Bitcoin

BTC Treasury Model Faces Reality Check

Credit : www.coindesk.com

Good morning, Asia. That is what makes new within the markets:

Welcome to Asia Morning briefing, a each day abstract of prime tales throughout American hours and an summary of market actions and evaluation. For an in depth overview of the American markets, see Coindesk’s Crypto Daybook Americas.

Bitcoin Treasury firms are confronted with a easy however cheeky check: can they carry out higher than BTC itself, or have buyers skip them and purchase the activum?

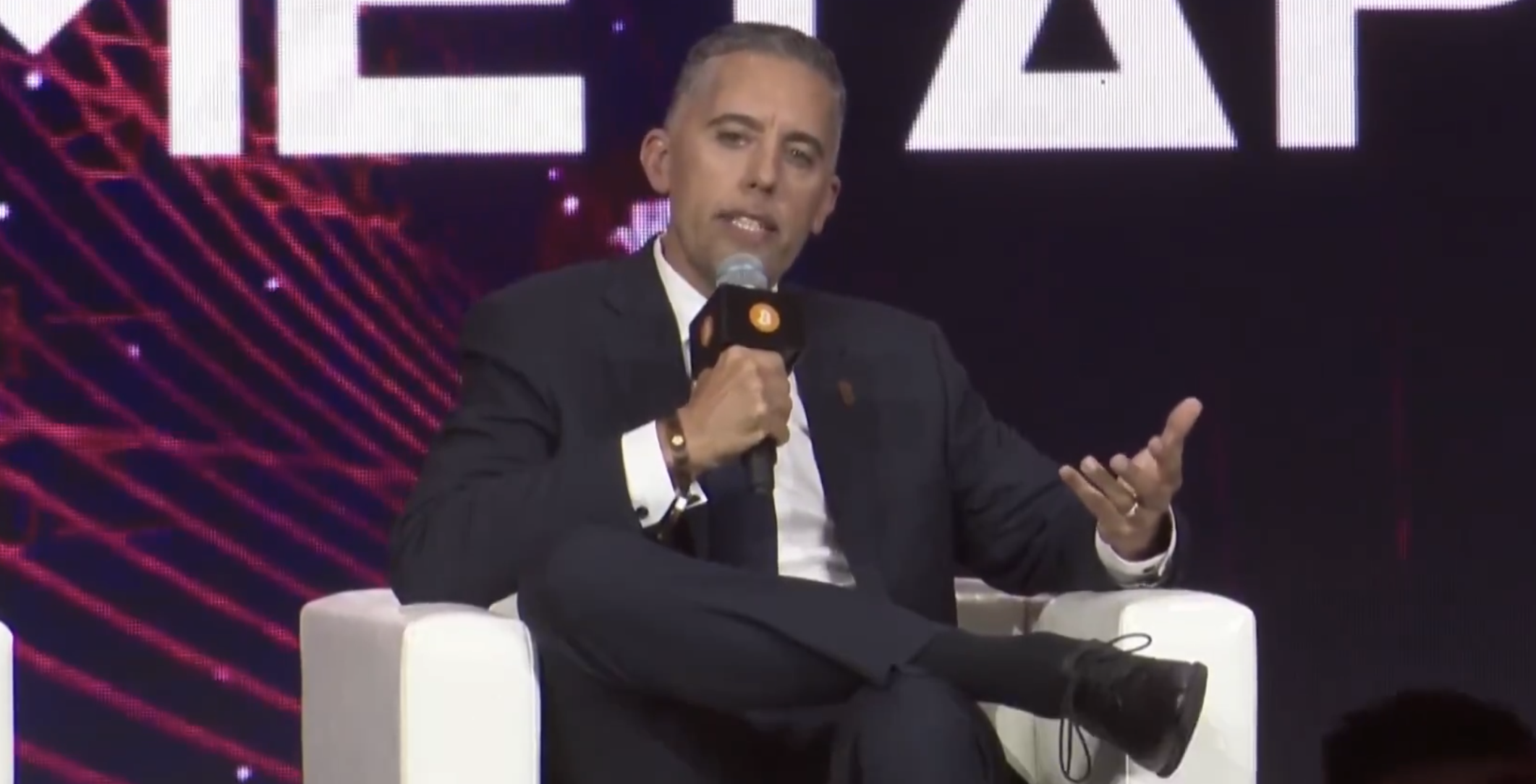

“In case you do not, there is no such thing as a motive to do the methods, simply purchase a Bitcoin ETF,” mentioned Matt Cole, CEO of Try Asset Administration, throughout a panel in BTC Asia in Hong Kong.

Cole is probably greatest often known as an avid supporter of Gamestop Put BTC on the stability.

On stage, Cole described the Playbook as a seek for Alpha, the place they discover methods to surpass BTC with out merely stacking Bitcoin-specific danger. Cole defined that this quantities to financing, the place he pointed to a shift from convertible units to perpetual most well-liked fairness as a approach to lock up leverage.

He added that probably the most tough milestone is scale: reaching $ 1 billion in capital, the purpose the place financing turns into low cost sufficient to assist IPOs and bigger groups.

“Probably the most tough factor to do for Bitcoin Treasury firms may be reached a billion greenback,” he mentioned, referring to Michael Saylor from MicroStrategy.

That scale, which Cole emphasised, solely works with Bitcoin. Ethereum and different tokens, he mentioned, behave an excessive amount of like sharing financial coverage.

“Ethereum gives a horrible possession for a treasury firm,” mentioned Cole. “Bitcoin is continually going up versus Fiat currencies as a result of they’re weakened.”

In keeping with him, the mounted vary of BTC makes it the one property which might be in a position to assist a lever bag technique that has been designed to place collectively over time.

Andrew Webley from The Smarter Internet Firm, a listed British internet designer with BTC on the stability sheet, broke a extra measured tone with regard to the market NAV, Bitcoin yield versus dilution and enterprise measurement.

Smaller firms, he mentioned, have a bonus in attracting capital, however transparency and clear danger communication stay simply as vital as arithmetic.

“A very powerful factor that you are able to do as a public firm is in my view to first publish our guidelines,” Webley mentioned, including that clear disclosure buyers helps to grasp the issues of a BTC Treasury mannequin.

“If somebody can perceive the dangers, then in our opinion this stuff are the easiest prospects in the entire world,” he added.

The cut up underlined the selection for buyers: investing in firms that pursue aggressive methods to surpass BTC or to favor firms that promise regular progress with clear transparency.

Anyway, panel members agreed that the function of Bitcoin as a treasury property is just increasing if Fiat continues to be being phased out.

Market motion:

BTC: Bitcoin acts above $ 110,500, acts barely decrease after a small withdrawal, though indicators of accumulation, reminiscent of resilient demand within the neighborhood of vital assist, recommend that market individuals stay bullish within the subsequent outbreak, in accordance with Coindesk’s Market Insights Bot.

ETH: ETH is traded at $ 4300, a lower of 0.6%. ETH continues to profit from sturdy institutional significance and ETF influx, which assist its structural upward upward upward place.

Gold: Gold continues to be traded close to document highs which might be supported by the expectations of the speed and the rising demand for secure port, though it noticed a slight withdrawal within the midst of revenue.

Nikkei 225: The most important index in Japan continues to assemble, stimulated by a mix of sturdy overseas purchases, pushed by the shift of the land of lengthy -term stimulans, company reforms and rising yields, and deaf financial indicators from the US, which will increase the worldwide fairness sentiment.

S&P 500: The S&P 500 rose by 0.83% to a document 6.502.08 When merchants collected weak knowledge from the non-public jobs pending the employment report on Friday for directions on prospects and recession dangers.

Elsewhere in Crypto:

- World Liberty Monetary Blacklists Justin Solar’s tackle with $ 107 million WLFI (Coindesk)

- SEC goes all the way in which into pro-Crypto agenda with a complete collection of digital property controls (Decrypt))

- NFL -Openter attracts $ 600K on polymarket as a platform focuses on $ 107B Sports activities contemplating business (Coindesk)

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024