Ethereum

Ethereum staking queue surges to $3.7B: 2-year high signals confidence

Credit : ambcrypto.com

Essential assortment eating places

The Validator queue of Ethereum has risen to an ATH of 860k ETH. Does the L1 quiet engineering shocks beneath the floor?

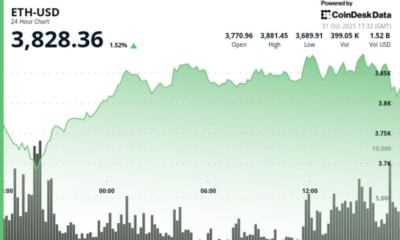

Ethereum’s [ETH] Worth fluctuations are synchronized with its growth flows.

EtHs specifically Total value set (TVs) At first of August 36.23 million ETH was as a result of Worth pushed $ 4.6k, however was decreased to 36 million, which signifies that 230k ETH Onstak in lower than a month.

Previously two weeks, TVs actually fell 145k ETH of 36.14 million, with ETHs being adopted 12% pullback of $ 4.9k.

Briefly, strikers spend some liquidity. Nonetheless, the Validator -Kwarrij van Ethereum exhibits steady internet entry.

Supply: Validatorqueuee

Merely put, a brand new demand for a strike stacks quietly beneath the hood.

Ethereum’s Entry Queue (Blue Line) stood as much as 860k ETH on 2 September, a two -year peak. That’s round $ 3.7 billion within the queue, or roughly 2.9% of ETH’s vary, with a stable layer pending an adjusting strain strain.

Stick that on the 29.45% set -out (36 million ETH), and greater than 32% of the ETH could be successfully locked or standing within the queue, in order that the overall set out Ethereum is dropped at 38 million, which marks a brand new of all time.

Ethereum’s deployment flows sign in the long run bullishness

With its strike within the queue, Ethereum is clearly a squeeze of the provide.

Nevertheless, the story doesn’t finish there. ETH recovered is ready to a This autumn Defi -hotspot.

Owlayer (an Ethereum Good Contract) TVL broke a file of $ 21 billion, which exhibits that merchants stack additional yield on high of Stanty ETH.

Merely put, ETH is locked up on the file tempo. It stacks shortage and offers by the validator queue whereas it brings in additional L2 yields. In flip, establishing shock strain beneath the floor delivers.

Supply: Defillama

It exhibits lengthy -term confidence in Ethereum has been laid down.

It was not random that the rise of $ 4.9k of all time was excessive. As a substitute, the powered provide shocks and institutional are powered by Defi-capital flows by deployment accumulation Nonetheless stepping strain strain.

In essence, the liquidity dynamics of Ethereum creates a stability between provide and demand, with ETH used, repeated protocols and underlying bid within the row to assist a structural bullish setup.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now