Policy & Regulation

GENIUS ACT and Beyond: Kaia Explains Asian Perspective

Credit : cryptonews.net

With the latest approval of the Genius Act, a milestone American regulation for Stablecoins, worldwide consideration is intensified. To debate the rising Stablecoin panorama in Asia, Beincrypto sat down with Dr. Sam web optimization, chairman of Kaia. As one of many main crypto platforms in Asia, Kaia is on the forefront of shaping regional stablecoin methods.

Stablecoins take consideration in Asia

President Donald Trump has signed the Genius Act, the primary American federal regulation for Stablecoins, only a day after it had laid out the home. Historic laws requires one-on-one reserves, common audits and limiting the difficulty of acknowledged banks, credit score associations and sure authorised non-banks, whereas algorithmic or unattended cash are prohibited.

The transfer has already induced a wave of enterprise curiosity. Inside a couple of weeks, giant American retailers similar to Amazon and Walmart began exploring their very own Stablecoins to cut back card community prices, pace management and combine loyalty packages. Proponents see this as a step in direction of the common adoption; Critics warn that the deposits of conventional banks may pull and drive them to speed up digital foreign money methods.

The timing comes when the US greenback is confronted with the sharpest lower within the first half since 1973, because of which European traders flip to euro-mixed commerce and Euro-Pegged Stablecoins to cut back the FX threat. Though the greenback stays dominant, the regulatory readability of the genius regulation can strengthen its place in crypto, simply as Asia weighs how they will profit from USD-based liquidity with out undermining native currencies.

Kaia DLT Basis’s Chairman, Dr. Sam web optimizationMentioned with Beincrypto how Asian coverage makers and platforms ought to reply and why a regional Stablecoin Alliance could be essential for the long-term autonomy of the area.

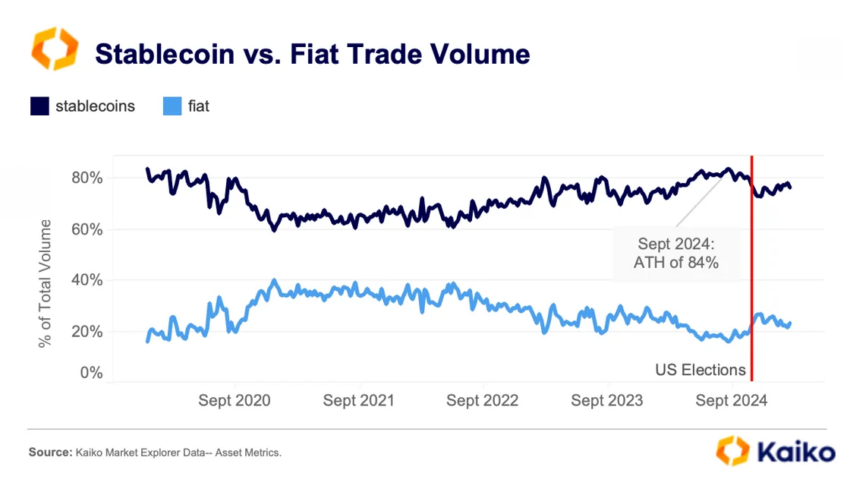

Stablecoinvs fiat. Supply: Kaiko

web optimization didn’t hesitate to decide on the Stablecoin when requested about essentially the most important development within the Digital Asset market in Asia.

“Essentially the most stylish is Stablecoin,” he stated. “Even earlier than the good motion, the growing use and quantity of Stablecoin truly ignored the dialogue and attracted loads of consideration in Asia.”

He emphasised that the adoption of the Stablecoin is quickly increasing in Asia, making it removed from a phenomenon that’s restricted to the US or Europe. USD-stunned cash are additionally closely utilized by Asian individuals and firms. The rise extends past speculative commerce, with stablecoins more and more embedded in on a regular basis transactions, cross -border commerce and regional regulatory agendas.

Leaders and regional defenders

When requested which international locations stimulate innovation, web optimization pointed to 2 main.

“I’d in all probability say that Singapore or De Vae, as a result of they had been fairly superior by way of making rules for stablecoins. In Singapore they made all of the stabile regime of the one foreign money in 2023, not solely concerning the Singapore greenback, but in addition different giant 10 currencies and likewise the uae and the uae and likewise the and likewise the and the stabilecoins. “

The early motion of Singapore positioned it for different Asian areas of regulation when setting clear, enforceable guidelines. The VAE, led by Dubai and Abu Dhabi, has additionally constructed up an intensive regulatory framework for digital belongings, together with stablecoins.

web optimization, however, stated that completely different international locations give attention to stablecoins linked to their very own foreign money.

“Japan, Korea, Hong Kong, China and the Philippines are extra centered on their currency-based Stablecoins as a result of they care about their individuals and their currencies.”

This displays a shared precedence: defending home financial programs and defending nationwide currencies aren’t moved by cash supported by overseas.

Genius Act: Each threats and alternatives

The Genius Act has created a transparent framework for regulated USD -StableCoins similar to USDC and PayPal USD. web optimization sees each hazard and potential for Asia.

“If we do not have native foreign money staboins, the Fiat -Valuta can be used much less as a result of using USD Stablecoins can improve loads. But when we put together the regional stablecoin and the right use of USD Stablecoins, this is usually a likelihood for the Asian international locations.”

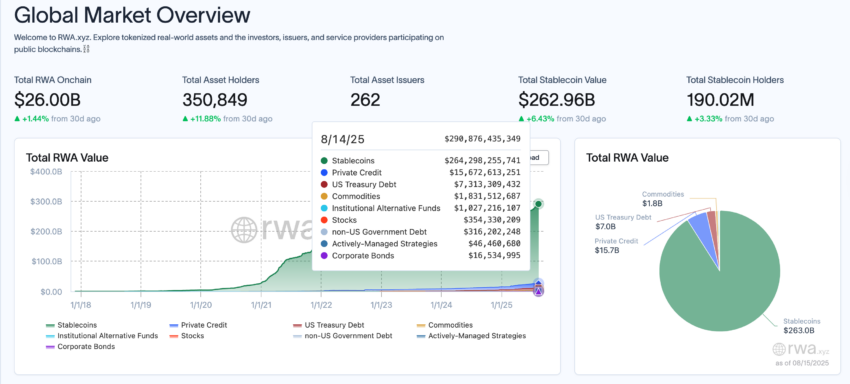

Worldwide market overview. Supply: rwa.xyz

web optimization famous that regulated USD Stablecoins below the Genius Act may unlock new capital flows for the Tokenized Activamarken of Asia – from authorities bonds to actual property – fundraising and buying and selling actions. He additionally emphasised that as a result of Stablecoins are often issued and completed on public block chains, they’re clear for all individuals. On the similar time, privateness can nonetheless be saved by selective anonymization of person information.

Japan’s strict mannequin and the necessity for stability

The Japanese Fee Companies Act solely allows banks, belief corporations and acknowledged switch suppliers to spend Stablecoins, which requires full spare backing and common audits. web optimization sees this as a robust safety for the yen.

“Regulation for Stablecoin is a solution to shield the Japanese foreign money and the Japanese market. Requiring a robust reserve inside sure areas of regulation can truly stop the cash from leaving the nation.”

However he additionally warned towards over -range.

“If the reserve requirement is simply too strict, this will stop the non-local gamers from coming into interoperability and lowering stablecoins supported by denominations from different international locations, one of the vital essential roles of digital currencies. We’d like a stability for non-local gamers to play.”

Funds, e-commerce and inclusion

web optimization believes that Stablecoins Web3 can push within the mainstream in Asia, particularly in funds and e-commerce.

“Completely sure,” he confirmed. “In some international locations, for instance, in Vietnam and Indonesia QR funds are virtually dominant as an alternative of bank card funds.”

By integrating stablecoins into QR-compatible portfolios, thousands and thousands can deal with with no need a checking account or card, for which they must undergo the complexity of the financial institution’s authentication course of.

“We do not need to reinvent the interface by having the stablecoin as one other foreign money agent, we will improve the cost transactions and decrease the issue of the cost.”

European Rand and Asia’s Alliance Hole

web optimization famous that Europe has simpler liquidity coordination due to the euro and mica framework. With its a number of currencies along with the regulatory variety, Asia doesn’t have this benefit.

“A single foreign money is pointless in Asia, however a multi-currency stablecoin Alliance may be very efficient. It might probably enhance the liquidity between completely different stabile stabiles.”

Such an alliance may very well be a foundation for cross -border interoperability and lowering friction between regional markets.

Kaia’s Route map for regional cooperation

Kaia is geared toward increasing real-world use instances for stablecoins and stimulating adoption in Asia. It already helps native USDT and is planning on doing Yen, Rupiah and Hong Kong-Greenback-backed Stablecoins on board Yen-, Rupiah and Hong Kong. The second part is the development of an FX marketplace for chains for seamless foreign money waps and environment friendly cross-border settlements. This could enhance liquidity, cut back transaction prices and make sooner funds attainable.

The ultimate part is to give attention to Asian Stablecoin aliens to standardize practices and to increase regional community results.

“We’re definitely engaged on that,” stated web optimization about Kaia’s collaboration with Line Messenger, one of the vital standard within the area. “At some point the road customers from Japan or different international locations can use completely different stablecoins within the line body. Nevertheless it additionally requires the precise rules.”

Kaia works intently with De Lijn to discover the combination of Stablecoin, within the expectation that as quickly because the authorized framework is prepared, line customers can seamlessly ship and obtain Stablecoins internationally.

Kaia is a low 1 blockchain platform launched in August 2024. It combines Klaytn van Kakao and Finschia van Naver, the dominant technical giants of Korea. Naver’s Line Messenger has an enormous Asian person base in Japan, Taiwan and different international locations.

Kaia Chain Community to Boarded Tether’s USDT in Might of this yr, and it is usually in discussions with different stablecoin and fintech corporations to make potential KRW, JPY and different backed stablecoins.

The figuring out selection of Asia

The technique is evident to web optimization: Construct native foreign money -stablecoins, Combine Selectively USD -Liquidity and join them by way of a regional interoperability framework.

“Stablecoins are now not only a crypto instrument. They turn out to be the connective tissue of digital funds in Asia … to hyperlink funds, tokenized markets and each day commerce.”

The Genius Act can strengthen the regulated position of the greenback within the world crypto. Whether or not Asia responds with fragmentation or a united technique will decide the monetary autonomy of the area for years.

The Submit Genius Act and Past: Kaia explains that the Asian perspective first appeared on Beincrypto.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024