NFT

96% of NFT collections considered ‘dead’

Credit : crypto.news

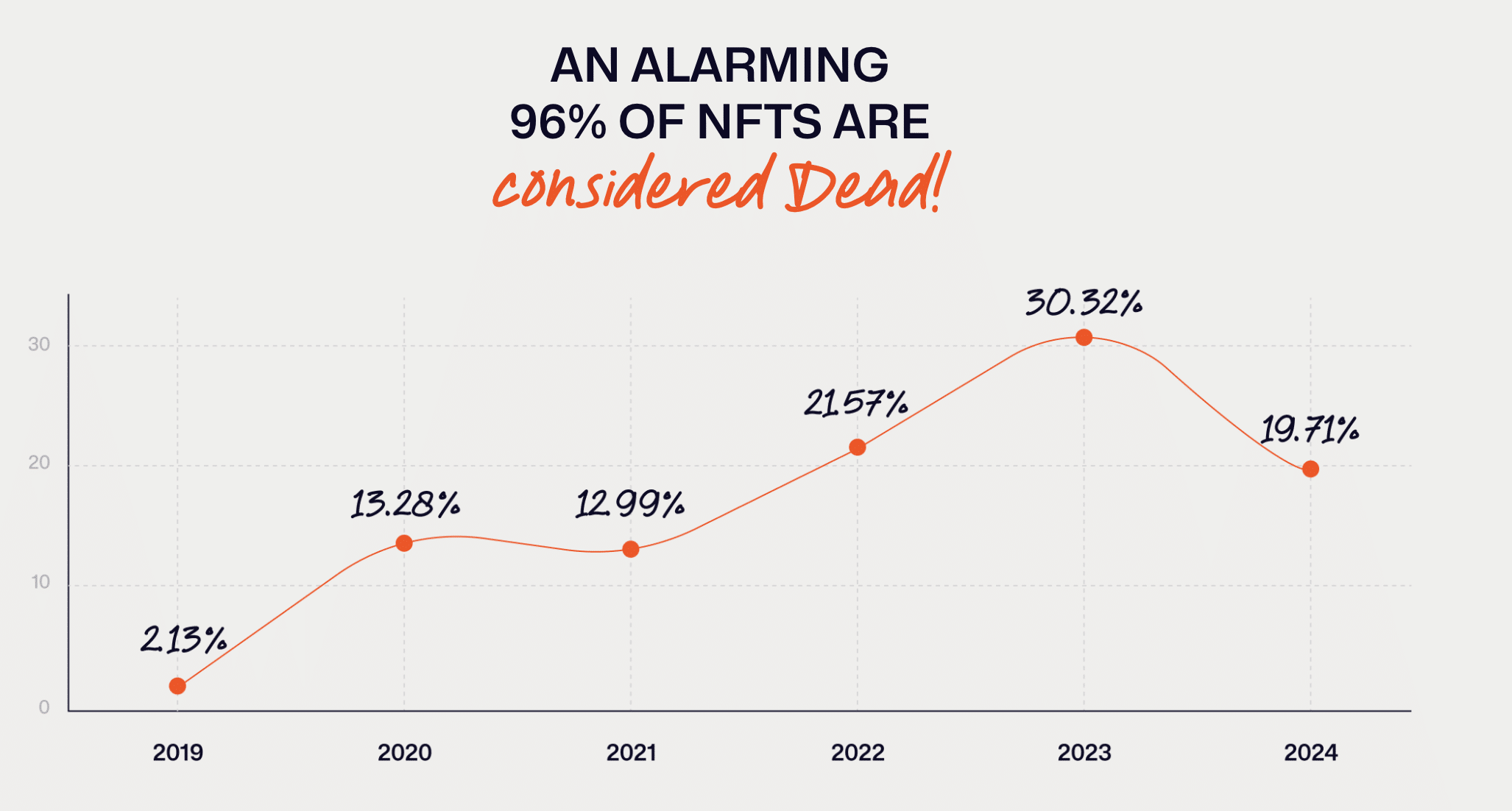

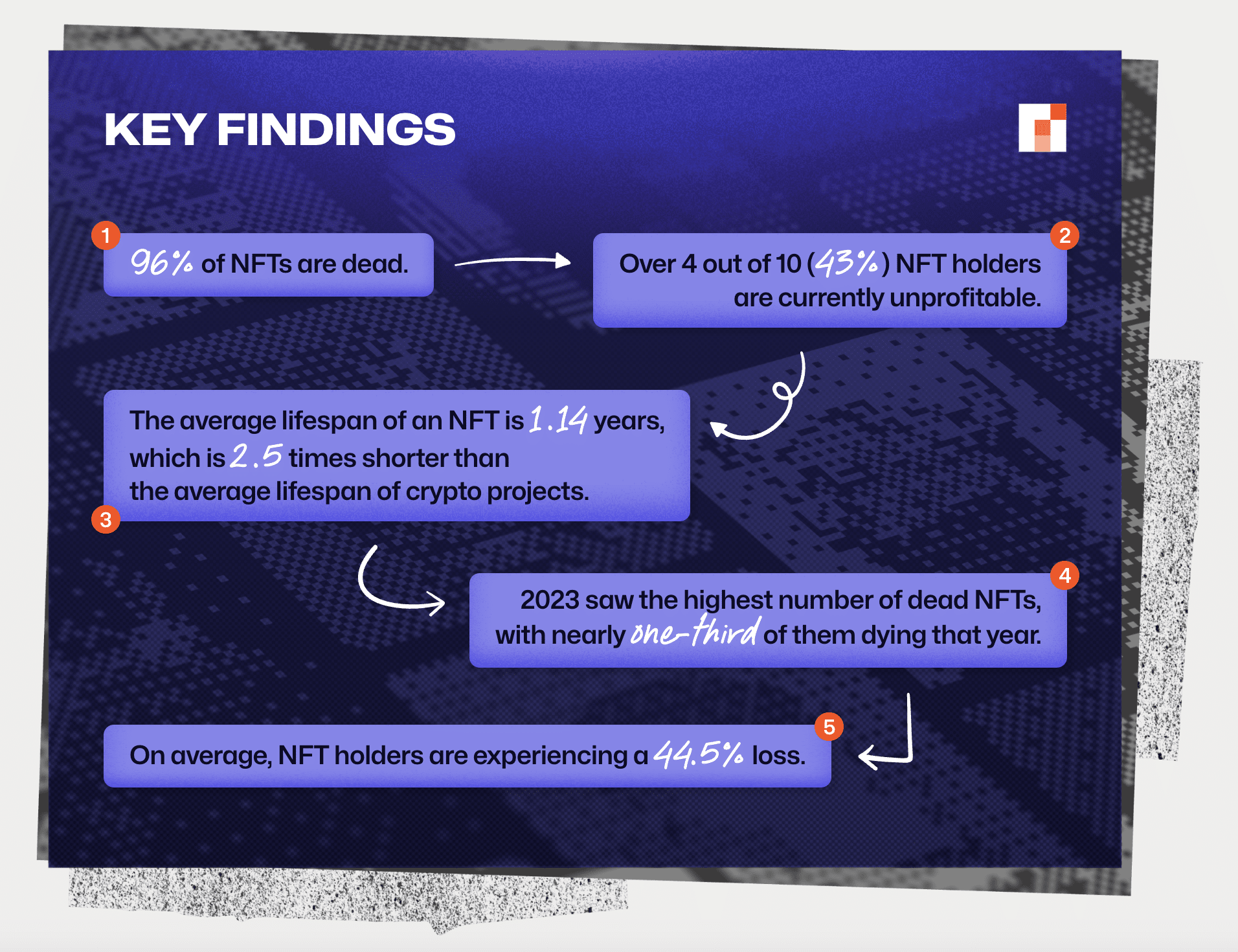

NFT Night analysts say 96% of the 5,000 NFT collections shall be lifeless by 2024.

The report reveals the state of the non-fungible token market and its issues in 2024. In response to consultants, 96% of the greater than 5,000 present NFT collections are ‘lifeless’. This implies they haven’t any buying and selling quantity, no gross sales for greater than seven days, and no exercise on social community X.

Analysts be aware that 4 out of 10 NFT homeowners at present have to make a revenue from their tokens. On the identical time, the common lifespan of collections is 1.14 years. That is 2.5 instances lower than the identical indicator for traditional crypto initiatives.

Moreover, 2023 was a file yr for NFT collapses. Throughout this era, nearly 30% of initiatives from this section fell into the ‘lifeless’ class. In response to consultants, 44.5% of NFT homeowners are dealing with losses.

The NFT Night Staff additionally recognized essentially the most worthwhile assortment up to now. It turned out to be the Azuki mission, which elevated the investments of token homeowners by a mean of two.3 instances.

“This success will be attributed to the gathering’s robust group involvement, distinctive creative attraction and efficient advertising and marketing methods.”

The consultants additionally named essentially the most unprofitable NFT assortment: Pudgy Penguins. It skilled a 97% decline in worth, making it the present file holder for a decline in proprietor revenue.

Specialists emphasised that the non-fungible token market has declined and traders on this section ought to act cautiously. Moreover, consultants consider that NFT creators ought to rethink their strategy to mission implementation.

Finish of an period

NFTs from widespread collections purchased on the wave of pleasure in 2022 are promoting at enormous losses.

For instance, Arkham Intelligence has calculated that NFTs that pop star Justin Bieber purchased price about $2 million in 2022 are actually price simply over $100,000. Losses reached 94.7%.

The singer’s pockets initially acquired $2.34 million price of Ethereum (ETH). Nearly all of the quantity, $1.86 million, went to the acquisition of two Bored Ape Yacht Membership (BAYC) and a pair of Mutant Ape Yacht Membership (MAYC). The pockets additionally included tokens from the World of Girls, Doodles, Otherdeed and Metacard collections. Since then, property have misplaced between 89.7% and 97.4% in worth.

Furthermore, Deepak Thapliyal, the proprietor of the most costly CryptoPunk #5822, who purchased the token in 2022 for 8,000 ETH ($23.7 million on the time of the transaction), bought the asset in August with out disclosing the sale worth . Amid the trade pleasure, the deal grew to become the fourth most costly of all NFTs in 2022.

The group suspected that the token was bought at a loss. The client was reportedly person X, who goes by the nickname VOMBATUS. The token was reportedly bought for 1,500 ETH (~$3.9 million), 80% cheaper than its earlier worth.

The rise and fall of OpenSea

In January 2022, the entire quantity of non-fungible tokens peaked at over $6 billion. As of July 2024, it had fallen beneath $430 million. NFTs are nonetheless alive, however they’re in unhealthy form.

OpenSea, as soon as the most important NFT market, is in a good worse state of affairs, The Verge notes that claims from the Securities and Alternate Fee and the Federal Commerce Fee, U.S. and worldwide tax authorities, elevated competitors, allegations of discrimination and worker layoffs .

Moreover, OpenSea’s valuation fell from $13.3 billion to $1.4 billion after one in all its largest traders, New York enterprise capital agency Coatue Administration, overvalued its stake within the crypto startup by 90%, from $120 million to $13 million.

Nevertheless, The edge notes that the corporate nonetheless has some steam left. An inner doc reveals that OpenSea had $438 million and $45 million in crypto reserves as of November 2023. It expects that with this capital and a brand new enterprise mannequin it is going to be in a position to overcome tough instances.

“In response to an inner doc, the corporate had $438 million in money and $45 million in crypto reserves as of November 2023, and it continues to depend on that capital within the hope {that a} ‘2.0’ pivot will assist it navigate uneven seas. ”

What’s going to occur to the NFT market?

The NFT market has lengthy been restricted to marketplaces like OpenSea or Rarible, the place customers can subject new NFTs or commerce them with others.

There are lending companies or platforms for buying and selling derivatives on NFTs from giant collections, permitting customers to take a position on NFTs with out proudly owning them.

Nevertheless, the bearish dynamics within the non-fungible token market persist, as evidenced by the fast decline within the costs of NFTs from the blue chip collections.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now