Policy & Regulation

EminiFX founder to pay $228M in Ponzi scheme ruling

Credit : cryptonews.net

A federal decide in New York has ordered Eddy Alexandre, founding father of the collapsed Crypto platform Eminifx, to pay greater than $ 228 million in refund after he had dominated that the corporate was a Ponzi schedule that tens of hundreds of traders.

The US Commodity Futures Buying and selling Fee (CFTC) has acquired a quick judgment towards Alexandre and Eminifx, with the American district decide Valerie Caproni who collectively held them accountable for greater than $ 228 million in refund and an additional $ 15 million in disgorgement, in line with a Tuesday topic.

“Defendants Alexandre and Eminifx are collectively and really liable to pay a refund for the full quantity of $ 228,576,962,” the court docket dominated. “Defendant Alexandre will pay disgorement for an quantity of $ 15,049,500.”

The ruling comes greater than three years after Alexandre was charged for the primary time and greater than a yr after he had responsible in a parallel prison case.

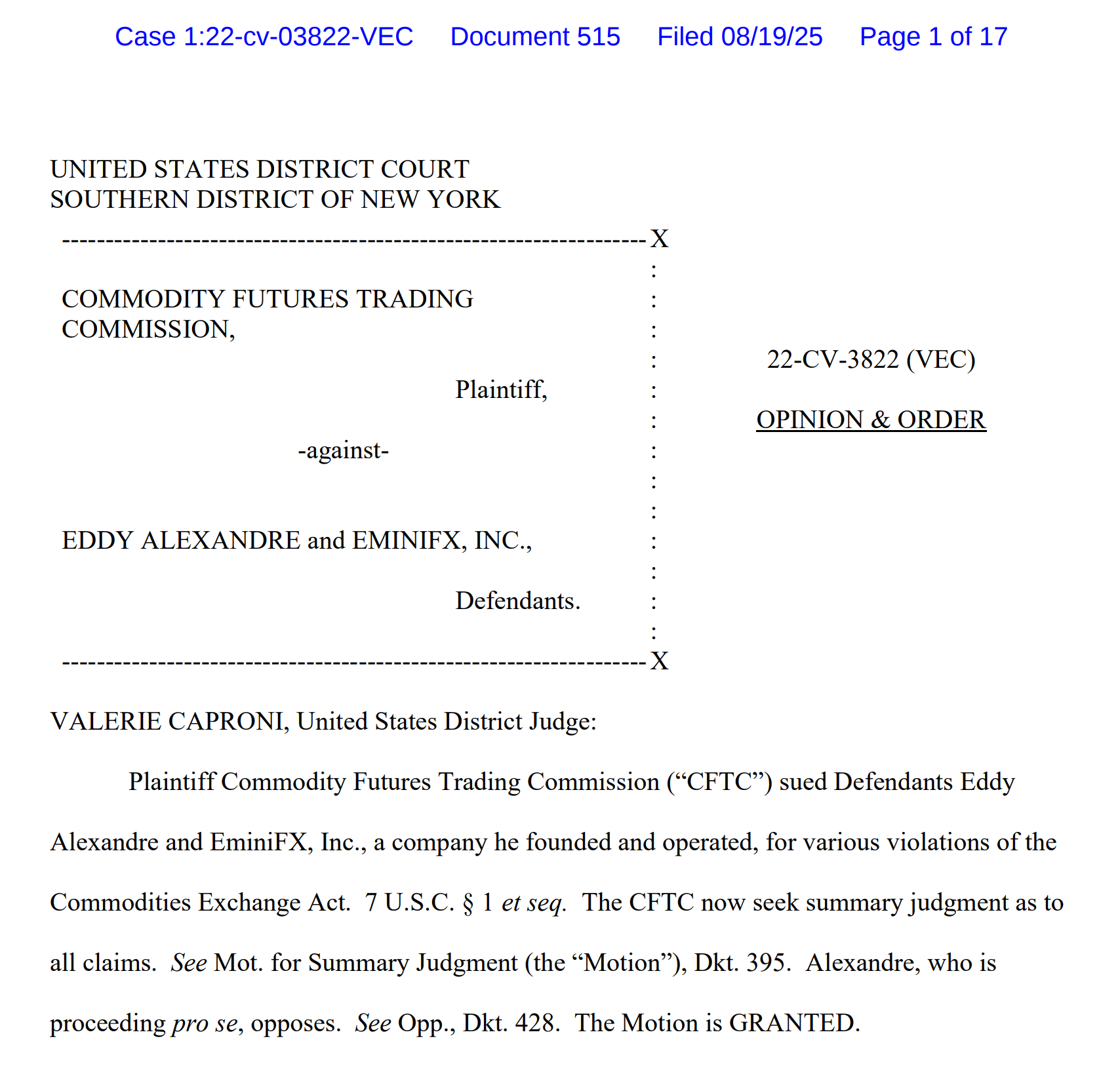

A snapshot of the case of the case. Supply: Courtlistener

Associated: Disaster administration for CEX throughout a cyber safety menace

Eminifx has collected $ 262 million on fake-Robo buying and selling claims

Eminifx was launched in 2021 and shortly attracted greater than 25,000 traders, which resulted in additional than $ 262 million in simply eight months. The corporate promised weekly returns from 5% to 9.99% by a so-called “Robo Advisor Assisted Account” that has reportedly deployed automated commerce methods in crypto and foreign exchange markets.

In actuality, judicial archives present that the platform has sustained internet losses of a minimum of $ 49 million and by no means used the commercial of the expertise.

In response to researchers, Alexandre has transferred a minimum of $ 15 million for private use, financing bank card accounts, luxurious vehicles and money recordings. Within the meantime, the recordings of traders have been paid with the assistance of blended funds of latest contributors.

Associated: Blockchain safety should find to cease the crypto -deed wave of Asia

Judicial penalties Eminifx founder as much as 9 years

The autumn of Alexandre began in Could 2022 when officers of Justice and the CFTC submitted parallel actions. Within the prison case, he admitted uncooked supplies fraud and was sentenced to 9 years in jail, together with a refund of $ 213 million.

The civil case, now concluded with the order of Caproni, provides a parallel refund and disgorgy mandate, though any refund funds “compensate for its disgorganment obligation”, in line with the court docket’s choice.

The recipient appointed by the court docket, who has been supervising the restoration and distribution of property since 2022, started to repay earlier this yr for suspending reclaimed funds to victims after a distribution plan was authorized in January.

In response to Certik, losses of crypto -hacks, scams and exploits reached $ 2.47 billion within the first half of 2025. Whereas the Q2 $ 800 million noticed misplaced over 144 incidents, a lower within the worth of 52% and 59 fewer hacks in comparison with Q1, the full of 2024 has already risen from 2024.

Journal: Coinbase Hack reveals that the legislation will most likely not defend you – this is the reason

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024