Ethereum

‘Quick to look past Ethereum,’ Bitwise CIO rues – Here’s why

Credit : ambcrypto.com

- ETH’s underperformance has fallen to multi-year lows.

- Bitwise’s CEO stays assured in ETH’s value reversal.

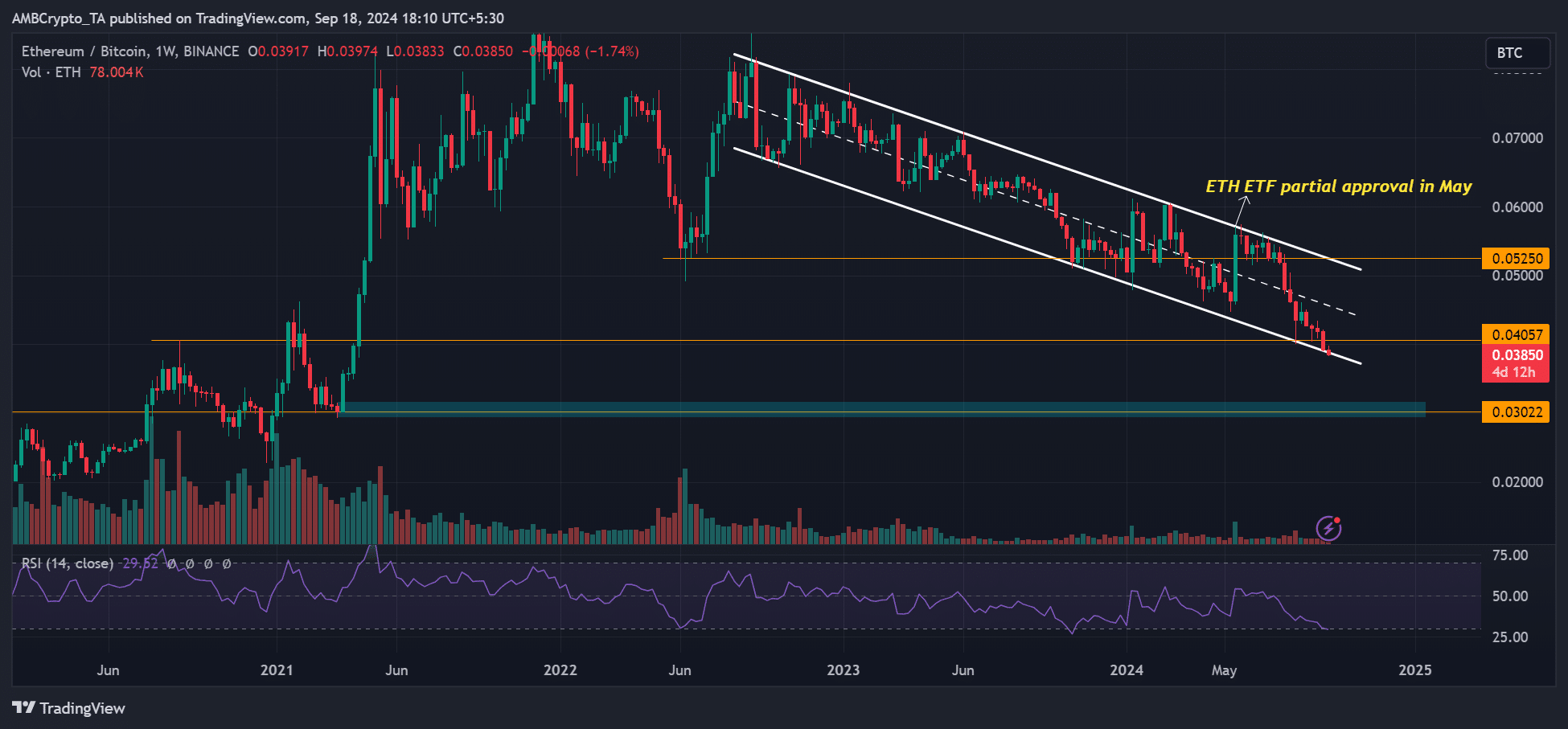

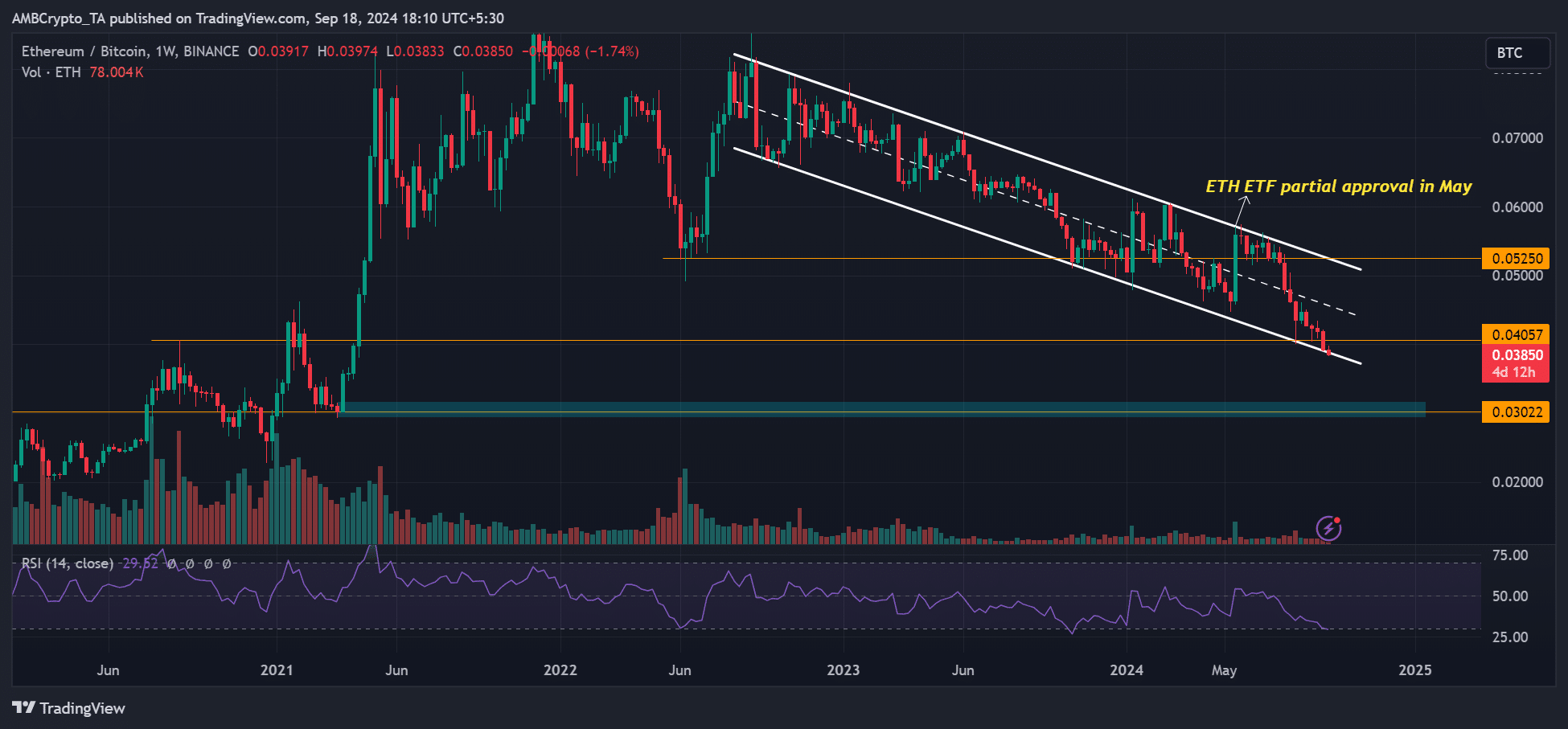

Ethereums [ETH] relative valuation of Bitcoin [BTC] sparked considerations out there earlier this week when the ETH/BTC pair broke under 0.04 for the primary time in nearly 4 years.

The pair follows ETH’s appreciation in opposition to BTC, and the multi-year downtrend highlighted the altcoins’ worrying underperformance.

In truth, ETH has erased its annual positive factors. However BTC rose 40%, and Solana [SOL]ETH’s principal competitor, rose 18% this 12 months.

ETH’s second will come…

Nevertheless, digital asset supervisor Bitwise was assured in ETH’s bullish value turnaround in the long run. Bitwise CIO Matt Hougan made a contrarian wager on ETH, highlighting a attainable restoration after the US elections.

A few of his latest remark to learn to traders,

“I feel individuals are too fast to look previous Ethereum and the actual success we’re already seeing in its ecosystem.”

Hougan cited prediction website Polymarket, the large stablecoin and the DeFi area as key bullish indicators for the altcoin. Moreover, growing institutional curiosity from BlackRock and the remainder has additionally been nice for ETH’s worth.

He added that extra readability on DeFi rules may give the altcoin a lift, particularly after the US elections. He famous:

“I think the market will begin to reassess Ethereum as we get nearer to the November elections and eventual regulatory readability. For now, it seems like a possible contrarian wager till the tip of the 12 months.”

ETH’s present issues

Market consultants have cited a number of causes for ETH’s comparatively poor efficiency in comparison with BTC.

David Duong, Coinbase’s head of institutional analysis, linked many of the present subdued value to the market construction that’s sometimes characterised by sluggish market exercise because of the summer time.

Nevertheless, the poor efficiency of US ETH ETFs within the spot market has additionally been cited as a catalyst for weak ETH sentiment.

Not like the US BTC ETFs, the ETH merchandise have change into internet damaging flows of $606 million since its launch in July.

In keeping with Hougan, regulatory uncertainty has additionally weighed on ETH, particularly within the run-up to the US elections with no potential clear presidential winner.

He added that group considerations about ETH’s tokenomics have additionally contributed to the present issues.

For context, ETH revenues have fallen to their lowest degree in 4 years after scaling allowed L2s to draw many of the quantity from the L1 base tier. This has raised considerations amongst customers, Hougan famous.

“Many marvel if Ethereum has shot itself within the foot by scaling away from the foundational Layer 1 blockchain.”

In the meantime, ETH/BTC was on the verge of breaking under its multi-year declining channel.

That stated, says market analyst Benjamin Cowen projected that ETH/BTC may backside out by the tip of the 12 months. On the time of writing, ETH was valued at $2.3K, down 43% from the March excessive of $4K.

Supply: ETH/BTC, TradingView

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024