Bitcoin

What It Means for BTC Price Action

Credit : coinpedia.org

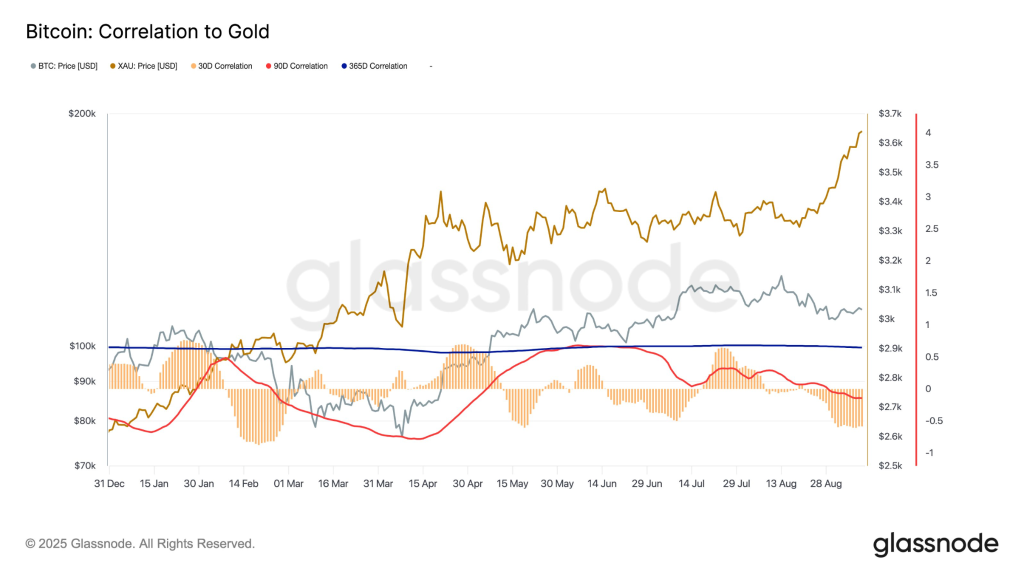

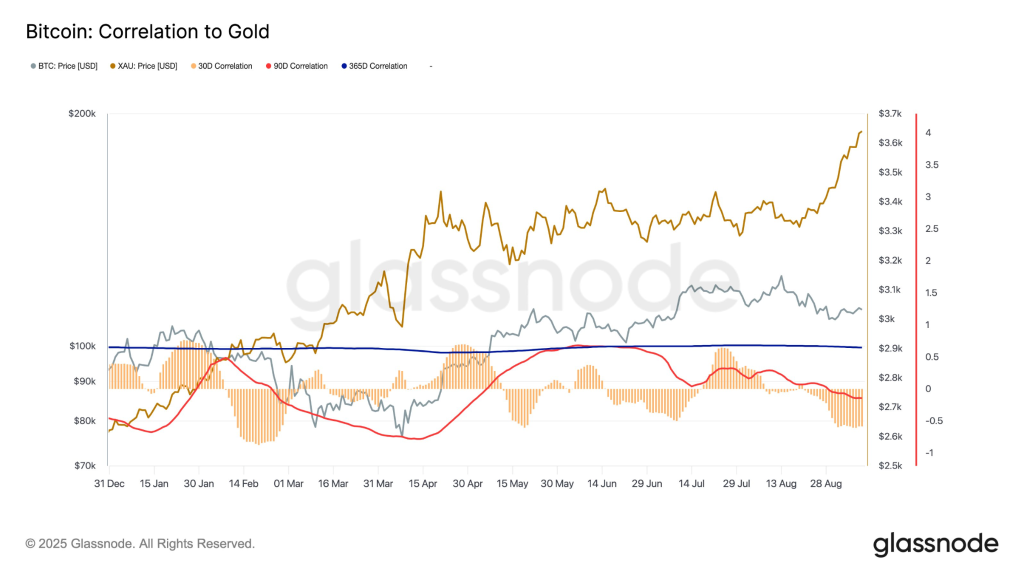

Bitcoin’s 30 -day correlation with gold has fallen to -0.53 in response to Glassnode. This marks a substantial shift in market conduct, whereby BTC worth extra typically strikes in the wrong way of gold. The information emphasizes how buyers are presently positioning Bitcoin as a risk-to-active, in order that the disconnection of the normal Secure-Haven story. This divergence has essential implications for worth motion, danger administration and commerce methods because the macro volatility warms up.

Bitcoin’s Correlation Shift defined

Earlier than the invention of Bitcoin, the one protected haven for investments was. Because the Bull Run in 2021, a big a part of the buyers has shifted their focus to Bitcoin. Since worldwide tensions have been a very powerful focus, buyers have returned to gold, which helps the worth to mark new highlights. This may be the rationale why the BTC worth consolidates inside a slim vary, as a result of the Star Crypto has been correlated with gold.

Correlation measures how two property defend themselves in relation to one another, the place +1 reveals an ideal constructive correlation and -1 that reveals an ideal reverse correlation. Based on the Glass node Knowledge, the present lecture is -0.53. This implies that when Gold Rallies, Bitcoin tends to withdraw – and vice versa. This means that merchants rotate between the 2 property, relying on the danger sentiment. When the uncertainty rises, gold attracts protected port flows, whereas Bitcoin sees the gross sales strain.

Bitcoin (BTC) Value evaluation: That is what you possibly can anticipate this month

Bitcoin presently consolidates between $ 57,200 – $ 64,000, with a robust demand seen close to $ 58k. A breakout above $ 64k might ship BTC to $ 68k – $ 70k, whereas a breakdown below $ 57k dangers a motion to $ 54k – $ 55k. Merchants should examine macro occasions corresponding to CPI knowledge and Fed Charge pointers, as a result of they will act as catalysts for volatility and probably reinvent the correlation of Bitcoin with gold.

Bitcoin presently consolidates above $ 115,500 and reveals power regardless of the file highs of Gold close to $ 3,645/oz. The subsequent key resistance is $ 120k – $ 122k and an outbreak above this zone can open the trail to $ 128k – $ 130k. Then again, there may be robust help within the neighborhood of $ 110k $ 105k, the place patrons are anticipated to construct aggressively in steps as a risk-off-pressure.

Commerce methods to think about

- Bullish Setup: Purchase Dips close to $ 110,000 with a stop-loss below $ 105,000, aimed toward $ 120,000 after which $ 130,000.

- Bearish hedge: Quick as BTC falls beneath $ 105k with Momentum, aimed toward $ 98k – $ 100k.

- View correlation: If gold continues to collect, BTC can expertise extra withdrawal within the brief time period earlier than resuming his upward pattern.

The unfavorable correlation of Bitcoin with gold emphasizes the rising position as a danger -sensitive energetic as a substitute of a protected haven. This creates alternatives for merchants to benefit from market sentiment fluctuations. If macro circumstances run risk-on, the Bitcoin worth can lead the load to greater ranges, however persistent risk-off phases can preserve it below strain.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now