Blockchain

Ethereum apps hold $330B in user deposits, maintaining L1 dominance

Credit : cryptonews.net

Ethereum continues to be removed from his aim to turn out to be a ‘one trillion chain’, however it stays the L1 community with a very powerful share within the crypto -Enterprise. Based mostly on latest knowledge, Ethereum apps include greater than $ 330 billion in consumer deposits.

The Ethereum apps point out a major exercise on the chains as a result of they turn out to be the L1 with nearly all of consumer deposits. Based mostly on token terminal knowledge, Ethereum wears $ 330 billion in consumer deposits, after an virtually to Defi exercise. Token Terminal has taken Tether because the main app by way of locked worth, but in addition ranked different defici and basic apps.

High -Apps on @Iretereum by TVL: https://t.co/rncgsneqky pic.twitter.com/wb9f1rwtv

– Token Terminal 📊 (@tokenderminal) September 7, 2025

Ethereum nonetheless has a $ 250 billion lead over Tron and stays unsurpassed by different L1 or L2. The primary motive is that the community is properly related to a number of centralized and decentralized services. This enables all customers and merchants to think about the out there liquidity and planning extra bold Defi actions.

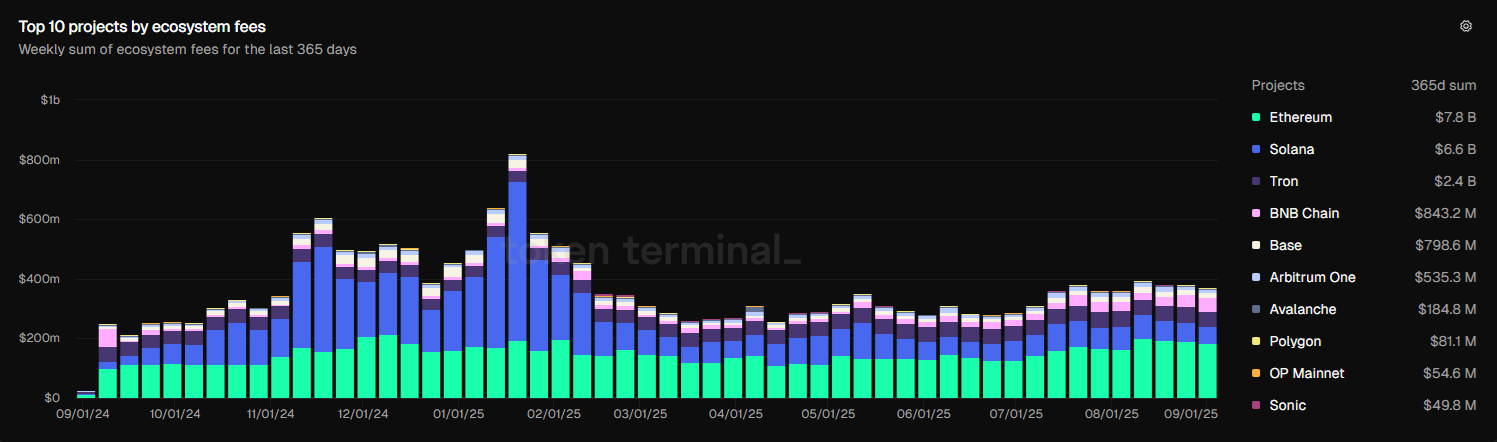

Ethereum recovered his primacy, after a brief interval wherein Solana was the chief for financial exercise on the chain, based mostly on app prices. | Supply: Token Terminal

For Ethereum, financial exercise goes again to the chain, with fixed progress in app revenue. After the 2021 cycle with novelty video games and NFTs, this time produce very liquid Defi apps increased revenue. The expansion of ETH above $ 4,000 additionally feeds on the TVL worth. One other ETH Rally can stimulate liquidity and exercise within the ecosystem.

On peak days, Ethereum -Apps have produced greater than $ 42 million in revenue traditionally. Throughout the bullcycles of 2024 and 2025 there’s a increased primary line for day by day prices. A very powerful L1 chain of Ethereum nonetheless bears nearly all of the exercise, with 12.98% From reimbursements from L2 chains.

Ethereum recovers each TVL management and financial exercise

Different knowledge is sweet for extra $ 91 billion Locked in worth on Defi apps. Ethereum additionally bears liquidity because of its stablecoin supply, as a result of it nonetheless stays the main community for USDT and USDC distribution. Tether is organized As the very best firm on Ethereum, as the corporate regards itself as a director of RWA -Tokenization.

Ethereum continues to be confronted with the query of whether or not worth locks interprets into enterprise exercise. At the moment there are days that Solana apps lead the ranks by way of day by day prices. Nevertheless, locked liquidity additionally reveals the belief of customers and liquidity.

Throughout some durations, Solana Ethereum surpassed day by day manufacturing manufacturing, regardless that it’s locked 1/10 of the worth. The chain was seen because the extra profitable financial mannequin and produced excessive prices based mostly on meme exercise.

Nevertheless, Ethereum’s deep liquidity and the availability of Stablecoin turned out to be engaging for whales, which relocate extra worth via the ecosystem in comparison with Solana. Though exercise on the low prices chain is engaging, Ethereum makes a return as a series for finance.

Lending -Apps Leiden each on Ethereum and Solana

Following the very best stablecoins on Ethereum and Solana, lending apps are at present the flowering crypto -business on each chains.

Aave is the second finest app on Ethereum, which just lately reached a document worth that has been locked at round $ 40 billion. Aave surpassed the efficiency of the earlier bullmarkt and achieved progress with out liquidations available in the market. Every day Aave allowances are additionally on a historic excessive, with the next primary line of greater than $ 3 million a day.

On Solana, Kamino Lend has expanded its worth within the neighborhood of a $ 3B document. Kamino stays smaller, however has grown ruthlessly in 2025. The mortgage protocol produces roughly 10% of Aave’s prices, round $ 300k per day.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024