Bitcoin

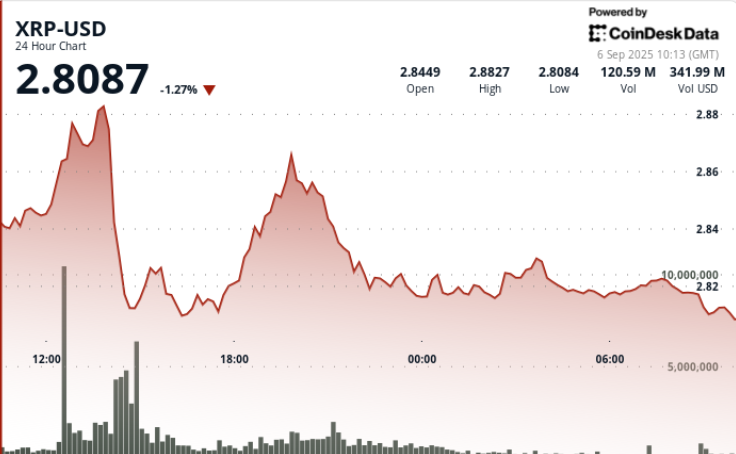

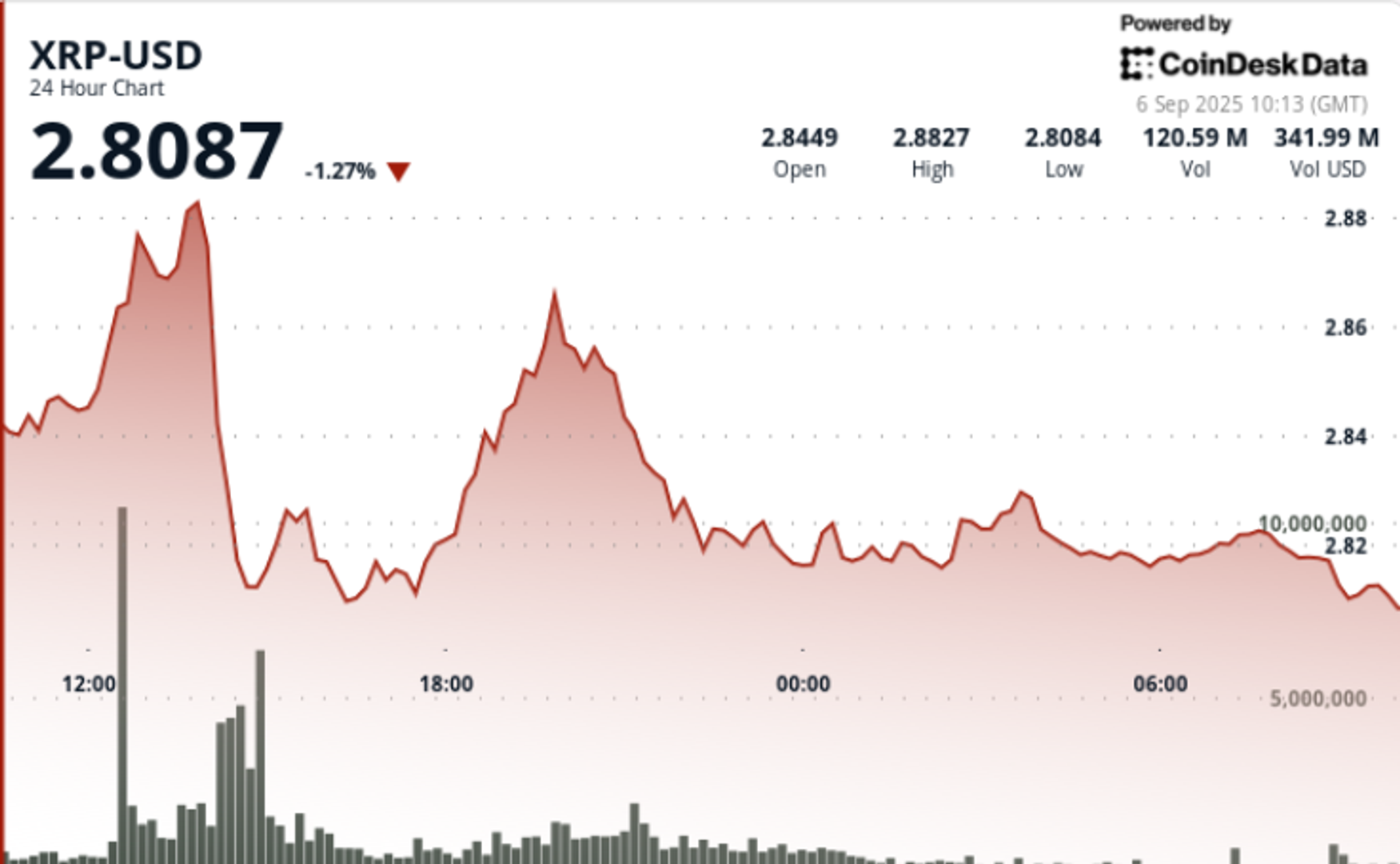

Holds Above $2.82 After Sharp Decline, Technicals Point to $3.30 Breakout

Credit : www.coindesk.com

XRP did not maintain the momentum above $ 2.88 – $ 2.89, inflicting a 4% lower as an institutional sale the advance. Heavy quantity confirmed resistance at these ranges, whereas consumers appeared once more within the vary of $ 2.81 – $ 2.83 to stabilize value motion.

The transfer retains XRP locked in a 47-day consolidation beneath $ 3.00, with merchants now viewing the $ 2.77 help spivot and the ETF choices of October as the next catalysts.

Information background

- Six institutional belongings managers have submitted Spot XRP ETF purposes, with SEC choices which are anticipated in October.

- The buildup of the whale continues, with round 340 million tokens which have been bought in latest weeks in latest weeks regardless of persistent volatility.

- Wisselsali stay raised above 3.5 billion XRP, on account of which questions are requested about doable supply stress corresponding to promoting CVs.

- Federal Reserve Coverage Shifts and Inflation Prints type broader liquidity situations on danger belongings.

- Earlier makes an attempt to interrupt increased noticed 227.7 million tokens close to $ 2.88 – $ 2.89, which confirmed that zone as a robust resistance.

Abstract of the worth promotion

- XRP traded inside a $ 0.08 vary from $ 2.81 to $ 2.89, which represents a volatility of three%.

- The sharpest decline got here at 2:00 PM on September 5 and fell from $ 2.88 to $ 2.81 to just about 280 million traded tokens.

- Stabilization adopted, with consolidation between $ 2.82 and $ 2.83 on lighter quantity.

- Closing value Close to $ 2.82 saved XRP simply above the $ 2.77 help pivot, seen as the following key from the opposite facet.

Technical evaluation

- Assist: Robust bidding zone recognized at $ 2.77 – $ 2.81 after repeated defenses.

- Resistance: Instantly ceiling at $ 2.88 – $ 2.89, with $ 3.00 psychological degree and $ 3.30 breakout – threshold above.

- Indicators: RSI is within the center 50 and displays impartial to bullish bias.

- MACD -Histogram convergates within the course of Bullish Crossover and alerts doable momentum shift when the amount returns.

- Construction: Steady 47-day consolidation under $ 3.00, with an in depth above $ 3.30 opening potential path to $ 4.00+.

Which merchants have a look at

- Or $ 2.77 is the decisive degree of help corresponding to promoting CVs.

- Worth conduct in retests of $ 2.88 – $ 2.89 resistance, particularly if the amount surpasses day by day averages.

- How whale accumulation compensates elevated alternate squares, which recommend a latent supply danger.

- October SEC choices on spot XRP ETFs, seen as an necessary institutional adoptive catalyst.

- Macro steering applications of FED coverage and inflation information releases that may affect flows over digital belongings.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now