Bitcoin

How Bitcoin Will React After The U.S. Election

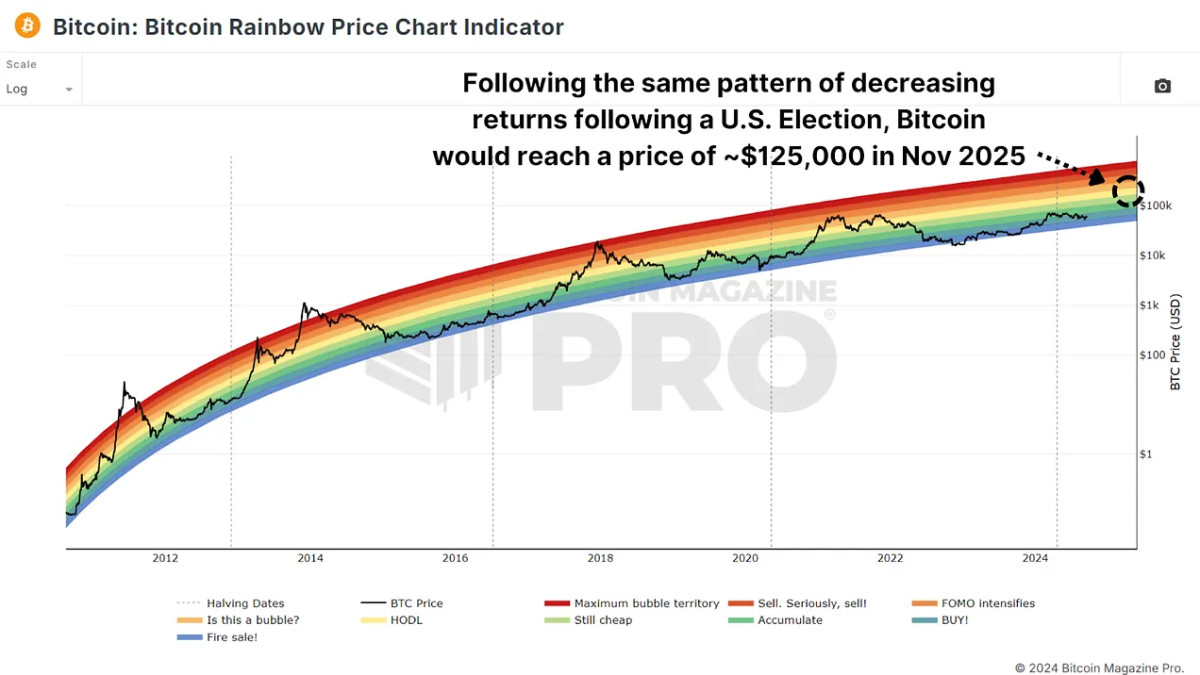

Credit : bitcoinmagazine.com

Because the US presidential election approaches, it’s price inspecting how earlier elections have affected Bitcoin’s worth. Traditionally, the US inventory market has proven notable tendencies round election durations. Given Bitcoin’s correlation with shares and, particularly, the S&P 500, these tendencies might present perception into what might occur subsequent.

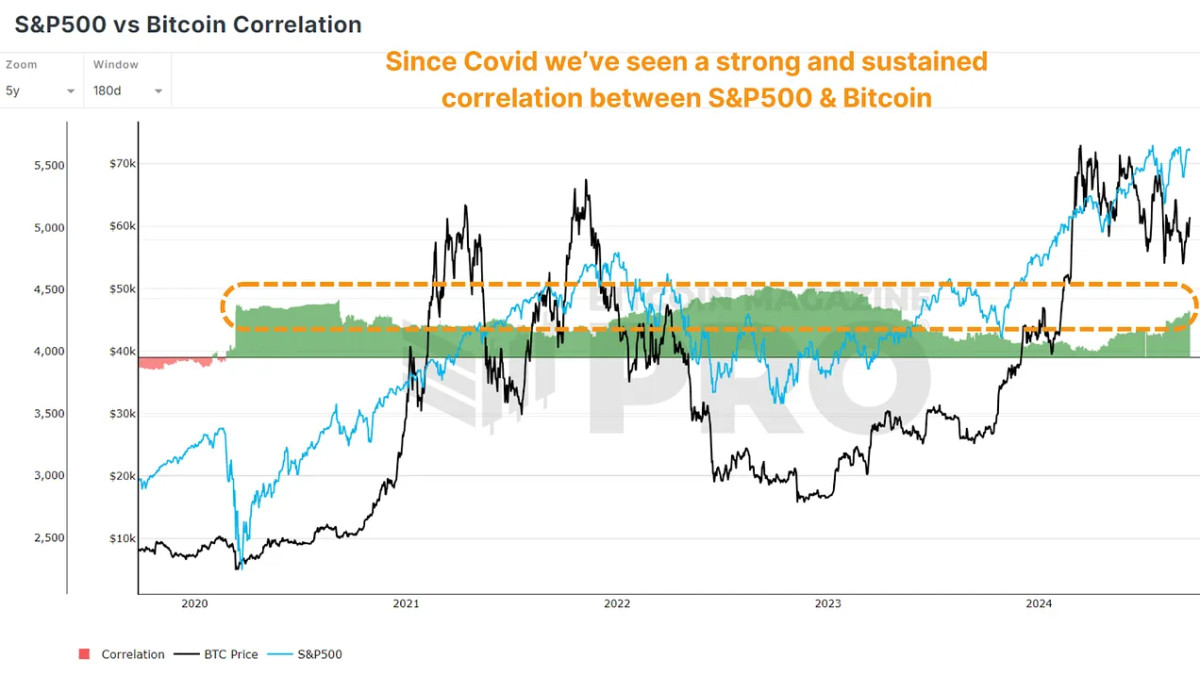

S&P 500 correlation

Bitcoin and the S&P 500 have traditionally had a strong correlationparticularly throughout BTC bull cycles and durations of dangerous sentiment in conventional markets. This phenomenon might probably come to an finish as Bitcoin matures and ‘decouples’ from equities and the story goes as a speculative asset. Nevertheless, there isn’t a proof but that that is the case.

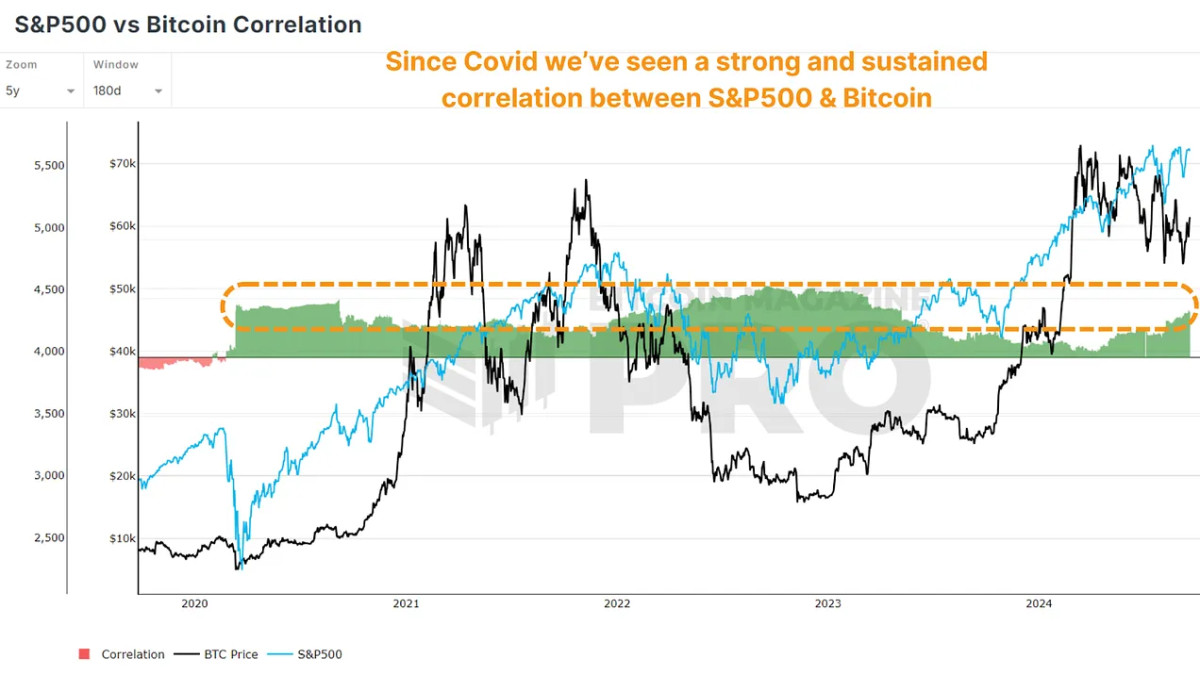

Outperformance after the elections

The S&P 500 has typically reacted positively to the US presidential elections. This sample has been constant over the previous few a long time, with the inventory market typically posting vital positive aspects within the 12 months after an election. Within the S&P500 vs Bitcoin YoY Change Chart we will see when elections happen (orange circles), and the value motion of BTC (black line) and the S&P 500 (blue line) within the months that observe.

2012 Elections: In November 2012, the S&P 500 grew 11% 12 months over 12 months. A 12 months later, this development rose to round 32%, following a robust market rally after the elections.

Election 2016: In November 2016, the S&P 500 rose about 7% 12 months over 12 months. A 12 months later it had elevated by round 22%, once more exhibiting a considerable enhance after the elections.

2020 Elections: The sample continued in 2020. S&P 500 development was about 17-18% in November 2020; the next 12 months this had risen to virtually 29%.

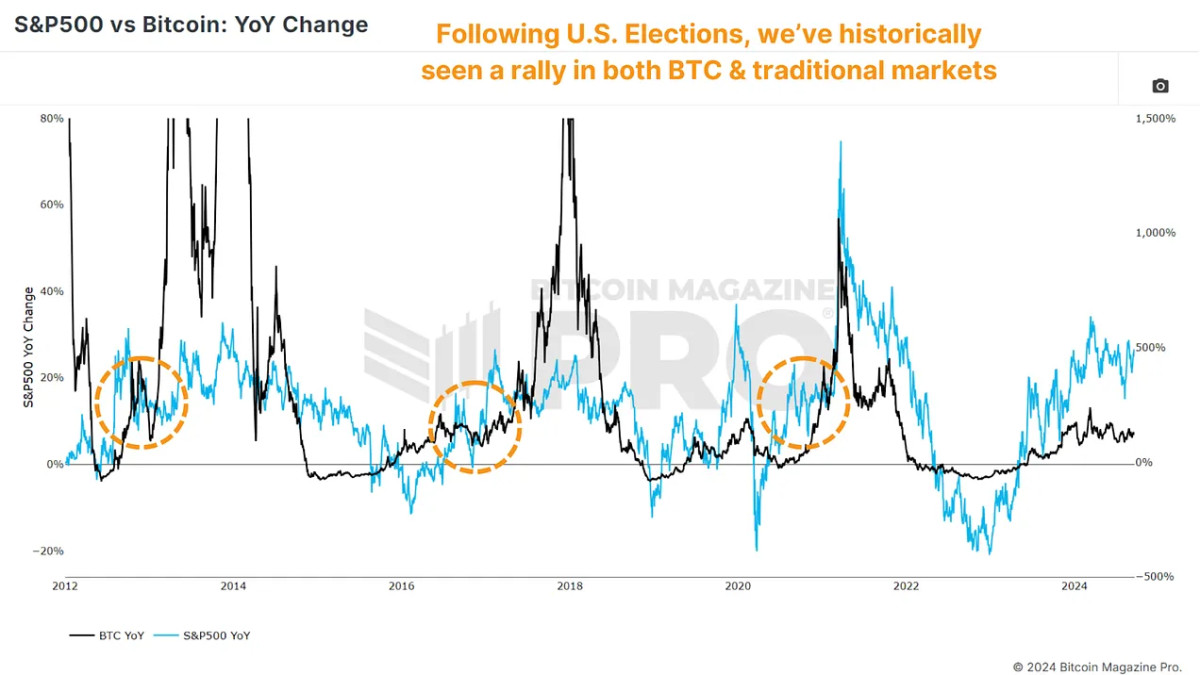

A current phenomenon?

This isn’t restricted to the earlier three elections when Bitcoin existed. To get a bigger information set, we will have a look at the previous 4 a long time, or ten elections, of returns on the S&P 500. Just one 12 months had detrimental returns twelve months after Election Day (2000, when the Web bubble burst) .

Historic information exhibits that the successful social gathering, whether or not Republican or Democrat, has no vital affect on these constructive market tendencies. As a substitute, the upside momentum is extra about resolving uncertainty and boosting investor confidence.

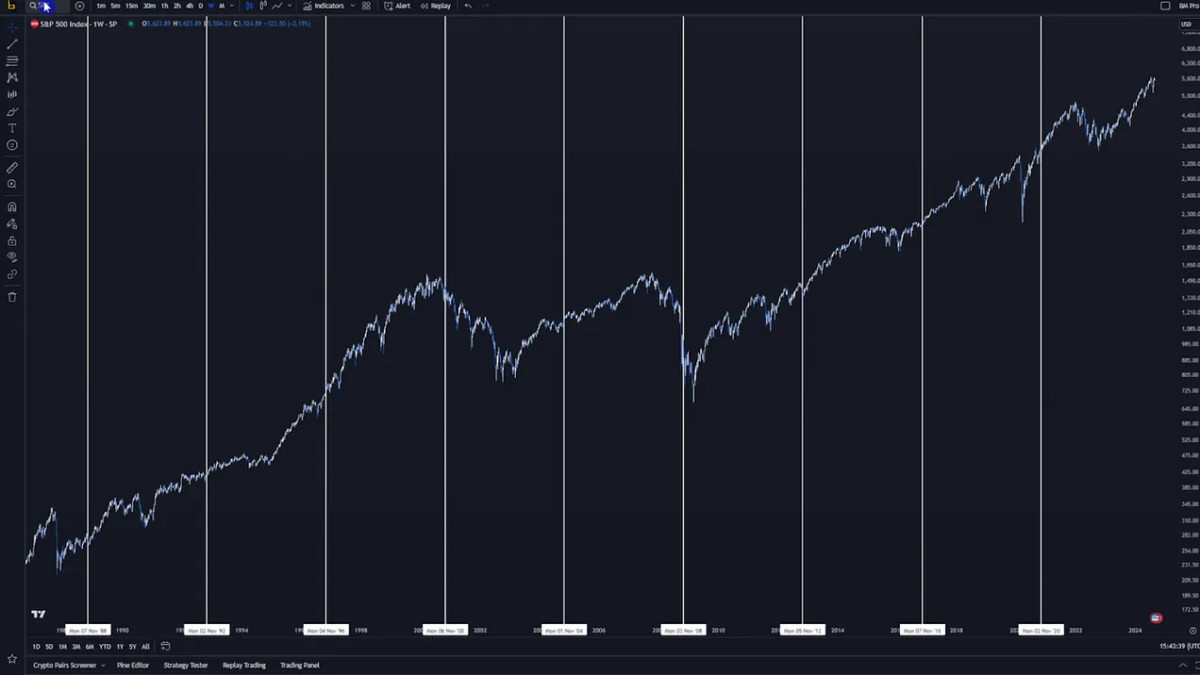

How will Bitcoin react this time?

As we strategy the 2024 US presidential election, it’s tempting to take a position about Bitcoin’s potential efficiency. If historic tendencies maintain, we might see vital worth will increase. For instance:

If we make the identical proportion achieve within the three hundred and sixty five days after the election as we did in 2012, Bitcoin’s worth might rise to $1,000,000 or extra. If we expertise the identical factor because the 2016 election, we might rise to round $500,000, and one thing just like 2020 might see a BTC of $250,000.

It is attention-grabbing to notice that every occasion has induced returns to fall by about 50% every time, so maybe $125,000 is a practical goal for November 2025, particularly since that worth and information correspond to the center bands of the Rainbow price chart. It is also price noting that Bitcoin posted even larger cycle peak positive aspects in all of those cycles!

Conclusion

The information means that the interval following the US presidential election is usually bullish for each the inventory market and Bitcoin. With lower than two months till the following election, Bitcoin buyers might have purpose to be optimistic concerning the months forward.

For a extra in-depth have a look at this subject, watch a current YouTube video right here: Will the US Elections Be Bullish for Bitcoin?

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024