Bitcoin

Analysts Flag Key Signals Ahead Of Inflation Data

Credit : bitcoinmagazine.com

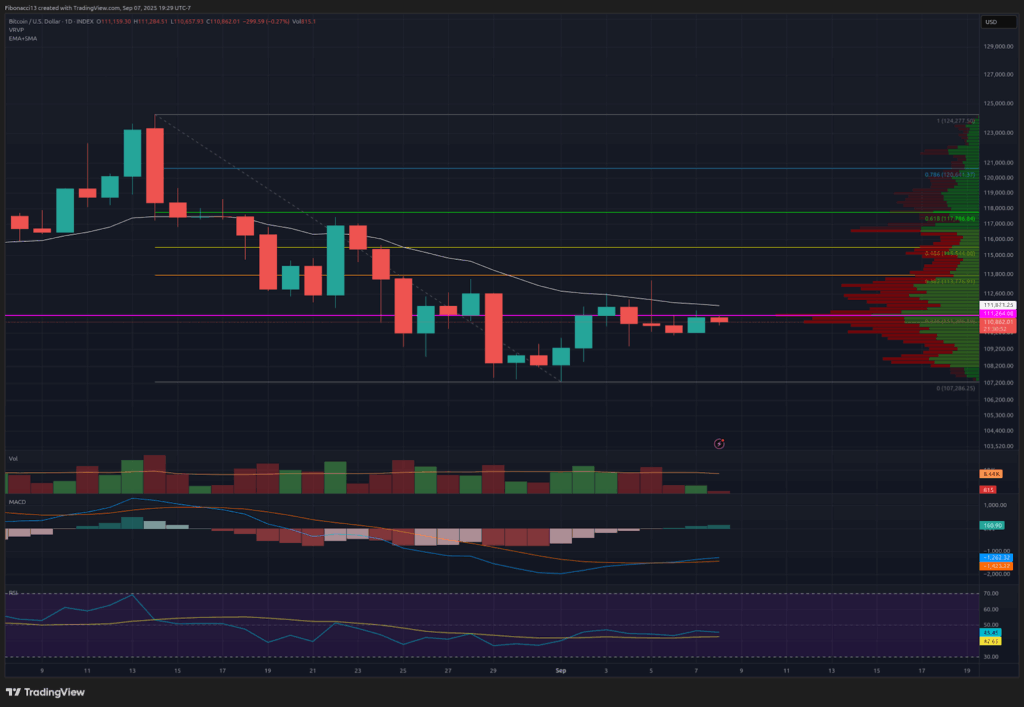

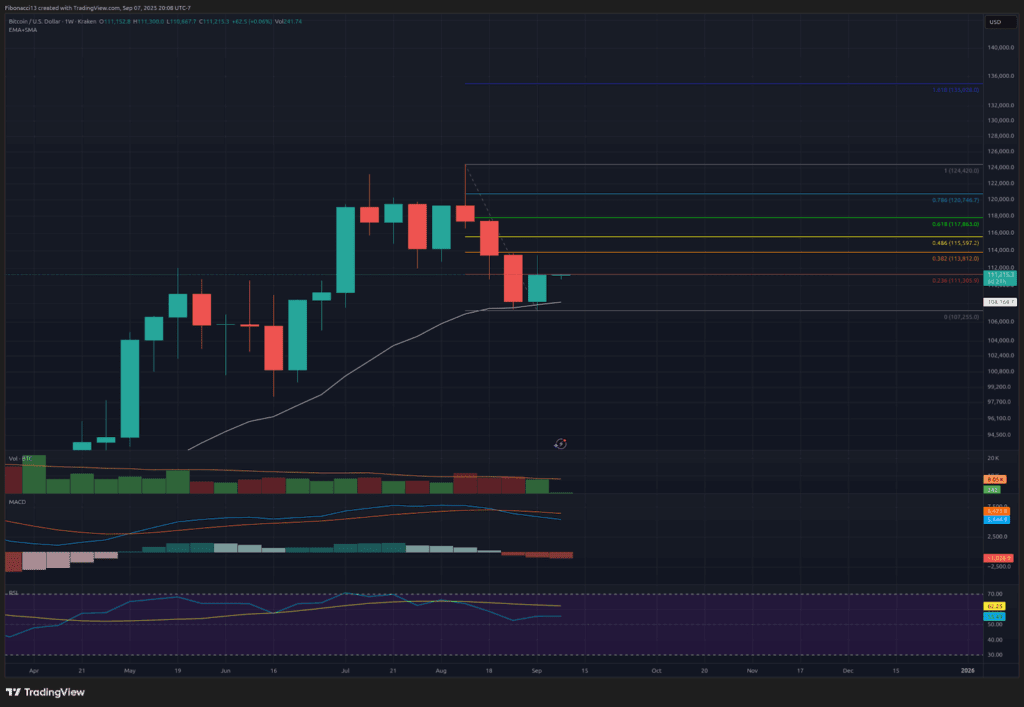

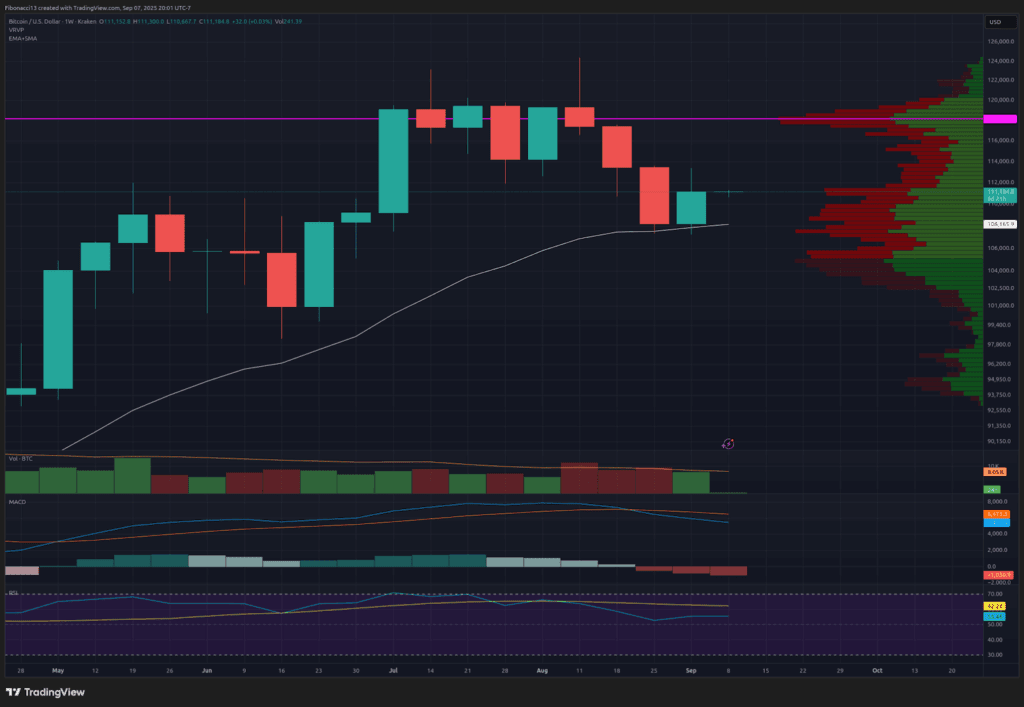

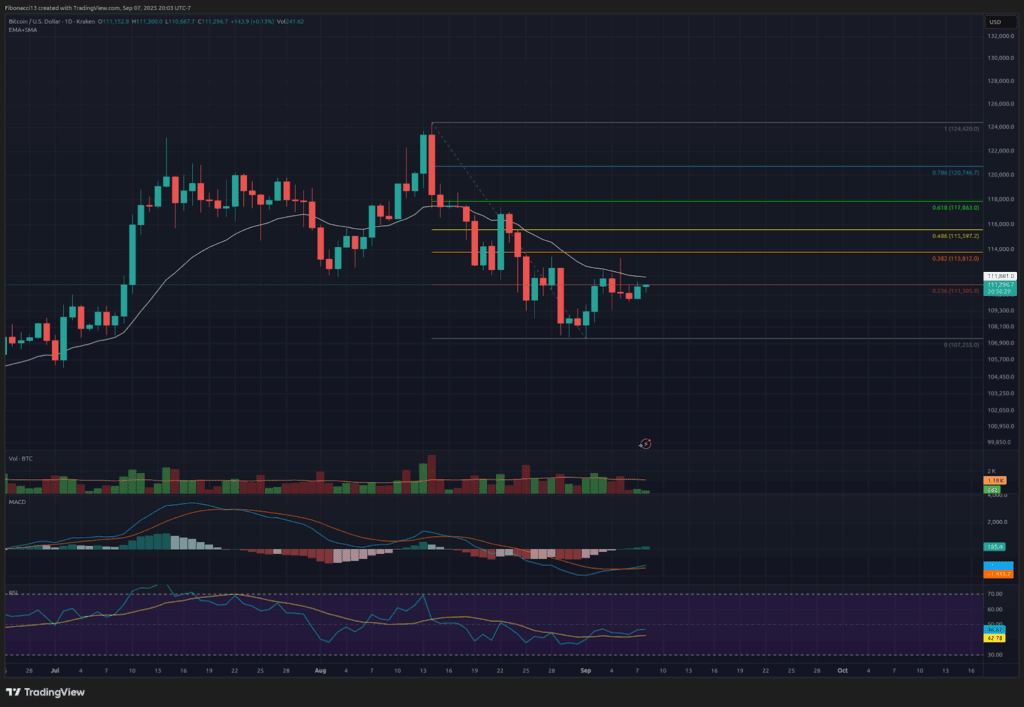

Bitcoin Worth discovered help with the 21-day EMA final week and prevented a deeper slide after closing the lows of the final week. Bulls managed to defend the extent of $ 107,000, however the momentum was slightly below the resistance. From Wednesday to Friday, Bitcoin didn’t succeed above $ 112,500 and the week ended at $ 111,162.

The shortcoming to reclaim $ 112,500 emphasised a break within the latest restoration. However, retaining $ 107,000 has saved the bias considerably on the prime in the interim. Merchants hold a detailed eye on whether or not this consolidation is creating right into a foundation or a continuation of the downward pattern.

Most necessary help and resistance ranges now

Presently, $ 107,000 is an important line of protection for Bitcoin value. A malfunction under would shift the main target to decrease help zones at $ 105,000, $ 102,500 and probably $ 96,000.

On the prime, $ 112,500 is the primary resistance to transform into help. If Bulls achieve closing the every day above that stage, the following objective is $ 115,500. Moreover, there’s $ 118,000 – a formidable barrier that would wish a weekly shut by to substantiate a renewed upward pattern.

Outlook for this week

The approaching week can carry extra volatility. On Thursday, September 11, the American inflation information will likely be Japanese at 8.30 am. A heter-Dan anticipated print may cause risk-off sentiment and drag Bitcoin decrease, whereas a softer quantity can dissolve.

If Bitcoin value can reclaim $ 112,500 early within the week, a push to $ 115,500 is probably going. If you don’t do that, the market turns into susceptible for one more take a look at of the bottom take a look at of $ 107,000.

Market temper: Impartial, leaning bullish help is holding, however resistance stays sturdy.

Within the coming weeks

Bitcoin appears to be like additional out and ultimately has to erase $ 118,000 with conviction to revive the upward pattern and push back bears. A decisive weekly near this stage would in all probability appeal to a momentum consumers and enhance sentiment in October.

If $ 107,000 breaks as an alternative, the trail opens to $ 105,000 and $ 102,500, with the potential of a sweep as little as $ 96,000 earlier than a sustainable soil is discovered. Given the sample of latest closures, some analysts warn that one other dip can’t be excluded.

Terminology Information:

Bulls/Bullish: Patrons or traders count on the value to be larger.

Bears/Bearish: Sellers or traders who count on the value will likely be decrease.

Help or help stage: A stage at which the value should apply to lively, at the least within the first occasion. The extra touches of help, the weaker it turns into and the larger the possibility that it’ll not maintain the prize.

Resistance or resistance stage: Reverse help. The extent that can in all probability reject the value, at the least within the first occasion. The extra touches in resistance, the weaker it turns into and the larger the possibility that it’s not to cease the value.

EMA: Exponentially advancing common. A progressive common that extra weight applies to latest costs than earlier costs, which reduces the delay within the progressive common.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024