Bitcoin

Bitcoin climbs higher amid Fed’s liquidity drop — Can BTC break above $65K?

Credit : ambcrypto.com

- Bitcoin’s value prospects look good regardless of the liquidity squeeze.

- Bitcoin’s key liquidity degree is at $65,000.

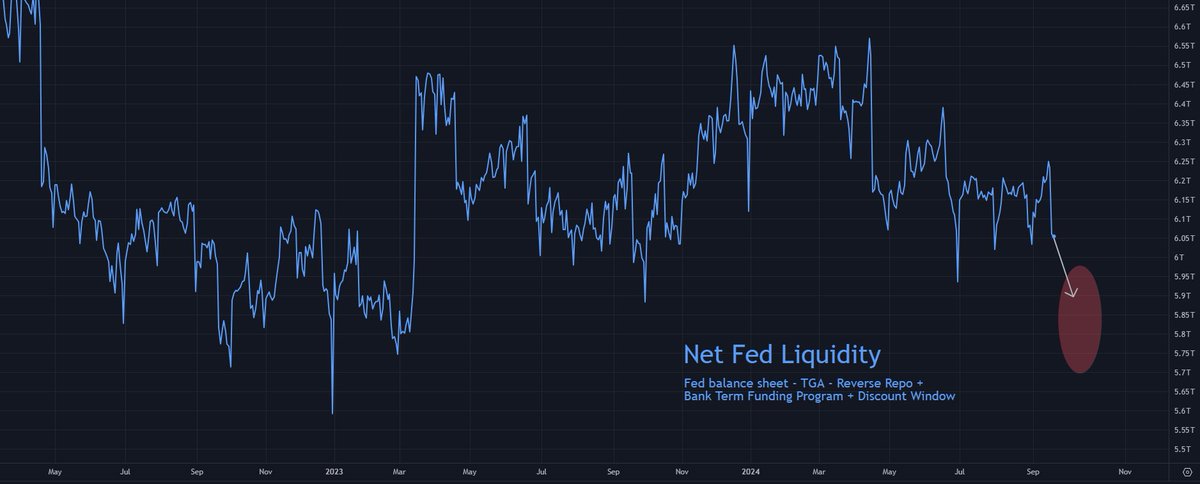

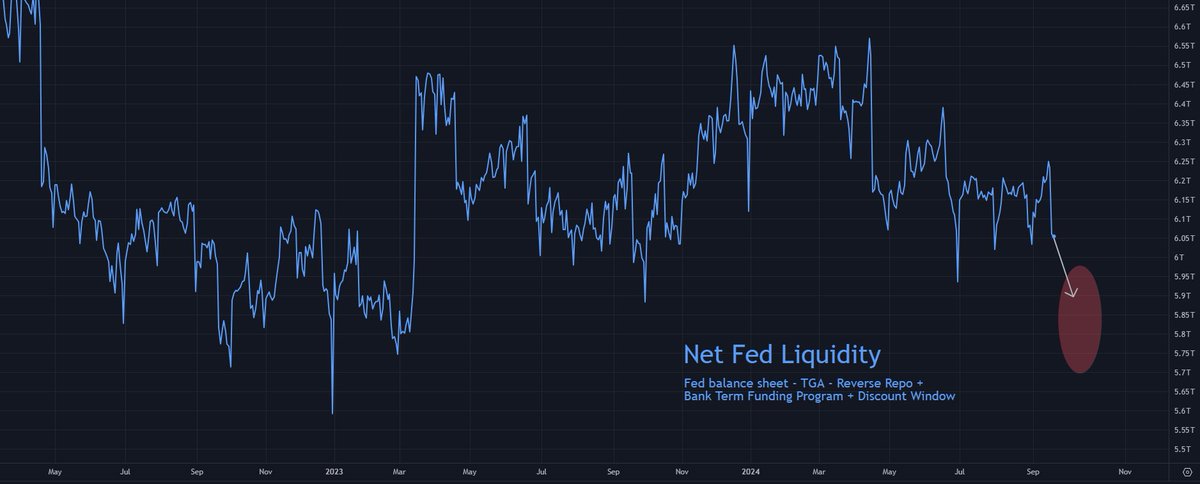

The liquidity disaster on the Federal Reserve is in full swing, with web liquidity falling by about $200 billion since Monday.

This decline is because of company tax funds rising the Treasury’s Normal Account, adopted by a possible improve in the usage of Reverse Repos in direction of the top of the month.

The market is now about midway via this liquidity disaster, which is anticipated to final one other seven buying and selling days.

One other $100 billion to $300 billion in liquidity could possibly be siphoned off earlier than October 1. Nevertheless, regardless of this tightening, main threat belongings similar to US inventory indices, gold and Bitcoin stay [BTC] have risen sharply, boosted by the Fed’s latest 50 foundation level charge minimize.

Supply: Tomas/X

Bitcoin markets have largely emerged from the short-term liquidity disaster, however warning continues to be warranted till this liquidity storm passes.

Can Bitcoin Proceed Its Rally Regardless of the Fed’s Liquidity Drop?

Over $2 billion in Bitcoin futures contracts opened

Regardless of the drop in liquidity, a number of indicators recommend that Bitcoin may proceed its upward trajectory. One such signal is the rise in open curiosity in futures contracts.

In simply 48 hours, greater than $2 billion price of Bitcoin futures contracts have been opened. Whereas this sharp improve may result in a possible lengthy squeeze, it additionally reveals that merchants are optimistic about Bitcoin’s future value.

The Federal Reserve’s charge minimize seems to have eased liquidity considerations, encouraging merchants to wager on Bitcoin reaching greater ranges.

Supply: Coinalyze/X

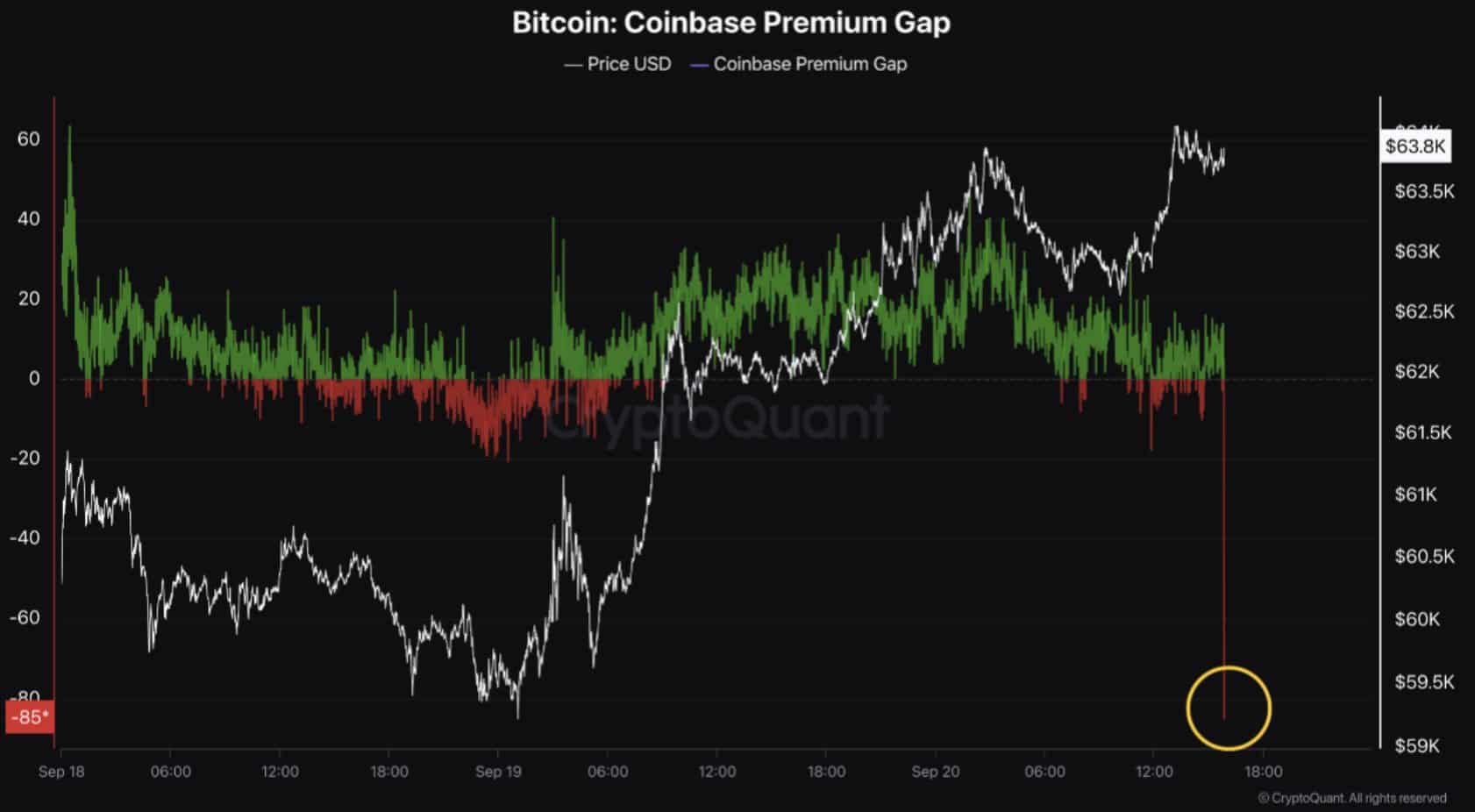

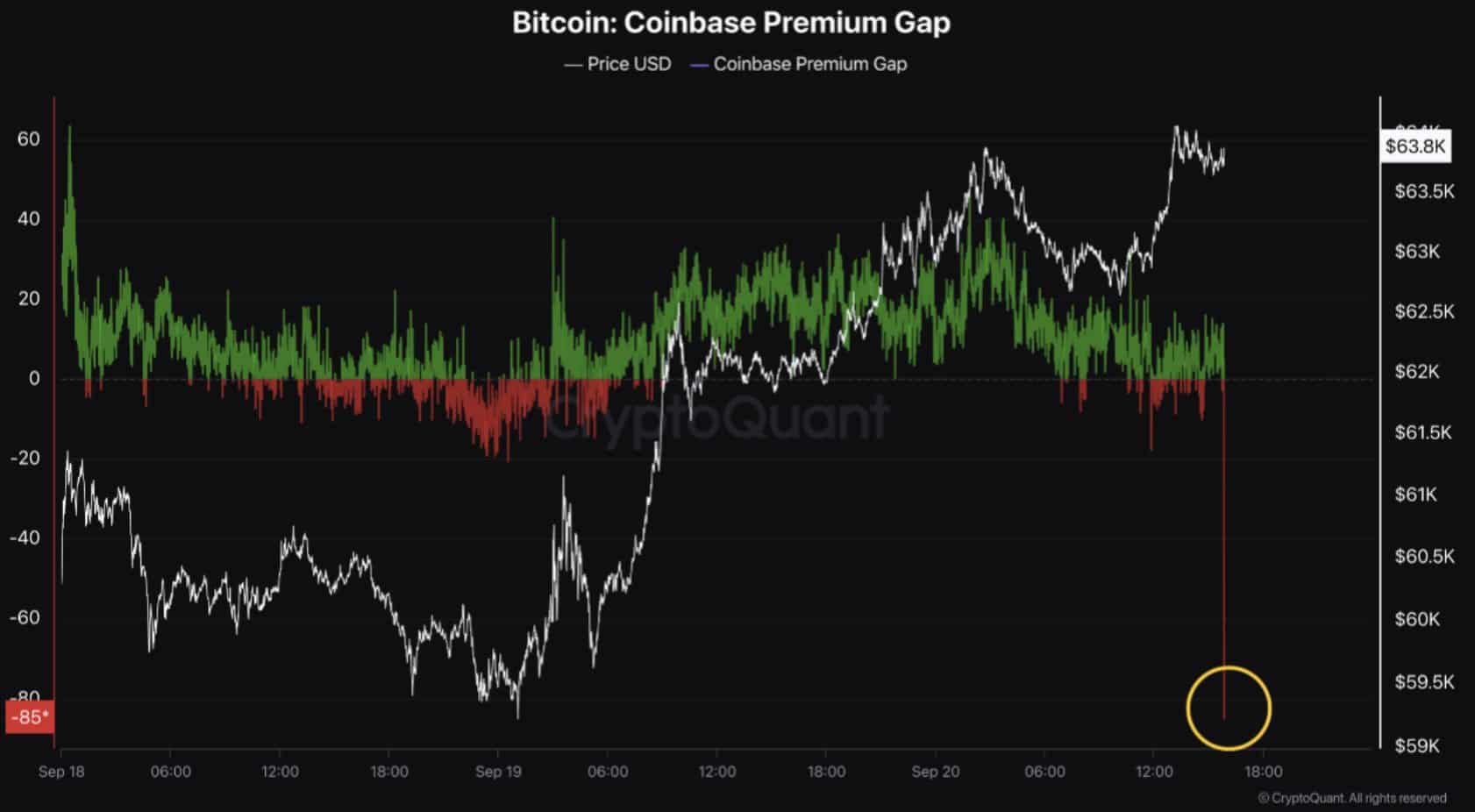

One other optimistic sign comes from the Coinbase Premium index, which measures the worth distinction between Bitcoin on Coinbase and Binance.

At present, Coinbase Premium is unfavorable, that means Bitcoin is cheaper on Coinbase than on Binance. This sample, often called divergence, usually signifies sturdy shopping for stress, particularly on Binance.

When two associated metrics transfer in reverse instructions, it usually alerts a reversal, indicating that Bitcoin’s latest downtrend might have bottomed out.

Supply: CryptoQuant

Though the worth of Bitcoin has not fallen, this shopping for stress signifies that Bitcoin may expertise a value improve.

Vital ranges and liquidation zones for the following transfer

Liquidation ranges are important for merchants as they assist establish zones the place the worth can transfer to extend liquidity. At present, Bitcoin’s key liquidity degree is at $65,000.

If Bitcoin breaks above this degree, it’ll probably attain $75K, the place vital liquidity awaits.

A break above $65,000 wouldn’t solely carry Bitcoin nearer to this subsequent goal but in addition affirm a bullish market construction. It will mark the next excessive, following the latest greater low following Bitcoin’s value drop in August.

Supply: Coinglass

Regardless of the Fed’s ongoing liquidity crunch, Bitcoin has proven resilience, with a number of indicators pointing to a continued rally.

Learn Bitcoin’s [BTC] Value forecast 2024–2025

The rise in open curiosity, sturdy shopping for stress on Binance, and key liquidity ranges all point out that Bitcoin’s value may transfer greater within the coming weeks.

Merchants ought to search for a break above the USD 65,000 degree, which may imply a major upside transfer in direction of USD 75,000. Nevertheless, warning stays crucial till the liquidity storm is totally over.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024