Bitcoin

Will BTC Break Out or Face a Fakeout After Tight Consolidation?

Credit : coinpedia.org

Bitcoin value has traded a decent consolidation vary, in order that merchants ponder whether the subsequent step will probably be a robust outbreak or a deceptive faux. After weeks of lateral value promotion, market individuals maintain carefully within the stage of necessary assist and resistance ranges for signum indicators. Now that sentiment shifting and buying and selling volumes are fluctuating, each motion now has which means. On this delicate section, the subsequent path of BTC may set the tone for the broader crypto market, making it a vital period for each buyers and merchants.

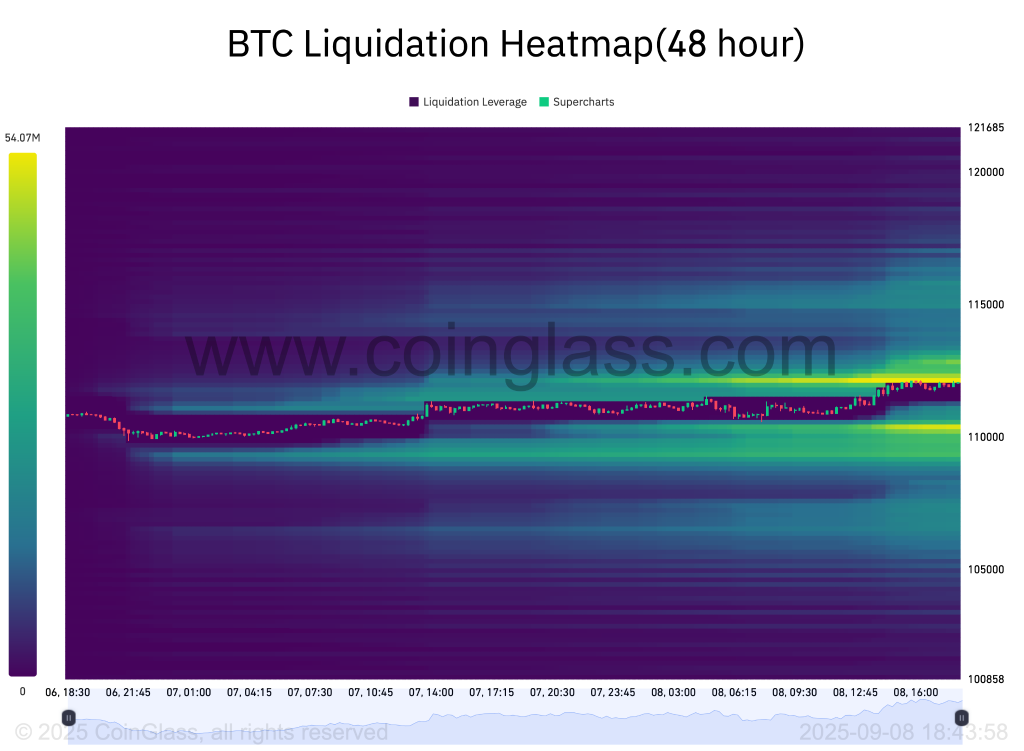

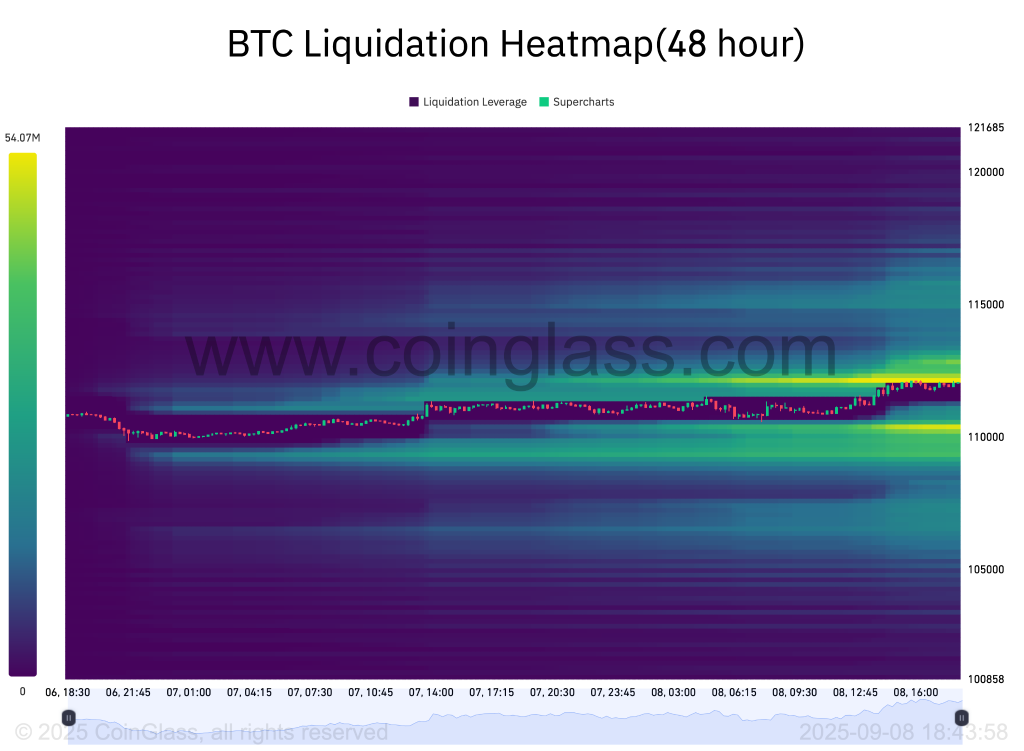

Bitcoin consolidate inside crucial liquidation zone

The present value promotion appears to have pressured buyers to make a secure cluster across the vary. The Bitcoin liquidation warmth folder exhibits the worth commerce between the liquidity cluster, which is collected between $ 112,100 and $ 112,300 and round $ 110,800. The bulls can’t break the higher cluster, which is anticipated to tug the degrees decrease to crush the sellers.

Alternatively, the open curiosity has persistently poured from greater than $ 87 billion to virtually $ 80 billion. This implies that future merchants don’t open new positions or shut their positions. Now that cash flows out of the market and the beginning of the exhaustion section signifies, it’s now assumed that the BTC value additionally reverses the pattern. Furthermore, the Coinbase Premium can also be destructive and the American inflation knowledge is coming this week. This expects the Bitcoin value to wipe the decrease liquidity.

Will Bitcoin value take a look at the assist at $ 108,000?

Though the worth has returned from the native assist to $ 107,300, the rally within the wider perspective stays consolidated in a falling channel. Within the meantime, the bulls attempt to break the resistance and if they’re profitable in it, it’s assumed that the worth is rising above $ 113,400, in order that the way in which is launched to check the upper targets. Nevertheless, the present value promotion exhibits a various value promotion, which signifies a possible withdrawal.

As could be seen within the graph above, the BTC value is traded inside a lowering parallel channel and tries to interrupt the higher resistance. As well as, it acts throughout the Ichimoku cloud and refers to in depth consolidation. An outbreak adopted by a retesthints to a bullish affirmation; Nevertheless, the graph sample suggests the potential of a rejection.

The RSI and CMF are incrementally, which is a bullish sign, however the earlier sample pushed the worth decrease after testing the resistance zone at $ 116,800, indicating a possible withdrawal to $ 110,000. That’s the reason within the coming days are fairly essential for the Bitcoin value rally as a rejection earlier than the breakout may activate the decrease targets round $ 110,000 or decrease.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024