Ethereum

Can The Market Handle The Risks?

Credit : www.newsbtc.com

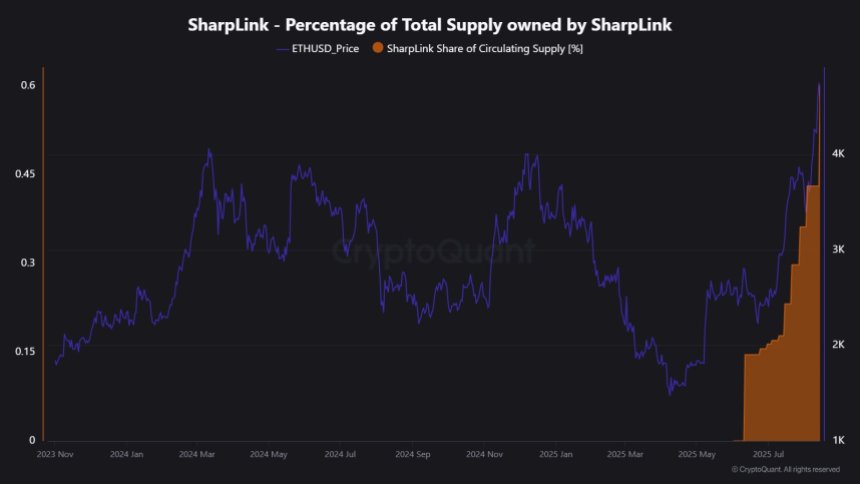

Ethereum undergoes a correction after weeks of Sterk Momentum, however institutional acceptance quietly reforms the lengthy -term dynamics of the market. In line with Cryptoquant, the favored ‘Crypto Treasury technique’ has lengthy been related to Bitcoin, now entered the Ethereum ecosystem. Greater than 16 corporations have already adopted this strategy and collectively 2,455,943 ETH with a price of just about $ 11.0 billion. This vital allocation has successfully concluded a major a part of the ETH, decreasing the out there provide on the open market.

Associated lecture

The Treasury motion displays the Playbook from Bitcoin, the place corporations have strategically constructed up as a reserve belongings. Nevertheless, Ethereum presents vital variations. Not like Bitcoin’s laborious coated inventory of 21 million, ETH has no fastened most. As a substitute, provide dynamics are fashioned by community exercise and the hearth mechanism with EIP-1559. Though this mechanics can create deflatory intervals, the overall vary of Ethereum has nonetheless elevated by round 1 million ETH (~ 0.9%) up to now yr.

This duality affords each alternatives and threat. On the one hand, institutional corporations scale back liquid provide and strengthen the position of Ethereum as a strategic energetic. However, variable situation signifies that in periods of low community exercise can speed up provide progress, diluting shortage results. Whereas Ethereum is testing crucial ranges of demand, the Treasury technique can grow to be essential when shaping the following giant pattern.

Ethereum: Treasury focus and leverage dangers

In line with Cryptuquant’s analysisEthereum’s latest pattern of the Treasury Adoption affords each alternatives and dangers. On the one hand, institutional treasuries have locked billions in ETH, decreasing the out there provide available on the market.

Nevertheless, the construction of those corporations additionally provides focus dangers. Bitmine Immersion Applied sciences, who, for instance, has overtly defined his objective to test 5% of all ETH, presently solely has 0.7%. The following largest holder, Sharplink Gaming, solely manages 0.6%. Because of this the adoption of the treasury remains to be concentrated amongst some gamers. If one or two giant holders had been to discharge their reserves, the market might need to do with aggressive value shocks.

Along with the buildup, leverage is one other rising issue. Cryptoquant emphasizes that ETH Futures open curiosity has risen to round $ 38 billion. This stage of leverage signifies that giant fluctuations in value may cause cascades readings. In crypto -markets, leverage is synonymous with volatility.

The vulnerability of this setup was clear on August 14, when a waste of solely $ 2 billion in open curiosity led to $ 290 million in pressured liquidations and a fall within the value of seven%. This occasion underlines how rapidly issues can spiral when the liquidity is skinny and the leverage is excessive. Solely offered sale is to not stimulate volatility – livered positions improve any motion. On this context, the acceptance of the treasury of Ethereum can assure in the long run, however concentrated corporations and rising leverage stay vital vulnerabilities.

Associated lecture

ETH Check Important Liquuidity ranges

The Ethereum value motion on the 3-day graph exhibits that after gathering to an area excessive close to $ 4,790, ETH has entered a correction part, however stays properly above crucial superior averages. Presently, round $ 4,227, the value has been withdrawn from its peak, however nonetheless retains the broader bullish construction.

The 50-day SMA ($ 2,687), 100-day SMA ($ 2,838) and 200-day SMA ($ 2,912) are all trending up, which displays a powerful underlying momentum. It is crucial that ETH acts significantly above these lengthy -term averages, which confirms that the bullish pattern stays intact regardless of the withdrawal. The sturdy struiting of lower than $ 3,000 earlier in the summertime meant a decisive reversal after months of consolidation, which laid the muse for the final outbreak.

Associated lecture

If Bulls reach sustaining the $ 4,200 – $ 4,100 help zone, ETH might once more take a look at resistance close to $ 4,790 and presumably go to cost discovery. Conversely, it can not retain a retest of the vary of $ 3,800 – $ 3,600. The upcoming periods shall be essential to verify whether or not Ethereum resumes its upward pattern or taking over a deeper correction.

Featured picture of Dall-E, graph of TradingView

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024