Policy & Regulation

BIS Floats AML Scores for Non-Custodial Crypto Wallets

Credit : cryptonews.net

The Financial institution for Worldwide Settlements (BIS) revealed a bulletin on 13 August and means that anti-money laundering practices (AML) might be prolonged to non-complaining crypto-portion with the assistance of their earlier transaction historical past, an idea that warns Blockchain-Community “. “

The report, entitled “An strategy to anti-money laundry apply for cryptoassets”, claims that the present requirements have “restricted effectiveness with decentralized file evaluation in permissionless public block chains.”

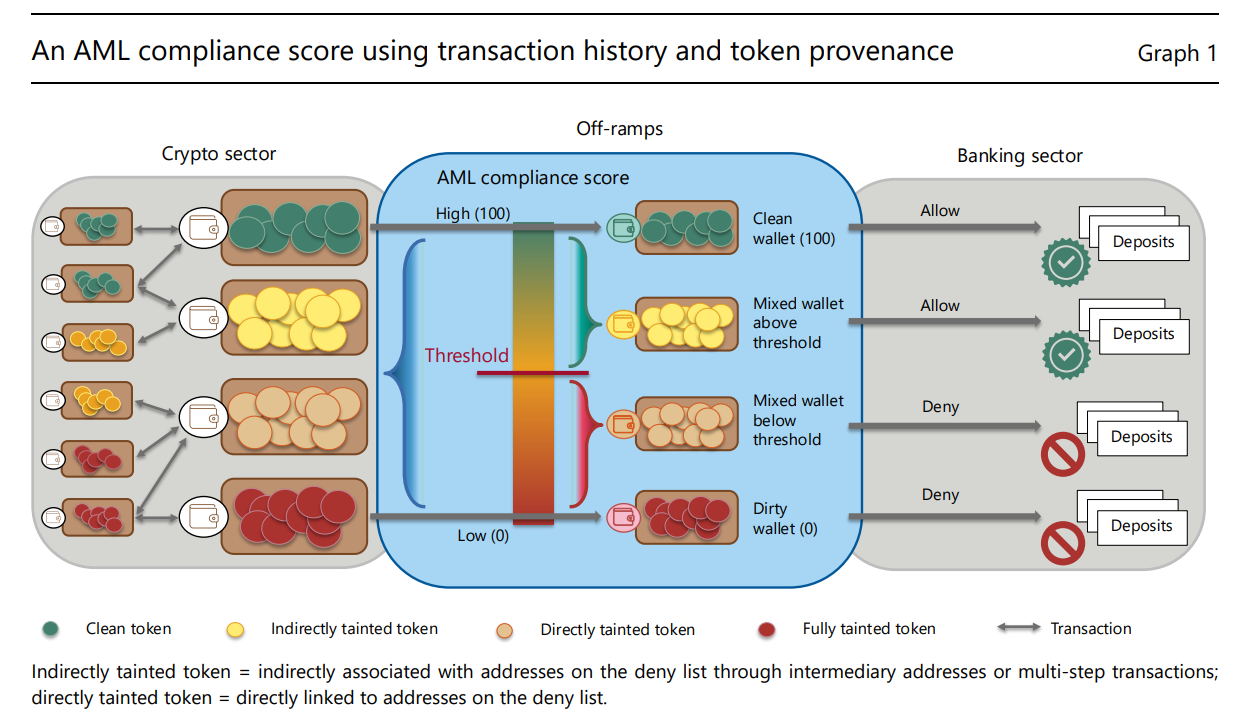

AML Compliance Rating – BIS

In line with the BIS, the absolutely obtainable transaction historical past on public grandbooks could also be used to find out whether or not tokens are “contaminated” and block or punish their conversion in Fiat foreign money in off-disaster.

The coordination brush of the central banks wrote that “customers may moderately be anticipated to train an obligation of care when buying and selling with crypto -tokens by checking upfront whether or not it’s recognized {that a} crypto coin shall be jeopardized,” including that failure to fulfill can result in fines.

“Though some customers moderately declare that they’ve obtained an contaminated token in good religion if details about unlawful use is scarce, such an argument could be much less convincing if there have been widespread and reasonably priced compliance service suppliers,” Bis defined.

Threat of fragmentation

The Bulletin even acknowledged that such a system may fragment stablecoins and famous that those that had been linked to unlawful currents “may commerce with the next low cost with others with out such a historical past.”

The proposal consists of mechanisms starting from “permitting frames” of portfolios that KYC chests have handed on to “refusing lists” flag addresses which might be linked to prison actions. The BIS claims that the rating itself might be embedded in portfolios or tokens itself. That’s the reason the system may even be expanded to customers who’re solely completed by way of non-right portfolios.

Ari Redbord, head of coverage and authorities issues worldwide at blockchain -forensic firm TRM Labs, stated in commentary on the Defiant that though blockchain evaluation can already determine publicity to unlawful portfolios, the important thing ensures that such a rating doesn’t turn out to be a black field. “

He argued for what TRM calls ‘Glassbox Attribution’, the place compliance groups can see the pockets connections behind every rating and make their very own judgments.

Redbord added that the embedding of compliance critiques in tokens or these KYC want for non-required portfolios “may characterize a big shift in how blockchain networks can work” and create “layered property, the place the identical token is handled in a different way based mostly on transaction historical past.”

He added that privateness would instantly be in danger, and that dangerous actors would in all probability swap to mixers or non -regulated platforms.

“A scoring system is probably a device within the toolbox, however it isn’t in itself an entire resolution. Regulators, normal letters and policymakers are confronted with a problem within the period of Defi-how authorized customers can act in a secure and personal method in public blockchains and on the similar time need to discover poor actors of the reworking,” says the reworking, “says,” says the reworking, “says the reworking,” says the reworking, “says the reworking,” says the reworking, “says the reworking,” says, “says the reworking,” says, “says the reworking,” says, “says the reworking,”.

The BIS seen the challenges, however stated that the plan may assist with the closing of gaps within the international monetary system. With stablecoins that at the moment are good for 63% of the unlawful crypto transactions in 2024, in keeping with Chainalysis and TRM Labs knowledge quoted within the report, BIS stated that the pretend within the Regulation within the Regulation embedded “if a promising highway comes ahead to conclude regulatory holes.”

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024