Analysis

Why Ethereum is Going Up? Everything You Need to Know

Credit : coinpedia.org

Ethereum -Worth at the moment confirmed a climb over $ 4,000 after per week marked by sharp falls and robust purchases. The current worth motion is the results of institutional flows and strategic whale actions. And in addition indicators of exhaustion in Oversold technical statistics. This evaluation examines the drivers behind the newest revival of ETH and its broader implications for merchants and traders.

ETF query: the bullish engine?

Giant monetary establishments feed optimism for Ethereum by deepening their ETF providing. Vanguard, a $ 10 trillion asset supervisor, introduced his intention to launch crypto ETFs. After echoing BlackRock’s vital Ethereum ETF corporations and up to date $ 254 million influx on sooner or later.

Given the market capitalization of Ethereum of $ 485.42 billion, just one fifth that of Bitcoin, Amplify inflow of Bitcoin, have this buying strain. Assist for the Ethereum course within the restoration of earlier highlights. Within the final 30 days, ETF AUM rose by 57% to $ 18.4 billion. The following vital marker would be the determination of the SEC on new recordsdata and steady ETF consumption statistics. In succession this might be the scene for additional bullish momentum

Whale accumulation and deployment

Regardless of the robust worth within the worth, whales performed a double -edged position within the ETH worth motion. In the course of the current decline close to $ 3,900, massive portfolios acquired greater than $ 2 billion in ETH. This features a single buy of $ 503 million by way of Falconx and one other $ 661 million in sooner or later. The aggressive buy pulls liquid provide from gala’s, which will increase the worth sensitivity for brand new shopping for.

On the similar time, taking a revenue injected by controversial holders comparable to co-founder Jeffrey Wilcke some volatility. As a result of hundreds of thousands of ETH had been transferred to exchanges, inflicting the concern of quick -term corrections. Now that 30% of the supply has now been set, the stability between accumulation and sells the over -sold circumstances of the Ethereum Worth Metriek.

Ethereum -Worth goals

The technical panorama of ETH alerts potential stabilization after an acute sale. The actively returned from $ 3,829, mirrored the 78.6% FIB racement and climbed above $ 4,020. The RSI recovered from 38.76 and went out of the bought -up attain. Whereas the MacD histogram confirmed a transparent enchancment.

Though the ETH worth stays amongst vital progressive averages, the broader Bollinger tires and transferred RSI exhaustion of current liquidations of the Ethereum Worth Dip. If the Ethereum worth will be above $ 4,000 and $ 4,160 can break by resistance. Then bulls can try for a goal worth close to $ 4,500.

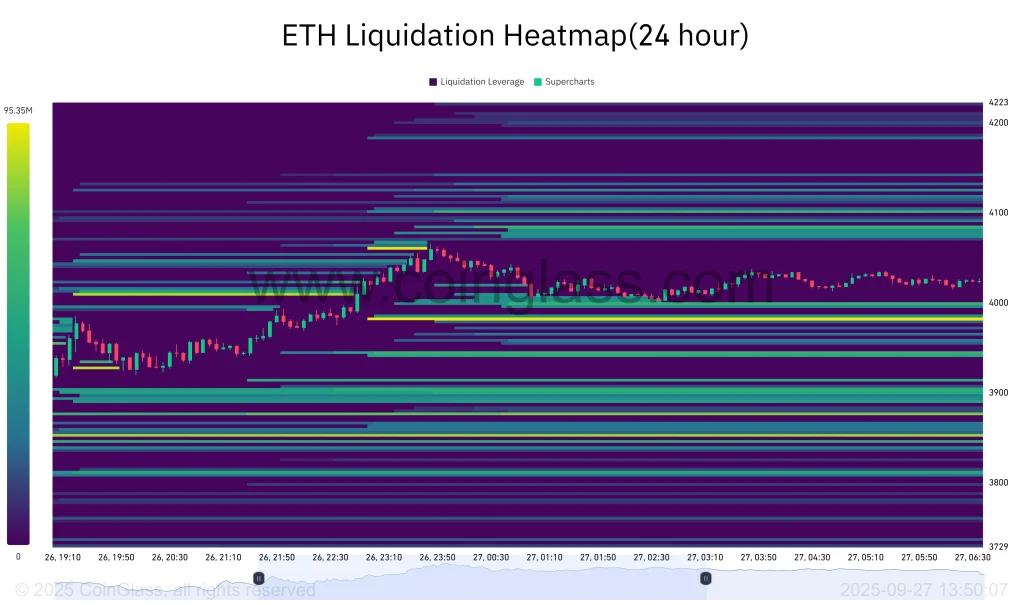

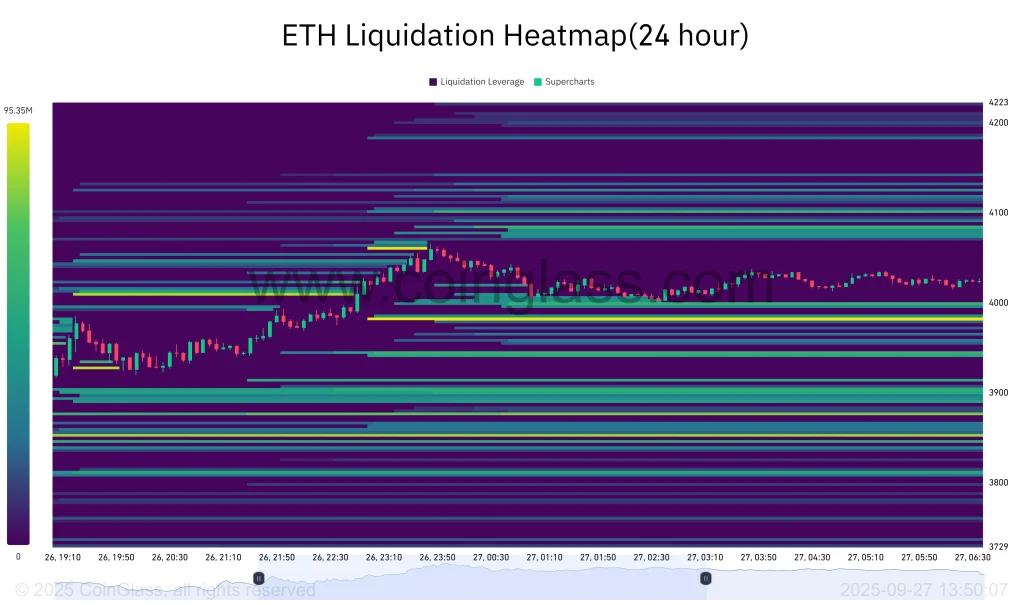

ETH Liquidation Warmth Map

The ETH Liquidatie warmap juice reveals concentrated clusters of leverage liquidations close to $ 4,000 and $ 3,900 ranges. This intensified sale coincided with aggressive worth actions, in order that the shift of over -sold circumstances was accelerated. This supplied essential liquidity for whales and consumers within the quick time period, which contributed to quick restoration.

Market sentiment and social elements

The restoration is mirrored in social sentiment, during which 79% of the discussions mirror optimism about institutional acceptance, technical upgrades and ecosystem development. The remaining emphasizes the worth volatility and competitors of different block chains, which underlines the warning of the market.

FAQs

A mixture of institutional ETF query, heavy whale accumulation and technical alerts about surpassing madmen led to renewed buy curiosity within the neighborhood of $ 3,900, which led to a worth restoration above $ 4,000.

Present technical means recommend that ETH has left the zone transferred, however with a excessive volatility and revenue when taking whales, warning is justified.

If the uptrend continues and ETH breaks above $ 4,160, Bulls can deal with $ 4,500 as the following resistance. Nonetheless, an absence to retain $ 3,900 can result in additional falls to $ 3,400.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024