Ethereum

Why ETH Is Going Down? How Low Can Ethereum Price Drop?

Credit : coinpedia.org

Ethereum ($ ETH) has just lately fallen underneath crucial help stage of $ 4,000, which expresses concern amongst traders about how low the Ethereum value might go within the brief time period. Numerous elements, together with macro -economic uncertainty, slowing down ETF consumption and low trade lives, contribute to the current lower.

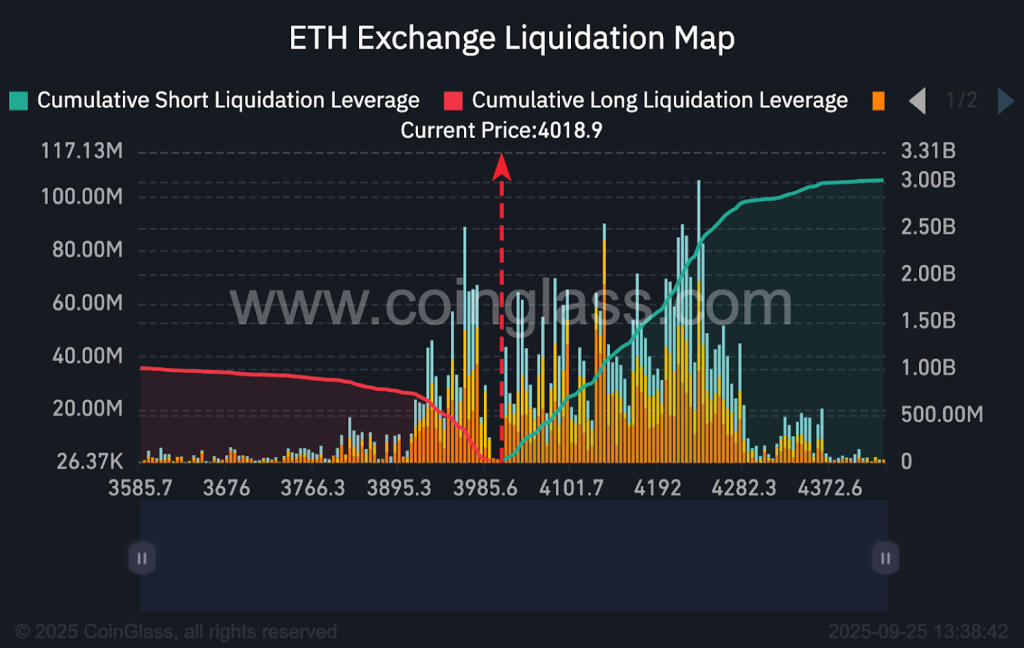

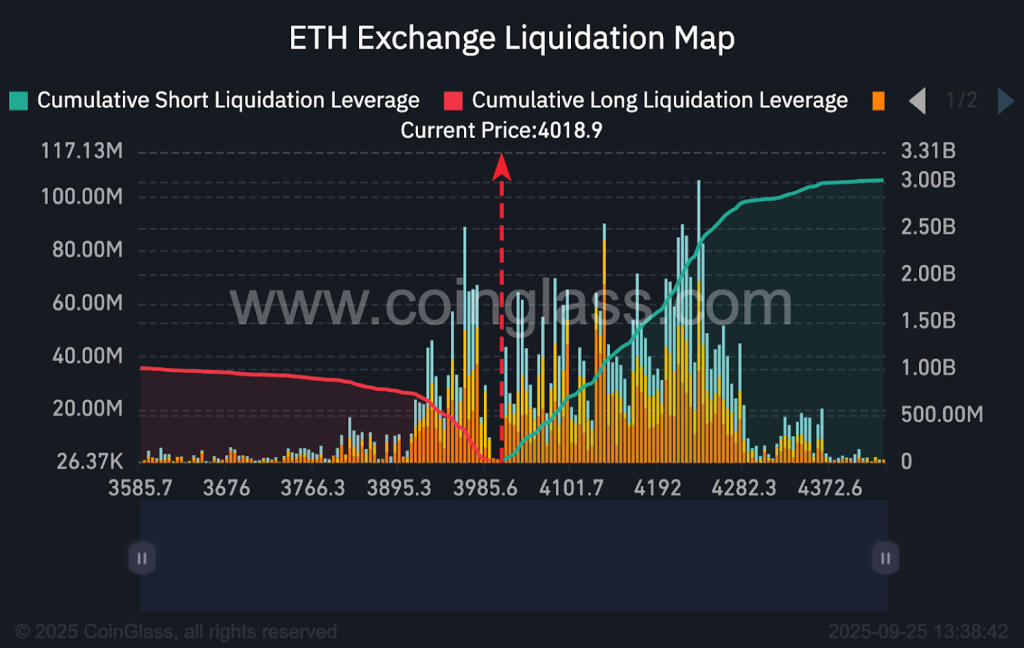

Ethereum Liquidation Warmth Map

In line with Coinglass, $ 100 million have been liquidated in Ethereum within the final hour. One whale dealer, 0xa523, misplaced $ 36.4 million at 9,152 $ ETH, with complete losses now greater than $ 45.3 million, and the invoice lags behind lower than $ 500,000.

This exhibits how dangerous leverage might be in risky markets. Excessive leverage is the stimulation of bigger value fluctuations in Ethereum and the affect of different cryptocurrencies comparable to Bitcoin. Day by day ETH lengthy liquidations have just lately lined $ 500 million, including extra stress to the market.

Delaying ETF ETF influx

In current weeks, the momentum of Ethereum has been weakened after preliminary pleasure of institutional purchases and ETF influx. Public corporations comparable to Tomlin’s Bitmine initially drove optimism, however current knowledge exhibits that Ethereum ETF consumption has been significantly delayed.

On 24 September, ETH-related ETFs skilled $ 79.4 million in internet outflows, in comparison with BTC ETFs, who noticed $ 241 million in internet consumption. This means that institutional traders are at the moment cautious with Ethereum, which provides downward stress to the worth.

Weak institutional query

Giant traders return from Ethereum. Grayscale just lately offered $ 53,810,000 in Ethereum on Coinbase, indicating that large cash doesn’t purchase $ ETH in the intervening time.

On the similar time, the Ethereum supply on exchanges has fallen to solely 14.8 million tokens-a lowest layer of 9 years since 2015. Though low supply can typically trigger shortage, it has been merged with the present value fall.

Exercise on the Ethereum chain has fallen by 10percentand the gasoline prices are decrease because of a diminished transaction quantity, which signifies weaker market participation and the consumer’s confidence fades.

- Additionally learn:

- Why crypto costs are falling immediately: vital elements behind the sale

- “

Ethereum -Dominance decreases

The dominance of Ethereum has fallen from 14.6% to 12.8%, demonstrating a lack of relative relevance. Analysts warn that if this pattern continues, Ethereum Altcoins might carry out with a most of 45%.

This decline displays each delaying institutional demand and a shift in broader crypto market flows, which emphasizes that the Ethereum assembly loses momentum earlier this yr.

How low can the ETH value go?

According to analyst TedETH/USD has examined the help stage of $ 4,060 twice in simply three days, indicating a powerful gross sales stress. Analysts now see the next help zone round $ 3,800, which might function a possible accumulation level for lengthy -term traders.

The Day by day Relative Energy Index (RSI) is 35, which means that Ethereum is offered over, however instantly lacks rebound -momentum. These technical alerts, mixed with liquidations of heavy derivatives, point out a possible additional lower earlier than restoration.

For lengthy -term traders, this withdrawal will also be a possible chance to gather $ ETH earlier than any market restoration.

By no means miss a beat within the crypto world!

Proceed to interrupt up information, knowledgeable evaluation and actual -time updates on the most recent developments in Bitcoin, Altcoins, Defi, NFTs and extra.

FAQs

The worth of Ethereum decreases because of the delay of ETF influx, giant sale of traders and excessive liquidations of livered lengthy positions, leading to vital gross sales stress.

For lengthy -term traders, this withdrawal to potential help ranges can supply accumulation possibility earlier than a possible market restoration.

In line with our Ethereum -price forecast 2025, the ETH value might attain a most of $ 9,428.11.

In line with our Ethereum -price forecast 2030, the ETH Munt value might attain a most of $ 71,594.69 by 2030.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now