Ethereum

Will Ethereum’s momentum shift above $2,496 or continue to struggle?

Credit : ambcrypto.com

- Ethereum’s weekly shut above $2,496 can be an encouraging sight.

- The long-term downward pattern delayed a value restoration as holders tried to exit the market at break-even ranges.

Ethereum [ETH] costs rose above $2,500, however the downward pattern of the previous two months was nonetheless in place. The long term views confirmed that $1,949 and $2,496 have been the important thing ranges to look at.

Supply: Burak Kesmeci on X

CryptoQuant Analyst Burak Kesmeci identified in a publish on X {that a} weekly shut above $2,496 can be constructive for ETH bulls. The degrees within the chart above are plotted primarily based on Ethereum’s downtrend from $4,807 to $1,067, which began in November 2021.

The TD Sequential additionally introduced a purchase sign for ETH, AMBCrypto checked out different metrics for Ethereum, and never all of them have been encouraging.

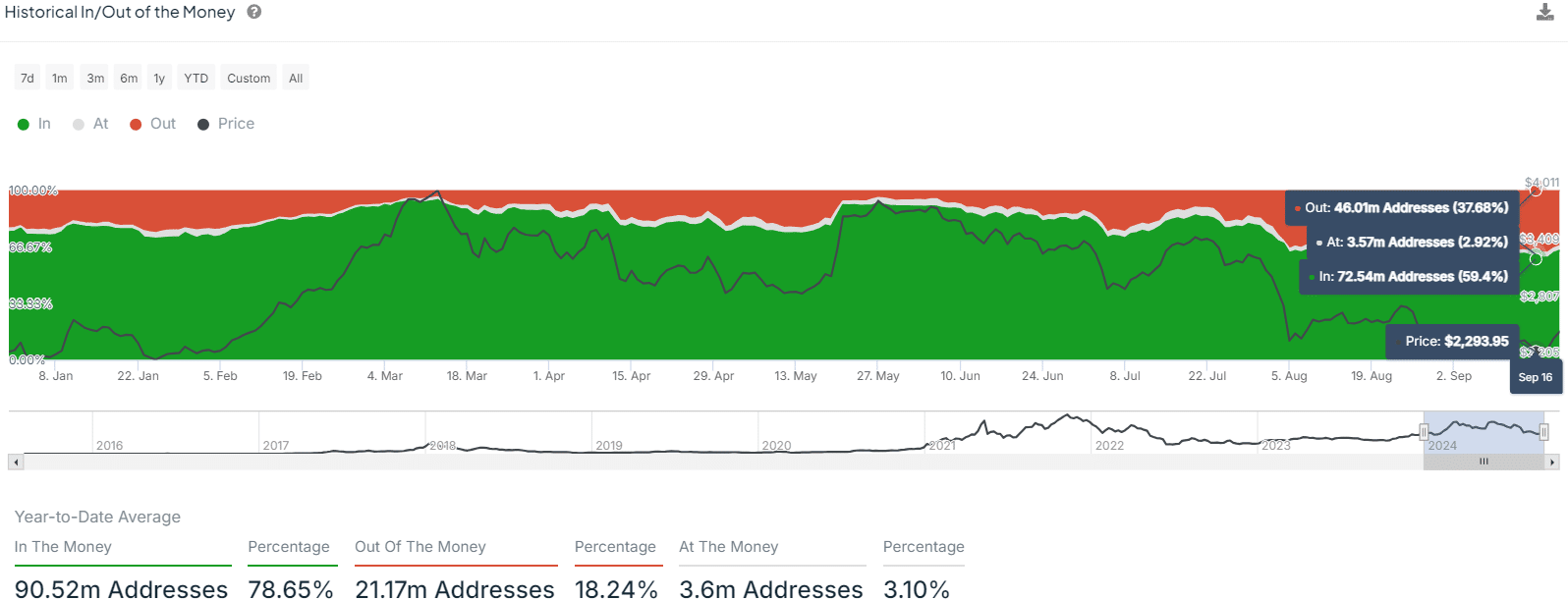

Historic in/out of cash lowest in 2024

The in/out cash information for the yr 2024 reached its lowest level on September 16. Solely 59.4% of all wallets have been within the cash on the time, though this determine rose to 64.4% on September 20.

This was the bottom share of addresses within the cash within the yr 2024. Lower than two weeks in the past, ETH was buying and selling at $2.3k.

At the start of the yr, ETH costs have been at $2,250, which means progress this yr has been very small, particularly in comparison with Bitcoin [BTC].

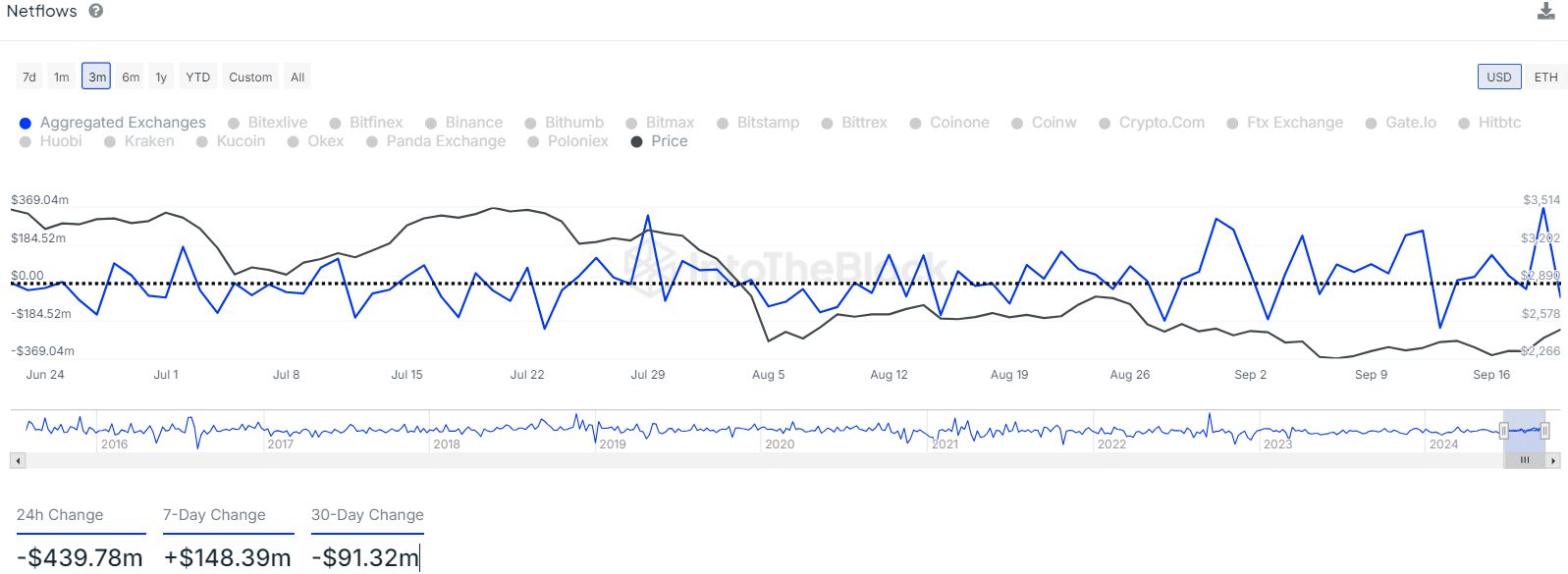

The netflow metric confirmed that $439 million price of Ethereum flowed out of exchanges prior to now 24 hours. The seven- and thirty-day adjustments have been much less excessive and revealed the oscillatory nature of the online flows.

Total, there may be accumulation, however it’s gradual. Traders hope that demand will improve quickly within the fourth quarter of 2024.

Measuring the momentum and sentiment of ETH holders

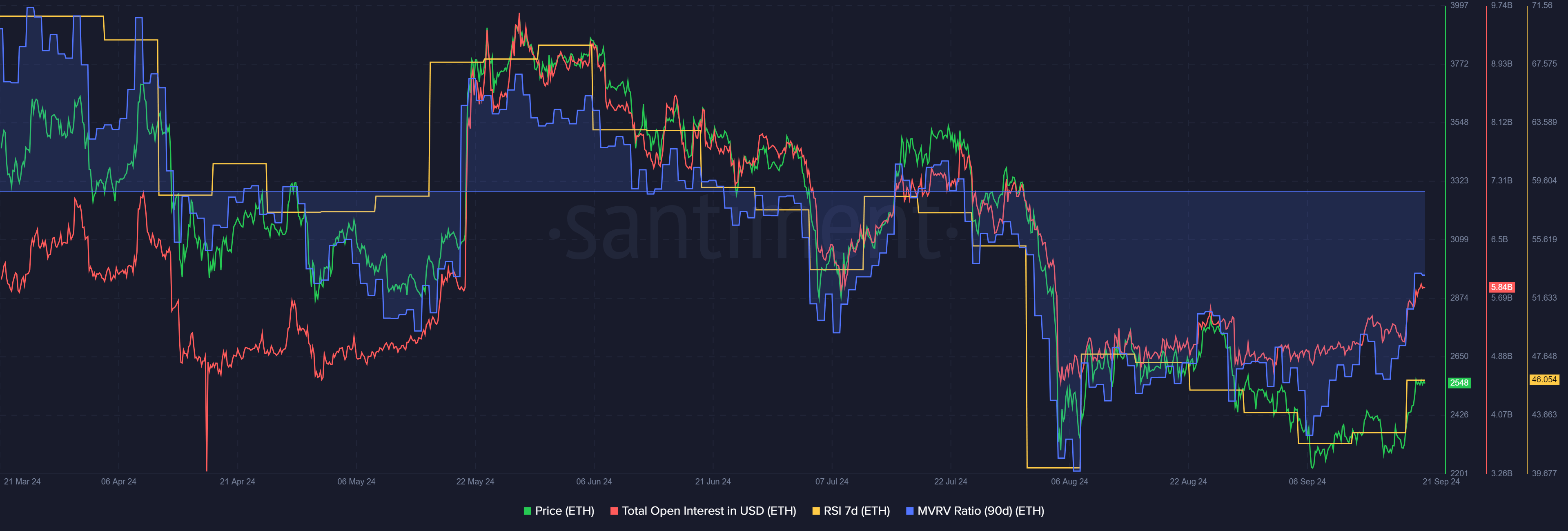

The 90-day MVRV was -8.45% on September 21, which was fairly a excessive loss for three-month holders. The sharp downtrend in June left many buyers sidelined, with the benchmark reaching -27.98% on August 7.

Learn Ethereum’s [ETH] Value forecast 2024-25

This was one other indication that fast value positive aspects can be troublesome for Ethereum as holders who may promote the asset throughout a rally seemed to interrupt even.

The Open Curiosity recorded a gentle improve over the previous month, indicating extra speculative exercise. The 7-day RSI was at 46, indicating that the weekly momentum was bearish however about to shift bullish.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024