Bitcoin

Why Bitcoin Price is Crashing Today? When Can BTC Price See Reversal?

Credit : coinpedia.org

The cryptocurrency market was confronted as we speak with one other dip when Bitcoin value actions dragged altcoins decrease. Regardless of the decline, many analysts say that these fluctuations are a part of a broader Bitcoin commerce vary, not collapse of the market.

Traders usually describe the method as “5 steps ahead, two steps again”, which emphasize the cyclical nature of bitcoin and cryptom markets.

Bitcoin liquidation refers to short-term gross sales

In two days, about $ 17.5 billion in Bitcoin choices can be set to run out, with a most ache level at $ 107,000. Traditionally, Bitcoin usually goes to most ache throughout main choices.

“$ BTC often soils in September. A big leg can happen earlier than a reversal, particularly with these monumental choices that expire,” noted a crypto trader.

Current market exercise reveals a Bitcoin-Liquidity Swing that lung-off lung between $ 109,000 and $ 111,000. The following liquidity cluster is round $ 107,000 $ 108,000, which might trigger additional short-term volatility.

“Deeper liquidity sweeps usually wrap aggressive shortcoming, however can arrange a pointy reversal as quickly because it has been erased,” warned analysts.

This set -up emphasizes the significance of monitoring Bitcoin -Liquidity ranges and value turnout indicators in September 2025.

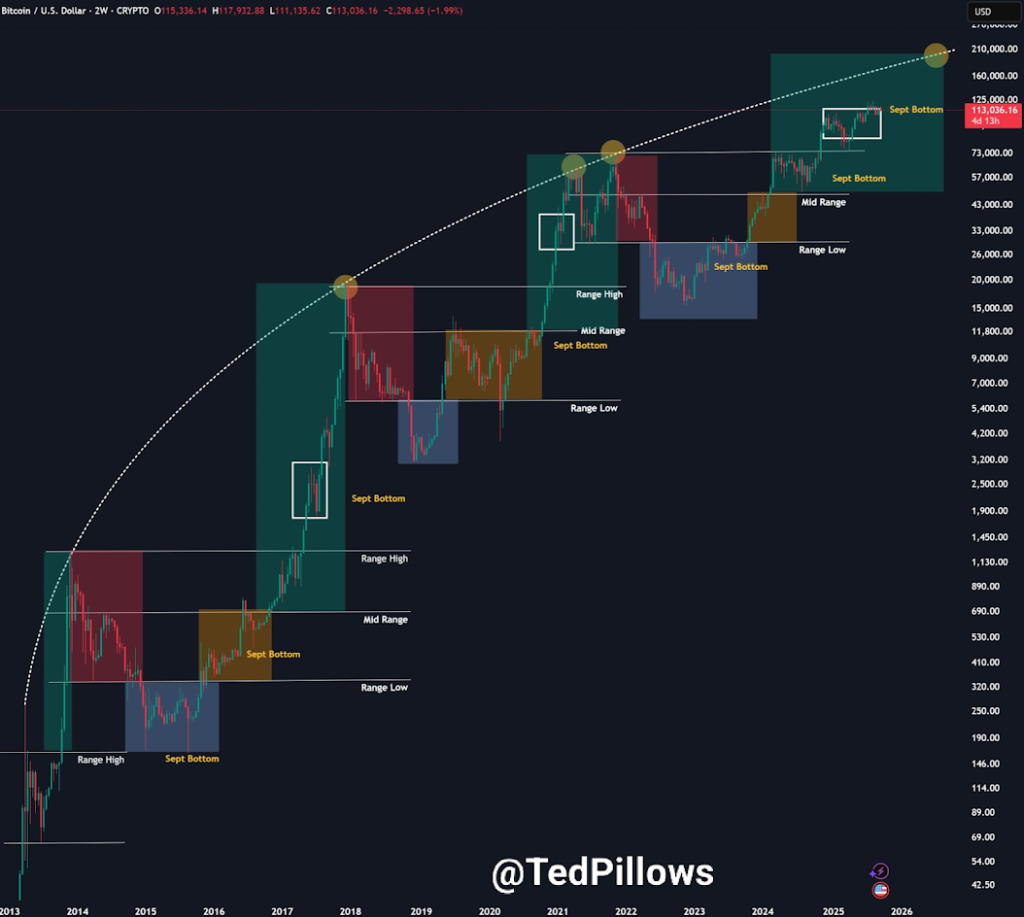

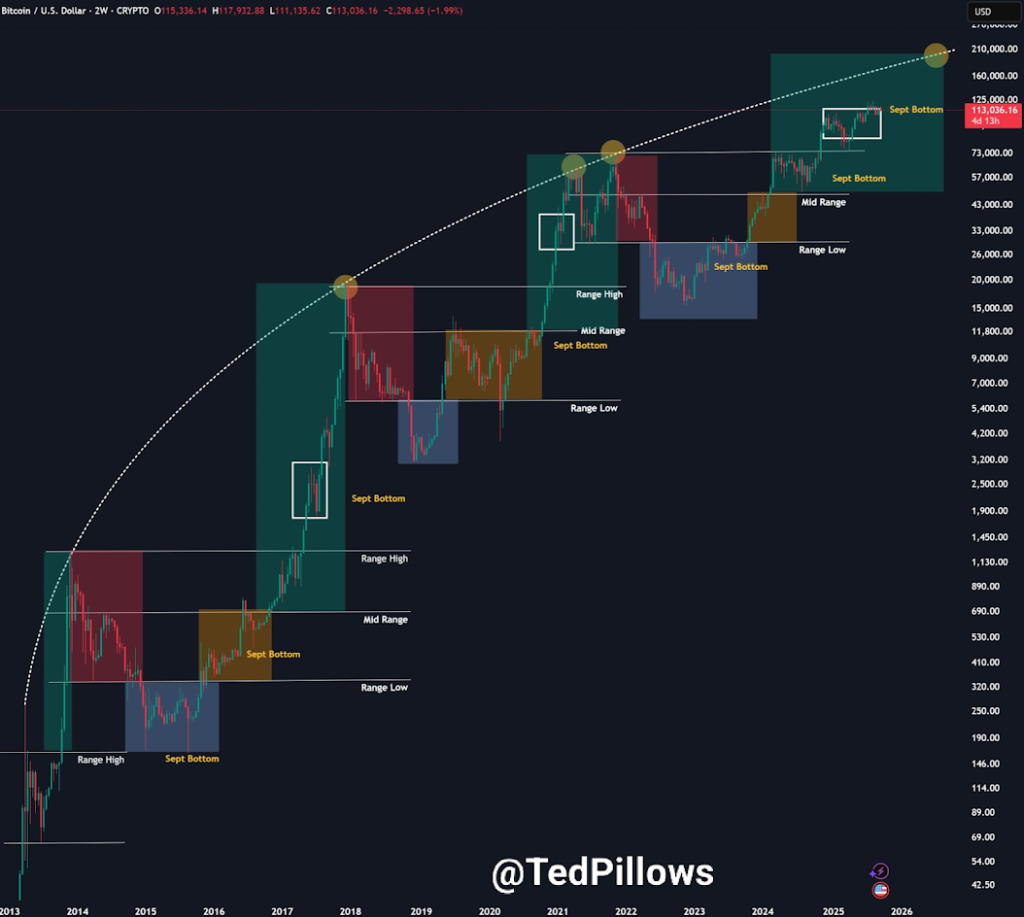

Bitcoin 4-year cycle prolonged to five-year cycle-Raoul Pal

Raoul Pal, founding father of World Macro Investor, means that the historic four-year cycle of Bitcoin, powered by halving occasions, might now have stretched right into a five-year Bitcoin market cycle.

“US Duct Maturity Extensions in 2021–22 pushed the typical weighted maturity from 4 years to five.4 years,” Said. “This could transfer the height of the Bitcoin cycle to Q2 2026 as a substitute of 2025.”

This perception may also help buyers to regulate methods for long-term Bitcoin prize cycles and anticipate future market top factors.

- Additionally learn:

- Crypto-market crash: XRP drops 4%, Bitcoin and Ethereum sink in September Sale

- “

Bitcoin follows the ISM firm cycle carefully

PAL emphasised Bitcoin’s tight correlation with the ISM Buying managers’ index (PMI), an vital indicator of US financial traits:

- Above 50: Financial enlargement

- Underneath 50: Financial contraction

“At present, the ISM is decrease than 50 and marks the longest contraction in a long time,” mentioned Pal. “Intervals wherein the in collaboration with was decrease than the 50, akin to 2015–16 and 2019-2020, preceded the large Bitcoin -Bierruns prematurely.”

Because of this Bitcoin value actions usually mirror US financial cycles, creating alternatives for strategic investments.

Excessive rates of interest decelerate Bitcoin Restoration and Cycle Rebound

The persistent excessive rate of interest surroundings of the Federal Reserve has put strain on Principal Avenue, whereas Wall Avenue advantages from the Basie of Property.

PAL famous: “The rates of interest ought to refuse to roll the American money owed and restore the financial enlargement. Till then, Bitcoin tends to observe the contractive pattern of the ISM.”

Traders who monitor Bitcoin market restoration underneath excessive rates of interest should count on a restricted set-up within the brief time period till the financial circumstances enhance.

By no means miss a beat within the crypto world!

Proceed to interrupt up information, knowledgeable evaluation and actual -time updates on the newest traits in Bitcoin, Altcoins, Defi, NFTs and extra.

FAQs

The market fell attributable to a short-term sale, presumably influenced by a big Bitcoin choices of $ 17.5 billion. This created volatility and liquidated over-pasted positions.

Excessive rates of interest decelerate the financial development, which may gradual the Bitcoin bull market. Lengthy-term restoration usually requires decrease charges to stimulate enlargement and risk-in-investments.

Not essential. The present volatility is seen as a standard correction. Historic information on the left Bitcoin Bull is working to phases for financial restoration, which can be in favor, which suggests a possible for future development.

Evaluation means that the basic 4-year cycle might be expanded. The following large peak might now be in Q2 2026, influenced by broader US financial debt cycles.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024