Analysis

SWIFT Blockchain Pilot Could Trigger the Next Price Breakout

Credit : coinpedia.org

International Funds Large Swift has Officially started live blockchain testsWith XRP and Hbar who pop up as two of the first belongings which might be thought-about. This growth has managed waves over the crypto market, as a result of each tasks are actually central to a change that may reform cross-border funds and tokenized belongings transfers.

For buyers, the implications transcend know-how. SWIFT processes greater than $ 150 trillion yearly, and even a fraction of that quantity that’s routed by blockchain networks, could cause an enormous demand for digital belongings similar to XRP and HBAR. The ability of XRP in instant settlement and liquidity administration makes it a pure match for banks, whereas Hbar’s excessive transit and enterprise administration correspond to giant -scale tokenization wants.

With each belongings now sure to the Route Card of Swift, ask merchants: may this be the catalyst for the following Grand Prix in XRP and HBAR?

XRP vs. Hbar: What matches higher in the way forward for Swift?

Whereas Swift accelerates his shift to blockchain-compatible monetary stories, two belongings are consequently within the highlight: XRP (Ripple) and Hbar (Hedera). Each supply pace, scalability and value effectivity, however their design philosophies and strengths differ, making them probably complementary as a substitute of direct rivals.

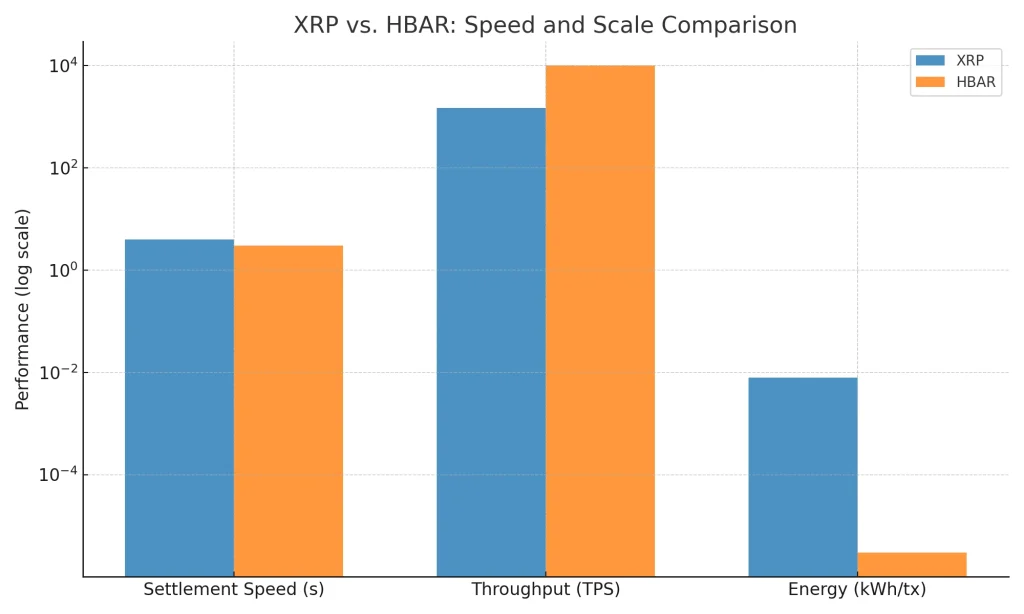

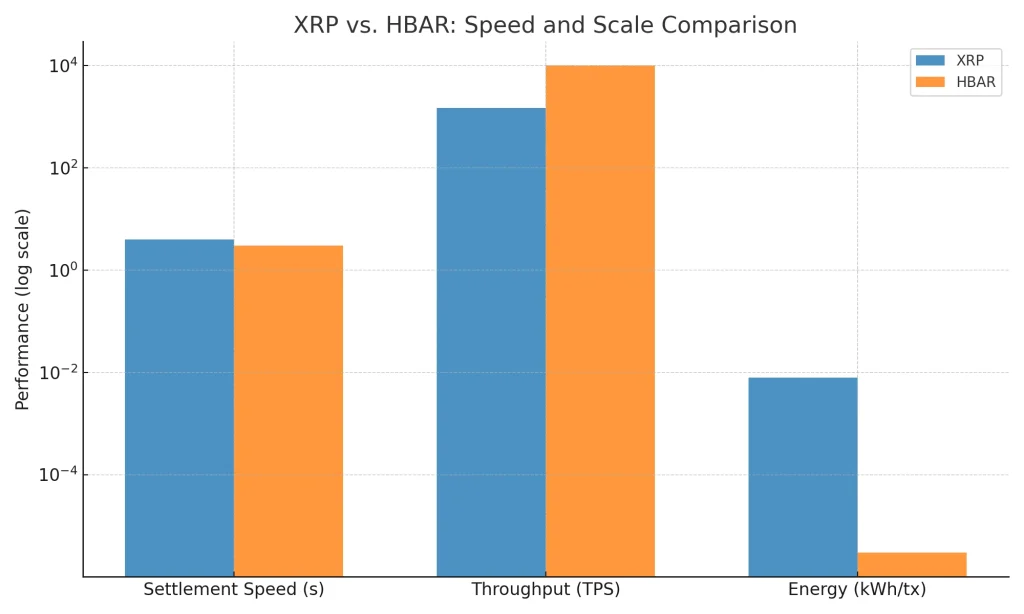

Technical comparability

| Perform | XRP (wrinkle) | HBar (Hedera) |

| Settlement pace | 3-5 seconds | ~ 3 seconds with finality |

| Conformity | Ripple Protocol Consensus (RPCA) | Hashgraph Gossip + Digital Voices (ABFT) |

| Transit (TPS) | ~ 1,500 TPS | 10,000+ TPS (scalable by way of Sharding) |

| Administration | Validator checklist (Unln), Ripple-linked companions | 39-copy administrative council (Google, IBM) |

| Vitality -efficiency | ~ 0.0079 kWh/TX | ~ 0.000003 kWh/TX (carbon detrimental) |

| Major use case | Cross -border funds, transferments | Tokenization, purposes for enterprise high quality |

| Approval | Banks, Cost Suppliers (Santander, SBI) | Firms, Tech Giants (Google, Boeing) |

XRP is constructed for international funds and gives speedy settlement and liquidity options that match financial institution wants. HBAR is designed for tokenization on Enterprise-Scale, with unparalleled transit, carbon-negative operations and robust governance. Collectively they’ll kind a double resolution: XRP for liquidity and funds and HBAR for Token -Ised Property and Company Rails.

Conclusion: XRP vs. HBAR – Which can Swift select?

Because the digital belongings of Swift progress, each XRP and HBBer have carved distinctive strengths – XRP as a liquidity bridge for international funds and HBBer and the scalable spine for topped deconomies. Nevertheless, the true influence could be felt of their costs. If even part of Swift’s ecosystem of $ 150 trillion flows via these networks, the demand may lead to a substantial benefit. As an alternative of a single winner, the long run might even see each XRP -price and HBar -price flourishing collectively -the felling of hypothesis that this integration may mark the beginning of their subsequent giant bullrun.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024