Altcoin

Ether strand in August – but will September spoil the party?

Credit : www.newsbtc.com

The Ethereum assembly this month has been sharp, however merchants are warned to look intently in September.

Associated lecture

Ether For the reason that starting of August he has climbed round 20% and traded at $ 4,745 on the time of publication. Costs even have $ 4,860 after pierced Dovish remarks From the American Federal Reserve chairman Jerome Powell on the Jackson Gap Symposium, a motion that many in crypto see as a potential spark for extra revenue.

Historic September Pullbacks

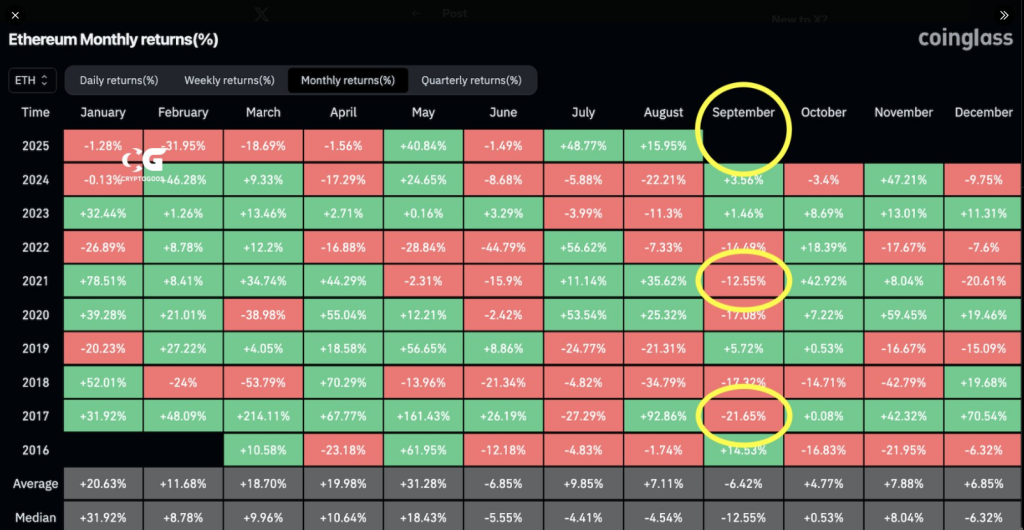

Based on CoinglassHistorical past presents a warning remark: there have been solely three instances since 2016 the place Ether rose in August after which slid in September.

In 2017, Ether jumped by 92% in August after which 20% dropped the next month. In 2020 the revenue of August 25% was adopted by a pullback of 17% in September.

And in 2021 a climb of 35% made manner in August for a 12% slip in September. Cryptogoos, a dealer on X, summarized it bluntly: seasonal in September whereas relieving years is often damaging.

$ ETH Seasonalness in September whereas relieving years is often damaging.

Will this time be totally different? pic.twitter.com/H9HJ40V3NP

– Cryptogoos (@Crypto_Goos) August 22, 2025

That sample doesn’t imply {that a} repetition is assured. Stories have introduced that each market construction and buyers profiles are actually totally different than in these earlier years.

In 2016 and 2020, short-term losses have been adopted in September by multi-month restoration, with Ether positioned the wrong way up within the final three months of these years. So though historical past issues, it doesn’t solely resolve the outcomes.

New cash, new dynamics

This month, in Spot Ether ETFs giant sufficient to draw consideration. Based mostly on reviews from Fat Aspect, spot ETFs noticed round $ 2.70 billion internet consumption in August, whereas Spot Bitcoin ETFs skilled round $ 1.2 billion in internet outflows for a similar interval.

On the identical time, corporations that hold crypto on their balances now hold a substantial piece of ether. Stories present that the full ether from Treasury corporations on 11 August was $ 13 billion in worth.

Arkham reported that Bitmine chairman Tom Lee purchased one other $ 45 million from Ether and lifted the pile from Bitmine to $ 7 billion.

These figures change arithmetic. Massive institutional piles and ETF query could make sharp, short-term actions extra persistent than in earlier cycles.

Capital appears to rotate; Bitcoin Dominance has fallen by 5% over the previous 30 days to 55%, who often attribute market members to funds that go to property than Bitcoin.

Associated lecture

What merchants can do beneath

Merchants and portfolio managers will in all probability monitor macros indicators and energy information. A softer rate of interest view from Powell is a bullish issue for threat property, however seasonal and earlier decreases after August are causes to remain cautious.

Featured picture of Unsplash, graph of TradingView

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024