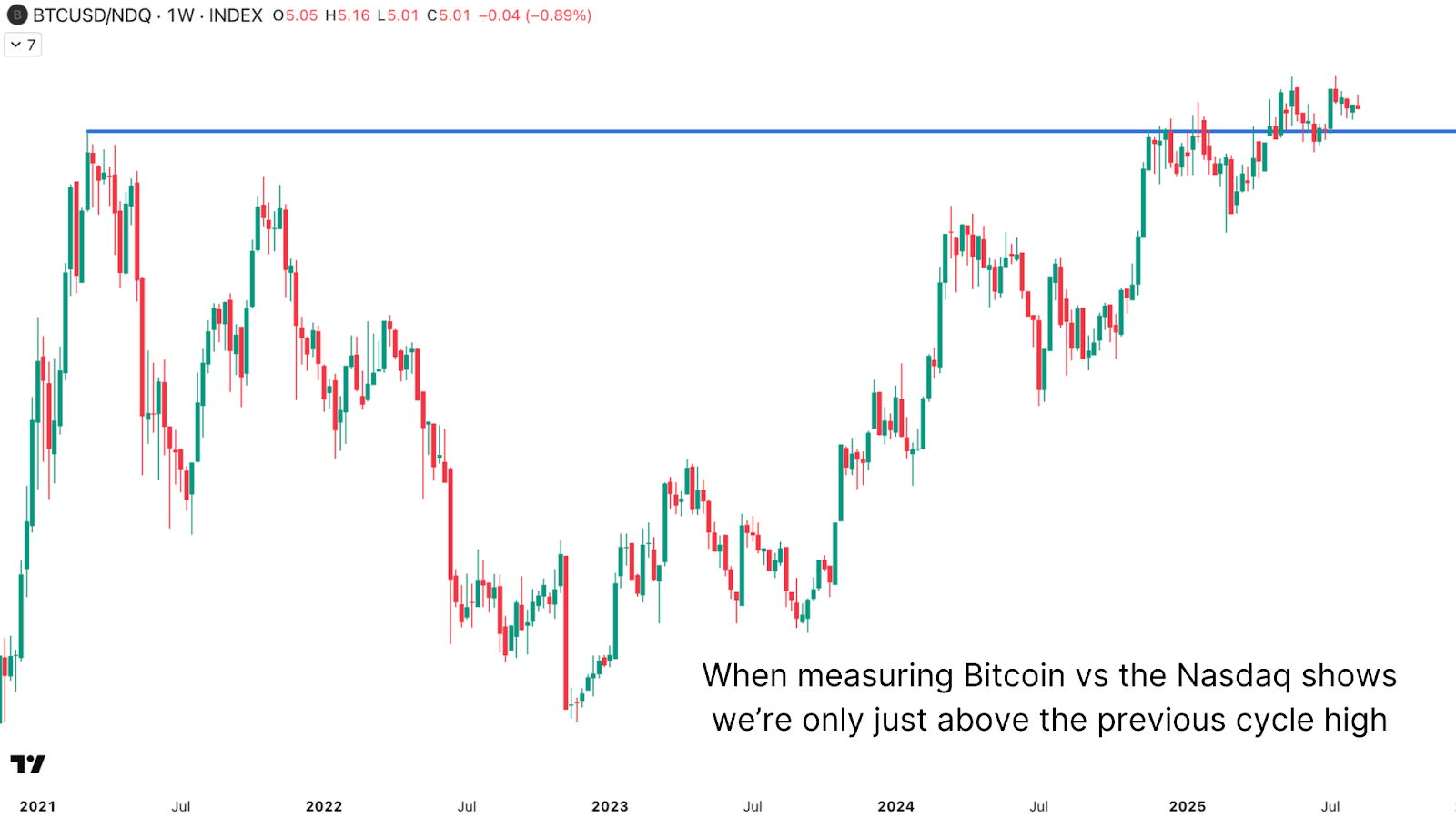

When measuring Bitcoin towards one thing extra secure than the US greenback, such because the Nasdaq or Other American technical sharesA special picture arises. American technical shares are additionally quick -growing, speculative property, so this comparability is a extra direct comparability than BTC versus USD. Right here the efficiency of Bitcoin appears to be like much less spectacular. On this present cycle, the climb past the earlier Excessive has been minimal. The graph reveals, nonetheless, that Bitcoin is at the moment changing earlier resistance into assist, which might lay the inspiration for a costlier motion increased. What we are able to additionally see, trying on the earlier double prime cycle, is a second peak at a significantly decrease degree, which means that the second peak from Bitcoin within the final cycle could also be extra powered by world liquidity growth and Fiat-Maluta debasia than by actual outperformance.

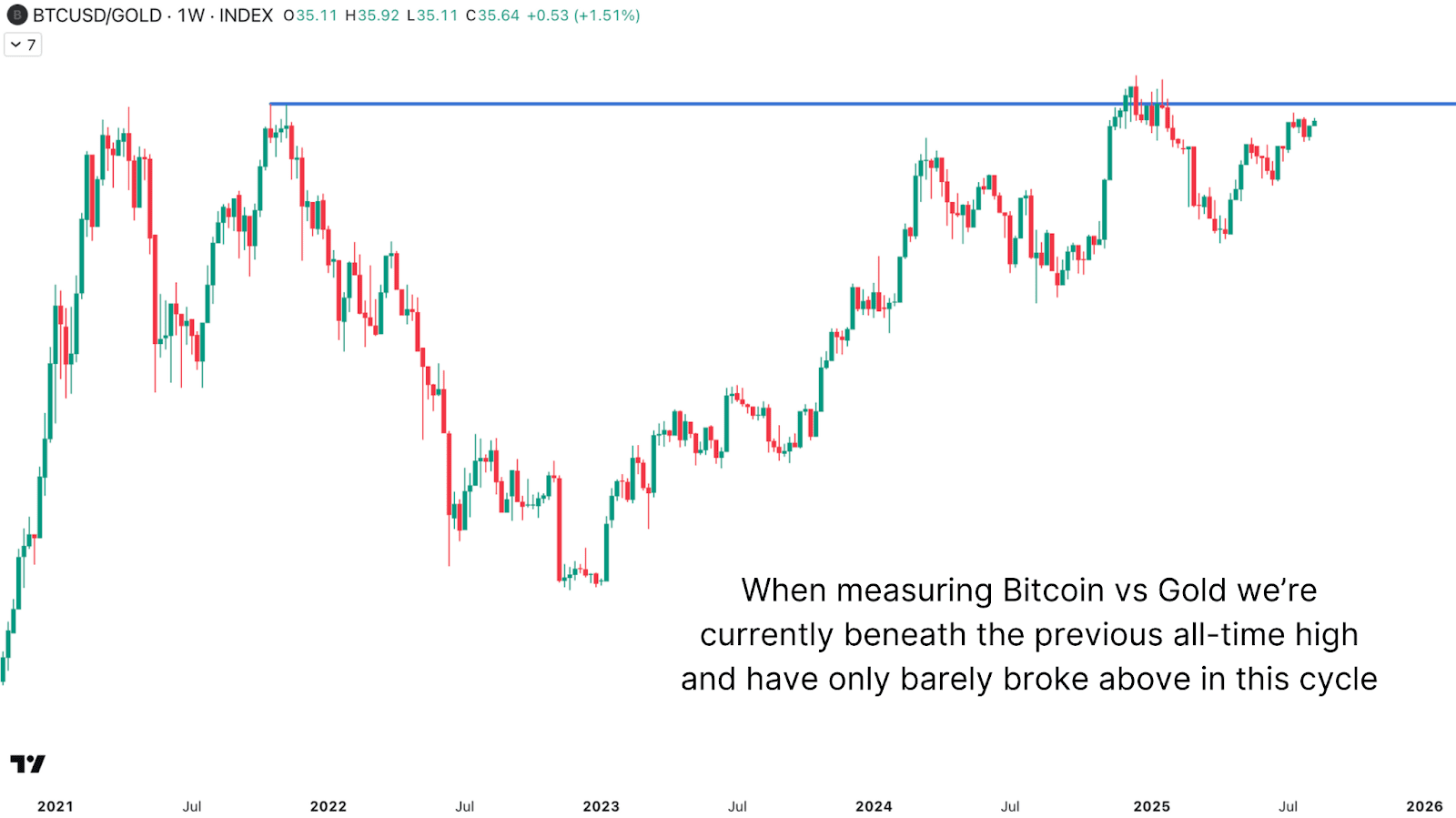

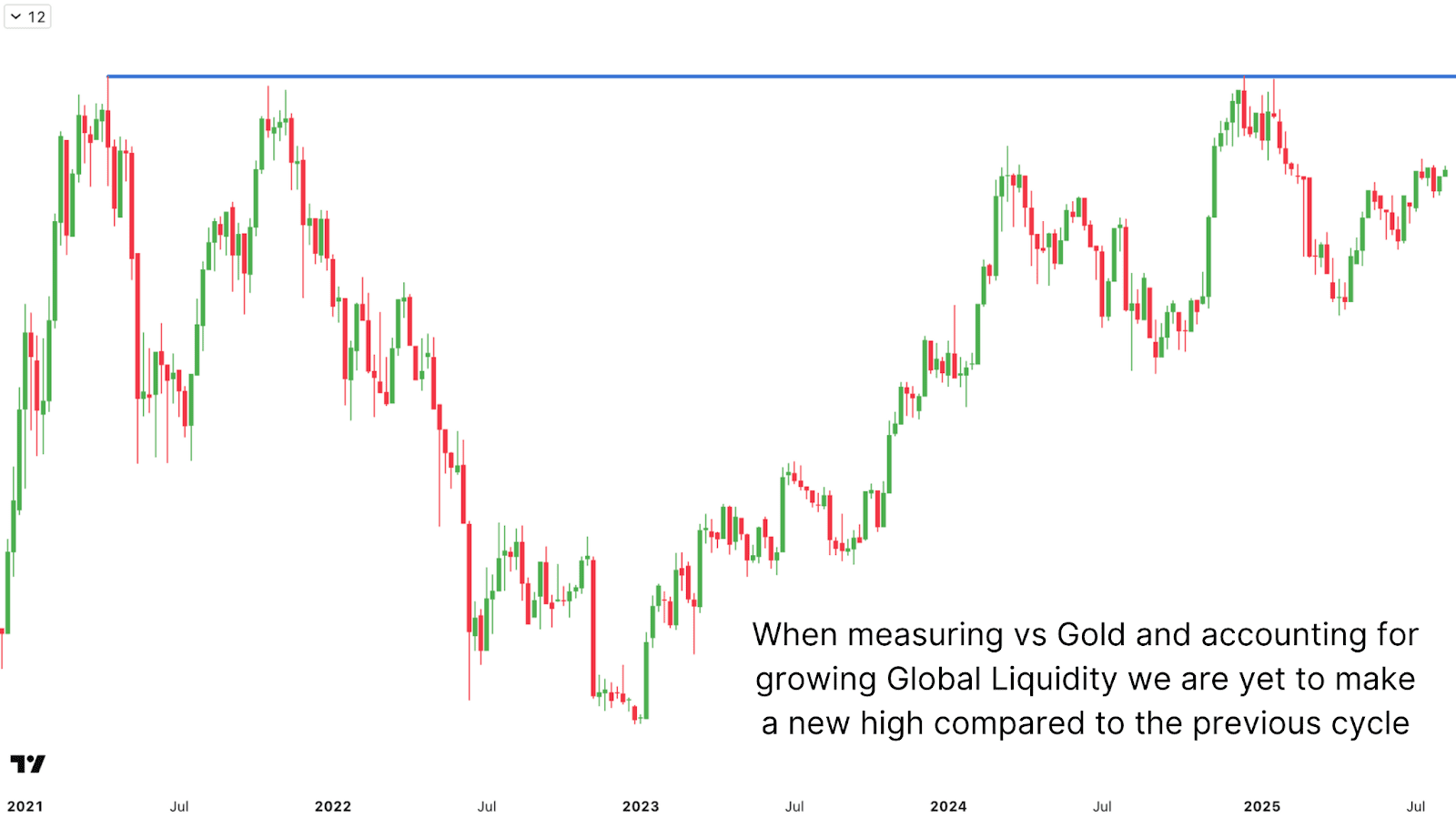

The story of “digital gold” invitations, invitations one other essential comparability, taking a look at BTC versus Gold. Bitcoin didn’t exceed his earlier time from the height of 2021 when measured in gold. That implies that an investor who purchased BTC on the height of 2021 and thus far would have held bounds as compared with simply holding gold. For the reason that final cycle was scammed, Bitcoin vs Gold has been returned greater than 300%, however gold itself has been in a strong bull run. Measuring in golden phrases strips to debasement results and reveals the “actual” buying energy of BTC.

Actual buying energy

To go one step additional, adjusting the Bitcoin versus Gold -Graphic for Global M2 money supply Enlargement paints an much more sobering picture. When the big liquidity injections within the world financial system are deemed lately, the Bitcoin peak prize continues to be within the circumstances for liquidity circumstances in “Liquidity corrected” nonetheless beneath the sooner peak. This helps clarify the dearth of pleasure within the retail commerce, as a result of there isn’t a new excessive in actual buying energy circumstances.

Conclusion

Till now, the Bull market from Bitcoin has been spectacular in {dollars}, with greater than 600% income of the lows and a comparatively low volatility climb. However when measured towards property similar to American technical shares or gold, and particularly when they’re tailored for world liquidity growth, the efficiency is far much less extraordinary. The info means that a lot of the assembly of this cycle is feasible fed by Fiat’s Basement as an alternative of pure outperformance. Though there’s nonetheless room for appreciable benefit, particularly if Bitcoin can break the resistance of liquidity and push it to even increased highlights, traders additionally must pay numerous consideration to those ratio playing cards. They provide a clearer perspective on relative efficiency and might supply helpful directions on the place the Bitcoin worth may go.

Did it like this deep dive in Bitcoin worth dynamics? Subscribe to Bitcoin Magazine Pro on YouTube For extra skilled market insights and evaluation!

Go to for extra in -depth analysis, technical indicators, actual -time market warnings and entry to skilled evaluation Bitcoinmagazinepro.com.

Disclaimer: This text is just for informative functions and shouldn’t be thought of as monetary recommendation. At all times do your individual analysis earlier than you make funding selections.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024