Bitcoin

Is Paper Bitcoin Behind The Stagnant Bitcoin Price?

Credit : bitcoinmagazine.com

The Bitcoin value has stunned many traders in current weeks. Regardless of appreciable accumulation by establishments and treasury corporations, the Bitcoin value is caught within the motion on sideways. Is that this the results of “Paper Bitcoin”, or are we simply witnessing the push and pull of provide and demand?

In my newest video -analysis, Paper Bitcoin ruined the Bitcoin Bull marketI dig in chain information, Treasury Holdings and derivatives exercise to separate info from conspiracy and clarify what the Bitcoin prize actually stimulates.

Institutional accumulation versus Bitcoin -price stagnation

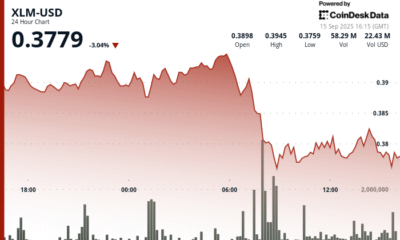

In current months, ETFs And Treasury have an estimated 200,000 BTC. For perspective, the entire treasury corporations are actually simply shy of 1 million bitcoin. Regardless of these flows, nonetheless, the Bitcoin value was flattened after he had briefly touched new highlights above $ 120,000 earlier than he withdrew to $ 108,000.

Why is that this institutional query not mirrored within the Bitcoin value? The reply lies in taking revenue by holders in the long run. Since July, greater than 450,000 BTC have moved from lengthy -term portfolios within the palms of newer, quick -term market contributors. This distribution has successfully neutralized the bullish influence of institutional influx on the Bitcoin value.

Lengthy -term holders take a revenue

Knowledge on the chain exhibits a transparent sale of cohorts that maintain Bitcoin for 4 to 10 years. These traders gathered at a lot decrease costs and now understand the win because the Bitcoin value pushes to a file space.

This sample is nothing new. Traditionally, long-term holders scale back publicity as a result of retail and establishments provide the Bitcoin value increased, solely to beat once more as soon as the market has cooled. Present HODL -GOLD DATA signifies that gross sales stress is of this group speed upAdd weight to the lateral heel we have now seen within the Bitcoin value.

The derivatives issue

One other Drag on Bitcoin value promotion is the rise in futures and choices exercise. Since July, the open curiosity in derivatives has risen roughly 50,000 BTC About gala’s. Though this isn’t direct proof of ‘paper bitcoin’, which means capital flows into livered betting as an alternative of accumulation of spot, which limits the upward stress on the Bitcoin value.

CME Futures and Choices Markets have additionally been significantly expanded, thereby strengthening the affect of derivatives on Bitcoin value actions within the quick time period. The web impact: extra liquidity tied in contracts, much less direct buying stress on BTC itself.

Provide and demand in movement

So, is the Bitcoin value manipulated by paper claims? The proof doesn’t strongly help that conclusion. What we see is Actual-time provide and request economic system At work:

- ~ 200,000 BTC collected by establishments.

- ~ 450,000 BTC distributed by holders in the long run.

- 50,000+ BTC tied up In derivatives markets.

Add it and explains why the Bitcoin value acquired caught regardless of the institutional query from Headline-Grans.

What’s the subsequent step for Bitcoin value?

Though the present circumstances point out extra turbulent consolidation within the quick time period, this doesn’t appear to be a market high. If the financing percentages can do a brief squeeze, a brief squeeze can have a unique leg increased within the Bitcoin -price. For now, nonetheless, the imbalance between accumulation and distribution can recommend that aspect motion can proceed.

Bitcoin’s Bullmarkt stays intact. Bitcoin stays intact. Buyers who’re fearful about “Paper Bitcoin” ought to bear in mind: the buildup of the place takes place, and with out this the Bitcoin value would in all probability act a lot decrease than now.

Go to deeper information, graphs {and professional} insights in Bitcoin -Perrends Bitcoinmagazinepro.com.

Subscribe to Bitcoin Magazine Pro on YouTube For extra knowledgeable market insights and evaluation!

Disclaimer: This text is just for informative functions and shouldn’t be thought of as monetary recommendation. At all times do your personal analysis earlier than you make funding selections.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024