Analysis

What It Means for ETH and SOL Prices in 2025

Credit : coinpedia.org

Stablecoin streams reform the crypto panorama, with Ethereum and Solana absorbing many of the contemporary supply in 2025. Since these digital {dollars} stimulate liquidity in Defi and funds, they’ve a direct affect on fuel use, validator options and in the end the worth strategy of ETH and SOL. Can the stablecoin -Domanes of Ethereum push the ETH worth of ETH above $ 5,000, or will Solana’s explosive progress develop a rally gasoline to $ 300 and past? The solutions lie how the dynamics of the Stablecoin evolve over each chains.

Stablecoins nourish the following section of crypto -readidity

Stablecoins act because the digital spine of liquidity within the cryptomarket. They nourish commerce, loans and methods and in addition ship as gateways for institutional and retailer cash.

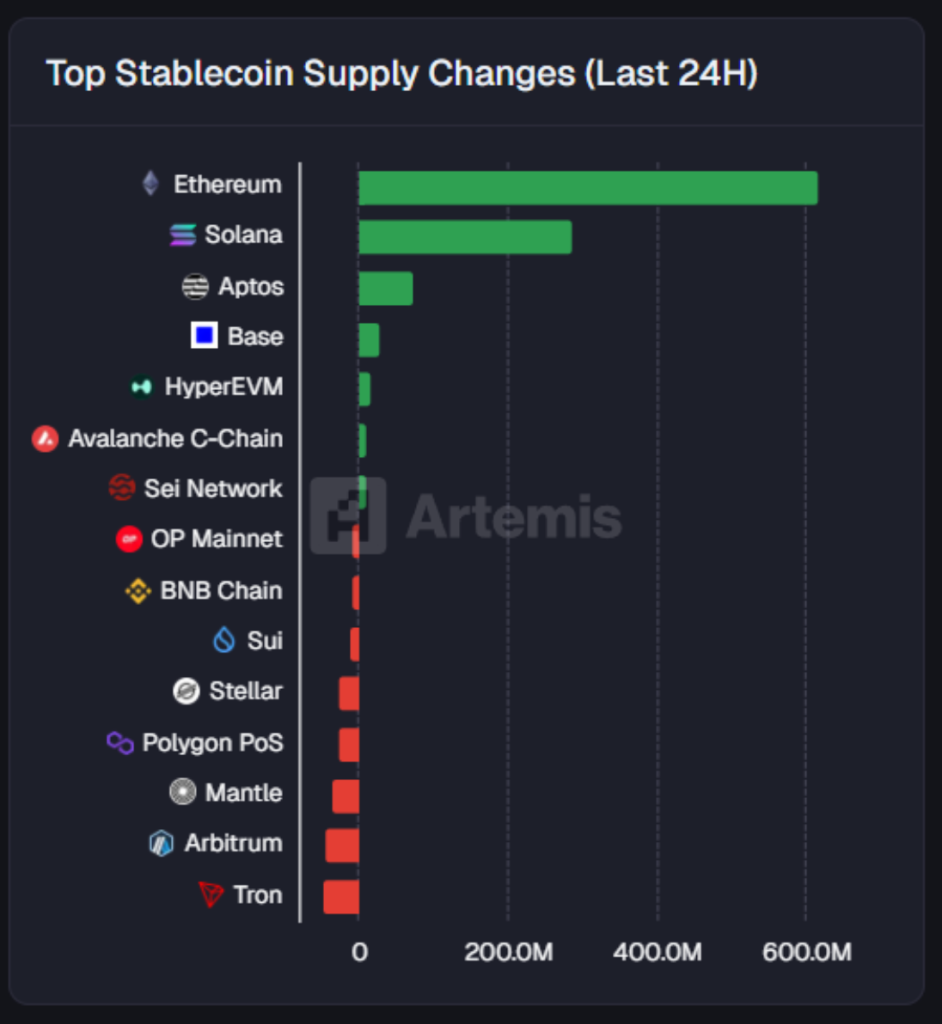

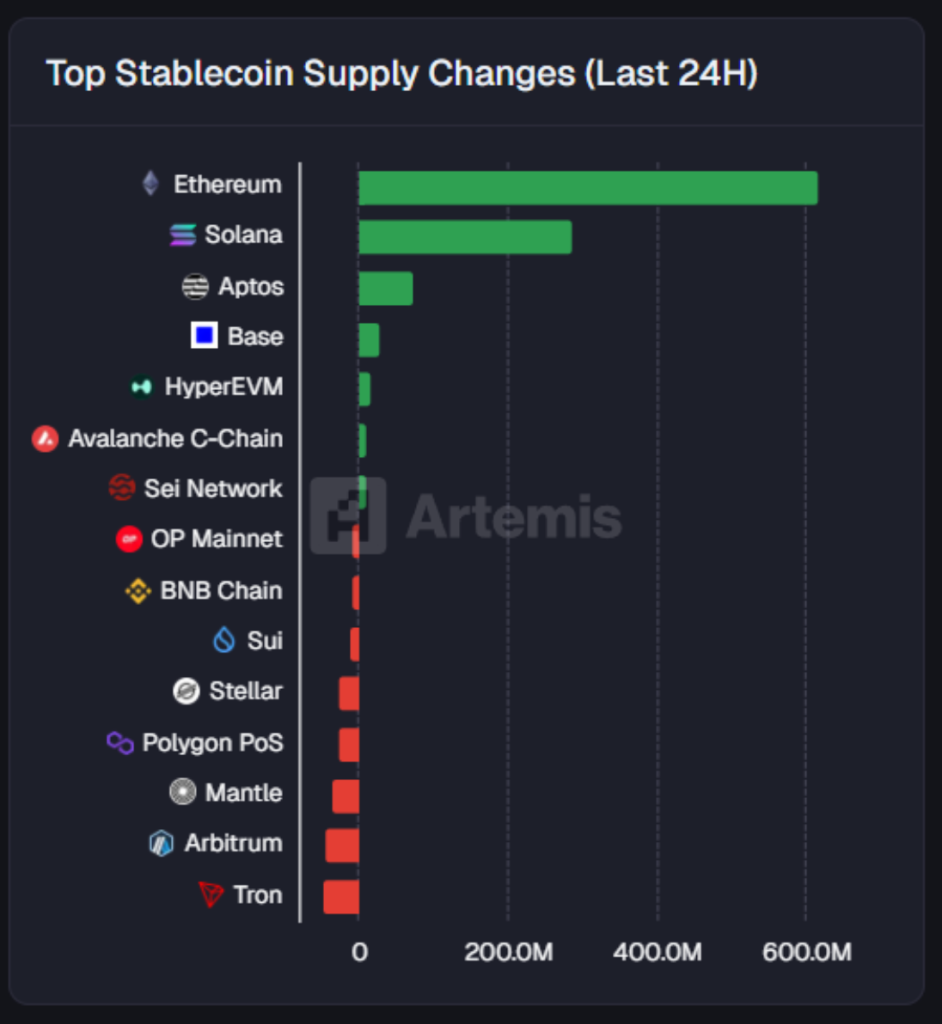

The mixed Stablecoin supply is now exceeding $ 280 billion, and in accordance with ArtemisEthereum and Solana clarify most of this progress:

- Ethereum recommends the lion’s share and strengthens its position because the settlement hub for Defi and Institutional Capital

- This 12 months Solana has let its Stablecoin supply develop greater than 2 × this 12 months, which signifies the acceptance of the acceptance of funds and retail commerce.

Stablecoins as a progress catalyst: why it is necessary for Eth & Sol costs

Each stablecoin switch on Ethereum makes use of ETH for fuel and a part of these reimbursements is burned below EIP-1559. Because the stablecoin flows rise, the provision dynamics of ETH are cited, including a deflatoire push. Stablecoin exercise stimulates ETH -Liquidity financial savings, helps Defi and improves institutional belief. Analysts count on that ETH will once more take a look at $ 3,800 – $ 4,200 if the influx stays sturdy, with the potential for contemporary highlights, macro -economic tail winds should match one another.

Within the meantime, Solana’s low prices and excessive transit make it an excellent alternative for retail funds, transfers and high-frequency defi-transactions. The rising acceptance of the Stablecoin right here means a better demand for SOL, which promote reimbursements and rewards. The rising adoption strengthens Solana’s credibility of the ecosystem and attracts new liquidity. Persistent influx may push Sol to $ 180 – $ 200, with a breakout situation that factors to $ 250 as the following resistance.

Conclusion

The rise in stablecoins on Ethereum and Solana is greater than a liquidity story – it’s a catalyst that types future worth actions. For Ethereum, the dominance within the STABLECOIN vary strengthens its place because the settlementback bone, to help ETH to the $ 5,000 zone. In the meantime, the quick growth of Solana reinforces upward potential, with $ 280- $ 300 objectives in sight if the adoptive momentum applies. Finally, the StableCoin stream course of can decide which blockchain data the following massive wave of Crypto market progress.

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024