Bitcoin

How MSTR Could Have Gained 50K Extra Bitcoin With MVRV BTC Strategy

Credit : bitcoinmagazine.com

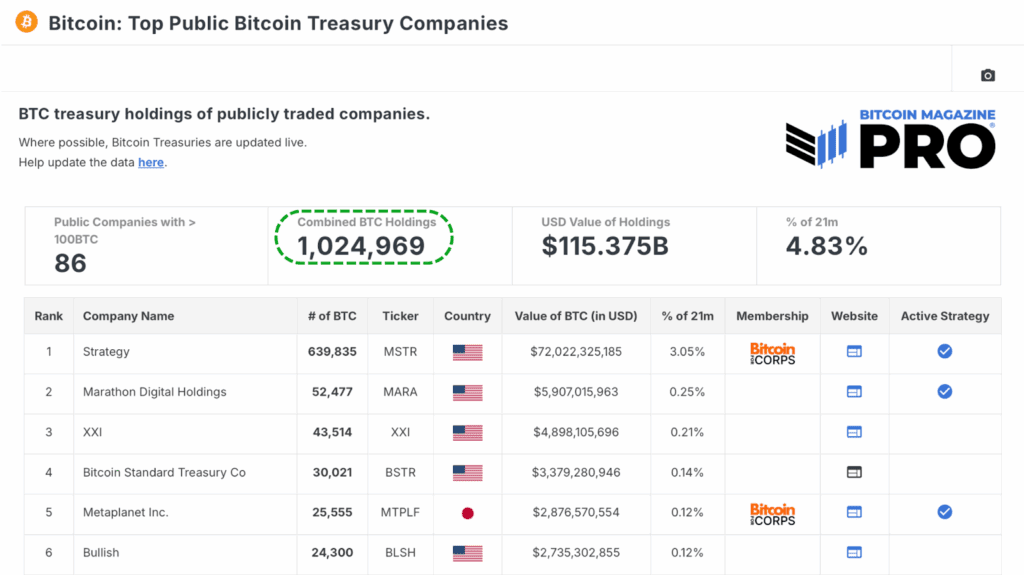

Bitcoin Treasury corporations have turn into one of the crucial necessary demanding packages on this cycle. Collectively, 86 listed corporations now have greater than 1 million BTC on their steadiness sheets. What began with MSTR (technique) in 2020 has since been unfold over the enterprise panorama, the place newcomers change their thoughts each week. However an extra consideration of their buying historical past reveals a shocking perception that many of those corporations may have significantly extra bitcoin in the present day if they’d adopted a easy, guidelines -based technique for accumulation.

MSTR is main the present state of Bitcoin Treasury Holdings

MSTR (technique) stays the clear chief amongst corporations of corporations, with practically 640,000 BTC. In all places Top Public Bitcoin Treasury companiesGreater than 1 million BTC is now successfully sealed away, a dynamic that completely reduces the liquid provide and strengthens the financial premium of Bitcoin (assuming that they after all by no means promote!) Though this has been an enormous internet constructive for Bitcoin’s provide abnormalities financial system, the information that a big share of those purchases.

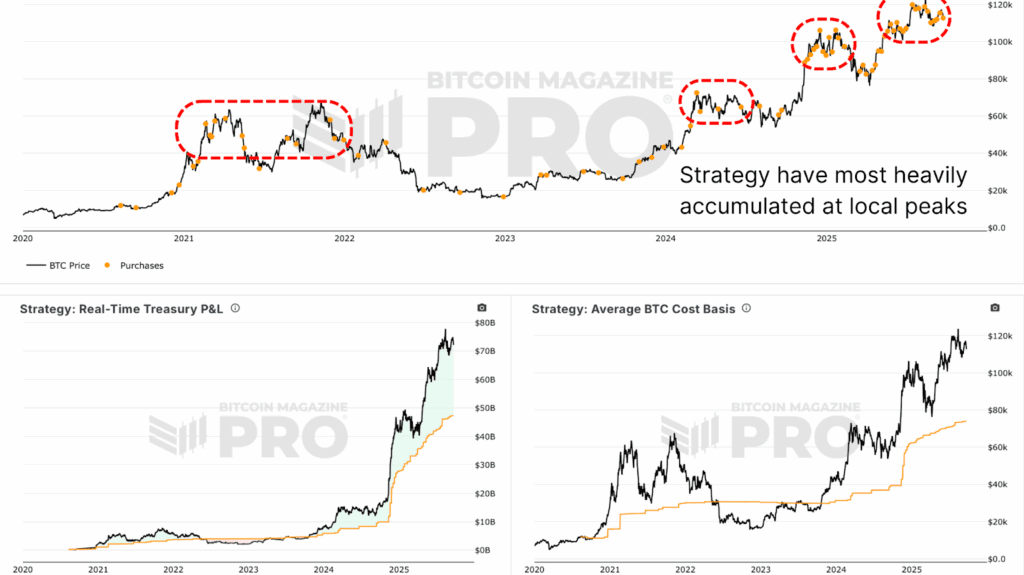

MSTR’s instance: purchase the highest in Bitcoin -Cycli

To take MSTRs (strategy) activity For instance. The corporate made a few of its heaviest allocations on the finish of 2024, whereas Bitcoin rose above $ 70,000 after ETF approvals. This was removed from distinctive, as a result of the broader treasury sector confirmed the identical sample of purchases for the entrance throughout euphoric phases.

Though comprehensible (capital is the simplest to extend when costs rise and the sentiment is excessive), the result’s that Treasury corporations typically pay an excessive amount of. Backtesting even exhibits that ready for even modest withdrawal may have saved on common 10-30% in comparison with their precise entrance costs. After all no person has a crystal ball to foretell a value motion, however at the least not instantly after a triple share of income in just a few weeks!

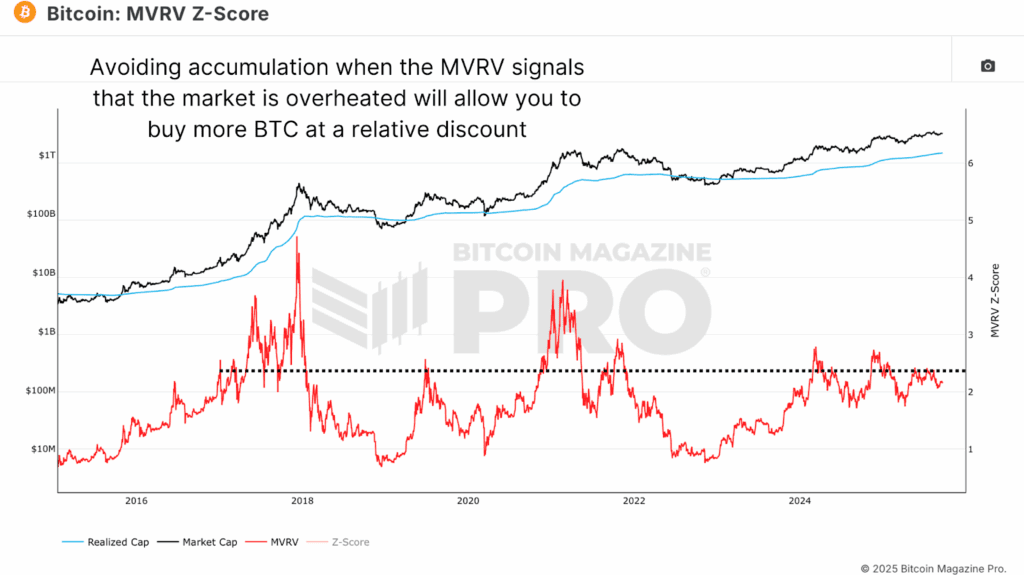

A easy MVRV data-controlled answer for MSTR and Treasuries

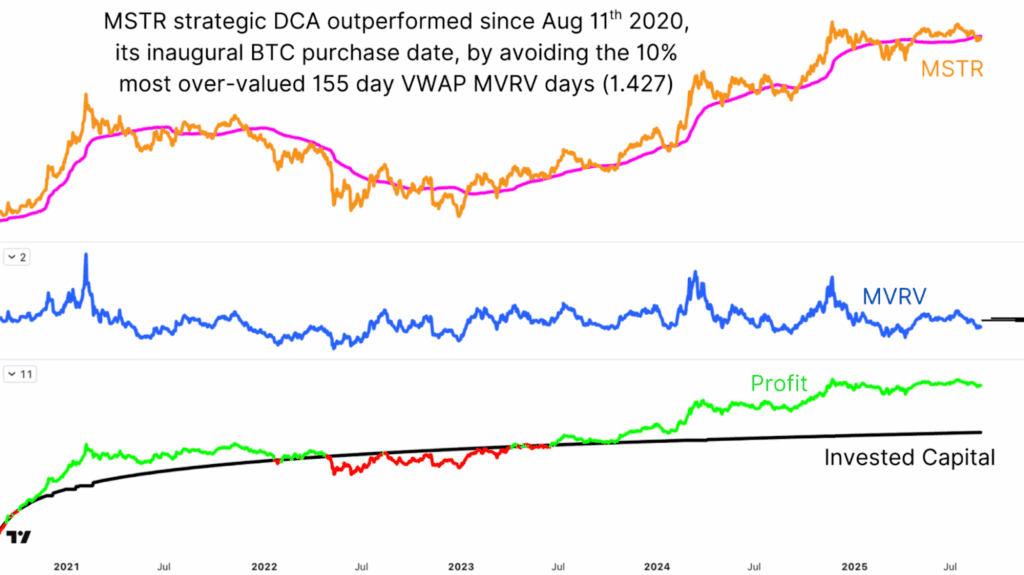

One easy adjustment may have made an enormous distinction: the usage of the MVRV ratio As a filter. This method is just not advanced. It doesn’t attempt to time precise soils, nor belief it on subjective judgment. As an alternative, it makes use of a rolling MVRV % wheel threshold to forestall it from being assigned throughout essentially the most overheated phases of bull markets.

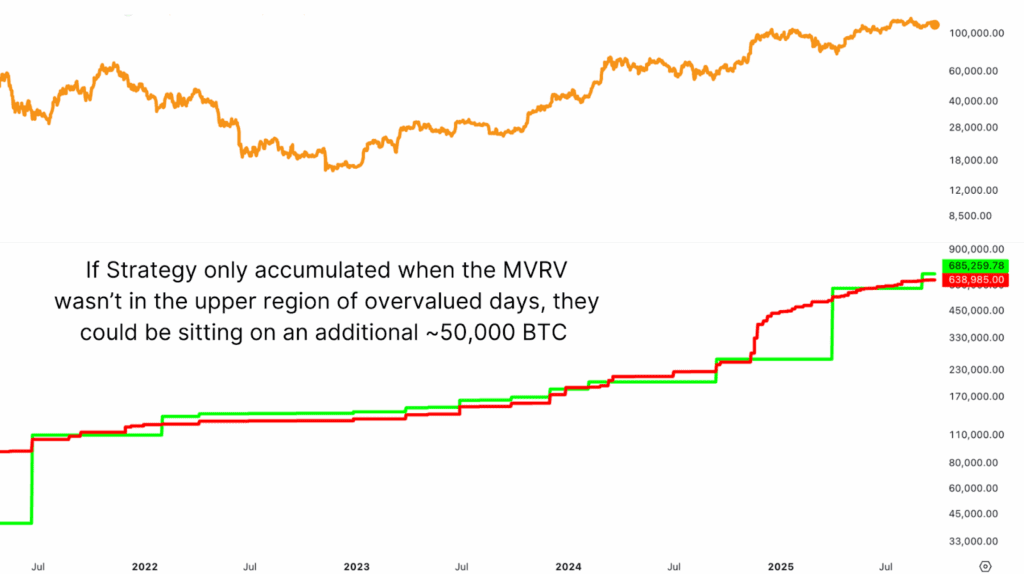

By avoiding purchases when the MVRV ratio was in its prime 20% of the historic measurements (a proxy for overvaluation) and simple to make use of that capital throughout cooler durations, MSTR (technique) would solely preserve nearly 685,000 BTC in the present day, nearly 50,000 BTC greater than it at present owns.

On the present costs, that’s greater than $ 5 billion in additional bitcoin. To place that in perspective, the “missed” bitcoin is roughly the identical because the mixed lifelong pursuits of the opposite Active Bitcoin Treasury companies (Besides marathon digital).

Comparable frameworks have been tested in other markets Corresponding to altcoins, shares and even the S&P 500, they usually constantly carry out higher than blind greenback value averages. Strategic greenback prices common beats emotional greenback prices on common just about, no matter market circumstances.

Implications for MSTR, treasuries and particular person buyers

For treasury corporations, the implementation of this mannequin can imply billions in additional worth over time. For particular person buyers, the identical precept applies to the easy avoidance of looking rallies throughout euphoric phases, and to make the market come to you as a substitute.

After all now we have to acknowledge the nuances. Firms are confronted with restrictions in attracting capital, finishing up giant block commerce with out slipping and managing the expectations of the shareholders. However even inside these limits, a easy knowledge -driven filter may considerably enhance the outcomes.

Conclusion: MSTRs path to smarter Bitcoin -accumulation

Bitcoin Treasury corporations have been an enormous internet constructive for the community. Their mixed 1 million BTC corporations scale back the supply, improve the cash a number of impact and emphasize the rising institutional acceptance of Bitcoin. However the knowledge exhibits that almost all of them may nearly definitely do higher. A easy technique to keep away from purchases throughout overheated circumstances would have yielded an additional 50,000 BTC, which is price greater than $ 5 billion in the present day.

The message is identical for each corporations and people: self-discipline surpasses FOMO. Treasury Accumulation has reformed Bitcoin’s provide panorama, however the next evolution could be smarter accumulation methods that maximize the return and restrict the downward volatility of the markets with out growing the danger.

View right here for a extra in-depth view of this topic, view our most up-to-date YouTube video right here:

This simple Bitcoin strategy would have made them billions

Go to deeper knowledge, graphs {and professional} insights in Bitcoin -Perrends Bitcoinmagazinepro.com.

Subscribe to Bitcoin Magazine Pro on YouTube For extra professional market insights and evaluation!

Disclaimer: This text is just for informative functions and shouldn’t be thought-about as monetary recommendation. At all times do your personal analysis earlier than you make funding selections.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024